PORTFOLIO CHOICE, LIQUIDITY CONSTRAINTS AND STOCK

... market timer. Relative to the i.i.d. returns model, high expected future returns generate additional saving (a speculative demand for saving) and a higher allocation of stocks in the portfolio for a given level of saving, while low expected future returns reduce total saving and decrease the exposu ...

... market timer. Relative to the i.i.d. returns model, high expected future returns generate additional saving (a speculative demand for saving) and a higher allocation of stocks in the portfolio for a given level of saving, while low expected future returns reduce total saving and decrease the exposu ...

ABS 415 Help Education Expert/abs415helpdotcom

... • You recently sold 100 shares of your new company, XYZ Corporation, to your brother at a family reunion. At the reunion your brother gave you a check for the stock and you gave your brother the stock certificates. Which of the following statements best describes this transaction? • 1) This is an ex ...

... • You recently sold 100 shares of your new company, XYZ Corporation, to your brother at a family reunion. At the reunion your brother gave you a check for the stock and you gave your brother the stock certificates. Which of the following statements best describes this transaction? • 1) This is an ex ...

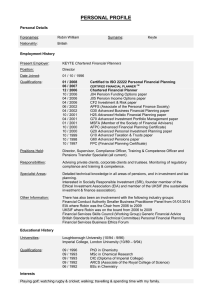

personal profile - Keyte Chartered Financial Planners

... The Sunday Times, the Financial Times and the Independent on Sunday, as well as featuring on Radio 4’s Money Box Live as one of the panel of specialists several times. Robin was a founding member of the Ethical Investment Association (EIA) and served as Chair and also on the board of UKSIF (the UK s ...

... The Sunday Times, the Financial Times and the Independent on Sunday, as well as featuring on Radio 4’s Money Box Live as one of the panel of specialists several times. Robin was a founding member of the Ethical Investment Association (EIA) and served as Chair and also on the board of UKSIF (the UK s ...

Using Data Envelopment Analysis to Select Efficient Large Market

... For these near-efficient stocks to be considered DEA-efficient, either the specified level of input reduction or output augmentation must occur, but both are not necessary. For example, for British Petroleum (BP) to be classified as DEA-efficient, their inputs must be reduced to 87.01% of their curr ...

... For these near-efficient stocks to be considered DEA-efficient, either the specified level of input reduction or output augmentation must occur, but both are not necessary. For example, for British Petroleum (BP) to be classified as DEA-efficient, their inputs must be reduced to 87.01% of their curr ...

Active Vs. Passive - Jentner Wealth Management

... that are predicted to post above-average returns. Much of what active managers do is attempt to gain insight into the future performance of a company. They may look for a company posting significant sales and profits or one that is touting the launch of a new product. However, while a manager is gat ...

... that are predicted to post above-average returns. Much of what active managers do is attempt to gain insight into the future performance of a company. They may look for a company posting significant sales and profits or one that is touting the launch of a new product. However, while a manager is gat ...

FRBSF L CONOMIC

... returns on assets are assumed to be rational. That is, expectations are assumed to be consistent with the structure of the model. I’ll start with the first explanation, that a rise in the price-to-dividend ratio is caused by higher expected dividend growth. The evidence on this is clear and negative ...

... returns on assets are assumed to be rational. That is, expectations are assumed to be consistent with the structure of the model. I’ll start with the first explanation, that a rise in the price-to-dividend ratio is caused by higher expected dividend growth. The evidence on this is clear and negative ...

market efficiency in baltic stock markets

... knowledge that would be useful in predicting future outcomes of stock movements. So unless the Baltic stock markets are weak form efficient, superior returns can be achieved by analyzing historical trends and behaviour of prices. According to Bodie, Kane, Marcus (2008), technical analysis is usually ...

... knowledge that would be useful in predicting future outcomes of stock movements. So unless the Baltic stock markets are weak form efficient, superior returns can be achieved by analyzing historical trends and behaviour of prices. According to Bodie, Kane, Marcus (2008), technical analysis is usually ...

DTZ investment market update

... withdrawal of funds by foreign banks and as a result, investment is expected to contract further.” Meanwhile, Ukraine has seen over the same period the largest single investment into real estate in Ukraine with the acquisition of Ocean Plaza by CIS investor ‘TPS’. DTZ are also now appointed on the s ...

... withdrawal of funds by foreign banks and as a result, investment is expected to contract further.” Meanwhile, Ukraine has seen over the same period the largest single investment into real estate in Ukraine with the acquisition of Ocean Plaza by CIS investor ‘TPS’. DTZ are also now appointed on the s ...

Interest rate

... • Interest paid comes from taxes or from revenues from special projects. Earned interest is exempt from federal income tax. Federal government • The safest investment you can make. Even if U.S. government goes bankrupt, it is obligated to repay bonds. ...

... • Interest paid comes from taxes or from revenues from special projects. Earned interest is exempt from federal income tax. Federal government • The safest investment you can make. Even if U.S. government goes bankrupt, it is obligated to repay bonds. ...

Is investing in structured products a form of betting?

... Certificates are always based on an underlying asset. This can be, for instance, equities in a particular company, an index such as the German DAX blue-chip index, a precious metal such as gold, or a commodity such as oil. The value of the certificate is dependent on the movements in the price of th ...

... Certificates are always based on an underlying asset. This can be, for instance, equities in a particular company, an index such as the German DAX blue-chip index, a precious metal such as gold, or a commodity such as oil. The value of the certificate is dependent on the movements in the price of th ...

Motivation - Center for IT and e

... Boardroom failures—those scandals revealed that boards or auditing committees did not play their roles effectively. Many board members did not exercise their responsibilities or did not have sufficient understanding of the businesses. Besides, board members were sometimes not independent. Securities ...

... Boardroom failures—those scandals revealed that boards or auditing committees did not play their roles effectively. Many board members did not exercise their responsibilities or did not have sufficient understanding of the businesses. Besides, board members were sometimes not independent. Securities ...

comcast corporation

... On the basis of the foregoing, we are of the opinion that the provisions of the written document constituting the Restricted Stock Plan comply with the requirements of ERISA pertaining to such provisions. This opinion letter is issued as of the date hereof and is limited to the laws now in effect an ...

... On the basis of the foregoing, we are of the opinion that the provisions of the written document constituting the Restricted Stock Plan comply with the requirements of ERISA pertaining to such provisions. This opinion letter is issued as of the date hereof and is limited to the laws now in effect an ...

How to Pick Managed Investments

... Another bias called “creation bias” is introduced when fund managers create new funds. They give seed capital to a lot of money managers, but the ones that underperform during their trial period are never opened to the public. In this way, all new stock funds (that the public hears about) come with ...

... Another bias called “creation bias” is introduced when fund managers create new funds. They give seed capital to a lot of money managers, but the ones that underperform during their trial period are never opened to the public. In this way, all new stock funds (that the public hears about) come with ...

power point slides

... reported this level. Now we know there are two types of cholesterol, HDL and LDL. One (“bad cholesterol”) strongly increases the risk of a heart attack, the other (“good cholesterol”) weakly reduces it. Routine blood tests now report the two levels separately. Similarly, beta has two types, but in t ...

... reported this level. Now we know there are two types of cholesterol, HDL and LDL. One (“bad cholesterol”) strongly increases the risk of a heart attack, the other (“good cholesterol”) weakly reduces it. Routine blood tests now report the two levels separately. Similarly, beta has two types, but in t ...

Invesco Core Plus Bond Fund investment philosophy and process

... Interest rate risk refers to the risk that bond prices generally fall as interest rates rise and vice versa. The risks of investing in securities of foreign issuers, including emerging market issuers, can include fluctuations in foreign currencies, political and economic instability, and foreign ...

... Interest rate risk refers to the risk that bond prices generally fall as interest rates rise and vice versa. The risks of investing in securities of foreign issuers, including emerging market issuers, can include fluctuations in foreign currencies, political and economic instability, and foreign ...

Private Equity Investment in Latin America

... economies benefit from an influx of private equity which aims to achieve profits through the long-term growth of target companies, as opposed to more traditional investments in local capital markets which have proven all too often to be speculative and short-term in nature. ...

... economies benefit from an influx of private equity which aims to achieve profits through the long-term growth of target companies, as opposed to more traditional investments in local capital markets which have proven all too often to be speculative and short-term in nature. ...

investing

... Moody’s also publish ratings that assess the credit risk for short-term debt. These ratings can be divided into investment grade and speculative grade. Systemic risk on money markets of OECD countries can only materialise in the extreme case of a severe banking crisis, such as the default of a major ...

... Moody’s also publish ratings that assess the credit risk for short-term debt. These ratings can be divided into investment grade and speculative grade. Systemic risk on money markets of OECD countries can only materialise in the extreme case of a severe banking crisis, such as the default of a major ...

Explaining investor preference for cash dividends

... o Can manipulatae the doer’s opportunities by influencing their constraints o An indivdual who wishes to safeguard portfolio wealth may implement a rule that capital cannot be consumed, only dividends. Prospect theory (Kahnerman & Tversky) – The form in which alternatives are presented (the way de ...

... o Can manipulatae the doer’s opportunities by influencing their constraints o An indivdual who wishes to safeguard portfolio wealth may implement a rule that capital cannot be consumed, only dividends. Prospect theory (Kahnerman & Tversky) – The form in which alternatives are presented (the way de ...

II. How to Read a Mutual Fund Prospectus

... Accumulated tax liability for funds with large capital gains Investors have less flexibility in timing their tax exposure in a fund Managers may not add value Disadvantages of closed-end funds include: Because the closed-end share price are determined by supply and demand, out-offavor funds find pri ...

... Accumulated tax liability for funds with large capital gains Investors have less flexibility in timing their tax exposure in a fund Managers may not add value Disadvantages of closed-end funds include: Because the closed-end share price are determined by supply and demand, out-offavor funds find pri ...

infrastructure as an alternative strategy

... • Dual till airports, water companies with material non-regulated service businesses • Expected return: 11%-14% ...

... • Dual till airports, water companies with material non-regulated service businesses • Expected return: 11%-14% ...

COURSE TITLE DERIVATIVES MARKETS (200 characters max

... The course aims at profound understanding the specifics of derivative markets. Vast scope of real derivative instruments traded on world exchanges will be described: starting with plain futures/forwards, swaps, through vanilla options, exotic options, ending with advanced financial instruments (like ...

... The course aims at profound understanding the specifics of derivative markets. Vast scope of real derivative instruments traded on world exchanges will be described: starting with plain futures/forwards, swaps, through vanilla options, exotic options, ending with advanced financial instruments (like ...

A CRITICAL ANALYSIS OF INVESTMENT OPTIONS IN NIGERIA

... certain number of naira or other units of money in interest every 6 months for a number of years until it matures. Ordinarily, payments for interest and principal must be made on time, regardless of whether the company has been making earnings or not. Common stock holders share in profits and in con ...

... certain number of naira or other units of money in interest every 6 months for a number of years until it matures. Ordinarily, payments for interest and principal must be made on time, regardless of whether the company has been making earnings or not. Common stock holders share in profits and in con ...

Top 7 Money Saving Tips for Eating Out

... Security deposit waived, taxes, title and license fees extra. ...

... Security deposit waived, taxes, title and license fees extra. ...

Stock trader

A stock trader or equity trader or share trader is a person or company involved in trading equity securities. Stock traders may be an agent, hedger, arbitrageur, speculator, stockbroker or investor. A stock investor is an individual or company who puts money to use by the purchase of equity securities, offering potential profitable returns, as interest, income, or appreciation in value (capital gains). This buy-and-hold long term strategy is passive in nature, as opposed to speculation, which is typically active in nature. Many stock speculators will trade bonds (and possibly other financial assets) as well. Stock speculation is a risky and complex occupation because the direction of the markets are generally unpredictable and lack transparency, also financial regulators are sometimes unable to adequately detect, prevent and remediate irregularities committed by malicious listed companies or other financial market participants. In addition, the financial markets are usually subjected to speculation.