JBWere SMA Growth Portfolio

... What are the benefits? Access to professional investment management You can invest in shares with the added benefit of a professionally managed portfolio. ...

... What are the benefits? Access to professional investment management You can invest in shares with the added benefit of a professionally managed portfolio. ...

Emerging Markets Fund

... otherwise they are included in the “Other Index / Unclassified” category. Derivatives are included on an exposure basis, and, where necessary are deltaadjusted. Delta–adjusting expresses derivatives in terms of the equivalent number of shares that would be needed to generate the same return. Where d ...

... otherwise they are included in the “Other Index / Unclassified” category. Derivatives are included on an exposure basis, and, where necessary are deltaadjusted. Delta–adjusting expresses derivatives in terms of the equivalent number of shares that would be needed to generate the same return. Where d ...

options markets - AUEB e

... banks the make the market (market makers) big multinationals, etc. The contracts are not standardized and “tailor-made” for clients • Organized exchanges: Most organized exchanges use market makers to facilitate options trading; A market maker quotes both bid and ask prices when requested; The marke ...

... banks the make the market (market makers) big multinationals, etc. The contracts are not standardized and “tailor-made” for clients • Organized exchanges: Most organized exchanges use market makers to facilitate options trading; A market maker quotes both bid and ask prices when requested; The marke ...

new proxy advisory code seeks to resolve concerns from listed

... A Draft “Code for Improving Engagement between Listed Entities and Proxy Advisers” was released today by the Australasian Investor Relations Association (AIRA) in an initiative aimed at fostering relations in the long term and to head off regulation. This comes ahead of a roundtable called for later ...

... A Draft “Code for Improving Engagement between Listed Entities and Proxy Advisers” was released today by the Australasian Investor Relations Association (AIRA) in an initiative aimed at fostering relations in the long term and to head off regulation. This comes ahead of a roundtable called for later ...

Socially Responsible Investing

... that Jewish law incorporated aspects of investing, and how to invest in an ethical manner. Generations of religious investors followed in this manner, investing in non-violent and peaceful organizations, and avoiding organizations that profit from manufacturing goods that can have detrimental societ ...

... that Jewish law incorporated aspects of investing, and how to invest in an ethical manner. Generations of religious investors followed in this manner, investing in non-violent and peaceful organizations, and avoiding organizations that profit from manufacturing goods that can have detrimental societ ...

The Value Line Investment Survey – Investor 600 Product Guide

... Value Line’s research and analysis are completely unbiased and independent. Value Line has no investment banking business with any company, including the approximately 600 companies included in this service. Unlike typical Wall Street brokerage firms, Value Line does not execute trades for its subsc ...

... Value Line’s research and analysis are completely unbiased and independent. Value Line has no investment banking business with any company, including the approximately 600 companies included in this service. Unlike typical Wall Street brokerage firms, Value Line does not execute trades for its subsc ...

The Price to Earnings Growth (PEG) Ratio

... more we would need to estimate how long the EPSG rates would last, and create a more detailed model of future year’s earnings. This is why analysts and portfolio managers, and investors in general, spend so much time trying to work out future earnings and future earnings growth for stocks. It is the ...

... more we would need to estimate how long the EPSG rates would last, and create a more detailed model of future year’s earnings. This is why analysts and portfolio managers, and investors in general, spend so much time trying to work out future earnings and future earnings growth for stocks. It is the ...

Chapter 6

... of the economy. Alta Industries is an electronics firm; Repo Men collects past-due debts; and American Foam manufactures mattresses and other foam products. Barney Smith also maintains an “index fund” which owns a market-weighted fraction of all publicly traded stocks; you can invest in that fund, a ...

... of the economy. Alta Industries is an electronics firm; Repo Men collects past-due debts; and American Foam manufactures mattresses and other foam products. Barney Smith also maintains an “index fund” which owns a market-weighted fraction of all publicly traded stocks; you can invest in that fund, a ...

Essentials of Managerial Finance

... statements of actions taken to finance forecasted increases in assets—must be considered to determine the exact amount of AFN. Essentials of Managerial Finance by S. Besley & E. Brigham ...

... statements of actions taken to finance forecasted increases in assets—must be considered to determine the exact amount of AFN. Essentials of Managerial Finance by S. Besley & E. Brigham ...

Business Process Integration I

... Availability Check In determining the material availability date the ...

... Availability Check In determining the material availability date the ...

Lecture Notes

... monetary exposure of the parties under the terms of the derivative instrument. As money usually is not due until the specified date of performance of the parties' obligations, lack of up-front commitment of cash may obscure the eventual monetary significance of the parties' obligations. An often ove ...

... monetary exposure of the parties under the terms of the derivative instrument. As money usually is not due until the specified date of performance of the parties' obligations, lack of up-front commitment of cash may obscure the eventual monetary significance of the parties' obligations. An often ove ...

what stock market returns to expect for the future?

... future should be lower than in the past since greater diversification means less risk for the investor. Second, the average cost of investing in mutual funds has declined due to the reduced importance of funds with high investment fees and the growth of index funds. While the decline in costs has af ...

... future should be lower than in the past since greater diversification means less risk for the investor. Second, the average cost of investing in mutual funds has declined due to the reduced importance of funds with high investment fees and the growth of index funds. While the decline in costs has af ...

What Stock Market Returns to Expect for the Future

... future should be lower than in the past since greater diversification means less risk for the investor. Second, the average cost of investing in mutual funds has declined due to the reduced importance of funds with high investment fees and the growth of index funds. While the decline in costs has af ...

... future should be lower than in the past since greater diversification means less risk for the investor. Second, the average cost of investing in mutual funds has declined due to the reduced importance of funds with high investment fees and the growth of index funds. While the decline in costs has af ...

VIT Multi-Strategy Alternatives Portfolio

... interest rates. Investors should also consider some of the potential risks of alternative investments: Alternative strategies may engage in investment practices that are speculative and involve a high degree of risk. Such practices may increase the volatility of performance and the risk of investmen ...

... interest rates. Investors should also consider some of the potential risks of alternative investments: Alternative strategies may engage in investment practices that are speculative and involve a high degree of risk. Such practices may increase the volatility of performance and the risk of investmen ...

Leverage Effects In The Mauritian`s Stock Market

... from 1989 to 2007, there are six years where the returns have been negatively skewed and two years where the kurtosis value has been lower than 3. On overall, for the whole sample, there is large kurtosis value, suggesting that the series follow a fat tail distribution, and a positively skewed serie ...

... from 1989 to 2007, there are six years where the returns have been negatively skewed and two years where the kurtosis value has been lower than 3. On overall, for the whole sample, there is large kurtosis value, suggesting that the series follow a fat tail distribution, and a positively skewed serie ...

StarMine Methodology

... portfolio simulation that measures each analyst relative to an industry-based benchmark. The top three qualifying analysts in each industry receive an award. Calculation of Industry Excess Return: All analyst returns are calculated relative to the return on a market capitalization-weighted portfolio ...

... portfolio simulation that measures each analyst relative to an industry-based benchmark. The top three qualifying analysts in each industry receive an award. Calculation of Industry Excess Return: All analyst returns are calculated relative to the return on a market capitalization-weighted portfolio ...

Sample Corporate Policy on Insider Trading

... Penalties for trading on or communicating material non-public information can be severe, both for individuals involved in such unlawful conduct and their employers and supervisors, and may include jail terms, criminal fines, civil penalties and civil enforcement injunctions. Given the severity of th ...

... Penalties for trading on or communicating material non-public information can be severe, both for individuals involved in such unlawful conduct and their employers and supervisors, and may include jail terms, criminal fines, civil penalties and civil enforcement injunctions. Given the severity of th ...

What Stock Market Returns to Expect for the

... portfolio at a lower cost by taking advantage of the economies of scale in investing. At the same time, these funds add another layer of intermediation, with its costs, including the costs of marketing the funds. Nevertheless, as the large growth of mutual funds indicates, many investors find them a ...

... portfolio at a lower cost by taking advantage of the economies of scale in investing. At the same time, these funds add another layer of intermediation, with its costs, including the costs of marketing the funds. Nevertheless, as the large growth of mutual funds indicates, many investors find them a ...

What Australian Investors Need to Know to Diversify

... we calculate two measures of risk using daily data and include one that reflect extreme events. Previous academic research [5, 2, 6, 3] has analyzed the optimal portfolio sizes for an average investor. We build on our predecessors’ contributions by estimating confidence bands around the average num ...

... we calculate two measures of risk using daily data and include one that reflect extreme events. Previous academic research [5, 2, 6, 3] has analyzed the optimal portfolio sizes for an average investor. We build on our predecessors’ contributions by estimating confidence bands around the average num ...

Unit 1:

... the instruments that are traded. Spot market transactions involve securities that have maturities of less than one year whereas futures markets transactions involve securities with maturities greater than one year. Capital market transactions involve only preferred stock or common stock. If General ...

... the instruments that are traded. Spot market transactions involve securities that have maturities of less than one year whereas futures markets transactions involve securities with maturities greater than one year. Capital market transactions involve only preferred stock or common stock. If General ...

Annexure I

... NOTICE is hereby given that the Trustee of Baroda Pioneer Mutual Fund (“the Fund”) has approved the following changes in the Scheme Information Document (SID) and Key Information Memorandum (KIM) of all the open ended schemes of Baroda Pioneer Mutual Fund, wherever applicable : 1. Discontinuation Bo ...

... NOTICE is hereby given that the Trustee of Baroda Pioneer Mutual Fund (“the Fund”) has approved the following changes in the Scheme Information Document (SID) and Key Information Memorandum (KIM) of all the open ended schemes of Baroda Pioneer Mutual Fund, wherever applicable : 1. Discontinuation Bo ...

THE CHINESE EQUITY MARKET An Economic Inquiry into Investment Opportunities and Risks

... The emerging market China is currently one of the most attractive and promising markets in the world. Many investors want to benefit from the high growth and promising economic outlook and therefore invest in China equity funds. However, both opportunity and risk factors need to be taken into consid ...

... The emerging market China is currently one of the most attractive and promising markets in the world. Many investors want to benefit from the high growth and promising economic outlook and therefore invest in China equity funds. However, both opportunity and risk factors need to be taken into consid ...

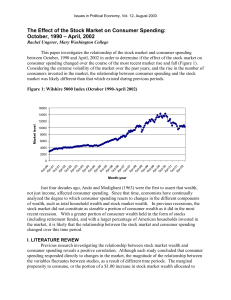

The Effect of the Stock Market on Consumer

... consumer spending, measures the magnitude of the stock market to consumer spending relationship. Overall, previous studies found an average marginal propensity to consume out of stock market wealth between $.03 and $.07 cents. In 1998, McCluer (1998) conducted a survey based cross-sectional analysis ...

... consumer spending, measures the magnitude of the stock market to consumer spending relationship. Overall, previous studies found an average marginal propensity to consume out of stock market wealth between $.03 and $.07 cents. In 1998, McCluer (1998) conducted a survey based cross-sectional analysis ...

Stock trader

A stock trader or equity trader or share trader is a person or company involved in trading equity securities. Stock traders may be an agent, hedger, arbitrageur, speculator, stockbroker or investor. A stock investor is an individual or company who puts money to use by the purchase of equity securities, offering potential profitable returns, as interest, income, or appreciation in value (capital gains). This buy-and-hold long term strategy is passive in nature, as opposed to speculation, which is typically active in nature. Many stock speculators will trade bonds (and possibly other financial assets) as well. Stock speculation is a risky and complex occupation because the direction of the markets are generally unpredictable and lack transparency, also financial regulators are sometimes unable to adequately detect, prevent and remediate irregularities committed by malicious listed companies or other financial market participants. In addition, the financial markets are usually subjected to speculation.