Models for Investors in Real World Markets. Wiley Series in... Statistics Brochure

... The collapse of the Scholes–Merton based Long Term Capital Management (LTCM) hedge fund should have sounded alarms or, at least, raised questions about investment strategies based on risk–neutral probabilities. More recently, the fallout of Enron, WorldCom, and similar fiascos must now give pause to ...

... The collapse of the Scholes–Merton based Long Term Capital Management (LTCM) hedge fund should have sounded alarms or, at least, raised questions about investment strategies based on risk–neutral probabilities. More recently, the fallout of Enron, WorldCom, and similar fiascos must now give pause to ...

Long-term Investing as asset prices rise

... safety and invest for the long-term The factors that influence whether management of these companies achieve good long term returns are numerous and complicated. While macro-economic and geopolitical factors are an important input, our thinking on such matters is much ...

... safety and invest for the long-term The factors that influence whether management of these companies achieve good long term returns are numerous and complicated. While macro-economic and geopolitical factors are an important input, our thinking on such matters is much ...

100 Bottles of Beer on the Wall

... The twin barrels of financial innovation and globalization have significantly complicated the forecasting of asset returns in recent years. Two domestic bubbles in the last decade are testimony to the power of levered money and the recirculation of price insensitive reserves back into U.S. financial ...

... The twin barrels of financial innovation and globalization have significantly complicated the forecasting of asset returns in recent years. Two domestic bubbles in the last decade are testimony to the power of levered money and the recirculation of price insensitive reserves back into U.S. financial ...

Should the Fed React to the Stock Market?

... which shows that lagged movements in the Standard & Poors (S&P) 500 stock index can help explain movements in the U.S. federal funds rate since 1987. Asset prices and the economy Changes in the prices of assets, such as stocks or houses, can have important consequences for the economy. During the la ...

... which shows that lagged movements in the Standard & Poors (S&P) 500 stock index can help explain movements in the U.S. federal funds rate since 1987. Asset prices and the economy Changes in the prices of assets, such as stocks or houses, can have important consequences for the economy. During the la ...

Principles of Portfolio Construction: Lord Abbett Smid

... validation, research consisting of f undamental company research and valuation analysis, and risk management f ocusing on risks at the company level and at the portf olio level. Of course, valuation and f undamental risk assessment have always been part of the process; over the past f ew years, w ...

... validation, research consisting of f undamental company research and valuation analysis, and risk management f ocusing on risks at the company level and at the portf olio level. Of course, valuation and f undamental risk assessment have always been part of the process; over the past f ew years, w ...

Introducing - StockCentral

... • When Bad Things Happen to Good Companies Learn how to handle unexpected problems that arise in companies you hold in your portfolio, and make more confident decisions about selling, holdhol ing, or buying these stocks with “issues.” • Stock Selection Blunders, Bungles, and Bloopers A survey of sta ...

... • When Bad Things Happen to Good Companies Learn how to handle unexpected problems that arise in companies you hold in your portfolio, and make more confident decisions about selling, holdhol ing, or buying these stocks with “issues.” • Stock Selection Blunders, Bungles, and Bloopers A survey of sta ...

M&B-Ch.1

... arrangements) that allows people to easily buy and sell (trade) financial securities (such as stocks and bonds), commodities (such as precious metals or agricultural goods), and other tangible items of value at low transaction costs and at prices that reflect; e.g., Bahrain Stock Exchange, New York ...

... arrangements) that allows people to easily buy and sell (trade) financial securities (such as stocks and bonds), commodities (such as precious metals or agricultural goods), and other tangible items of value at low transaction costs and at prices that reflect; e.g., Bahrain Stock Exchange, New York ...

here

... a bulletproof system that no one can beat.” Chen is known around the world for his excellence in artificial intelligence work. He is the developer of Coplink, an artificial-intelligence-driven search engine for crime characteristics that scans multiple databases for connections among names, vehicles ...

... a bulletproof system that no one can beat.” Chen is known around the world for his excellence in artificial intelligence work. He is the developer of Coplink, an artificial-intelligence-driven search engine for crime characteristics that scans multiple databases for connections among names, vehicles ...

As we forecasted at the beginning of the year, the market has

... DISCLOSURE: Past performance is no guarantee of future results. Investments are subject to risk, including the loss of principal. Because investment return and principal value fluctuate, shares may be worth more or less than original value. These investments may not be suitable for all investors, an ...

... DISCLOSURE: Past performance is no guarantee of future results. Investments are subject to risk, including the loss of principal. Because investment return and principal value fluctuate, shares may be worth more or less than original value. These investments may not be suitable for all investors, an ...

Weekly Commentary 04-27-15 PAA

... return of the markets over most rolling periods during the past century.” This is a remarkable expectation. Second, it’s not achievable without taking considerable risk and the vast majority of investors surveyed said, if they had to choose, they would opt for safety of principal over performance po ...

... return of the markets over most rolling periods during the past century.” This is a remarkable expectation. Second, it’s not achievable without taking considerable risk and the vast majority of investors surveyed said, if they had to choose, they would opt for safety of principal over performance po ...

Federated Mid-Cap Index Fund

... comprise the mid-level stock capitalization sector of the United States equity market. The fund normally invests its assets primarily in common stocks included in the Standard & Poor's MidCap 400 Index. It may invest in derivatives contracts (such as, for example, futures contracts, option contracts ...

... comprise the mid-level stock capitalization sector of the United States equity market. The fund normally invests its assets primarily in common stocks included in the Standard & Poor's MidCap 400 Index. It may invest in derivatives contracts (such as, for example, futures contracts, option contracts ...

Dividend Growth Model

... Dividend Growth Model FINA 635A Managerial Finance Nisan Langberg Stock valuation and the implied growth rate In order to evaluate whether Netflix is an overpriced stock you are asked to estimate the growth in earnings that investors expect. Suppose that Netflix will experience a fixed (short-term) ...

... Dividend Growth Model FINA 635A Managerial Finance Nisan Langberg Stock valuation and the implied growth rate In order to evaluate whether Netflix is an overpriced stock you are asked to estimate the growth in earnings that investors expect. Suppose that Netflix will experience a fixed (short-term) ...

2014 Headwinds, Tailwinds, Trends, Strategy

... This commentary contains opinions and analysis that are provided by the presenter for informational purposes only and should not be used as the primary basis for an investment decision. Please consider your individual investment objectives and risk tolerances before making investment decisions. Not ...

... This commentary contains opinions and analysis that are provided by the presenter for informational purposes only and should not be used as the primary basis for an investment decision. Please consider your individual investment objectives and risk tolerances before making investment decisions. Not ...

Loss Avoidance - Raymond James

... Why did the British and French governments continue to pour taxpayer funds into the plane when it was clear that it would be unprofitable? It was because, in their minds, “they had invested too much to quit”. After pouring so much money into development, they found it unthinkable to give up and cut ...

... Why did the British and French governments continue to pour taxpayer funds into the plane when it was clear that it would be unprofitable? It was because, in their minds, “they had invested too much to quit”. After pouring so much money into development, they found it unthinkable to give up and cut ...

Optimal Portfolios under Worst Case Scenarios

... and do not care about the states of the world in which the cash-flows are received. In a very interesting paper Dybvig (1988a, 1988b) essentially showed that in these instances optimal portfolios are decreasing in the state price density, also pointing indirectly to the important role of diversified ...

... and do not care about the states of the world in which the cash-flows are received. In a very interesting paper Dybvig (1988a, 1988b) essentially showed that in these instances optimal portfolios are decreasing in the state price density, also pointing indirectly to the important role of diversified ...

Document

... Blue Chip Companies: Largest, most financially sound, best-known firms listed on NYSE, with stock normally in high demand, long term profitably ...

... Blue Chip Companies: Largest, most financially sound, best-known firms listed on NYSE, with stock normally in high demand, long term profitably ...

PERSONAL FINANCE TEST B - Cardinal Spellman High School

... 105 dollars paid exactly one year from now both have the same value to the recipient who assumes 5 percent interest; using time value of money terminology, 100 dollars invested for one year at 5 percent interest has a future value of 105 dollars.[1] This notion dates at least to Martín de Azpilcueta ...

... 105 dollars paid exactly one year from now both have the same value to the recipient who assumes 5 percent interest; using time value of money terminology, 100 dollars invested for one year at 5 percent interest has a future value of 105 dollars.[1] This notion dates at least to Martín de Azpilcueta ...

ExRiskValue

... stock prices are much more volatile than changes in dividend payouts. Because the low volatility of dividend payout, the discount rate for value future dividend should be low. However, stock prices are mainly determined by short term investors. Their discount rate is determined by CAPM model, which ...

... stock prices are much more volatile than changes in dividend payouts. Because the low volatility of dividend payout, the discount rate for value future dividend should be low. However, stock prices are mainly determined by short term investors. Their discount rate is determined by CAPM model, which ...

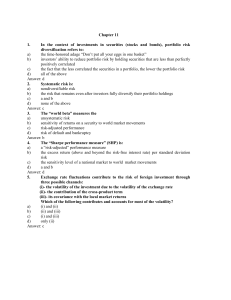

TEST BANK

... Calculate the variance of the monthly rate of return in dollar terms, if the variance of the foreign market’s return (in terms of its own currency) is 1.14, the variance between the U.S. dollar and the foreign currency is 17.64, the covariance is 2.34, and the contribution of the cross-product term ...

... Calculate the variance of the monthly rate of return in dollar terms, if the variance of the foreign market’s return (in terms of its own currency) is 1.14, the variance between the U.S. dollar and the foreign currency is 17.64, the covariance is 2.34, and the contribution of the cross-product term ...

The Efficient Market Hypothesis

... price movements was likely to fail. • A forecast about favorable future price performance leads to favorable current performance, as market participants all try to get into the action before price jump. ...

... price movements was likely to fail. • A forecast about favorable future price performance leads to favorable current performance, as market participants all try to get into the action before price jump. ...

4) Sentiment derived from Put/Call ratio

... sentiment is very bearish but how much bearish, how does it compare to previous episodes based on market data and what does it imply in the near future? This is the question I am trying to answer for you. Stock market are in the 8th month of corrective action. Fear and bearishness is very diffuse an ...

... sentiment is very bearish but how much bearish, how does it compare to previous episodes based on market data and what does it imply in the near future? This is the question I am trying to answer for you. Stock market are in the 8th month of corrective action. Fear and bearishness is very diffuse an ...

July 24, 2016 - Stearns Financial Group

... in order to buy at better prices are likely to be disappointed unless there is some big negative surprise that creates a more intense “risk off” investor mood. SFG’s take: The latest surge in U.S. stocks and other investments are a result of relative positive surprises in the economy and earnings, a ...

... in order to buy at better prices are likely to be disappointed unless there is some big negative surprise that creates a more intense “risk off” investor mood. SFG’s take: The latest surge in U.S. stocks and other investments are a result of relative positive surprises in the economy and earnings, a ...

Don`t Expect the Easy Market Gains of the Reagan Era

... 2017. We expect stock and bond market volatility to remain highly variable, as it often is near inflection points. Low expected returns and higher volatility mean that investment success will make it hard for investors to reap the returns they desire. In our view, additional return through active ma ...

... 2017. We expect stock and bond market volatility to remain highly variable, as it often is near inflection points. Low expected returns and higher volatility mean that investment success will make it hard for investors to reap the returns they desire. In our view, additional return through active ma ...

Stock trader

A stock trader or equity trader or share trader is a person or company involved in trading equity securities. Stock traders may be an agent, hedger, arbitrageur, speculator, stockbroker or investor. A stock investor is an individual or company who puts money to use by the purchase of equity securities, offering potential profitable returns, as interest, income, or appreciation in value (capital gains). This buy-and-hold long term strategy is passive in nature, as opposed to speculation, which is typically active in nature. Many stock speculators will trade bonds (and possibly other financial assets) as well. Stock speculation is a risky and complex occupation because the direction of the markets are generally unpredictable and lack transparency, also financial regulators are sometimes unable to adequately detect, prevent and remediate irregularities committed by malicious listed companies or other financial market participants. In addition, the financial markets are usually subjected to speculation.