... GDP and international reserves have continued to decline, which resulted in a 20.5% year-on-year devaluation of the Surinamese dollar in November 2015. From January to August 2015, total government revenue fell by 19% compared with the year-earlier period. While there was a small increase in indirec ...

1 SAMPLE TEST 3 QUESTIONS TRUE

... MULTIPLE CHOICE (3 points each). Circle your answer. 4. Excess reserves make a bank less vulnerable to panics, but bankers do not like to hold excess reserves because holding excess reserves a. are disliked by depositors. b. means lower profits for banks. c. are discouraged by government regulators. ...

... MULTIPLE CHOICE (3 points each). Circle your answer. 4. Excess reserves make a bank less vulnerable to panics, but bankers do not like to hold excess reserves because holding excess reserves a. are disliked by depositors. b. means lower profits for banks. c. are discouraged by government regulators. ...

Money in the Economy

... differential between any two countries is equal to the expected rate of change in the exchange rate between those two countries. ...

... differential between any two countries is equal to the expected rate of change in the exchange rate between those two countries. ...

Singapore`s Exchange Rate

... Singapore’s Exchange Rate-Based Monetary Policy Since 1981, monetary policy in Singapore has been centred on the management of the exchange rate. The primary objective has been to promote price stability as a sound basis for sustainable economic growth. The exchange rate represents an ideal intermed ...

... Singapore’s Exchange Rate-Based Monetary Policy Since 1981, monetary policy in Singapore has been centred on the management of the exchange rate. The primary objective has been to promote price stability as a sound basis for sustainable economic growth. The exchange rate represents an ideal intermed ...

Trinidad_and_Tobago_en.pdf

... Moreover, as fiscal injections expanded by 3.8% in fiscal year 2007-2008 relative to 2006-2007, the central bank raised the commercial bank reserve requirement from 11% to 15% and then, in October, to 17%. The central bank also stepped up its open market liquidity absorption operations by a huge 135 ...

... Moreover, as fiscal injections expanded by 3.8% in fiscal year 2007-2008 relative to 2006-2007, the central bank raised the commercial bank reserve requirement from 11% to 15% and then, in October, to 17%. The central bank also stepped up its open market liquidity absorption operations by a huge 135 ...

Paper 257

... Abstract In the last decades, many developing countries abandoned their existing policy regimes and adopted inflation targeting (IT) by which they aimed to control inflation through the use of policy interest rates. During the period before the crisis, most of these countries experienced large appre ...

... Abstract In the last decades, many developing countries abandoned their existing policy regimes and adopted inflation targeting (IT) by which they aimed to control inflation through the use of policy interest rates. During the period before the crisis, most of these countries experienced large appre ...

International Monetary Systems

... 1. International Monetary Fund (IMF) Purpose: To lend FX to any member whose supply of FX had become scarce. (To help the countries facing difficulty: CA deficit tight monetary policy employment). Lending would be conditional on the member’s pursuit of economic policies that IMF would think app ...

... 1. International Monetary Fund (IMF) Purpose: To lend FX to any member whose supply of FX had become scarce. (To help the countries facing difficulty: CA deficit tight monetary policy employment). Lending would be conditional on the member’s pursuit of economic policies that IMF would think app ...

LCQ19: Linked Exchange Rate (7

... currency collapse. It provides Hong Kong with a firm monetary anchor which, among other things, reduces the foreign exchange risk faced by importers, exporters and international investors. The disadvantages of the Link are that it ties Hong Kong to US monetary policy at times when the economic cycle ...

... currency collapse. It provides Hong Kong with a firm monetary anchor which, among other things, reduces the foreign exchange risk faced by importers, exporters and international investors. The disadvantages of the Link are that it ties Hong Kong to US monetary policy at times when the economic cycle ...

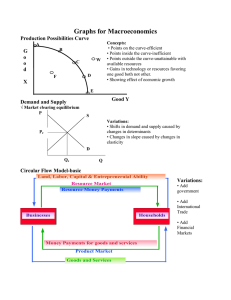

Graphs for Macroeconomics Production Possibilities Curve G o

... • As new demand and supply factors impact this market, changes in interest rate causes changes in investment and interest rate-driven consumption, which affects AD, ASsr, ASlr PL and Real GDP. • When government financing deficit spending, the impact of borrowing increases the demand curve and raises ...

... • As new demand and supply factors impact this market, changes in interest rate causes changes in investment and interest rate-driven consumption, which affects AD, ASsr, ASlr PL and Real GDP. • When government financing deficit spending, the impact of borrowing increases the demand curve and raises ...

Economy of the United Kingdom

... London is the world capital for foreign exchange trading. The highest daily volume, counted in trillions of dollars US, is reached when New York enters the trade. The currency of the UK is the pound sterling, represented by the symbol £. The Bank of England is the central bank, responsible for issui ...

... London is the world capital for foreign exchange trading. The highest daily volume, counted in trillions of dollars US, is reached when New York enters the trade. The currency of the UK is the pound sterling, represented by the symbol £. The Bank of England is the central bank, responsible for issui ...

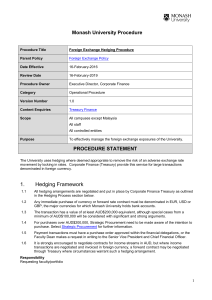

Foreign Exchange Hedge Aust Procedures

... movement by locking in rates. Corporate Finance (Treasury) provide this service for large transactions denominated in foreign currency. ...

... movement by locking in rates. Corporate Finance (Treasury) provide this service for large transactions denominated in foreign currency. ...

Deutsche Bank’s View of the US Economy and the Fed

... full solution to the Hotelling (1931) problem requires that the government set the initial wage so that the initial stock of labor is employed when the domestic wage rises to the world wage. ...

... full solution to the Hotelling (1931) problem requires that the government set the initial wage so that the initial stock of labor is employed when the domestic wage rises to the world wage. ...

Real GDP Growth Rates

... ◦ The continuation of an overvalued ruble and lack of capital inflows depleted reserves rapidly. Thus, Russian govt. Devalued the ruble Defaulted on domestic debt Declared a 90-day moratorium on repayment of foreign debt September 2, 1998: ◦ Forced to float the ruble ...

... ◦ The continuation of an overvalued ruble and lack of capital inflows depleted reserves rapidly. Thus, Russian govt. Devalued the ruble Defaulted on domestic debt Declared a 90-day moratorium on repayment of foreign debt September 2, 1998: ◦ Forced to float the ruble ...

EXCHANGE RATES

... effective, and to prevent or manage exchange rate 5...... . The CTT is not designed to change FX market behaviour, but only to raise money without 6... the market. But of course taxing FX transactions would increase the spread (difference between the 7... and the 8... prices at which trades would be ...

... effective, and to prevent or manage exchange rate 5...... . The CTT is not designed to change FX market behaviour, but only to raise money without 6... the market. But of course taxing FX transactions would increase the spread (difference between the 7... and the 8... prices at which trades would be ...

chapte r 4

... How exchange rates reach equilibrium? 1. Demand for a Currency a. derived from the local buyers who are willing and able to purchase foreign goods but who must convert their local currencies. b. An indirect relationship exists between the cost of foreign currency and amount demanded. c. Graphically, ...

... How exchange rates reach equilibrium? 1. Demand for a Currency a. derived from the local buyers who are willing and able to purchase foreign goods but who must convert their local currencies. b. An indirect relationship exists between the cost of foreign currency and amount demanded. c. Graphically, ...

Chapter 1

... assets The concept of equilibrium Basic supply and demand to explain behavior in financial markets The search for profits An approach to financial structure based on transaction costs and asymmetric ...

... assets The concept of equilibrium Basic supply and demand to explain behavior in financial markets The search for profits An approach to financial structure based on transaction costs and asymmetric ...

Slides on Currencies in International Trade (Session 3)

... purchase and sale of an amount of foreign exchange on two different dates ◦ Swaps are used when it is desirable to move out of one currency into another for a limited period without incurring foreign exchange rate risk For example, you have accepted an order in Japanese yen and you must manufactur ...

... purchase and sale of an amount of foreign exchange on two different dates ◦ Swaps are used when it is desirable to move out of one currency into another for a limited period without incurring foreign exchange rate risk For example, you have accepted an order in Japanese yen and you must manufactur ...

Bolivia_en.pdf

... credit and net domestic credit to the non-financial public sector. During the first half of the year, total net domestic credit did not meet the programme target. After leaving the repo rate unchanged for more than one and a half years, the central bank raised this rate in June 2011 as part of its c ...

... credit and net domestic credit to the non-financial public sector. During the first half of the year, total net domestic credit did not meet the programme target. After leaving the repo rate unchanged for more than one and a half years, the central bank raised this rate in June 2011 as part of its c ...

international portfolio flows and exchange rate volatility in emerging

... rate volatility using monthly bilateral data for the UWS vis-a-vis seven Asian developing and emerging countries (India, Indonesia, Pakistan, the Philippines, South Korea, Taiwan and Thailand) over the period 1993:01-2015:11. GARCH models and Markov switching specifications with time-varying transit ...

... rate volatility using monthly bilateral data for the UWS vis-a-vis seven Asian developing and emerging countries (India, Indonesia, Pakistan, the Philippines, South Korea, Taiwan and Thailand) over the period 1993:01-2015:11. GARCH models and Markov switching specifications with time-varying transit ...

Макроэкономический Анализ и Обзор Финан

... Inflation did not grow as high as in 2007 due to 1) falling commodity prices at the world markets 2) the Nominal Effective Exchange rate appreciation at more than 12% (AZN is pegged to basket) ...

... Inflation did not grow as high as in 2007 due to 1) falling commodity prices at the world markets 2) the Nominal Effective Exchange rate appreciation at more than 12% (AZN is pegged to basket) ...

Chronology of Events

... High government deficits and debt would not have been a major problem if the economy had been able to generate capital inflows through trade. But, the economy had very poor export growth and entered a recession in the late 1990’s. ...

... High government deficits and debt would not have been a major problem if the economy had been able to generate capital inflows through trade. But, the economy had very poor export growth and entered a recession in the late 1990’s. ...

Lecture 2 (POWER POINT)

... exchange rate within ±1% of the adopted par value by buying or selling foreign reserves as necessary. • The U.S. was only country responsible for maintaining the gold parity, which they did at $35 per ounce. • Under Bretton Woods, the IMF was created and World Bank are created. • The Bretton Woods s ...

... exchange rate within ±1% of the adopted par value by buying or selling foreign reserves as necessary. • The U.S. was only country responsible for maintaining the gold parity, which they did at $35 per ounce. • Under Bretton Woods, the IMF was created and World Bank are created. • The Bretton Woods s ...

Highlights of Colombia Economic analysis 2011

... U.S. Dollar drops, considering bond purchases by the Federal Reserve3 and the European Central Bank; a lower rating of U.S. Treasury Bonds and T-bills, making investments in emerging markets more attractive; higher foreign sales; foreign investment flows; and more resources from foreign financing. I ...

... U.S. Dollar drops, considering bond purchases by the Federal Reserve3 and the European Central Bank; a lower rating of U.S. Treasury Bonds and T-bills, making investments in emerging markets more attractive; higher foreign sales; foreign investment flows; and more resources from foreign financing. I ...

Foreign-exchange reserves

Foreign-exchange reserves (also called forex reserves or FX reserves) are assets held by a central bank or other monetary authority, usually in various reserve currencies, mostly the United States dollar, and to a lesser extent the euro, the pound sterling, and the Japanese yen, and used to back its liabilities—e.g., the local currency issued, and the various bank reserves deposited with the central bank by the government or by financial institutions.