Changes in demand of domestic goods relative

... 3. Changes in policies take time to be implemented and to affect the economy. Because they are slow, policies may affect the economy after the effects of an economic change have dissipated. ...

... 3. Changes in policies take time to be implemented and to affect the economy. Because they are slow, policies may affect the economy after the effects of an economic change have dissipated. ...

Exchange rates

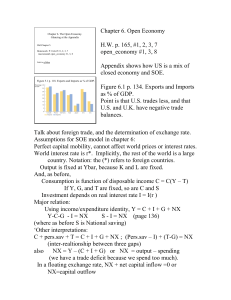

... Point is that U.S. trades less, and that U.S. and U.K. have negative trade balances. Talk about foreign trade, and the determination of exchange rate. Assumptions for SOE model in chapter 6: Perfect capital mobility, cannot affect world prices or interest rates. World interest rate is r*. Implicitly ...

... Point is that U.S. trades less, and that U.S. and U.K. have negative trade balances. Talk about foreign trade, and the determination of exchange rate. Assumptions for SOE model in chapter 6: Perfect capital mobility, cannot affect world prices or interest rates. World interest rate is r*. Implicitly ...

What caused the Great Depression?

... – Banks used gold as reserves to back up their loans when bank gold reserves were lost to other countries because of the gold standard they had to reduce loans businesses had to cut back on production because they couldn’t get loans workers laid off and supply orders reduced ...

... – Banks used gold as reserves to back up their loans when bank gold reserves were lost to other countries because of the gold standard they had to reduce loans businesses had to cut back on production because they couldn’t get loans workers laid off and supply orders reduced ...

Currency Depreciation and J Curve Analysis

... correction coefficient (-0.2955) indicates 29.5% disequilibrium is corrected every quarter and negative sign of coefficient implies TB moves downwards and towards the long run equilibrium path. However, there ...

... correction coefficient (-0.2955) indicates 29.5% disequilibrium is corrected every quarter and negative sign of coefficient implies TB moves downwards and towards the long run equilibrium path. However, there ...

dr Bartłomiej Rokicki Chair of Macroeconomics and International

... • Similarly to the exchange rate derivatives we may also find interest rate derivatives such as interest rate futures or interest rate swaps. • Interest rate futures in the US markets are traded on the CME (Chicago Mercantile Exchange). All CME interest rate futures contracts are traded using a pric ...

... • Similarly to the exchange rate derivatives we may also find interest rate derivatives such as interest rate futures or interest rate swaps. • Interest rate futures in the US markets are traded on the CME (Chicago Mercantile Exchange). All CME interest rate futures contracts are traded using a pric ...

File

... Risk of foreign capital exiting- if this happens in domestic economy unemployment rises as capital leaves. Significant reduction in imports. ...

... Risk of foreign capital exiting- if this happens in domestic economy unemployment rises as capital leaves. Significant reduction in imports. ...

Monetary Policy in the Post-Crisis Period A. Hakan Kara

... Step 1: Keep short term rates as low as possible and use interest rate corridor to discourage short term capital inflows to allow an orderly realignment in exchange rates. Step 2: Tighten through macro prudential instruments to curb credit growth and domestic absorption ( in coordination with other ...

... Step 1: Keep short term rates as low as possible and use interest rate corridor to discourage short term capital inflows to allow an orderly realignment in exchange rates. Step 2: Tighten through macro prudential instruments to curb credit growth and domestic absorption ( in coordination with other ...

The Foreign Currency Market

... (ii) Using a correctly labeled graph of the foreign exchange market for the euro, show how the value of the euro would change relative to the United States dollar in a flexible exchange rate system. ...

... (ii) Using a correctly labeled graph of the foreign exchange market for the euro, show how the value of the euro would change relative to the United States dollar in a flexible exchange rate system. ...

Macroeconomics Case Study: Chinese Macroeconomic Policy

... to the WTO means opening up the economy by reducing trade barriers, and the financial sector will be opened to foreign financial institutes for business with Chinese enterprises, starting from 2006. The “gradual reform” policy stance may have been one of the reasons for success, but at the same time, ...

... to the WTO means opening up the economy by reducing trade barriers, and the financial sector will be opened to foreign financial institutes for business with Chinese enterprises, starting from 2006. The “gradual reform” policy stance may have been one of the reasons for success, but at the same time, ...

ch25 - Index of

... rate increases when inflation is too high and decreases when output is too low ...

... rate increases when inflation is too high and decreases when output is too low ...

presentation - Centre for History and Economics

... The strongest country tries to impose fiscal and monetary discipline on the weakest and least disciplined members by demanding tougher rules and controls, ultimately threatening implicitly to withdraw from the monetary union. The first Revision of the Stability pact weakened it (2005), following Ger ...

... The strongest country tries to impose fiscal and monetary discipline on the weakest and least disciplined members by demanding tougher rules and controls, ultimately threatening implicitly to withdraw from the monetary union. The first Revision of the Stability pact weakened it (2005), following Ger ...

14.02 Principles of Macroeconomics Fall 2004 Quiz 2

... Communia is likely to have a higher natural level of output than Individuela. Communia is likely to have a higher natural rate of unemployment than Individuela. Wages are probably lower in Communia than in Individuela. In the short-run, the price level is always lower in Communia than in Individuela ...

... Communia is likely to have a higher natural level of output than Individuela. Communia is likely to have a higher natural rate of unemployment than Individuela. Wages are probably lower in Communia than in Individuela. In the short-run, the price level is always lower in Communia than in Individuela ...

Full Report - Federal Reserve Bank of New York

... about 18.6 percent since the start of the year. The dollar generally appreciated against the currencies of most other industrialized countries during the first two months of the quarter. The dollar’s gains were largely driven by similar factors as those observed since the global credit crisis sharpl ...

... about 18.6 percent since the start of the year. The dollar generally appreciated against the currencies of most other industrialized countries during the first two months of the quarter. The dollar’s gains were largely driven by similar factors as those observed since the global credit crisis sharpl ...

Causes of Capital Inflows and Policy Responses to Them

... When a capital inflow is associated with an upward shift in the money demand function (induced, say, by financial deregulation), no policy action is required because, in this case, the expansion of the monetary base will not be inflationary or threaten external viability. It may be necessary, howeve ...

... When a capital inflow is associated with an upward shift in the money demand function (induced, say, by financial deregulation), no policy action is required because, in this case, the expansion of the monetary base will not be inflationary or threaten external viability. It may be necessary, howeve ...

what is happening to pakistan`s external sector

... trouble. This perception shows how little self confidence we have as a nation in our own capabilities and achievements. It is true that September 11 did help in diverting workers’ remittances from open market to inter bank, in providing some debt relief and new loans and grants, in removing official ...

... trouble. This perception shows how little self confidence we have as a nation in our own capabilities and achievements. It is true that September 11 did help in diverting workers’ remittances from open market to inter bank, in providing some debt relief and new loans and grants, in removing official ...

Israel Economic Review Vol. 10, No. 1 (2012), 00–11 Israel

... also advocated a "Council of Europe". formed thereafter with the assistance of French Foreign Minister Robert Schuman, mandated to create supranational communities on the path to a fully democratic, integrated Union. 3(3) The Schuman Declaration May 9, 1950 reaffirmed the concept in conjunction with ...

... also advocated a "Council of Europe". formed thereafter with the assistance of French Foreign Minister Robert Schuman, mandated to create supranational communities on the path to a fully democratic, integrated Union. 3(3) The Schuman Declaration May 9, 1950 reaffirmed the concept in conjunction with ...

I = NX

... How does the level of prices effect exchange rates? It doesn’t. All changes in a nation’s price level will be fully incorporated into the nominal exchange rate. It is the law of one price applied to the international marketplace. Purchasing-Power Parity suggests that nominal exchange rate movements ...

... How does the level of prices effect exchange rates? It doesn’t. All changes in a nation’s price level will be fully incorporated into the nominal exchange rate. It is the law of one price applied to the international marketplace. Purchasing-Power Parity suggests that nominal exchange rate movements ...

ask tyler - Forstrong Global Asset Management Inc.

... but in this case employing a currency hedge. The ETF will hold the same Japanese stocks, but will also hold forward contracts to sell yen and buy Canadian dollars. Forward contracts are essentially an agreement to buy one currency and sell another at a fixed exchange rate on a specified date in the ...

... but in this case employing a currency hedge. The ETF will hold the same Japanese stocks, but will also hold forward contracts to sell yen and buy Canadian dollars. Forward contracts are essentially an agreement to buy one currency and sell another at a fixed exchange rate on a specified date in the ...

Lecture 9 & 10 - National University of Ireland, Galway

... Dispersion of inflation much lower during EMU than in early 1990s. Similar dispersion to the United States Growth dispersion not unusually large However, both inflation and growth dispersion are persistent ...

... Dispersion of inflation much lower during EMU than in early 1990s. Similar dispersion to the United States Growth dispersion not unusually large However, both inflation and growth dispersion are persistent ...

If purchasing-power parity holds, a dollar will buy more

... and output in both the short and long run. and output only in the short run. in the long and short run, but affect output only in the short run. in the long and short run, but affect output only in the long run. Question 17 ...

... and output in both the short and long run. and output only in the short run. in the long and short run, but affect output only in the short run. in the long and short run, but affect output only in the long run. Question 17 ...

Foreign-exchange reserves

Foreign-exchange reserves (also called forex reserves or FX reserves) are assets held by a central bank or other monetary authority, usually in various reserve currencies, mostly the United States dollar, and to a lesser extent the euro, the pound sterling, and the Japanese yen, and used to back its liabilities—e.g., the local currency issued, and the various bank reserves deposited with the central bank by the government or by financial institutions.