Financial Globalization and Exchange Rates Philip R. Lane Gian Maria Milesi-Ferretti

... B. Gross flows and gross positions, industrial countries Figure 2 summarizes the evolution of gross external assets and liabilities in industrial countries during the past 20 years. The growth in international financial interdependence is striking: during this period, aggregate assets and liabilitie ...

... B. Gross flows and gross positions, industrial countries Figure 2 summarizes the evolution of gross external assets and liabilities in industrial countries during the past 20 years. The growth in international financial interdependence is striking: during this period, aggregate assets and liabilitie ...

Stock Market Response to Monetary and Fiscal Policy Shocks: Multi

... 2.1. Monetary policy and stock market performance Stock markets have a multidimensional role to play in connection with monetary policy decision making. On one hand, stock market performance is greatly affected by innovations in monetary policy through several channels, while, on the other hand, sto ...

... 2.1. Monetary policy and stock market performance Stock markets have a multidimensional role to play in connection with monetary policy decision making. On one hand, stock market performance is greatly affected by innovations in monetary policy through several channels, while, on the other hand, sto ...

PDD W P

... Consequently, the country is forced to liberalize its financial sector more to allow for greater capital inflows in response to its raising demand. To allow for more flexible movements of capital across border, the economy that is not well prepared will run a risk of mismanagement in the financial s ...

... Consequently, the country is forced to liberalize its financial sector more to allow for greater capital inflows in response to its raising demand. To allow for more flexible movements of capital across border, the economy that is not well prepared will run a risk of mismanagement in the financial s ...

Biographical Information Curriculum Vitae of Willem H. Buiter General

... helicopter money-rejecting comments of Mr. Fergus Cumming, can be found here. 74. "The ECB as Lender of Last Resort for Sovereigns in the Euro Area", with Ebrahim Rahbari, CEPR Discussion Paper No. 8974, May 2012, Journal of Common Market Studies, Special Issue: The JCMS Annual Review of the Europea ...

... helicopter money-rejecting comments of Mr. Fergus Cumming, can be found here. 74. "The ECB as Lender of Last Resort for Sovereigns in the Euro Area", with Ebrahim Rahbari, CEPR Discussion Paper No. 8974, May 2012, Journal of Common Market Studies, Special Issue: The JCMS Annual Review of the Europea ...

The Role of Simple Rules in the Conduct of

... The parameters associated with the inflation gap and the output gap were chosen by Taylor so that the equation roughly described the actual behaviour of the Federal Reserve in setting its target for the federal funds rate. Taylor shows that the parameter associated with the inflation gap needs to be ...

... The parameters associated with the inflation gap and the output gap were chosen by Taylor so that the equation roughly described the actual behaviour of the Federal Reserve in setting its target for the federal funds rate. Taylor shows that the parameter associated with the inflation gap needs to be ...

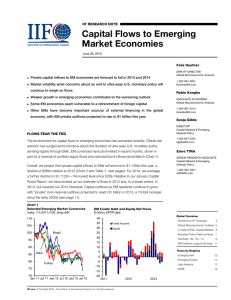

Capital Flows to Emerging Market Economies

... feature going forward. While an increase in policy rates by the Federal Reserve may still be some time away – not least because the U.S. unemployment rate may decline more slowly going forward and core inflation remains low – a process of normalization would be in line with the fact that U.S. growth ...

... feature going forward. While an increase in policy rates by the Federal Reserve may still be some time away – not least because the U.S. unemployment rate may decline more slowly going forward and core inflation remains low – a process of normalization would be in line with the fact that U.S. growth ...

Towards a Strategy for Economic Growth in Uruguay

... multilateral real exchange rate remained relatively flat (with some deflationary trend) until the end of 1990. From then on it entered a strong real appreciation trend until its crisis in 2002. By contrast, while Argentina and Brazil also exhibit these broad trends, they show much more volatility. I ...

... multilateral real exchange rate remained relatively flat (with some deflationary trend) until the end of 1990. From then on it entered a strong real appreciation trend until its crisis in 2002. By contrast, while Argentina and Brazil also exhibit these broad trends, they show much more volatility. I ...

CHAPTER 8

... Why does prudential regulation fail to stem a banking crisis? Is this different than the U.S. and other developed economies? The story is similar to the U.S., with various interests trying to prevent regulators from doing their jobs. However, in developing economies, these interest (business) pr ...

... Why does prudential regulation fail to stem a banking crisis? Is this different than the U.S. and other developed economies? The story is similar to the U.S., with various interests trying to prevent regulators from doing their jobs. However, in developing economies, these interest (business) pr ...

NBER WORKING PAPER SERIES MONETARY POLICY STRATEGY: HOW DID WE GET HERE?

... Why did monetary targeting in the United States, Canada and the United Kingdom during the late 1970s and the 1980s not prove successful in controlling inflation? There are two interpretations for why this was the case. One is that monetary targeting was not pursued seriously, so it never had a chanc ...

... Why did monetary targeting in the United States, Canada and the United Kingdom during the late 1970s and the 1980s not prove successful in controlling inflation? There are two interpretations for why this was the case. One is that monetary targeting was not pursued seriously, so it never had a chanc ...

NBER WORKING PAPER SERIES

... so. The situation is exactly the same in the exchange market. It is far simpler to allow one price to change, namely, the price of foreign exchange, than to rely upon changes in the multitude of prices that together constitute the internal price structure.” In his case against the euro, Feldstein ( ...

... so. The situation is exactly the same in the exchange market. It is far simpler to allow one price to change, namely, the price of foreign exchange, than to rely upon changes in the multitude of prices that together constitute the internal price structure.” In his case against the euro, Feldstein ( ...

Financial Crises in Emerging Market Countries

... Why does prudential regulation fail to stem a banking crisis? Is this different than the U.S. and other developed economies? The story is similar to the U.S., with various interests trying to prevent regulators from doing their jobs. However, in developing economies, these interest (business) pr ...

... Why does prudential regulation fail to stem a banking crisis? Is this different than the U.S. and other developed economies? The story is similar to the U.S., with various interests trying to prevent regulators from doing their jobs. However, in developing economies, these interest (business) pr ...

``Cooperation in Hard Times: Self-Restraint of Trade Protection''

... theories would point to the challenge of informal cooperation among states. Indeed, the purpose of institutions such as the WTO is to address this challenge by providing credible third-party enforcement that ties leaders’ hands in an anarchic international environment. Yet at the height of world eco ...

... theories would point to the challenge of informal cooperation among states. Indeed, the purpose of institutions such as the WTO is to address this challenge by providing credible third-party enforcement that ties leaders’ hands in an anarchic international environment. Yet at the height of world eco ...

Volume 69 No. 2, June 2006 Contents

... and Governor Alan Bollard consider three major global developments that are having a profound effect on the New Zealand economy. ...

... and Governor Alan Bollard consider three major global developments that are having a profound effect on the New Zealand economy. ...

Has the Riksbank Been Reacting to Asset Prices?

... (Svensson 2014b: 104-5). Svensson has argued that nearly 40,000 jobs may have been lost because of this policy (Svensson 2013: 2), while contending that the Riksbank has historically interpreted its task of contributing to financial stability too broadly and has thereby wrongly taken it upon itself ...

... (Svensson 2014b: 104-5). Svensson has argued that nearly 40,000 jobs may have been lost because of this policy (Svensson 2013: 2), while contending that the Riksbank has historically interpreted its task of contributing to financial stability too broadly and has thereby wrongly taken it upon itself ...

FISCAL AND MONETARY POLICY INTERACTIONS: A GAME

... Palavras-chave: Política Fiscal e Monetária, Teoria dos Jogos, Equilíbrio de Nash, Equilíbrio de Stackelberg, Cooperação, Brasil. ...

... Palavras-chave: Política Fiscal e Monetária, Teoria dos Jogos, Equilíbrio de Nash, Equilíbrio de Stackelberg, Cooperação, Brasil. ...

English

... multilateral real exchange rate remained relatively flat (with some deflationary trend) until the end of 1990. From then on it entered a strong real appreciation trend until its crisis in 2002. By contrast, while Argentina and Brazil also exhibit these broad trends, they show much more volatility. I ...

... multilateral real exchange rate remained relatively flat (with some deflationary trend) until the end of 1990. From then on it entered a strong real appreciation trend until its crisis in 2002. By contrast, while Argentina and Brazil also exhibit these broad trends, they show much more volatility. I ...

M o n e t a r y ... Contents 1 March 2002

... strength than we expected and there appears to be little surplus productive capacity. Although GDP growth for the September quarter was weaker than expected, much of that weakness appears to have been connected with the unusually dry winter and is likely to have been reversed in subsequent months. S ...

... strength than we expected and there appears to be little surplus productive capacity. Although GDP growth for the September quarter was weaker than expected, much of that weakness appears to have been connected with the unusually dry winter and is likely to have been reversed in subsequent months. S ...

Chinese Exporters, Exchange Rate Exposure, and the

... are 100 percent denominated in U.S. dollars while its markets are equally split between the U.S., Europe and Japan. The …rm has negligible imported costs. When interviewed, the …rm’s general manager was acutely aware of the dollar exposure of the …rm and the pressure the …rm faced due to the rise of ...

... are 100 percent denominated in U.S. dollars while its markets are equally split between the U.S., Europe and Japan. The …rm has negligible imported costs. When interviewed, the …rm’s general manager was acutely aware of the dollar exposure of the …rm and the pressure the …rm faced due to the rise of ...

Managing Financial Crisis in an Interconnected World

... Per Jacobsson Foundation Lecture to this most distinguished audience here at the Bank for International Settlements (BIS) in Basel. This lecture series commemorates the lifelong contributions of Per Jacobsson to the international financial system. While his contributions have been extensive, importa ...

... Per Jacobsson Foundation Lecture to this most distinguished audience here at the Bank for International Settlements (BIS) in Basel. This lecture series commemorates the lifelong contributions of Per Jacobsson to the international financial system. While his contributions have been extensive, importa ...

NBER WORKING PAPER SERIES ENDOGENOUS FINANCIAL OPENNESS: EFFICIENCY AND POLITICAL ECONOMY CONSIDERATIONS

... We close Section 2 with the polar case, corresponding to high degrees of opportunism and political uncertainty. Here, first period policies are determined by a policy maker representing a narrow interest group facing political uncertainty. Specifically, we consider the case where the policy maker co ...

... We close Section 2 with the polar case, corresponding to high degrees of opportunism and political uncertainty. Here, first period policies are determined by a policy maker representing a narrow interest group facing political uncertainty. Specifically, we consider the case where the policy maker co ...

Deflation and Liberty - Satoshi Nakamoto Institute

... irrelevant for the wealth of a nation.10 This crucial insight would also inspire the intellectual battles of the next four or five generations of economists—men such as Jean-Baptiste Say, David Ricardo, John Stuart Mill, Frédéric Bastiat, and Carl Menger—who constantly made the case for sound money. ...

... irrelevant for the wealth of a nation.10 This crucial insight would also inspire the intellectual battles of the next four or five generations of economists—men such as Jean-Baptiste Say, David Ricardo, John Stuart Mill, Frédéric Bastiat, and Carl Menger—who constantly made the case for sound money. ...

Preview Sample 2

... ■ The second phase of globalization began around 1900 and was caused by the rise of electricity and steel production. ■ The phase reached its height just before the Great Depression, a worldwide economic downturn that started in 1929. ■ At the turn-of-the-century, Western Europe was the most industr ...

... ■ The second phase of globalization began around 1900 and was caused by the rise of electricity and steel production. ■ The phase reached its height just before the Great Depression, a worldwide economic downturn that started in 1929. ■ At the turn-of-the-century, Western Europe was the most industr ...

Chapter 10 8e SM

... 3. Although balance sheet exposure does not result in cash inflows and outflows, it does nevertheless affect amounts reported in consolidated financial statements. If the foreign currency is the functional currency, translation adjustments will be reported in stockholders’ equity. If translation adj ...

... 3. Although balance sheet exposure does not result in cash inflows and outflows, it does nevertheless affect amounts reported in consolidated financial statements. If the foreign currency is the functional currency, translation adjustments will be reported in stockholders’ equity. If translation adj ...

The Composition of Capital Flows: Is South Africa Different? -

... Most empirical analyses focus on FDI. Recent surveys of the empirical literature by Chakrabati (2001) and Kamaly (2002) suggest that a few selected variables play a key role in a country’s ability to attract FDI. The most important variables are the host country’s growth prospects, the openness of t ...

... Most empirical analyses focus on FDI. Recent surveys of the empirical literature by Chakrabati (2001) and Kamaly (2002) suggest that a few selected variables play a key role in a country’s ability to attract FDI. The most important variables are the host country’s growth prospects, the openness of t ...

International monetary systems

International monetary systems are sets of internationally agreed rules, conventions and supporting institutions, that facilitate international trade, cross border investment and generally the reallocation of capital between nation states. They provide means of payment acceptable between buyers and sellers of different nationality, including deferred payment. To operate successfully, they need to inspire confidence, to provide sufficient liquidity for fluctuating levels of trade and to provide means by which global imbalances can be corrected. The systems can grow organically as the collective result of numerous individual agreements between international economic factors spread over several decades. Alternatively, they can arise from a single architectural vision as happened at Bretton Woods in 1944.