1 THE KEYNES SOLUTION FOR PREVENTING GLOBAL

... capital funds across national boundaries B a policy that is directly contrary to the idea that free markets means free movement of capital funds across national borders. Despite such anti-free market government policies, this post war period until 1971 was an era of sustained economic growth in both ...

... capital funds across national boundaries B a policy that is directly contrary to the idea that free markets means free movement of capital funds across national borders. Despite such anti-free market government policies, this post war period until 1971 was an era of sustained economic growth in both ...

Module1.3

... Used by Fed for temporary adjustments to money supply. Repurchase agreements. Securities sold by dealers under agreement to repurchase on a certain date at a certain price. (adds reserve balances to the banking system) Reverse repurchase agreements. Securities purchased by dealers under agreement to ...

... Used by Fed for temporary adjustments to money supply. Repurchase agreements. Securities sold by dealers under agreement to repurchase on a certain date at a certain price. (adds reserve balances to the banking system) Reverse repurchase agreements. Securities purchased by dealers under agreement to ...

Week 2 - University of Massachusetts Amherst

... Evaluating the Floating Exchange Rate System • 1. The domestic policy can be conducted independently of the exchange rate, for the most part. This may be good or bad. – Typically, the Central Bank focuses on domestic policy, ignoring exchange rate fluctuation.e.g. Greenspan worries about inflation ...

... Evaluating the Floating Exchange Rate System • 1. The domestic policy can be conducted independently of the exchange rate, for the most part. This may be good or bad. – Typically, the Central Bank focuses on domestic policy, ignoring exchange rate fluctuation.e.g. Greenspan worries about inflation ...

The Crisis through the Lens of History

... net wealth. For example, household net wealth in the United States has fallen by an estimated 15 percent over the past year. Fourth, emerging economies are also facing much tighter limits on external financing, as global deleveraging and increasing risk aversion have curtailed investor interest in t ...

... net wealth. For example, household net wealth in the United States has fallen by an estimated 15 percent over the past year. Fourth, emerging economies are also facing much tighter limits on external financing, as global deleveraging and increasing risk aversion have curtailed investor interest in t ...

Essay q Q uestions for Chapter 5

... fiscal policies to fight the Great Recession. Furthermore can the separate effects of the fiscal and monetary programs be identified and measured? If such analysis of breaking down the separate monetary and fiscal effects is not possible, evaluate the effectiveness of the jointlaunched fiscal and mo ...

... fiscal policies to fight the Great Recession. Furthermore can the separate effects of the fiscal and monetary programs be identified and measured? If such analysis of breaking down the separate monetary and fiscal effects is not possible, evaluate the effectiveness of the jointlaunched fiscal and mo ...

1) An updated version of estimation of what is the actual Chinese

... that the countries that held more reserves came through the global financial crisis of 2008 in better shape than others. A majority of the reserves are typically held in the form of dollars (an estimated 70%, in China’s case), especially US Treasury bills. These pay a low rate of return. Meanwhile, ...

... that the countries that held more reserves came through the global financial crisis of 2008 in better shape than others. A majority of the reserves are typically held in the form of dollars (an estimated 70%, in China’s case), especially US Treasury bills. These pay a low rate of return. Meanwhile, ...

Financial stability and monetary policy

... Publication of voting records Openness, accountability ...

... Publication of voting records Openness, accountability ...

Weekly Commentary 12-15-14 PAA

... whether economic growth – in the United States and abroad – will be stifled by changing monetary policy in the United States. As a result, all eyes have been on the Federal Reserve, which is expected to begin raising the Fed funds rates sometime soon. However, the Federal Reserve’s monetary policy i ...

... whether economic growth – in the United States and abroad – will be stifled by changing monetary policy in the United States. As a result, all eyes have been on the Federal Reserve, which is expected to begin raising the Fed funds rates sometime soon. However, the Federal Reserve’s monetary policy i ...

The Global Economic Crisis and Alternatives to Rebuild the Economy

... Less resources to combat downturn and its effects Even countries with “good” economic policies are being affected Irony: money is flowing back to US ...

... Less resources to combat downturn and its effects Even countries with “good” economic policies are being affected Irony: money is flowing back to US ...

Document

... In 1981, Ronald Reagan followed policies almost exactly like Kennedy’s in 1961 with a tax cut and increased defense spending, but the rationale was a supply-side, not Keynesian, argument. Reagan said that cutting high marginal tax rates would encourage work and that reinstating the investment tax cr ...

... In 1981, Ronald Reagan followed policies almost exactly like Kennedy’s in 1961 with a tax cut and increased defense spending, but the rationale was a supply-side, not Keynesian, argument. Reagan said that cutting high marginal tax rates would encourage work and that reinstating the investment tax cr ...

FRBSF L CONOMIC

... Other euro-area countries are also implementing austerity measures and reforms. Portugal is planning to reduce its budget deficit to 2.8% of GDP by 2013. The government also plans to carry out structural reforms to enhance export competitiveness, invest in human and physical capital, and improve the ...

... Other euro-area countries are also implementing austerity measures and reforms. Portugal is planning to reduce its budget deficit to 2.8% of GDP by 2013. The government also plans to carry out structural reforms to enhance export competitiveness, invest in human and physical capital, and improve the ...

Argentina`s Economic Crisis: Interpretations and Proposals

... The Argentine ruling class made this process of revenue transfer out of the country viable, thereby impairing the internal market. It failed also in its project of establishing Mercosur, intended to establish a geographical area of business activity with some autonomy from the major capitalist count ...

... The Argentine ruling class made this process of revenue transfer out of the country viable, thereby impairing the internal market. It failed also in its project of establishing Mercosur, intended to establish a geographical area of business activity with some autonomy from the major capitalist count ...

Euro: Great Thing for Slovakia in Bad Times!

... For Slovakia, benefits of the adoption of single currency were thought to outweigh the costs by big margin even when the global economy was in full swing financial and transaction costs administrative costs ...

... For Slovakia, benefits of the adoption of single currency were thought to outweigh the costs by big margin even when the global economy was in full swing financial and transaction costs administrative costs ...

euro – advantages and disadvantages

... expansion of markets, i.e. by removing barriers to the free movement of goods, capital and labor force. This is one of the most important reasons for understand that the unification of countries in Europe is a way of increasing the prosperity of the citizens by the widespread use of the principle of ...

... expansion of markets, i.e. by removing barriers to the free movement of goods, capital and labor force. This is one of the most important reasons for understand that the unification of countries in Europe is a way of increasing the prosperity of the citizens by the widespread use of the principle of ...

Market Focus –IMF calls for rebalancing of world growth

... Europe. Repeating the same message as in July, the IMF believes that wherever possible high deficit advanced countries should make an early start in cutting their budget deficits. ♦ Although the emerging nations have relied on strong domestic consumption over the past year, the IMF thinks they will ...

... Europe. Repeating the same message as in July, the IMF believes that wherever possible high deficit advanced countries should make an early start in cutting their budget deficits. ♦ Although the emerging nations have relied on strong domestic consumption over the past year, the IMF thinks they will ...

FE_04 - University of Hawaii

... A change in monetary policy (interest rates) => changes in the exchange rate. Pressure on exchange rates implies a limited scope for interest rates. The three are tightly tied and are independent of any influence from the current account. ...

... A change in monetary policy (interest rates) => changes in the exchange rate. Pressure on exchange rates implies a limited scope for interest rates. The three are tightly tied and are independent of any influence from the current account. ...

Tackling the World Recession John Grieve Smith

... of the EU unemployment was generally higher before the crisis — 8.5 per cent in euroland as opposed to 5 per cent here — and there was already a need for accelerating the growth of demand to bring down unemployment. Manufacturing industry is being particularly badly hit. Industrial production is fal ...

... of the EU unemployment was generally higher before the crisis — 8.5 per cent in euroland as opposed to 5 per cent here — and there was already a need for accelerating the growth of demand to bring down unemployment. Manufacturing industry is being particularly badly hit. Industrial production is fal ...

A fresh start for DECPG

... • Developing countries aim to become less dependent on dollar and US monetary policy. • Coming decade will show shift from ingoing FDI to outgoing FDI. ...

... • Developing countries aim to become less dependent on dollar and US monetary policy. • Coming decade will show shift from ingoing FDI to outgoing FDI. ...

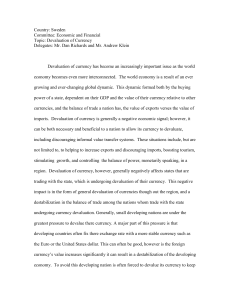

EcoFin

... greatest pressure to devalue there currency. A major part of this pressure is that developing countries often fix there exchange rate with a more stable currency such as the Euro or the United States dollar. This can often be good, however is the foreign currency’s value increases significantly it c ...

... greatest pressure to devalue there currency. A major part of this pressure is that developing countries often fix there exchange rate with a more stable currency such as the Euro or the United States dollar. This can often be good, however is the foreign currency’s value increases significantly it c ...

1 - National Bank

... Inflation has been well-contained since the February devaluation, and we see the current monetary policy stance as appropriate. Given the weak demand environment, we expect that inflation will be contained to 9 percent by year-end and will then gradually decline during the course of 2010. When infla ...

... Inflation has been well-contained since the February devaluation, and we see the current monetary policy stance as appropriate. Given the weak demand environment, we expect that inflation will be contained to 9 percent by year-end and will then gradually decline during the course of 2010. When infla ...

An internationalised rupee? - Bank for International Settlements

... The fourth issue that I would like to address is whether currency internationalisation poses challenges to the conduct of monetary policy. For Australia, the floating exchange rate has mitigated the impact of external shocks and minimised output variance. But the nominal anchor disappeared until in ...

... The fourth issue that I would like to address is whether currency internationalisation poses challenges to the conduct of monetary policy. For Australia, the floating exchange rate has mitigated the impact of external shocks and minimised output variance. But the nominal anchor disappeared until in ...

Homework #3 - UCSB Economics

... On one side, it seems unlikely that market intervention from some of the world’s most economically influential countries would even have much impact on the currency markets, due to the vastly large amount of currency that is traded every day. On the other hand, just the stated intention of a large c ...

... On one side, it seems unlikely that market intervention from some of the world’s most economically influential countries would even have much impact on the currency markets, due to the vastly large amount of currency that is traded every day. On the other hand, just the stated intention of a large c ...

International monetary systems

International monetary systems are sets of internationally agreed rules, conventions and supporting institutions, that facilitate international trade, cross border investment and generally the reallocation of capital between nation states. They provide means of payment acceptable between buyers and sellers of different nationality, including deferred payment. To operate successfully, they need to inspire confidence, to provide sufficient liquidity for fluctuating levels of trade and to provide means by which global imbalances can be corrected. The systems can grow organically as the collective result of numerous individual agreements between international economic factors spread over several decades. Alternatively, they can arise from a single architectural vision as happened at Bretton Woods in 1944.