What Drives the Economy? Key Economic Variables

... of the Australian dollar, the RBA stands ready, like other central banks, to intervene on foreign exchanges if trade becomes disorderly. ...

... of the Australian dollar, the RBA stands ready, like other central banks, to intervene on foreign exchanges if trade becomes disorderly. ...

Tenge Real Effective Exchange Rate Index (REER)

... turnover is at least 0.5%. At the same time, the sample of countries - major trade partners should cover at least 90% of the total turnover. It should be noted that for analytical purposes, the National Bank of the Republic of Kazakhstan calculates indexes of effective exchange rates also on the bas ...

... turnover is at least 0.5%. At the same time, the sample of countries - major trade partners should cover at least 90% of the total turnover. It should be noted that for analytical purposes, the National Bank of the Republic of Kazakhstan calculates indexes of effective exchange rates also on the bas ...

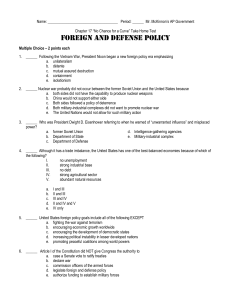

Foreign and Defense Policy

... e. industries that manufacture weapons systems c. US Senators 14. ______ A government that offers protectionism in its global trade emphasizes a. open markets for all domestic goods b. giving foreign exports priority status in the sale of all goods and services c. the immediate interests of domestic ...

... e. industries that manufacture weapons systems c. US Senators 14. ______ A government that offers protectionism in its global trade emphasizes a. open markets for all domestic goods b. giving foreign exports priority status in the sale of all goods and services c. the immediate interests of domestic ...

Currency Derivatives

... Say that after 3 months the rate of exchange reaches Rs. 46 to a USD (i.e. $100 = Rs 4600) ...

... Say that after 3 months the rate of exchange reaches Rs. 46 to a USD (i.e. $100 = Rs 4600) ...

the keynes solution: the path to global economic prosperity via a

... investment banks and the shadow banking system to the “mispricing of [probabilistic] risk” despite the fact that many large financial institutions were utilizing some variant of “risk management” models developed by Nobel Prize winning economists (as Greenspan noted in his testimony). This was true ...

... investment banks and the shadow banking system to the “mispricing of [probabilistic] risk” despite the fact that many large financial institutions were utilizing some variant of “risk management” models developed by Nobel Prize winning economists (as Greenspan noted in his testimony). This was true ...

Monetary policy outline: - International Policy Fellowships

... further moderated price pressures. After inflation of 25 percent in 1993 (the first year of independence) on the heels of the introduction of the VAT and a 10 percent devaluation, inflation fell gradually to some 7 percent at end 1995 and remained at about this level until mid 1999, despite consider ...

... further moderated price pressures. After inflation of 25 percent in 1993 (the first year of independence) on the heels of the introduction of the VAT and a 10 percent devaluation, inflation fell gradually to some 7 percent at end 1995 and remained at about this level until mid 1999, despite consider ...

International Monetary Policy Co

... Importance of International Policy Coordination The global economy consists of many interdependent individual and regional economies. Expansionary or contractionary monetary and fiscal policies in one country most often affects economic events significantly in another economies. Economic events in t ...

... Importance of International Policy Coordination The global economy consists of many interdependent individual and regional economies. Expansionary or contractionary monetary and fiscal policies in one country most often affects economic events significantly in another economies. Economic events in t ...

PDF Download

... registered by Spain (4 points). It remained unchanged in Germany, France and Italy, and fell in the UK (3 points). The EU consumer confidence indicator rose by yet another point in May. At the country level, developments were mixed. While consumers in Germany and Italy reported an increase in confid ...

... registered by Spain (4 points). It remained unchanged in Germany, France and Italy, and fell in the UK (3 points). The EU consumer confidence indicator rose by yet another point in May. At the country level, developments were mixed. While consumers in Germany and Italy reported an increase in confid ...

the failure of oca analysis

... of economic agents. If market participants expect a change in government policy, they will act in order to capture all the benefits and minimize the losses arising from that policy. For example, much of the so-called wage and price rigidities, which plague modern economies, are due to the overestima ...

... of economic agents. If market participants expect a change in government policy, they will act in order to capture all the benefits and minimize the losses arising from that policy. For example, much of the so-called wage and price rigidities, which plague modern economies, are due to the overestima ...

Day 2 - Refined Foreign Exchange

... • With a favourable RoE tourists are encouraged to travel • Tourists from a rich country will travel to SA • They will receive more rand for their currency • They perceive South Africa to be a cheap ...

... • With a favourable RoE tourists are encouraged to travel • Tourists from a rich country will travel to SA • They will receive more rand for their currency • They perceive South Africa to be a cheap ...

Foreign Exchange

... • With a favourable RoE tourists are encouraged to travel • Tourists from a rich country will travel to SA • They will receive more rand for their currency • They perceive South Africa to be a cheap ...

... • With a favourable RoE tourists are encouraged to travel • Tourists from a rich country will travel to SA • They will receive more rand for their currency • They perceive South Africa to be a cheap ...

EOCT Study Guide

... o Inefficiency: protectionism prevents domestic businesses from competing with international businesses which allows inefficient businesses, who would otherwise have been outcompeted and forced to close, to remain open. Over the long term, this weakens the national economy. - Trading Blocks: many na ...

... o Inefficiency: protectionism prevents domestic businesses from competing with international businesses which allows inefficient businesses, who would otherwise have been outcompeted and forced to close, to remain open. Over the long term, this weakens the national economy. - Trading Blocks: many na ...

SECTION8

... If the currency is OVERVALUED. • Central Banker must meet excess demand for the currency by supplying it. – Must be following a contractionary monetary policy. ...

... If the currency is OVERVALUED. • Central Banker must meet excess demand for the currency by supplying it. – Must be following a contractionary monetary policy. ...

The Triple Crisis and the Global Aid Architecture

... Changes in Private Capital Flows by Region Between 2007 and 2008 ($ Billion) -$88 Billion ...

... Changes in Private Capital Flows by Region Between 2007 and 2008 ($ Billion) -$88 Billion ...

Is Eurozone an Optimal Currency Area and What Barriers Could Obstruct the Future Development?

... We will use available data of economic variables to describe a current situation within the euro currency area of 17 states (which differ in size, degrees of openness and structure of economy) and compare it with the OCA model presumptions. In context of OCA model we will follow casual connections a ...

... We will use available data of economic variables to describe a current situation within the euro currency area of 17 states (which differ in size, degrees of openness and structure of economy) and compare it with the OCA model presumptions. In context of OCA model we will follow casual connections a ...

An assessment of the economic

... The (new) inconsistent triangle • The inconsistent triangle (Padoa-Schioppa, 1985) – Incompatibility between fixed but adjustable exchange rates, full capital mobility and independent monetary policies – This inconsistent triangle prooved to be true ...

... The (new) inconsistent triangle • The inconsistent triangle (Padoa-Schioppa, 1985) – Incompatibility between fixed but adjustable exchange rates, full capital mobility and independent monetary policies – This inconsistent triangle prooved to be true ...

Slope of the Phillips curve

... improvements are…contractionary on impact”? This is taken as a firm “stylized fact” that the models must be forced to obey. But I would have said the opposite: Positive productivity shocks are often associated with rapid growth and overheating of economy (e.g., rising real estate prices): Ireland, C ...

... improvements are…contractionary on impact”? This is taken as a firm “stylized fact” that the models must be forced to obey. But I would have said the opposite: Positive productivity shocks are often associated with rapid growth and overheating of economy (e.g., rising real estate prices): Ireland, C ...

BM410-18 International Analysis and

... currency • Variations in return related to the possibility that foreign exchange may be restricted and free flow of capital may not be allowed Can you hedge these risks? • It is not possible to completely hedge all foreign investments. You may be able to hedge part of those risks, but not all of t ...

... currency • Variations in return related to the possibility that foreign exchange may be restricted and free flow of capital may not be allowed Can you hedge these risks? • It is not possible to completely hedge all foreign investments. You may be able to hedge part of those risks, but not all of t ...

Recession

... monetary policy disturb the coordination process in economic life, both through expansion and contraction of the money supply ...

... monetary policy disturb the coordination process in economic life, both through expansion and contraction of the money supply ...

Kitty Law

... Communist state to a democracy. As a result, the nation required financial assistance to help in its transition. During this time, the nation suffered hyperinflation (when inflation goes out of control as a result of plummeting currency values). In 1997, inflation went up 500%, and by 2001, it was a ...

... Communist state to a democracy. As a result, the nation required financial assistance to help in its transition. During this time, the nation suffered hyperinflation (when inflation goes out of control as a result of plummeting currency values). In 1997, inflation went up 500%, and by 2001, it was a ...

Hoisington Quarterly Review and Outlook – 4Q 2016

... Monetary policy has become asymmetric due to over-indebtedness. This means that an easing of policy produces little stimulus while a modest tightening is very powerful in restraining economic activity. The Nobel laureate Milton Friedman held that through liquidity, income and price effects, (1) mone ...

... Monetary policy has become asymmetric due to over-indebtedness. This means that an easing of policy produces little stimulus while a modest tightening is very powerful in restraining economic activity. The Nobel laureate Milton Friedman held that through liquidity, income and price effects, (1) mone ...

How can quantitative easing policies be brought to an end

... Banks in the USA. The Central Bank is the reserve where all banks can use to find supplies and to satisfy their clientele’s liquidity requirements. It is both the “hammer” and the “anvil”: it must both restrict itself to a passive role, waiting for discounts to come from the market according to its ...

... Banks in the USA. The Central Bank is the reserve where all banks can use to find supplies and to satisfy their clientele’s liquidity requirements. It is both the “hammer” and the “anvil”: it must both restrict itself to a passive role, waiting for discounts to come from the market according to its ...

International monetary systems

International monetary systems are sets of internationally agreed rules, conventions and supporting institutions, that facilitate international trade, cross border investment and generally the reallocation of capital between nation states. They provide means of payment acceptable between buyers and sellers of different nationality, including deferred payment. To operate successfully, they need to inspire confidence, to provide sufficient liquidity for fluctuating levels of trade and to provide means by which global imbalances can be corrected. The systems can grow organically as the collective result of numerous individual agreements between international economic factors spread over several decades. Alternatively, they can arise from a single architectural vision as happened at Bretton Woods in 1944.