This PDF is a selection from a published volume from... Bureau of Economic Research

... controls. In these comments I will focus on the Chilean experience during the 1990s. As Edwards argues, “The . . . Chilean experience is particularly important since its practice of imposing reserve requirements has been praised by a number of analysts, including senior staff of the multilateral ins ...

... controls. In these comments I will focus on the Chilean experience during the 1990s. As Edwards argues, “The . . . Chilean experience is particularly important since its practice of imposing reserve requirements has been praised by a number of analysts, including senior staff of the multilateral ins ...

Carbaugh, International Economics 9e, Chapter 9

... Lowering of barriers caused within-region trade to grow much more quickly than overall world trade in the 1960s Steps to remove remaining barriers (198592) further increased integration Maastricht Summit (1991) began process of economic and monetary union (EMU) EMU came into full effect in 2 ...

... Lowering of barriers caused within-region trade to grow much more quickly than overall world trade in the 1960s Steps to remove remaining barriers (198592) further increased integration Maastricht Summit (1991) began process of economic and monetary union (EMU) EMU came into full effect in 2 ...

DOES DEVALUATION LEAD TO ECONOMIC RECOVERY OR

... confidence it will tend to have a positive effect; while where it fails to create confidence, or even damages it, it will also fail to turn capital outflows around and may even speed them up. Thus where devaluation is part of a credible macroeconomic strategy, is combined with appropriate counter- i ...

... confidence it will tend to have a positive effect; while where it fails to create confidence, or even damages it, it will also fail to turn capital outflows around and may even speed them up. Thus where devaluation is part of a credible macroeconomic strategy, is combined with appropriate counter- i ...

FRBSF E L CONOMIC ETTER

... participant’s views about the most likely, or modal, future outcome, conditioned on his or her assessment of “appropriate monetary policy,” which is defined as the future interest rate path that best satisfies that participant’s interpretation of the Federal Reserve’s dual objectives of maximum empl ...

... participant’s views about the most likely, or modal, future outcome, conditioned on his or her assessment of “appropriate monetary policy,” which is defined as the future interest rate path that best satisfies that participant’s interpretation of the Federal Reserve’s dual objectives of maximum empl ...

the global financial risks analysis in relation with systemic crisis

... variables counts also negative effects of globalization phenomenon, that would be called network shocks (Aglietta, 2005), defined by the enforced assimilations of the new global realities or values that appeared or amplified on the same time with it (as international crime networks or terrorism). Th ...

... variables counts also negative effects of globalization phenomenon, that would be called network shocks (Aglietta, 2005), defined by the enforced assimilations of the new global realities or values that appeared or amplified on the same time with it (as international crime networks or terrorism). Th ...

This PDF is a selection from an out-of-print volume from... of Economic Research

... once again under the shadow of financial instability, though decidedly not on the ropes. Acute overvaluation, melting of confidence, questions about the sustainability of reforms are all back. Today the questions are how much of the recent progress can be carried forward and how best to defuse the c ...

... once again under the shadow of financial instability, though decidedly not on the ropes. Acute overvaluation, melting of confidence, questions about the sustainability of reforms are all back. Today the questions are how much of the recent progress can be carried forward and how best to defuse the c ...

NBER TECHNICAL WORKING PAPERS SERIES FINANCIAL INTERMEDIATION AND MONETARY

... transmitting monetary shocks to the domestic economy and to the rest of the world output. We follow the strategy introduced in Grilli and Roubini [1989, 1991] which extended to an open economy framework pioneering work by Lucas [1991] on the liquidity effect of open—market ...

... transmitting monetary shocks to the domestic economy and to the rest of the world output. We follow the strategy introduced in Grilli and Roubini [1989, 1991] which extended to an open economy framework pioneering work by Lucas [1991] on the liquidity effect of open—market ...

Rules- Based International Monetary Reform

... supplement, to deviations of interest rates from normal policy. Currency intervention has been used widely in recent years by many emerging market countries. However, currency interventions can have adverse side effects even if they temporarily prevent appreciation. If they are not accompanied by ca ...

... supplement, to deviations of interest rates from normal policy. Currency intervention has been used widely in recent years by many emerging market countries. However, currency interventions can have adverse side effects even if they temporarily prevent appreciation. If they are not accompanied by ca ...

The Single Supervisory Mechanism (SSM)

... Notes: Long-term lending rates on loans with a maturity of more than one year. Aggregation is based on new business volumes. ...

... Notes: Long-term lending rates on loans with a maturity of more than one year. Aggregation is based on new business volumes. ...

A widening gap in living standards

... of Med and EU countries • Barcelona process to facilitate ...

... of Med and EU countries • Barcelona process to facilitate ...

Movement of the United States Dollars against selected major

... and many governmental policies. Its studies are of great interest to researches and governments since currency movements in either way has great policy implications. It is upon this purview that its studies have aroused the interest of many researchers. The Brandes Institute in 2007 conducted an ana ...

... and many governmental policies. Its studies are of great interest to researches and governments since currency movements in either way has great policy implications. It is upon this purview that its studies have aroused the interest of many researchers. The Brandes Institute in 2007 conducted an ana ...

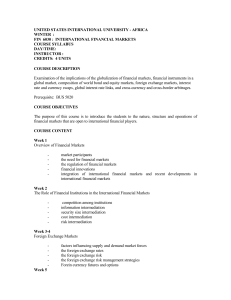

united states international university - africa

... the mismatch problem and creation of adjustable-rate mortgages default risk for mortgages development of secondary mortgage markets market for collateralized mortgage obligations ...

... the mismatch problem and creation of adjustable-rate mortgages default risk for mortgages development of secondary mortgage markets market for collateralized mortgage obligations ...

RESTRICTEDCode - World Trade Organization

... Although real GDP growth slowed in 2001 (1.9%), it rebounded in 2002 to 5.3%, perhaps aided by a more stable currency, low inflation, and early signs of fiscal consolidation in the Central Government. The Government forecasts about 4.5%-5.5% growth in 2003. Thailand’s steady progress towards macro s ...

... Although real GDP growth slowed in 2001 (1.9%), it rebounded in 2002 to 5.3%, perhaps aided by a more stable currency, low inflation, and early signs of fiscal consolidation in the Central Government. The Government forecasts about 4.5%-5.5% growth in 2003. Thailand’s steady progress towards macro s ...

W o r k

... The goal of this paper is to quantitatively account for this puzzle by introducing price rigidity and local currency pricing (LCP ) in an otherwise standard dynamic general equilibrium model. In studying the impact on equilibrium allocations of some firms’ ability to price discriminate across count ...

... The goal of this paper is to quantitatively account for this puzzle by introducing price rigidity and local currency pricing (LCP ) in an otherwise standard dynamic general equilibrium model. In studying the impact on equilibrium allocations of some firms’ ability to price discriminate across count ...

Topic 2 - CaRLO Economics

... In better responses, candidates clearly distinguished between the domestic and global factors that affect Australia's exchange rate. Additionally, these candidates often integrated these factors and examined both the short-term and long-term effects on the exchange rate. These responses often made r ...

... In better responses, candidates clearly distinguished between the domestic and global factors that affect Australia's exchange rate. Additionally, these candidates often integrated these factors and examined both the short-term and long-term effects on the exchange rate. These responses often made r ...

MONETARY POLICY TRANSMISSION MECHANISM IN ROMANIA

... The inflation impulse response to an unexpected growth of short term interest rate is negative. Thus, the inflation will significantly decrease and it will come back to its previous level after a long period due to a interest rate growth (i.e. a tighter monetary policy). A interest rate shock will l ...

... The inflation impulse response to an unexpected growth of short term interest rate is negative. Thus, the inflation will significantly decrease and it will come back to its previous level after a long period due to a interest rate growth (i.e. a tighter monetary policy). A interest rate shock will l ...

The Political Economy of Monetary Institutions

... determine monetary policy directly. With a fully independent central bank, by contrast, the government delegates monetary policy to an agent—typically the central bank’s governing board—and is restricted by statute from interfering with the agent’s freedom of action in the monetary domain. Countries ...

... determine monetary policy directly. With a fully independent central bank, by contrast, the government delegates monetary policy to an agent—typically the central bank’s governing board—and is restricted by statute from interfering with the agent’s freedom of action in the monetary domain. Countries ...

Peter Chow Presentation

... emerging Asian economies. The cumulated trade deficits in the U.S., which was mainly financed by the issuance of Treasury bonds, were to a great extent, purchased by the trade surplus countries to become their major foreign exchange reserves. It led to the “Lucus’ Paradox” of having ‘uphill” capital ...

... emerging Asian economies. The cumulated trade deficits in the U.S., which was mainly financed by the issuance of Treasury bonds, were to a great extent, purchased by the trade surplus countries to become their major foreign exchange reserves. It led to the “Lucus’ Paradox” of having ‘uphill” capital ...

3. Global crisis - University of Nottingham

... 1. Why did the crisis happen? • High-income countries embedded inside a currency union are more vulnerable to balance of payments cum financial crises than countries with floating exchange rates and their own central banks. • They are like emerging countries with exceptionally hard exchange-rate pe ...

... 1. Why did the crisis happen? • High-income countries embedded inside a currency union are more vulnerable to balance of payments cum financial crises than countries with floating exchange rates and their own central banks. • They are like emerging countries with exceptionally hard exchange-rate pe ...

(dis)equilibrium, uncertainty and monetary analysis: an essential

... on decisions with respect to production, the quantities, the raw materials, exchange and transactions between different firms. Economic actors were ex ante influenced on their decisionmaking: this can be seen as a significant limit to past economic organisations (Polanyi et al., 1957). Advanced mark ...

... on decisions with respect to production, the quantities, the raw materials, exchange and transactions between different firms. Economic actors were ex ante influenced on their decisionmaking: this can be seen as a significant limit to past economic organisations (Polanyi et al., 1957). Advanced mark ...

BUSINESS ENGLISH EXAM – PRACTICE TEST

... The administration of President George W. Bush used to argue that the IMF alone, not bilateral lenders, should be in charge of rescues. That doctrine, like several others, appears to have been discarded. The fund has insisted it stands ready to get money quickly to countries that need it and is cons ...

... The administration of President George W. Bush used to argue that the IMF alone, not bilateral lenders, should be in charge of rescues. That doctrine, like several others, appears to have been discarded. The fund has insisted it stands ready to get money quickly to countries that need it and is cons ...

Emerging Forces in the Capital Markets

... that are literally emerging into the global investment spotlight--in each of those cases, with securities markets that have rapidly taken on characteristics capable of attracting funds from established institutional investors. But even in the lower tiers of economic development, building blocks of f ...

... that are literally emerging into the global investment spotlight--in each of those cases, with securities markets that have rapidly taken on characteristics capable of attracting funds from established institutional investors. But even in the lower tiers of economic development, building blocks of f ...

Minutes of the Monetary Policy Meeting on November 18 and 19, 2015

... Members agreed that the European economy maintained its moderate recovery as private consumption continued to increase, although exports had shown some weakness, mainly due to the effects of the slowdown in emerging economies. As for the outlook, they concurred that the economy would likely continue ...

... Members agreed that the European economy maintained its moderate recovery as private consumption continued to increase, although exports had shown some weakness, mainly due to the effects of the slowdown in emerging economies. As for the outlook, they concurred that the economy would likely continue ...

McGraw-Hill/Irwin

... international goals, but countries often respond to an international goal when forced to do so by other countries. Expansionary monetary policy, through its effect on income, tends to increase its trade deficit. Contractionary fiscal policy tends to decrease a country’s trade deficit. International ...

... international goals, but countries often respond to an international goal when forced to do so by other countries. Expansionary monetary policy, through its effect on income, tends to increase its trade deficit. Contractionary fiscal policy tends to decrease a country’s trade deficit. International ...

GCE Economics Course Companion

... the ignoring of transport costs; perfect occupational mobility of factors of production within a country; full employment of factors of production; perfectly competitive markets; constant returns to scale; and no externalities from production or consumption. Some commentators also point ...

... the ignoring of transport costs; perfect occupational mobility of factors of production within a country; full employment of factors of production; perfectly competitive markets; constant returns to scale; and no externalities from production or consumption. Some commentators also point ...

International monetary systems

International monetary systems are sets of internationally agreed rules, conventions and supporting institutions, that facilitate international trade, cross border investment and generally the reallocation of capital between nation states. They provide means of payment acceptable between buyers and sellers of different nationality, including deferred payment. To operate successfully, they need to inspire confidence, to provide sufficient liquidity for fluctuating levels of trade and to provide means by which global imbalances can be corrected. The systems can grow organically as the collective result of numerous individual agreements between international economic factors spread over several decades. Alternatively, they can arise from a single architectural vision as happened at Bretton Woods in 1944.