The Political Economy of Commitment to the Gold Standard First

... According to Eichengreen (1992: 60), “the role of the gold standard as a credibilitycreating device was most prominent on the fringes of the gold standard.” For peripheral countries, however, it was far harder to generate credibility via the commitment. Even the most successful gold standard countri ...

... According to Eichengreen (1992: 60), “the role of the gold standard as a credibilitycreating device was most prominent on the fringes of the gold standard.” For peripheral countries, however, it was far harder to generate credibility via the commitment. Even the most successful gold standard countri ...

International Monetary Arrangements

... Stability (and Growth) Pact • EMU “Ins” should maintain deficits of less than 3% GDP while in EMU or face penalties – German origins – Implies pro-cyclic fiscal policy (!) ...

... Stability (and Growth) Pact • EMU “Ins” should maintain deficits of less than 3% GDP while in EMU or face penalties – German origins – Implies pro-cyclic fiscal policy (!) ...

PDF format

... Now let me turn to the developments in global financial and capital markets. Since the collapse of Lehman Brothers, the global economy and financial markets have changed dramatically. The fourth quarter figures for GDP, industrial production, and exports have started to be released in various countr ...

... Now let me turn to the developments in global financial and capital markets. Since the collapse of Lehman Brothers, the global economy and financial markets have changed dramatically. The fourth quarter figures for GDP, industrial production, and exports have started to be released in various countr ...

IOSR Journal Of Humanities And Social Science (IOSR-JHSS)

... potentials of emerging market’s financial systems are fully explored through integration with the rest of the world. The financial system has been identified as the mainstay of an economy. It is purported to be the transmission mechanism for behavior of various macroeconomic variables thereby propel ...

... potentials of emerging market’s financial systems are fully explored through integration with the rest of the world. The financial system has been identified as the mainstay of an economy. It is purported to be the transmission mechanism for behavior of various macroeconomic variables thereby propel ...

find out more - Roberto Giori Company

... the safety of the banking system spread in late 2008, many people became terrified of losing their savings. Instead, they put their trust in cold, hard cash. Not surprisingly, as depositors socked away money to protect themselves against a financial collapse, they often sought $100 bills. Such a lar ...

... the safety of the banking system spread in late 2008, many people became terrified of losing their savings. Instead, they put their trust in cold, hard cash. Not surprisingly, as depositors socked away money to protect themselves against a financial collapse, they often sought $100 bills. Such a lar ...

25 development of the czechoslovak koruna exchange rate

... over the years 1989 – 1990 The situation in 1989 displayed all the signs of a top-down managed economy. All prices whether for goods or work were administratively governed. In 1988 the attempts to introduce a real, single foreign exchange rate began to manifest themselves, where there had been long ...

... over the years 1989 – 1990 The situation in 1989 displayed all the signs of a top-down managed economy. All prices whether for goods or work were administratively governed. In 1988 the attempts to introduce a real, single foreign exchange rate began to manifest themselves, where there had been long ...

Cash Is Dead! Long Live Cash! - Federal Reserve Bank of San

... the safety of the banking system spread in late 2008, many people became terrified of losing their savings. Instead, they put their trust in cold, hard cash. Not surprisingly, as depositors socked away money to protect themselves against a financial collapse, they often sought $100 bills. Such a lar ...

... the safety of the banking system spread in late 2008, many people became terrified of losing their savings. Instead, they put their trust in cold, hard cash. Not surprisingly, as depositors socked away money to protect themselves against a financial collapse, they often sought $100 bills. Such a lar ...

Monetary Conditions in the Euro Area

... to last and may vary from case to case. Thus, depending on market perceptions a tightening action of the central bank could result in a large increase of the interest rate and a small appreciation, or in a small increase of the interest rate and a large appreciation. While the overall effect on aggr ...

... to last and may vary from case to case. Thus, depending on market perceptions a tightening action of the central bank could result in a large increase of the interest rate and a small appreciation, or in a small increase of the interest rate and a large appreciation. While the overall effect on aggr ...

chapter 38 - Spring Branch ISD

... and Trade Deficits A. Short-Answer, Essays, and Problems 1. What happens in the foreign exchange market when there is a U.S. export transaction? ...

... and Trade Deficits A. Short-Answer, Essays, and Problems 1. What happens in the foreign exchange market when there is a U.S. export transaction? ...

ADDICTED TO DOLLARS

... A key objective of this paper is to • Shed light on the interconnection between the two competing concepts of partial dollarization. • To this effect, we define a partially dollarized economy as one where – households and firms hold a fraction of their portfolio (inclusive of money balances) in for ...

... A key objective of this paper is to • Shed light on the interconnection between the two competing concepts of partial dollarization. • To this effect, we define a partially dollarized economy as one where – households and firms hold a fraction of their portfolio (inclusive of money balances) in for ...

LCcarG683_en.pdf

... The precise impact of the recession especially in the wake of 11 September, and the slowdown in economic growth on the Caribbean will depend on a number of factors. These include the length and depth of the economic slump in these major markets and other markets; the impact of the slowdown on capita ...

... The precise impact of the recession especially in the wake of 11 September, and the slowdown in economic growth on the Caribbean will depend on a number of factors. These include the length and depth of the economic slump in these major markets and other markets; the impact of the slowdown on capita ...

monetary policy

... Monetary policy by the US Federal Reserve is important for the US economy. However, economists disagree about several aspects of Federal Reserve decision-making powers including the composition of the Federal Reserve committees, Federal Reserve goals, and the actual impact Federal Reserve of policy ...

... Monetary policy by the US Federal Reserve is important for the US economy. However, economists disagree about several aspects of Federal Reserve decision-making powers including the composition of the Federal Reserve committees, Federal Reserve goals, and the actual impact Federal Reserve of policy ...

Seychelles

... Arrangement for Seychelles, and Approves US$2.3 Million Disbursement The Executive Board of the International Monetary Fund (IMF) today completed the third review under the Extended Fund Facility arrangement (EFF)1 with Seychelles. The completion of the review enables a disbursement of SDR 1.635 mil ...

... Arrangement for Seychelles, and Approves US$2.3 Million Disbursement The Executive Board of the International Monetary Fund (IMF) today completed the third review under the Extended Fund Facility arrangement (EFF)1 with Seychelles. The completion of the review enables a disbursement of SDR 1.635 mil ...

exchange rate

... • Free convertibility is the norm in the world today, although many countries impose some restrictions on the amount of money that can be converted • The main reason to limit convertibility is to preserve foreign exchange reserves and prevent capital flight (when residents and nonresidents rush to c ...

... • Free convertibility is the norm in the world today, although many countries impose some restrictions on the amount of money that can be converted • The main reason to limit convertibility is to preserve foreign exchange reserves and prevent capital flight (when residents and nonresidents rush to c ...

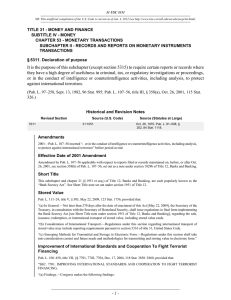

It is the purpose of this subchapter (except section 5315) to require

... “(1) The global war on terrorism and cutting off terrorist financing is a policy priority for the United States and its partners, working bilaterally and multilaterally through the United Nations, the United Nations Security Council and its committees, such as the 1267 and 1373 Committees, the Finan ...

... “(1) The global war on terrorism and cutting off terrorist financing is a policy priority for the United States and its partners, working bilaterally and multilaterally through the United Nations, the United Nations Security Council and its committees, such as the 1267 and 1373 Committees, the Finan ...

A Currency Union or an Exchange Rate Union: Evidence from

... however, that East Asia is still not ready for establishing an optimum currency area. Other authors find that only a few countries in the region are ready to form a currency area.1 There is not a consensus built yet on whether or not the East Asian countries as a whole can form a currency union. Alt ...

... however, that East Asia is still not ready for establishing an optimum currency area. Other authors find that only a few countries in the region are ready to form a currency area.1 There is not a consensus built yet on whether or not the East Asian countries as a whole can form a currency union. Alt ...

Chapter 20: Output, the Interest Rate, and the Exchange Rate

... Suppose you know that the domestic price level rises faster than the U.S. price level, Then you know that the country faces a real appreciation that can rapidly make domestic goods noncompetitive. To avoid this effect, countries choose a predetermined depreciation rate against the dollar, a “c ...

... Suppose you know that the domestic price level rises faster than the U.S. price level, Then you know that the country faces a real appreciation that can rapidly make domestic goods noncompetitive. To avoid this effect, countries choose a predetermined depreciation rate against the dollar, a “c ...

Current Research Journal of Economic Theory 4(4): 120-131, 2012 ISSN: 2042-485X

... (1978) and Krugman (1993), among others. The OCA theory focuses on whether or not the existence of a single currency in a particular geographical region would maximize economic efficiency. In other words, are the costs of forming a common currency less than the associated costs of exchange rate adju ...

... (1978) and Krugman (1993), among others. The OCA theory focuses on whether or not the existence of a single currency in a particular geographical region would maximize economic efficiency. In other words, are the costs of forming a common currency less than the associated costs of exchange rate adju ...

MALAYSIA’S RESPONSE TO THE FINANCIAL CRISIS: Shankaran Nambiar*

... In 1985, when the economy was beset with a downturn, the central bank resorted to a more flexible exchange rate regime. This was probably in view of the need to stimulate the sluggish economy. The exchange rate was, at that time, perceived as being overvalued. The more liberal approach to exchange r ...

... In 1985, when the economy was beset with a downturn, the central bank resorted to a more flexible exchange rate regime. This was probably in view of the need to stimulate the sluggish economy. The exchange rate was, at that time, perceived as being overvalued. The more liberal approach to exchange r ...

The BRICs AND THE CRISIS

... in the management of the global economy? Why it could matter more: • Moving towards a more ‘normal’ situation, it will become difficult for the G20 to deliver concrete results. Need for a strong EU-US cooperation to ensure that the G20 will continue to deliver. • Both the US and the EU are looking E ...

... in the management of the global economy? Why it could matter more: • Moving towards a more ‘normal’ situation, it will become difficult for the G20 to deliver concrete results. Need for a strong EU-US cooperation to ensure that the G20 will continue to deliver. • Both the US and the EU are looking E ...

PDF

... 38 banks were liquidated later in April 1999. The second event that Kaminsky and Reinhart (1999) associate with banking crises is the need for large-scale bailout packages such as were offered by the Indonesian government as well as the International Monetary Fund (US$43 billion) to the crippled ban ...

... 38 banks were liquidated later in April 1999. The second event that Kaminsky and Reinhart (1999) associate with banking crises is the need for large-scale bailout packages such as were offered by the Indonesian government as well as the International Monetary Fund (US$43 billion) to the crippled ban ...

The effects of US unconventional monetary policies in Latin America

... impact of the US non-standard monetary policies on Latin American economies differs from the impact on other EMEs. In this connection, there are reasons to expect that Latin American economies might be more vulnerable to increases in US interest rates. First, although many Latin American economies h ...

... impact of the US non-standard monetary policies on Latin American economies differs from the impact on other EMEs. In this connection, there are reasons to expect that Latin American economies might be more vulnerable to increases in US interest rates. First, although many Latin American economies h ...

Capital Flows and Monetary Policy

... Effect of sudden stops on output mechanisms not transparent, lack empirical evidence: - Firms borrow in advance to pay imported inputs or wage bill - In cases this produces a shock to total factor productivity ...

... Effect of sudden stops on output mechanisms not transparent, lack empirical evidence: - Firms borrow in advance to pay imported inputs or wage bill - In cases this produces a shock to total factor productivity ...

The financial cycle and macroeconomics

... foreign such cycles. Typical examples are the banking strains in Germany and Switzerland recently. Conversely, most financial cycle peaks coincide with financial crises. In fact, there are only three instances post-1985 for which the peak was not close to a crisis, and in all of them the financial s ...

... foreign such cycles. Typical examples are the banking strains in Germany and Switzerland recently. Conversely, most financial cycle peaks coincide with financial crises. In fact, there are only three instances post-1985 for which the peak was not close to a crisis, and in all of them the financial s ...

International monetary systems

International monetary systems are sets of internationally agreed rules, conventions and supporting institutions, that facilitate international trade, cross border investment and generally the reallocation of capital between nation states. They provide means of payment acceptable between buyers and sellers of different nationality, including deferred payment. To operate successfully, they need to inspire confidence, to provide sufficient liquidity for fluctuating levels of trade and to provide means by which global imbalances can be corrected. The systems can grow organically as the collective result of numerous individual agreements between international economic factors spread over several decades. Alternatively, they can arise from a single architectural vision as happened at Bretton Woods in 1944.