Exam I - UTSA.edu

... the value of the Swiss franc with respect to the U.S. dollar will generally appreciate the value of the Swiss franc with respect to the U.S. dollar will generally depreciate the value of the Swiss franc with respect to the U.S. dollar would generally remain constant The value of the Swiss franc with ...

... the value of the Swiss franc with respect to the U.S. dollar will generally appreciate the value of the Swiss franc with respect to the U.S. dollar will generally depreciate the value of the Swiss franc with respect to the U.S. dollar would generally remain constant The value of the Swiss franc with ...

Keynes’s Monetary Theory: A Different Jnterpretation Allan H. Meltzer

... that equilibrium levels of output and employment are too low because the capital stock is too small, i.e., below its saturation level. In fact, however, Keynes himself believed that low levels of outputand employment were caused by the capital stock being too large. Writing at a time when the econom ...

... that equilibrium levels of output and employment are too low because the capital stock is too small, i.e., below its saturation level. In fact, however, Keynes himself believed that low levels of outputand employment were caused by the capital stock being too large. Writing at a time when the econom ...

NBER WORKING PAPER SERIES MACROECONOMIC POLICY DESIGN IN AN INTERDEPENDENT WORLD ECONOMY-

... and/or fiscal response in the Rest of the Industrial World to a tightening of U.S. fiscal Policy and what should be the U.S. monetary response? (2) What Should be the monetary and/or fiscal response in the United States and in the Rest of the Industri World to a "Collapse of the U.S. dollar?" ...

... and/or fiscal response in the Rest of the Industrial World to a tightening of U.S. fiscal Policy and what should be the U.S. monetary response? (2) What Should be the monetary and/or fiscal response in the United States and in the Rest of the Industri World to a "Collapse of the U.S. dollar?" ...

2. Outlook and Policy Challenges for Latin America and the

... Latin America and the Caribbean Growth in Latin America and the Caribbean slowed to 1.3 percent in 2014 and is projected to dip below 1 percent in 2015. The downturn in global commodity markets remains an important drag on South America’s economies, even as lower oil prices and a solid U.S. recovery ...

... Latin America and the Caribbean Growth in Latin America and the Caribbean slowed to 1.3 percent in 2014 and is projected to dip below 1 percent in 2015. The downturn in global commodity markets remains an important drag on South America’s economies, even as lower oil prices and a solid U.S. recovery ...

Regional Science Matters

... show freer trade and factor mobility from integration allow less-developed members to grow faster than more-developed ones. Factor price equalization further supports the convergence hypothesis (Stolper and Samuelson 1941). In a two-country resource-rich/resource-poor model, lowering tariffs has a n ...

... show freer trade and factor mobility from integration allow less-developed members to grow faster than more-developed ones. Factor price equalization further supports the convergence hypothesis (Stolper and Samuelson 1941). In a two-country resource-rich/resource-poor model, lowering tariffs has a n ...

Exchange rate anomalies in the industrial countries: A solution with

... policy shocks with narrow monetary aggregates (such as non-borrowed reserves) that may be better proxies of monetary policy. Sims (1992) suggested that the price puzzle might be due to the fact that interest rate innovations partly re#ect in#ationary pressures that lead to price increases. He also a ...

... policy shocks with narrow monetary aggregates (such as non-borrowed reserves) that may be better proxies of monetary policy. Sims (1992) suggested that the price puzzle might be due to the fact that interest rate innovations partly re#ect in#ationary pressures that lead to price increases. He also a ...

Syllabus

... Macroeconomic Fluctuations Giovanni Favara Spring 2007 This is the first year course for the M.Sc sequence in macroeconomics. Its purpose is to introduce the basic models used to study macroeconomic fluctuations. The course is organized around eight topics. There are more topics than I can hope to c ...

... Macroeconomic Fluctuations Giovanni Favara Spring 2007 This is the first year course for the M.Sc sequence in macroeconomics. Its purpose is to introduce the basic models used to study macroeconomic fluctuations. The course is organized around eight topics. There are more topics than I can hope to c ...

currency crises, capital-account liberalization, and selection bias

... 2 The appropriate pace of deregulation of domestic financial markets also has been of concern, even in many industrial countries. The United States, Japan, and Sweden, among others, all have experienced some domestic financial instability following deregulation of domestic financial institutions. ...

... 2 The appropriate pace of deregulation of domestic financial markets also has been of concern, even in many industrial countries. The United States, Japan, and Sweden, among others, all have experienced some domestic financial instability following deregulation of domestic financial institutions. ...

Contents of the course - Solvay Brussels School

... A critique of the IMF approach – (5) The hypothesised cause of BOP problems • There is a concentration in the IMF programmes on demand deflation and financial market liberalisation. • The structuralist school; however, underlines other cause than those seen by the IMF. • Structuralists argue that d ...

... A critique of the IMF approach – (5) The hypothesised cause of BOP problems • There is a concentration in the IMF programmes on demand deflation and financial market liberalisation. • The structuralist school; however, underlines other cause than those seen by the IMF. • Structuralists argue that d ...

E x c h a n g e ... d e v e l o p e d ...

... allows for efficient absorption of shocks to the current account, but is also believed to be disruptive to trade and foreign investment. To the extent that most fluctuations are temporary, and some large swings are clear over-reactions that do not find support in fundamentals, one does not have to l ...

... allows for efficient absorption of shocks to the current account, but is also believed to be disruptive to trade and foreign investment. To the extent that most fluctuations are temporary, and some large swings are clear over-reactions that do not find support in fundamentals, one does not have to l ...

The correlation of Demand and Supply shocks

... the Optimal Currency Area (OCA) theory, introduced by Mundell (1961). From the OCA theory point of view, when a country wants to join in a monetary union there should be taken into consideration criteria like the convergence of economic structures, business cycle synchronization, demand and supply ...

... the Optimal Currency Area (OCA) theory, introduced by Mundell (1961). From the OCA theory point of view, when a country wants to join in a monetary union there should be taken into consideration criteria like the convergence of economic structures, business cycle synchronization, demand and supply ...

The Historical Dimension of the US Dodd

... supervision regulations in response to the change of government, society, market, and financial environment, and especially the happening of some historic events. At the same time, these series of financial supervision laws and regulations in the history are made as institutional tools of financial ...

... supervision regulations in response to the change of government, society, market, and financial environment, and especially the happening of some historic events. At the same time, these series of financial supervision laws and regulations in the history are made as institutional tools of financial ...

Financial Stability Board: Task Force on Climate-related

... stakeholders need, and understanding the challenges that corporations face in delivering this information. The final recommendations will be intended for issuers of public securities and key financial-sector participants. The Task Force plans to drive voluntary adoption by ensuring that the recommen ...

... stakeholders need, and understanding the challenges that corporations face in delivering this information. The final recommendations will be intended for issuers of public securities and key financial-sector participants. The Task Force plans to drive voluntary adoption by ensuring that the recommen ...

Have The Lessons Learned from The Asian Financial Crisis Been

... the financial aspect, it is one of a consensus that the Asian financial crisis was triggered by the illiquidity in Thailand, indicated by the ratio of short-term debt to reserves. Radelet, Sachs, Cooper, and Bosworth (1998), Bussière and Mulder (1999) and Caramazza, Ricci and Salgado (2000) found in ...

... the financial aspect, it is one of a consensus that the Asian financial crisis was triggered by the illiquidity in Thailand, indicated by the ratio of short-term debt to reserves. Radelet, Sachs, Cooper, and Bosworth (1998), Bussière and Mulder (1999) and Caramazza, Ricci and Salgado (2000) found in ...

Part Four: Open-Economy Macroeconomics and the International

... relative to gold. These gold prices imply an exchange rate between currencies. If in the United States the price of an ounce of gold is maintained by agreement at $5 and in Britain at £1, then the implied cost of the pound is $5/£1. If, on the foreign exchange market, the dollar threatens to change ...

... relative to gold. These gold prices imply an exchange rate between currencies. If in the United States the price of an ounce of gold is maintained by agreement at $5 and in Britain at £1, then the implied cost of the pound is $5/£1. If, on the foreign exchange market, the dollar threatens to change ...

On the Political Economy of Exchange Rate Policy

... thought to ensure a high degree of credibility. At the same time though, there remains no consensus between rational choice theorists on this issue, and others have argued that a floating, rather than a fixed exchange rate regime, will provide the most optimal policy rule. Since this will allow th ...

... thought to ensure a high degree of credibility. At the same time though, there remains no consensus between rational choice theorists on this issue, and others have argued that a floating, rather than a fixed exchange rate regime, will provide the most optimal policy rule. Since this will allow th ...

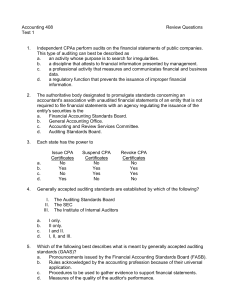

Test 1, Review Questions

... The opinion of an independent party is needed because a company may not be objective with respect to its own financial statements. d. It is a customary courtesy that all stockholders receive an independent report on management's stewardship in managing the affairs of the business. 11. Which paragrap ...

... The opinion of an independent party is needed because a company may not be objective with respect to its own financial statements. d. It is a customary courtesy that all stockholders receive an independent report on management's stewardship in managing the affairs of the business. 11. Which paragrap ...

Synthetic Commodity Money

... case of metallic moneys such shocks might consist either in the discovery of new relatively high-yield ore or of lower-cost means for extracting minerals from known sources. In the absence of positive innovations to supply, on the other hand, the wearing-down of outstanding coins and rising marginal ...

... case of metallic moneys such shocks might consist either in the discovery of new relatively high-yield ore or of lower-cost means for extracting minerals from known sources. In the absence of positive innovations to supply, on the other hand, the wearing-down of outstanding coins and rising marginal ...

Effects of Monetary and Macroprudential Policies on Financial

... There are two main types of policy tools to influence financial conditions in the economy: policy rates and macroprudential policy instruments. While policy rates are well-known monetary policy tools, macroprudential measures have resurged recently and are becoming an increasingly active instrument ...

... There are two main types of policy tools to influence financial conditions in the economy: policy rates and macroprudential policy instruments. While policy rates are well-known monetary policy tools, macroprudential measures have resurged recently and are becoming an increasingly active instrument ...

departamento de economía departamento de economía

... The succeeding years saw the highest and most prolonged worldwide growth rate in contemporary history, cut short by the US crisis that led to an economic crisis on a global scale: the most severe since 1929. The direct cause of the crisis was the price shock in the US real estate market, in which ho ...

... The succeeding years saw the highest and most prolonged worldwide growth rate in contemporary history, cut short by the US crisis that led to an economic crisis on a global scale: the most severe since 1929. The direct cause of the crisis was the price shock in the US real estate market, in which ho ...

The Effectiveness of Monetary and Fiscal Policy in

... policies have significant and positive effect on economic growth, the greater coefficient of monetary policy implied that monetary policy is more effective than fiscal policy in enhancing economic growth in Pakistan. However, opposing results were obtained by Chowdhury (1986) in his research on the ...

... policies have significant and positive effect on economic growth, the greater coefficient of monetary policy implied that monetary policy is more effective than fiscal policy in enhancing economic growth in Pakistan. However, opposing results were obtained by Chowdhury (1986) in his research on the ...

Chapter 15 Price Levels and the Exchange Rate in the Long Run

... • There is no inflation in the long run, but only during the transition to the long run equilibrium. • During the transition, inflation causes the nominal interest rate to increase to its long run rate. • Expectations of inflation cause the expected return on foreign currency to increase, making the ...

... • There is no inflation in the long run, but only during the transition to the long run equilibrium. • During the transition, inflation causes the nominal interest rate to increase to its long run rate. • Expectations of inflation cause the expected return on foreign currency to increase, making the ...

Synchronization between Financial Crisis and International

... fluctuations in Asia have remained less synchronized with the global factor than those in the industrial countries. The Asian regional factors have become increasingly important in tightening the interdependence within the region over time. Therefore, although emerging Asian economies cannot ‘decoup ...

... fluctuations in Asia have remained less synchronized with the global factor than those in the industrial countries. The Asian regional factors have become increasingly important in tightening the interdependence within the region over time. Therefore, although emerging Asian economies cannot ‘decoup ...

NBER WORKING PAPER SERIES THE NIXON SHOCK AFTER FORTY YEARS:

... Woods system, was made over a weekend at Camp David by President Nixon and his advisers in August 1971. However, the deterioration of the U.S. balance of payments position during the 1960s meant that pressure to take such a step had been building for many years. The surprise imposition of the import ...

... Woods system, was made over a weekend at Camp David by President Nixon and his advisers in August 1971. However, the deterioration of the U.S. balance of payments position during the 1960s meant that pressure to take such a step had been building for many years. The surprise imposition of the import ...

Evaluating development efforts

... There are good reasons why. On the one hand, with a given set of risk-management mechanisms, large shocks may be more difficult to absorb than small ones. These threshold effects of volatility have been found to be empirically relevant for investment (Sarkar 2002; Servén 2003). On the other hand, du ...

... There are good reasons why. On the one hand, with a given set of risk-management mechanisms, large shocks may be more difficult to absorb than small ones. These threshold effects of volatility have been found to be empirically relevant for investment (Sarkar 2002; Servén 2003). On the other hand, du ...

International monetary systems

International monetary systems are sets of internationally agreed rules, conventions and supporting institutions, that facilitate international trade, cross border investment and generally the reallocation of capital between nation states. They provide means of payment acceptable between buyers and sellers of different nationality, including deferred payment. To operate successfully, they need to inspire confidence, to provide sufficient liquidity for fluctuating levels of trade and to provide means by which global imbalances can be corrected. The systems can grow organically as the collective result of numerous individual agreements between international economic factors spread over several decades. Alternatively, they can arise from a single architectural vision as happened at Bretton Woods in 1944.