International Political Economy

... the interwar years provided and object lesson. But there was an acknowledgement that free markets could be unstable. There was a belief that a liberal international economy could assist in ...

... the interwar years provided and object lesson. But there was an acknowledgement that free markets could be unstable. There was a belief that a liberal international economy could assist in ...

Downlaod File

... When the dollar is worth more in relation to currencies of other countries. The goods that produced outside US (imported goods) relatively cheaper than the goods that produce by US. And the US companies that manufacture jeans will not be happier because they will loss the competition with the manufa ...

... When the dollar is worth more in relation to currencies of other countries. The goods that produced outside US (imported goods) relatively cheaper than the goods that produce by US. And the US companies that manufacture jeans will not be happier because they will loss the competition with the manufa ...

Exchange Market as a Part of International Financial Markets

... The interbank market caters for both the majority of commercial turnover and large amounts of speculative trading every day. A large bank may trade billions of dollars daily 2. Commercial companies: They often trade fairly small amounts compared to those of banks or speculators, and their trades oft ...

... The interbank market caters for both the majority of commercial turnover and large amounts of speculative trading every day. A large bank may trade billions of dollars daily 2. Commercial companies: They often trade fairly small amounts compared to those of banks or speculators, and their trades oft ...

Inflation Targeting—The UK Experience

... domestic objectives—even with a domestic objective of low inflation. In that view, it is better to allow the exchange rate to float and to address monetary policy directly to domestic objectives. Many adherents of that view also believe that low inflation can be expected to lead to exchange rate sta ...

... domestic objectives—even with a domestic objective of low inflation. In that view, it is better to allow the exchange rate to float and to address monetary policy directly to domestic objectives. Many adherents of that view also believe that low inflation can be expected to lead to exchange rate sta ...

2013 Market Outlook PowerPoint Presentation

... per month in addition to the $40 billion of mortgage backed securities it already was buying. QE-Infinity? Announces no rate increases until unemployment hits 6.5% and/or inflation above ...

... per month in addition to the $40 billion of mortgage backed securities it already was buying. QE-Infinity? Announces no rate increases until unemployment hits 6.5% and/or inflation above ...

This PDF is a selection from an out-of-print volume from... Bureau of Economic Research

... All three measures of the real exchange rate show significant time variation. The main question of the paper is, can we make sense of this using microfounded models? The internal real exchange rate appreciates considerably in developing economies, i.e., non-tradables become relatively more expensive ...

... All three measures of the real exchange rate show significant time variation. The main question of the paper is, can we make sense of this using microfounded models? The internal real exchange rate appreciates considerably in developing economies, i.e., non-tradables become relatively more expensive ...

Exchange Rates and International Finance

... • In the long run, the value of the real exchange rate is pinned down by the law of one price: EP = Pw. • The real exchange rate is just the ratio of prices at home and abroad, EP/ Pw. • The value of the real exchange rate is equal to 1 in the long run. – Goods have to sell for the same price. – Fr ...

... • In the long run, the value of the real exchange rate is pinned down by the law of one price: EP = Pw. • The real exchange rate is just the ratio of prices at home and abroad, EP/ Pw. • The value of the real exchange rate is equal to 1 in the long run. – Goods have to sell for the same price. – Fr ...

Argentina_en.pdf

... around 35% each). With international prices and taxable quotas higher than in the previous year, export duties were the fastest growing tax category, as receipts more than doubled. Other taxes grew in line with aggregate growth. The moderate slowdown in the growth rate of expenditure (which had been ...

... around 35% each). With international prices and taxable quotas higher than in the previous year, export duties were the fastest growing tax category, as receipts more than doubled. Other taxes grew in line with aggregate growth. The moderate slowdown in the growth rate of expenditure (which had been ...

To view this press release as a file

... 3.1 percent. Despite the widening of the yield gap vis-à-vis the US, the shekel appreciated by 4.5 percent against the dollar as well. Part of the appreciation reflects the relatively good state of Israel’s economy, reflected in, for example, a surplus in the current account and in relatively high g ...

... 3.1 percent. Despite the widening of the yield gap vis-à-vis the US, the shekel appreciated by 4.5 percent against the dollar as well. Part of the appreciation reflects the relatively good state of Israel’s economy, reflected in, for example, a surplus in the current account and in relatively high g ...

Document

... In the first decade of the Bretton Woods system, many countries ran current account deficits as they reconstructed their war-torn economies. Since the main external problem of these countries, taken as a group, was to acquire enough dollars to finance necessary purchase from the United States, these ...

... In the first decade of the Bretton Woods system, many countries ran current account deficits as they reconstructed their war-torn economies. Since the main external problem of these countries, taken as a group, was to acquire enough dollars to finance necessary purchase from the United States, these ...

PPP GDP 2006 (millions of dollars)

... At times,spot exchange rates move too much given some economic disturbance.Also, we have observed instances when country A has a higher inflation rate than country B, yet A’s currency appreciates relative to B’s. such anomalies can be explained in the context of an “overshooting” exchange rate model ...

... At times,spot exchange rates move too much given some economic disturbance.Also, we have observed instances when country A has a higher inflation rate than country B, yet A’s currency appreciates relative to B’s. such anomalies can be explained in the context of an “overshooting” exchange rate model ...

April 2016 - Dana Investment Advisors

... central to our economic systems, are a big loser when interest rates are low. Financial institutions profit on the spread between the rate they pay for funds and the rate they lend funds. Today that spread is very narrow. Many banks will be reporting earnings for the first quarter this week. Those e ...

... central to our economic systems, are a big loser when interest rates are low. Financial institutions profit on the spread between the rate they pay for funds and the rate they lend funds. Today that spread is very narrow. Many banks will be reporting earnings for the first quarter this week. Those e ...

Panel on Remarks by Robert T. Parry

... financial markets and cross-border capital flows quickly transmit pressures abroad to U.S. markets. But neither has had much effect on our ability to control domestic monetary policy. The reason is that there’s still a substantial “home bias” in our demand for goods, services, and assets—that is, th ...

... financial markets and cross-border capital flows quickly transmit pressures abroad to U.S. markets. But neither has had much effect on our ability to control domestic monetary policy. The reason is that there’s still a substantial “home bias” in our demand for goods, services, and assets—that is, th ...

Midterm Exam – Potential questions

... *Actually, this rate is based on the Deutsche Mark. a. Assuming that Japan has one third of its trade with each of the three countries and that the index is 100 for 1995, calculated the trade weighted exchange rate for 2000 and 2005. Did the trade-weighted yen appreciate or depreciate for Japan betw ...

... *Actually, this rate is based on the Deutsche Mark. a. Assuming that Japan has one third of its trade with each of the three countries and that the index is 100 for 1995, calculated the trade weighted exchange rate for 2000 and 2005. Did the trade-weighted yen appreciate or depreciate for Japan betw ...

Document

... Increase in growth because of absence of devaluation risk. Should spur in local savings, lower interest rates, and increase FDI Less perceived volatility especially capital outflows- Mex. Peso Crisis Budget constraint- Gov’t Wouldn’t be able to run “la maquinita” thus would have to adjust via intern ...

... Increase in growth because of absence of devaluation risk. Should spur in local savings, lower interest rates, and increase FDI Less perceived volatility especially capital outflows- Mex. Peso Crisis Budget constraint- Gov’t Wouldn’t be able to run “la maquinita” thus would have to adjust via intern ...

Expanding Economic Relations between China and New Zealand

... 10. Use of the Chinese renminbi is more restricted than the New Zealand dollar. The renminbi operates under a managed float regime against a basket of currencies. 1 While the Chinese current account is fully convertible, its capital account currently has restricted convertibility, with some control ...

... 10. Use of the Chinese renminbi is more restricted than the New Zealand dollar. The renminbi operates under a managed float regime against a basket of currencies. 1 While the Chinese current account is fully convertible, its capital account currently has restricted convertibility, with some control ...

No Slide Title

... • A depreciation (fall) in the U.S. real exchange rate means that U.S. goods have become cheaper relative to foreign goods. • This encourages consumers both at home and abroad to buy more U.S. goods and fewer goods from other countries. • As a result, U.S. exports rise, and U.S. imports ...

... • A depreciation (fall) in the U.S. real exchange rate means that U.S. goods have become cheaper relative to foreign goods. • This encourages consumers both at home and abroad to buy more U.S. goods and fewer goods from other countries. • As a result, U.S. exports rise, and U.S. imports ...

14.02: Problem Set 4 Solutions Fall 2003

... See diagram. Note that the uncovered interest parity curve is E = Ee/[1 + i - i*]. So when i* increases, E is higher for any given i, which is why the curve in the right hand panel shifts out. Also, since NX = NX(Y,Y*, Ee/[1 + i - i*]), an increase in i* also increases NX for a given Y (as long as t ...

... See diagram. Note that the uncovered interest parity curve is E = Ee/[1 + i - i*]. So when i* increases, E is higher for any given i, which is why the curve in the right hand panel shifts out. Also, since NX = NX(Y,Y*, Ee/[1 + i - i*]), an increase in i* also increases NX for a given Y (as long as t ...

What were things like during and before the great depression

... in to banks. With the supply of money growing rapidly, banks were opening up at the rate of 4 – 5 per day. What Caused The Great Depression? The Great Depression happened due to a number of reasons. It was created by a combination of a stock market crash, bad banking structure and tight monetary pol ...

... in to banks. With the supply of money growing rapidly, banks were opening up at the rate of 4 – 5 per day. What Caused The Great Depression? The Great Depression happened due to a number of reasons. It was created by a combination of a stock market crash, bad banking structure and tight monetary pol ...

Chapter 2:

... appreciations and depreciations. It next shows how a pair of bilateral rates can be used to compute the cross rate for a given currency. The section also demonstrates how to compute the bid-ask spread and the bid-ask margin for a currency, and distinguishes between the nominal and real exchange rate ...

... appreciations and depreciations. It next shows how a pair of bilateral rates can be used to compute the cross rate for a given currency. The section also demonstrates how to compute the bid-ask spread and the bid-ask margin for a currency, and distinguishes between the nominal and real exchange rate ...

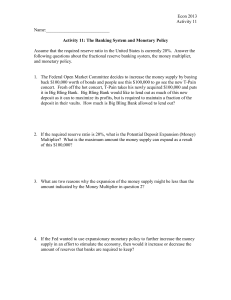

Activity 11 - The Banking System and Monetary Policy

... Assume that the required reserve ratio in the United States is currently 20%. Answer the following questions about the fractional reserve banking system, the money multiplier, and monetary policy. ...

... Assume that the required reserve ratio in the United States is currently 20%. Answer the following questions about the fractional reserve banking system, the money multiplier, and monetary policy. ...

Mundell Ponencia TJ

... inflation rate is 3 per cent, plans for stabilization at the end of two years would require an exchange rate of (10 – 3) x2 = 14 per cent below the current equilibrium. • If, for example the current exchange rate is 10% overvalued (because of the disinflation policy), the new equilibrium exchange ra ...

... inflation rate is 3 per cent, plans for stabilization at the end of two years would require an exchange rate of (10 – 3) x2 = 14 per cent below the current equilibrium. • If, for example the current exchange rate is 10% overvalued (because of the disinflation policy), the new equilibrium exchange ra ...

Fed Raises Rates - Focus Wealth Partners

... Yesterday’s rate hike was well telegraphed, and the fed funds futures market had been pricing in a nearly 100% chance of a hike for some time. Though the potential for some bond market volatility in the short term exists, I don’t expect another broad-based bond sell-off (or a corresponding quick ris ...

... Yesterday’s rate hike was well telegraphed, and the fed funds futures market had been pricing in a nearly 100% chance of a hike for some time. Though the potential for some bond market volatility in the short term exists, I don’t expect another broad-based bond sell-off (or a corresponding quick ris ...