Chapter 16

... Common Property Resources • Resources for which property rights are absent or poorly defined • No one can effectively be excluded from such resources • Without government intervention, these resources are generally overexploited & undersupplied ...

... Common Property Resources • Resources for which property rights are absent or poorly defined • No one can effectively be excluded from such resources • Without government intervention, these resources are generally overexploited & undersupplied ...

Name

... 1. Explain an example that demonstrates the “real world” application of each of the following. Define the terms in your own words and use examples that clearly demonstrate your understanding of each concept. a. Explicit and Implicit Costs (____/5) b. The Law of Diminishing Marginal Returns (____/5) ...

... 1. Explain an example that demonstrates the “real world” application of each of the following. Define the terms in your own words and use examples that clearly demonstrate your understanding of each concept. a. Explicit and Implicit Costs (____/5) b. The Law of Diminishing Marginal Returns (____/5) ...

AP Micro 6-2 Public Goods (cont)

... 2. Define Market Failure. 3. What is the “invisible hand”? 4. List the 4 Market Failures. 5. Why must the government provide public goods? 6. Define Free Rider. 7. What is wrong with having free riders? 8. List 10 streets in Pasadena. ...

... 2. Define Market Failure. 3. What is the “invisible hand”? 4. List the 4 Market Failures. 5. Why must the government provide public goods? 6. Define Free Rider. 7. What is wrong with having free riders? 8. List 10 streets in Pasadena. ...

Econ 102 Fall 2004 –First Midterm

... Macroeconomics – the study of the aggregate behavior of individual economic agents. Positive Economics – the study of how the economy behaves. Normative Economics – the benchmarking of how the economy should be. Reasons for market failure Externalities – a situation when the market fails to fully ac ...

... Macroeconomics – the study of the aggregate behavior of individual economic agents. Positive Economics – the study of how the economy behaves. Normative Economics – the benchmarking of how the economy should be. Reasons for market failure Externalities – a situation when the market fails to fully ac ...

AP Economics Semester 1: Microeconomics Homework Check: 150

... Unit 3: Theory of the Firm (6 Weeks) Mankiw 6th Ed: Chapters 13, 14, 15, 16, and 17 Terms: Total Revenue, Total Cost, Profit, Explicit Costs, Implicit Costs, Economic Profit, Accounting Profit, Production Function, Marginal Product, Diminishing Marginal Product, Fixed Costs, Variable Cost, Average ...

... Unit 3: Theory of the Firm (6 Weeks) Mankiw 6th Ed: Chapters 13, 14, 15, 16, and 17 Terms: Total Revenue, Total Cost, Profit, Explicit Costs, Implicit Costs, Economic Profit, Accounting Profit, Production Function, Marginal Product, Diminishing Marginal Product, Fixed Costs, Variable Cost, Average ...

Law and Economics – Hsu

... 1. For a given price, what is the quantity that will be bought? C. Market Supply Curve 1. For a given price, what is the quantity that will be produced? 2. Slopes upward because individual companies have different costs. Inefficient, etc. The higher the price the easier it is for Joe Blow to enter t ...

... 1. For a given price, what is the quantity that will be bought? C. Market Supply Curve 1. For a given price, what is the quantity that will be produced? 2. Slopes upward because individual companies have different costs. Inefficient, etc. The higher the price the easier it is for Joe Blow to enter t ...

Document

... Costs are subjective…..like benefits. This means that costs and benefits are particular to a given person…..they ...

... Costs are subjective…..like benefits. This means that costs and benefits are particular to a given person…..they ...

Monopoly 2 and Monopsony

... Where ε is the elasticity of demand. Note how this rule implies that a monopolist would never operate in the inelastic portion of the demand it is facing. Does this rule feel counterintuitive? Combining the above two equations we have ...

... Where ε is the elasticity of demand. Note how this rule implies that a monopolist would never operate in the inelastic portion of the demand it is facing. Does this rule feel counterintuitive? Combining the above two equations we have ...

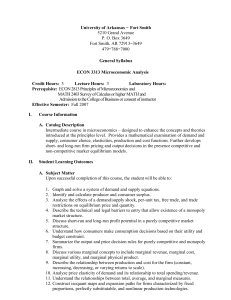

Microeconomic Analysis

... 12. Construct isoquant maps and expansion paths for firms characterized by fixed proportions, perfectly substitutable, and nonlinear production technologies. ...

... 12. Construct isoquant maps and expansion paths for firms characterized by fixed proportions, perfectly substitutable, and nonlinear production technologies. ...

Chapter 5 – Understanding Supply

... Excise tax – A tax on the production or sale of a good, in addition to the regular sales tax. An excise tax increases production costs by adding an extra cost for each unit sold. Excise tax are sometimes used to discourage the sale of goods that the government thinks are harmful to the public good, ...

... Excise tax – A tax on the production or sale of a good, in addition to the regular sales tax. An excise tax increases production costs by adding an extra cost for each unit sold. Excise tax are sometimes used to discourage the sale of goods that the government thinks are harmful to the public good, ...

CERTIFICATE OF COST ALLOCATION PLAN

... for [identify period covered by plan] are allowable in accordance with the requirements of 2 CFR. Part 225, (Formerly OMB Circular A 87), "Cost Principles for State, Local, and Indian Tribal Governments," and the Federal award(s) to which they apply. Unallowable costs have been adjusted for in alloc ...

... for [identify period covered by plan] are allowable in accordance with the requirements of 2 CFR. Part 225, (Formerly OMB Circular A 87), "Cost Principles for State, Local, and Indian Tribal Governments," and the Federal award(s) to which they apply. Unallowable costs have been adjusted for in alloc ...

Econ160SQ6(Externalities, Public Goods)

... To find the optimal tax, we need to first find the gap between MCprivate and MCtotal at the efficient quantity. At an output quantity of 3, the gap is $10 ($80 minus $70). Therefore, the tax should be set at $10 per unit. The firm will now not produce the 4th unit since MR is $80 but marginal cost t ...

... To find the optimal tax, we need to first find the gap between MCprivate and MCtotal at the efficient quantity. At an output quantity of 3, the gap is $10 ($80 minus $70). Therefore, the tax should be set at $10 per unit. The firm will now not produce the 4th unit since MR is $80 but marginal cost t ...

Externality

In economics, an externality is the cost or benefit that affects a party who did not choose to incur that cost or benefit.For example, manufacturing activities that cause air pollution impose health and clean-up costs on the whole society, whereas the neighbors of an individual who chooses to fire-proof his home may benefit from a reduced risk of a fire spreading to their own houses. If external costs exist, such as pollution, the producer may choose to produce more of the product than would be produced if the producer were required to pay all associated environmental costs. Because responsibility or consequence for self-directed action lies partly outside the self, an element of externalization is involved. If there are external benefits, such as in public safety, less of the good may be produced than would be the case if the producer were to receive payment for the external benefits to others. For the purpose of these statements, overall cost and benefit to society is defined as the sum of the imputed monetary value of benefits and costs to all parties involved. Thus, unregulated markets in goods or services with significant externalities generate prices that do not reflect the full social cost or benefit of their transactions; such markets are therefore inefficient.