Practice Quiz

... Topic: Perfect competition, Difficulty: D, Type: RE, Answer: d If a firm has no ability to select the price of its product, it: a. will go out of business due to losses. b. is a price-maker. c. cannot maximize profit. d. has a horizontal individual demand curve. Topic: Price taker, Difficulty: D, Ty ...

... Topic: Perfect competition, Difficulty: D, Type: RE, Answer: d If a firm has no ability to select the price of its product, it: a. will go out of business due to losses. b. is a price-maker. c. cannot maximize profit. d. has a horizontal individual demand curve. Topic: Price taker, Difficulty: D, Ty ...

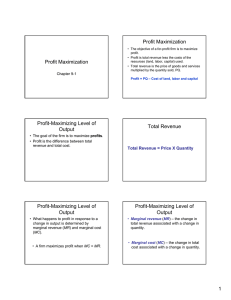

Profit Maximization Profit Maximization Profit

... MC = ∆TC/∆Q • Comparing marginal revenue and marginal cost determines whether the firm needs to supply more or less in order to maximize profit. ...

... MC = ∆TC/∆Q • Comparing marginal revenue and marginal cost determines whether the firm needs to supply more or less in order to maximize profit. ...

Profit Maximization

... determined by comparing marginal revenue and marginal cost. • Marginal cost is the additional cost of producing one more unit of output. • Marginal revenue is the additional revenue from selling one more unit of output. • Profit is maximized at the output level where marginal revenue and marginal co ...

... determined by comparing marginal revenue and marginal cost. • Marginal cost is the additional cost of producing one more unit of output. • Marginal revenue is the additional revenue from selling one more unit of output. • Profit is maximized at the output level where marginal revenue and marginal co ...

Profit maximization by firms

... – If P=ACmin, then both shutting down and the best positive sales quantity yield zero profit, which is the best the firm can do. ...

... – If P=ACmin, then both shutting down and the best positive sales quantity yield zero profit, which is the best the firm can do. ...

MULTIPLE CHOICE QUESTIONS 1. Refer to Figure 1. After a tax is

... PAGE 5 11. A wealthy individual voluntarily contributes 5% of her annual income to charities. Which of the following is TRUE? (a) This exchange would not be Pareto optimal, since the individual contributing the money to the charity receives nothing in exchange. (b) This exchange must be Pareto opti ...

... PAGE 5 11. A wealthy individual voluntarily contributes 5% of her annual income to charities. Which of the following is TRUE? (a) This exchange would not be Pareto optimal, since the individual contributing the money to the charity receives nothing in exchange. (b) This exchange must be Pareto opti ...

Schiller, Ch - GEOCITIES.ws

... How do we decide how much of any good to buy? How does a change in the price of a good affect the quantity we purchase or the amount of money we spend on it? Why do we buy certain goods but not others? Demand is the willingness and ability to buy specific quantities of a good at alternative pr ...

... How do we decide how much of any good to buy? How does a change in the price of a good affect the quantity we purchase or the amount of money we spend on it? Why do we buy certain goods but not others? Demand is the willingness and ability to buy specific quantities of a good at alternative pr ...

Monopoly

... • Only a single large firm can achieve low average total costs • Protects the firm from competitors • Natural monopoly – the market demand curve cuts the long-run ATC curve where average total costs are still declining ...

... • Only a single large firm can achieve low average total costs • Protects the firm from competitors • Natural monopoly – the market demand curve cuts the long-run ATC curve where average total costs are still declining ...

Document

... Julie, who has been working for an advertising firm, is thinking of starting her own advertising company. She has determined that, based on how much business she would likely be doing, her yearly costs would be $60,000 for rent on the office building, $200,000 for wages and salaries of employees, an ...

... Julie, who has been working for an advertising firm, is thinking of starting her own advertising company. She has determined that, based on how much business she would likely be doing, her yearly costs would be $60,000 for rent on the office building, $200,000 for wages and salaries of employees, an ...

Chapter 09 Key Question Solutions

... show how (a) an increase and (b) a decrease in market demand will upset that long-run equilibrium. Trace graphically and describe verbally the adjustment processes by which long-run equilibrium is restored. Now rework your analysis for increasing- and decreasing-cost industries and compare the three ...

... show how (a) an increase and (b) a decrease in market demand will upset that long-run equilibrium. Trace graphically and describe verbally the adjustment processes by which long-run equilibrium is restored. Now rework your analysis for increasing- and decreasing-cost industries and compare the three ...

9‑3 (Key Question) Use the following demand schedule to determine

... show how (a) an increase and (b) a decrease in market demand will upset that long-run equilibrium. Trace graphically and describe verbally the adjustment processes by which long-run equilibrium is restored. Now rework your analysis for increasing- and decreasing-cost industries and compare the three ...

... show how (a) an increase and (b) a decrease in market demand will upset that long-run equilibrium. Trace graphically and describe verbally the adjustment processes by which long-run equilibrium is restored. Now rework your analysis for increasing- and decreasing-cost industries and compare the three ...

Externality

In economics, an externality is the cost or benefit that affects a party who did not choose to incur that cost or benefit.For example, manufacturing activities that cause air pollution impose health and clean-up costs on the whole society, whereas the neighbors of an individual who chooses to fire-proof his home may benefit from a reduced risk of a fire spreading to their own houses. If external costs exist, such as pollution, the producer may choose to produce more of the product than would be produced if the producer were required to pay all associated environmental costs. Because responsibility or consequence for self-directed action lies partly outside the self, an element of externalization is involved. If there are external benefits, such as in public safety, less of the good may be produced than would be the case if the producer were to receive payment for the external benefits to others. For the purpose of these statements, overall cost and benefit to society is defined as the sum of the imputed monetary value of benefits and costs to all parties involved. Thus, unregulated markets in goods or services with significant externalities generate prices that do not reflect the full social cost or benefit of their transactions; such markets are therefore inefficient.