Omega:A Sharper Ratio

... Fundamental Uncertainty may be viewed as a game against nature but the Market Risk Premium Uncertainty is a game against others. It is reasonable to assume that the higher the fundamental uncertainty, the more variable the market risk premium may be. Extending the investment tenor increases fundamen ...

... Fundamental Uncertainty may be viewed as a game against nature but the Market Risk Premium Uncertainty is a game against others. It is reasonable to assume that the higher the fundamental uncertainty, the more variable the market risk premium may be. Extending the investment tenor increases fundamen ...

Lecture

... • Marketable investment securities are classified as either held-to-maturity, trading or available-for-sale. • Held-to-maturity securities are debt securities acquired with the intent that they will be held to maturity. Held-to-maturity securities are reported on the balance sheet at amortized cost. ...

... • Marketable investment securities are classified as either held-to-maturity, trading or available-for-sale. • Held-to-maturity securities are debt securities acquired with the intent that they will be held to maturity. Held-to-maturity securities are reported on the balance sheet at amortized cost. ...

Table of Contents - Massachusetts Collectors and Treasurers

... Retirement Fund: (MGL, Ch. 40, sec. 5D) The policy adopted restricts investment in exclusively US Treasuries for terms not exceeding 5 years. A combination of notes and bills will be used to ensure cash flow requirements are met and the annual yield is achieved. Principal will be tapped as required ...

... Retirement Fund: (MGL, Ch. 40, sec. 5D) The policy adopted restricts investment in exclusively US Treasuries for terms not exceeding 5 years. A combination of notes and bills will be used to ensure cash flow requirements are met and the annual yield is achieved. Principal will be tapped as required ...

MBA Module 1 PPT

... • All transactions between the company and its shareholders are considered financing transactions. This includes payment of dividends, the issuance of stock, and any subsequent stock repurchase. • Financing transactions affect only the balance sheet; they do not affect the income statement. ...

... • All transactions between the company and its shareholders are considered financing transactions. This includes payment of dividends, the issuance of stock, and any subsequent stock repurchase. • Financing transactions affect only the balance sheet; they do not affect the income statement. ...

stocks - McGraw Hill Higher Education

... would be if your predictions about the price and the dividend are correct. However, the actual return on a stock could be more or less than what you expect! Calculate how well you did as versus the 12% expected return if the following occurs to Blue Sky stock: The actual price a year from now ...

... would be if your predictions about the price and the dividend are correct. However, the actual return on a stock could be more or less than what you expect! Calculate how well you did as versus the 12% expected return if the following occurs to Blue Sky stock: The actual price a year from now ...

Q QUA ANTI ITAT

... 2 3x 5y 9 are equations. An equation contains one or more unknowns. In the first equation, the unknown is x and the second equation the unknowns are x and y. The value or values of unknown for which the equation is true are called solution of equations. ...

... 2 3x 5y 9 are equations. An equation contains one or more unknowns. In the first equation, the unknown is x and the second equation the unknowns are x and y. The value or values of unknown for which the equation is true are called solution of equations. ...

frequently asked questions (faqs)

... 2. What are different interest rate futures contracts that have been permitted by regulators? As per circulars issued by regulators (RBI and SEBI) on December 5, 2013, stock exchange have been permitted to launch interest rate futures contracts on 10 year GoI securities and new tenor bonds guideline ...

... 2. What are different interest rate futures contracts that have been permitted by regulators? As per circulars issued by regulators (RBI and SEBI) on December 5, 2013, stock exchange have been permitted to launch interest rate futures contracts on 10 year GoI securities and new tenor bonds guideline ...

Chapter 21 Glossary

... bargain-purchase option An option that allows a lessee to purchase the leased property for a price that is significantly lower than the property’s expected fair value at the date the option becomes exercisable. At the inception of the lease, the difference between the option price and the expected f ...

... bargain-purchase option An option that allows a lessee to purchase the leased property for a price that is significantly lower than the property’s expected fair value at the date the option becomes exercisable. At the inception of the lease, the difference between the option price and the expected f ...

chapter 11 part 2 savings class notes

... income on a steady basis. When referring to mutual funds, the terms "fixedincome," "bond," and "income" are synonymous. These terms denote funds that invest primarily in government and corporate debt. While fund holdings may appreciate in value, the primary objective of these funds is to provide a s ...

... income on a steady basis. When referring to mutual funds, the terms "fixedincome," "bond," and "income" are synonymous. These terms denote funds that invest primarily in government and corporate debt. While fund holdings may appreciate in value, the primary objective of these funds is to provide a s ...

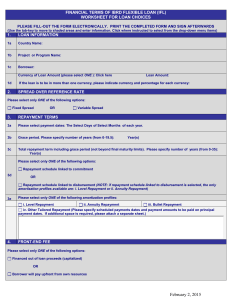

English - World Bank Treasury

... Cap/Collar premium to be financed out of the loan proceeds (as long as there are available funds to be disbursed) 5b Cap/Collar premium paid by the Borrower from own resources ...

... Cap/Collar premium to be financed out of the loan proceeds (as long as there are available funds to be disbursed) 5b Cap/Collar premium paid by the Borrower from own resources ...

1) Eurobonds versus Domestic Bonds

... yen cost of debt because they are considering launching a new bond issue in Tokyo to raise money for a new investment there. The risk-free interest rates on dollars and yen are r$ = 5% and r¥ = 1%, respectively. Coval Consulting is willing to assume that capital markets are internationally integrate ...

... yen cost of debt because they are considering launching a new bond issue in Tokyo to raise money for a new investment there. The risk-free interest rates on dollars and yen are r$ = 5% and r¥ = 1%, respectively. Coval Consulting is willing to assume that capital markets are internationally integrate ...