Value versus Growth - Krannert School of Management

... Reserve Accord that allows the Treasury bill rates to vary freely. The mean monthly excess returns of the book-to-market deciles increase from 0.48% per month for the growth decile to 0.97% for the value decile. The value-minus-growth portfolio earns an average return of 0.48% with a volatility of 4 ...

... Reserve Accord that allows the Treasury bill rates to vary freely. The mean monthly excess returns of the book-to-market deciles increase from 0.48% per month for the growth decile to 0.97% for the value decile. The value-minus-growth portfolio earns an average return of 0.48% with a volatility of 4 ...

The Balance of Payments Accounts

... Monetary expansion (LM-LM’) – rise in money supply – rise in income (imports) – trade deficit – fall in interest rates (capital outflow) – larger deficit of the BP – larger depreciation to restore BP=0 – larger rise in net exports (shift in IS and BP line to the right) Effects: rise in income larger ...

... Monetary expansion (LM-LM’) – rise in money supply – rise in income (imports) – trade deficit – fall in interest rates (capital outflow) – larger deficit of the BP – larger depreciation to restore BP=0 – larger rise in net exports (shift in IS and BP line to the right) Effects: rise in income larger ...

In recent years, the personal saving rate in the

... wealth also includes tangible real assets, which constitute about one-third of their total asset holdings. The principal component of tangible assets is real estate, representing approximately 80% of the total. Like the stock market, housing prices also have appreciated, thus adding to household net ...

... wealth also includes tangible real assets, which constitute about one-third of their total asset holdings. The principal component of tangible assets is real estate, representing approximately 80% of the total. Like the stock market, housing prices also have appreciated, thus adding to household net ...

186 - Supreme Court of Canada Judgments

... hand, would secure to the company a fair return for the capital invested. By a fair return is meant that the company will be allowed as large a return on the capital invested in its enterprise (which will be net to the company) as it would receive if it were investing the same amount in other securi ...

... hand, would secure to the company a fair return for the capital invested. By a fair return is meant that the company will be allowed as large a return on the capital invested in its enterprise (which will be net to the company) as it would receive if it were investing the same amount in other securi ...

Mortgage-Related Securities

... • Default risk: If there are a large number of defaults on the mortgages underlying a mortgage-related security, its market value and the income it produces can suffer. • Rise in interest rates: You could lose money if interest rates rise. All of the mortgages in a particular pool have the same inte ...

... • Default risk: If there are a large number of defaults on the mortgages underlying a mortgage-related security, its market value and the income it produces can suffer. • Rise in interest rates: You could lose money if interest rates rise. All of the mortgages in a particular pool have the same inte ...

Sappi Limited

... Should the fair value option be allowed under any other circumstances? If so, under what other circumstances should it be allowed and why? We have not identified any other circumstances under which the fair value option needs to be available to entities. Question 7 Do you agree that reclassification ...

... Should the fair value option be allowed under any other circumstances? If so, under what other circumstances should it be allowed and why? We have not identified any other circumstances under which the fair value option needs to be available to entities. Question 7 Do you agree that reclassification ...

Creating a Dynamic DCF Analysis: A Detailed Excel Approach

... 1998). In a project valuation, the DCF is dependent upon determining the expected after-tax free cash flows associated with an asset and then discounting these cash inflows and outflows to find the aggregate net present value (NPV) contributing to the decision making process. The model’s major compo ...

... 1998). In a project valuation, the DCF is dependent upon determining the expected after-tax free cash flows associated with an asset and then discounting these cash inflows and outflows to find the aggregate net present value (NPV) contributing to the decision making process. The model’s major compo ...

The wrong tool for the right job: The Fed shouldn`t raise interest rates

... necessarily a good indicator of the Fed’s short-term interest rate decisions. In the mid-2000s longer term rates remained stubbornly low even as the Fed hiked short-term rates. Given this disconnect between the Fed’s policy rates and the longer-term rates examined by Glaeser et al. (2012), the direc ...

... necessarily a good indicator of the Fed’s short-term interest rate decisions. In the mid-2000s longer term rates remained stubbornly low even as the Fed hiked short-term rates. Given this disconnect between the Fed’s policy rates and the longer-term rates examined by Glaeser et al. (2012), the direc ...

Working Paper No. 427 Liquidity Preference Theory Revisited—To

... FILLING THE GAP—THE LIQUIDITY [PREFERENCE] THEORY OF INTEREST It is crucial to remember that Keynes diagnosed the theory of interest as the fatal flaw in the (neo-)classical orthodoxy he was attacking. In The General Theory, he emphasized that decisions to spend or not to spend must not be confused ...

... FILLING THE GAP—THE LIQUIDITY [PREFERENCE] THEORY OF INTEREST It is crucial to remember that Keynes diagnosed the theory of interest as the fatal flaw in the (neo-)classical orthodoxy he was attacking. In The General Theory, he emphasized that decisions to spend or not to spend must not be confused ...

0538479736_265849

... Recourse is defined by the FASB as “the right of a transferee of receivables to receive payment from the transferor of those receivable for any of the following reasons: a) failure of the debtors to pay when due, b) the effects of prepayments, or c) adjustments resulting from defects in the eligibil ...

... Recourse is defined by the FASB as “the right of a transferee of receivables to receive payment from the transferor of those receivable for any of the following reasons: a) failure of the debtors to pay when due, b) the effects of prepayments, or c) adjustments resulting from defects in the eligibil ...

The Equity Premium Stock and Bond Returns since 1802

... invested in various asset classes in The average nominal arithmetic 1802 would have accumulated to (or mean) return on stocks is 9.0 by the end of 1990. These series per cent per year over the entire are referred to as total return period. Although this can be inindexes, because they assume terprete ...

... invested in various asset classes in The average nominal arithmetic 1802 would have accumulated to (or mean) return on stocks is 9.0 by the end of 1990. These series per cent per year over the entire are referred to as total return period. Although this can be inindexes, because they assume terprete ...

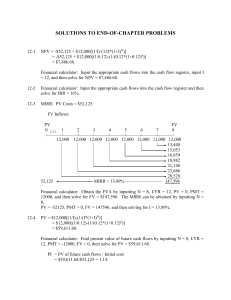

solutions to end-of

... Projects A and B are mutually exclusive, thus, only one of the projects can be chosen. As long as the cost of capital is greater than the crossover rate, both the NPV and IRR methods will lead to the same project selection. However, if the cost of capital is less than the crossover rate the two meth ...

... Projects A and B are mutually exclusive, thus, only one of the projects can be chosen. As long as the cost of capital is greater than the crossover rate, both the NPV and IRR methods will lead to the same project selection. However, if the cost of capital is less than the crossover rate the two meth ...

What is Finance?

... govern audited financial statements The objective of GAAP is to provide a consistent account of a firm's financial status based on historical cost, where revenues and expenses are matched over the appropriate time period. ...

... govern audited financial statements The objective of GAAP is to provide a consistent account of a firm's financial status based on historical cost, where revenues and expenses are matched over the appropriate time period. ...