Issue 43 Key RSC Discussion

... KeyRSC, the AC currently has no way to know precisely what the correct value is at the point at which message 3 is constructed. To work around this, LWAPP designers chose to have the AC simply set this value to 0. This decision does not affect the WTP, who maintains this counter; it only affects the ...

... KeyRSC, the AC currently has no way to know precisely what the correct value is at the point at which message 3 is constructed. To work around this, LWAPP designers chose to have the AC simply set this value to 0. This decision does not affect the WTP, who maintains this counter; it only affects the ...

Accounting for Notes Receivable

... Promissory Note-a written promise to pay a specified amount of money either on demand or at a definite future date. Promissory Notes may be used in exchange for goods or services, in exchange for loaned funds, or in exchange for an outstanding account receivable. Principal-amount stated on the face ...

... Promissory Note-a written promise to pay a specified amount of money either on demand or at a definite future date. Promissory Notes may be used in exchange for goods or services, in exchange for loaned funds, or in exchange for an outstanding account receivable. Principal-amount stated on the face ...

Press Release on results of monetary policy management and

... thereby supporting for the achievement of economic growth exceeding the target level set for 2015 which is the key year of implementing socio – economic plan for 2011-2015 period in accordance with capital absorption of the economy as well as credit safety and quality. By December 21, 2015, credit t ...

... thereby supporting for the achievement of economic growth exceeding the target level set for 2015 which is the key year of implementing socio – economic plan for 2011-2015 period in accordance with capital absorption of the economy as well as credit safety and quality. By December 21, 2015, credit t ...

PPT

... The drop in its stock price has pushed the market debt to capital ratio to 83.18%. Concurrently, the beta of the stock, estimated using the unlevered beta of 0.82 for the restaurant industry and the current market debt to equity ratio has risen to 3.46. The high default risk in the firm has caused t ...

... The drop in its stock price has pushed the market debt to capital ratio to 83.18%. Concurrently, the beta of the stock, estimated using the unlevered beta of 0.82 for the restaurant industry and the current market debt to equity ratio has risen to 3.46. The high default risk in the firm has caused t ...

Document

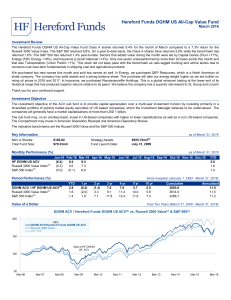

... • Holding a stock too long may lead to lower returns than expected • If stocks decline right after purchase, is that a further buying opportunity or an indication of incorrect analysis? • Continuously monitor key assumptions • Evaluate closely when market value approaches estimated intrinsic value • ...

... • Holding a stock too long may lead to lower returns than expected • If stocks decline right after purchase, is that a further buying opportunity or an indication of incorrect analysis? • Continuously monitor key assumptions • Evaluate closely when market value approaches estimated intrinsic value • ...

Chapter 22 Credit Risk

... Solution (a) Assuming that the unconditional default probabilities are the same on each possible default date. The calculation are as follows: Time Default Recovery Risk-free Loss given Discount PV of expe(years) probability rate(%) value($) default($) factor cted loss($) ...

... Solution (a) Assuming that the unconditional default probabilities are the same on each possible default date. The calculation are as follows: Time Default Recovery Risk-free Loss given Discount PV of expe(years) probability rate(%) value($) default($) factor cted loss($) ...

Case 2–1 - Fisher College of Business

... stock (and therefore its resale value) as well as the company's ability to pay dividends to its stockholders. Financial ratios that may be considered are the current ratio (current assets/current liabilities) to assess liquidity, the debt ratio (total liabilities/total assets) to determine leverage, ...

... stock (and therefore its resale value) as well as the company's ability to pay dividends to its stockholders. Financial ratios that may be considered are the current ratio (current assets/current liabilities) to assess liquidity, the debt ratio (total liabilities/total assets) to determine leverage, ...

aia-qb

... (a) Which portfolio’s expected return is not in line with the factor model relationship? (b) What conditions must an arbitrage portfolio satisfy? (c) Advise if an arbitrage portfolio can be constructed by investors. ...

... (a) Which portfolio’s expected return is not in line with the factor model relationship? (b) What conditions must an arbitrage portfolio satisfy? (c) Advise if an arbitrage portfolio can be constructed by investors. ...

Purchase of Rental Property Form

... BankRate.com for the interest rate payable for the desired loan term of 10, 15 or 30 years. Take the interest rate and multiply by the loan amount for an approximate dollar value to place in this field. Special Note – As this is not a primary residential purchase, the mortgage rate may not be the sa ...

... BankRate.com for the interest rate payable for the desired loan term of 10, 15 or 30 years. Take the interest rate and multiply by the loan amount for an approximate dollar value to place in this field. Special Note – As this is not a primary residential purchase, the mortgage rate may not be the sa ...

Half Year Sept 07 £`m

... * Before exceptional items and amortisation of acquired intangibles ** Net of grant amortisation *** Operating property profits and share based payments charges ...

... * Before exceptional items and amortisation of acquired intangibles ** Net of grant amortisation *** Operating property profits and share based payments charges ...

IRD - Mortgage Concepts Inc.

... Let’s take a closer look at how most Banks calculate INTEREST RATE DIFFERENTIAL While, advertising low rates for new business, the Bank’s published interest rates are generally much higher and be can found in the fine print of the mortgage commitment. Although, it seems like you are catching a great ...

... Let’s take a closer look at how most Banks calculate INTEREST RATE DIFFERENTIAL While, advertising low rates for new business, the Bank’s published interest rates are generally much higher and be can found in the fine print of the mortgage commitment. Although, it seems like you are catching a great ...

chapter 12 international bond markets

... value. Additionally, investors are usually willing to accept a lower coupon rate of interest than the comparable straight fixed coupon bond rate because they find the call feature attractive. Bonds with equity warrants can be viewed as a straight fixed-rate bond with the addition of a call option (o ...

... value. Additionally, investors are usually willing to accept a lower coupon rate of interest than the comparable straight fixed coupon bond rate because they find the call feature attractive. Bonds with equity warrants can be viewed as a straight fixed-rate bond with the addition of a call option (o ...