Technical Prep

... value for the firm. The equity value divided by the number of diluted shares outstanding is the per share value. (Whew!!!) DCF results should be presented as a RANGE of estimated values, not a single estimate. DCF tends to be overvalued because of projections by management. Trading Comparables (Comp ...

... value for the firm. The equity value divided by the number of diluted shares outstanding is the per share value. (Whew!!!) DCF results should be presented as a RANGE of estimated values, not a single estimate. DCF tends to be overvalued because of projections by management. Trading Comparables (Comp ...

OVERVIEW Value_Investing_Slides

... 1) Look Intelligently for Value Opportunities (low P/E, M/B) • Mr. Market is not Crazy about Everything • This is the first step not to be confused with Value Investing 2) Know What You Know ...

... 1) Look Intelligently for Value Opportunities (low P/E, M/B) • Mr. Market is not Crazy about Everything • This is the first step not to be confused with Value Investing 2) Know What You Know ...

Investing in Bond Funds

... shopping. Just as you wouldn’t want to have all of your stocks in one style, you also want to diversify your bond portfolio. A well-rounded bond portfolio should have some exposure to most of the following bond types: Government, mortgage-backed, municipal, corporate, and world bonds. It is importan ...

... shopping. Just as you wouldn’t want to have all of your stocks in one style, you also want to diversify your bond portfolio. A well-rounded bond portfolio should have some exposure to most of the following bond types: Government, mortgage-backed, municipal, corporate, and world bonds. It is importan ...

B233note

... The model specifies the two sources of risk: market or systematic risk attributable to the security’s sensitivity to market movements and firm specific risk. The above equation is a single-variable regression equation of Ri on the market excess return RM. The regression line is called the security c ...

... The model specifies the two sources of risk: market or systematic risk attributable to the security’s sensitivity to market movements and firm specific risk. The above equation is a single-variable regression equation of Ri on the market excess return RM. The regression line is called the security c ...

Multiple Choice

... Answer: a 15. Which of the following is not true regarding prepayments? a. The greater the prepayments, the shorter the security's duration. b. Prepayments are relatively low during the first two years of a mortgage. c. Mortgages to older people tend to have more prepayments than mortgages to younge ...

... Answer: a 15. Which of the following is not true regarding prepayments? a. The greater the prepayments, the shorter the security's duration. b. Prepayments are relatively low during the first two years of a mortgage. c. Mortgages to older people tend to have more prepayments than mortgages to younge ...

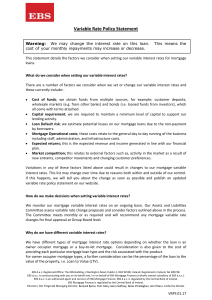

here - EBS

... interest rates. This list may change over time due to reasons both within and outside of our control. If this happens, we will tell you about the change as soon as possible and publish an updated variable rate policy statement on our website. How do we make decisions when setting variable interest r ...

... interest rates. This list may change over time due to reasons both within and outside of our control. If this happens, we will tell you about the change as soon as possible and publish an updated variable rate policy statement on our website. How do we make decisions when setting variable interest r ...

Synopsis_2014_v3 ed 7 and 8

... Ch. 2-6 presents different financial institutions. Identify the major types of financial institutions, which are they? What do they do? We go through these chapter briefly in class. The material is meant for self-studies. It is important to understand the different institutions and what they do on t ...

... Ch. 2-6 presents different financial institutions. Identify the major types of financial institutions, which are they? What do they do? We go through these chapter briefly in class. The material is meant for self-studies. It is important to understand the different institutions and what they do on t ...

The corporate finance implications of rapidly rising interest rates.

... been expecting rising interest rates for the last several years. Over the last three years, for example, economists had forecast the 10-year U.S. Treasury rate to be 70 basis points (bps), 160 bps, and 80 bps higher than the actual rate at the end of 2010, 2011, and 2012, respectively. Today, econom ...

... been expecting rising interest rates for the last several years. Over the last three years, for example, economists had forecast the 10-year U.S. Treasury rate to be 70 basis points (bps), 160 bps, and 80 bps higher than the actual rate at the end of 2010, 2011, and 2012, respectively. Today, econom ...

DESJARDINS CANADIAN EQUITY VALUE FUND

... The Desjardins Funds are not guaranteed, their value fluctuates frequently and their past performance is not indicative of their future returns. The indicated rates of return are the historical annual compounded total returns as indicated the date of the present document including changes in securit ...

... The Desjardins Funds are not guaranteed, their value fluctuates frequently and their past performance is not indicative of their future returns. The indicated rates of return are the historical annual compounded total returns as indicated the date of the present document including changes in securit ...

Highlights of Chapters 19, 16, 33, and 25

... existing assets and the firm plans to keep the same debt / equity ratio, then the firm can value the new project at the after-tax WACC. Example: Project cash flows: -$100 at t = 0, and a perpetuity of $12.50 expected positive cash flows (taxable income) starting at time one. 34% tax rate results in ...

... existing assets and the firm plans to keep the same debt / equity ratio, then the firm can value the new project at the after-tax WACC. Example: Project cash flows: -$100 at t = 0, and a perpetuity of $12.50 expected positive cash flows (taxable income) starting at time one. 34% tax rate results in ...

Real Estate Principles

... Process by which title to land is transferred from its legal owner to someone who openly possesses the land for a statutory time period without the permission of the owner. Requirements to obtain title by adverse possession ...

... Process by which title to land is transferred from its legal owner to someone who openly possesses the land for a statutory time period without the permission of the owner. Requirements to obtain title by adverse possession ...

Chapter 15

... The risk to the equity is increased by the used of financial leverage Leverage allows the cash flows to be divided into two components: less risky and more risky Value can be created if debt holder and equity holder have different risk-return preferences ...

... The risk to the equity is increased by the used of financial leverage Leverage allows the cash flows to be divided into two components: less risky and more risky Value can be created if debt holder and equity holder have different risk-return preferences ...