A Call to ARMs: Adjustable Rate Mortgages in the 1980s

... The role of financial intermediaries is to improve the efficiency of capital markets by linking those who save and those who borrow. They perform this intermediary service by converting their assets into forms better suited to the preferences of their creditors in terms of denomination, liquidity, m ...

... The role of financial intermediaries is to improve the efficiency of capital markets by linking those who save and those who borrow. They perform this intermediary service by converting their assets into forms better suited to the preferences of their creditors in terms of denomination, liquidity, m ...

Eurozone - Doing Business | DOINGBUSINESS.RO

... Somewhat ironically, many banks are now focused on preparing for the AQR process, just as credit demand is starting to rise. The Eurozone’s small and medium-sized enterprises (SMEs), keen to invest for the recovery, are particularly in need of funding. It will also be interesting to see whether othe ...

... Somewhat ironically, many banks are now focused on preparing for the AQR process, just as credit demand is starting to rise. The Eurozone’s small and medium-sized enterprises (SMEs), keen to invest for the recovery, are particularly in need of funding. It will also be interesting to see whether othe ...

Economic Activity and the Short-Term Credit Markets: An

... mostly consistent with an interpretationof these interactionsbased on shocks to monetarypolicy or to corporatecash flows, and, in some respects, also with an interpretationbased on shocks to investors'perceptions of defaultrisk. The evidence is inconclusiveon the role played by shocks to banks' capi ...

... mostly consistent with an interpretationof these interactionsbased on shocks to monetarypolicy or to corporatecash flows, and, in some respects, also with an interpretationbased on shocks to investors'perceptions of defaultrisk. The evidence is inconclusiveon the role played by shocks to banks' capi ...

challenges smes face in acquiring loans from banks

... Commercial/Traditional Bank Loans – These are commercial banks that gives loans to firms to finance their business activities (Scarborough 2012). Firms prefer commercial loans because they have lower interest rates as compared to other debt options (Gary 2005). Commercial banks gives different kinds ...

... Commercial/Traditional Bank Loans – These are commercial banks that gives loans to firms to finance their business activities (Scarborough 2012). Firms prefer commercial loans because they have lower interest rates as compared to other debt options (Gary 2005). Commercial banks gives different kinds ...

The importance of long-term financing by banks

... of funding are available in all the countries analysed, although the weightings vary. If a corresponding demand arises, banks can thus grant long-term loans in all countries. However, historical analysis also shows that long-term financing must first become established, i.e. it requires market parti ...

... of funding are available in all the countries analysed, although the weightings vary. If a corresponding demand arises, banks can thus grant long-term loans in all countries. However, historical analysis also shows that long-term financing must first become established, i.e. it requires market parti ...

Banking fragility and distress: An econometric study of

... Many of the empirical world wide crisis studies are done in the IMF. Typically, the wide country samples are rather heterogeneous. Hence, the dependent variable is usually some discrete one-off crisis data. Probit/logit estimation technique is mostly used as the large samples allow statistically suf ...

... Many of the empirical world wide crisis studies are done in the IMF. Typically, the wide country samples are rather heterogeneous. Hence, the dependent variable is usually some discrete one-off crisis data. Probit/logit estimation technique is mostly used as the large samples allow statistically suf ...

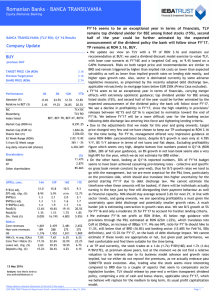

Romanian Banks – BANCA TRANSILVANIA

... We see a decline in profitability in FY’17, since the high volatility in provisions’ releases between H2’15 and Q1’16 is expected to normalize toward the end of FY’16. We believe FY’17 will be a more difficult year for the banking sector following debt discharge law entering into force and tightenin ...

... We see a decline in profitability in FY’17, since the high volatility in provisions’ releases between H2’15 and Q1’16 is expected to normalize toward the end of FY’16. We believe FY’17 will be a more difficult year for the banking sector following debt discharge law entering into force and tightenin ...

Corporate financing in Austria in the run-up to capital

... criteria for classifying companies. Hence, SMEs are businesses with fewer than 250 employees and whose sales do not exceed EUR 50 million per year or whose balance sheet amounts to no more than EUR 43 million. The international Eurostat and OECD tables on which table 1 is based use employee figures ...

... criteria for classifying companies. Hence, SMEs are businesses with fewer than 250 employees and whose sales do not exceed EUR 50 million per year or whose balance sheet amounts to no more than EUR 43 million. The international Eurostat and OECD tables on which table 1 is based use employee figures ...

Price Negotiation in Differentiated Products Markets: Evidence from

... their loyal customers. In Wolinsky (1986) consumers are motivated by more than just price. They search for a firm that will provide them with a suitable product, not just one with a low price. In the labor literature, empirical models combining search and negotiation have been developed and estimate ...

... their loyal customers. In Wolinsky (1986) consumers are motivated by more than just price. They search for a firm that will provide them with a suitable product, not just one with a low price. In the labor literature, empirical models combining search and negotiation have been developed and estimate ...

county of riverside small business loan fund guidelines

... will be implemented by consultants under contract with local Technical Assistance providers. The SBL Loan program Fund will be administered by the County of Riverside Economic Development Agency and will be under the management of the CDBG program. Daily program operation/loan servicing and monitori ...

... will be implemented by consultants under contract with local Technical Assistance providers. The SBL Loan program Fund will be administered by the County of Riverside Economic Development Agency and will be under the management of the CDBG program. Daily program operation/loan servicing and monitori ...

Endogenous financial intermediation and real effects of capital

... welfare gains. We also use our model to study the decision to allow foreign banks to enter the domestic credit market. Supporters of these financial sector liberalizations, such as Mishkin (2000), argue the additional competition strengthens the banking system. In contrast, Hellmann et al. (2000) ar ...

... welfare gains. We also use our model to study the decision to allow foreign banks to enter the domestic credit market. Supporters of these financial sector liberalizations, such as Mishkin (2000), argue the additional competition strengthens the banking system. In contrast, Hellmann et al. (2000) ar ...

Personal Bankruptcy and Credit Market Competition

... products which generate a cross-subsidy from naı̈ve to sophisticated consumers. Our results thus suggest that, while the legal environment in which lenders and borrowers operate is obviously important, further research into the consumer lending industry is required to fully assess the welfare implic ...

... products which generate a cross-subsidy from naı̈ve to sophisticated consumers. Our results thus suggest that, while the legal environment in which lenders and borrowers operate is obviously important, further research into the consumer lending industry is required to fully assess the welfare implic ...

Cooking the Books Workbook - Association of Certified Fraud

... A sponsor is typically a well-meaning family member who agrees to co-sign for another family member with poor credit, only to find out at closing that the sponsor is the only person listed on the loan. Under duress, they are convinced to sign the closing documents as the sole borrower with the reass ...

... A sponsor is typically a well-meaning family member who agrees to co-sign for another family member with poor credit, only to find out at closing that the sponsor is the only person listed on the loan. Under duress, they are convinced to sign the closing documents as the sole borrower with the reass ...

Loan Agreement - Act respecting financial assistance for education

... Section 8 – Consent Afinancial institution may request that a consent clause regarding the collection and communication of personal information be included in the agreement even though the Act respecting financial assistance for education expenses in no way stipulates that entering into a loan agree ...

... Section 8 – Consent Afinancial institution may request that a consent clause regarding the collection and communication of personal information be included in the agreement even though the Act respecting financial assistance for education expenses in no way stipulates that entering into a loan agree ...

Securitisation-Markets

... resulting in less interest income than the bondholders assumed they would receive. As a result future cash flows can only be guessed at rather than known with a high degree of confidence ...

... resulting in less interest income than the bondholders assumed they would receive. As a result future cash flows can only be guessed at rather than known with a high degree of confidence ...

determinants of universal bank lending rate in ghana

... The main purpose of statutory reserve requirements set by the Central Bank is to protect the depositor but this pool of resources allows for financial, fiscal deficit has resulted in financial tax obligation on universal banks. It develops a situation that can create high inflation and continues hig ...

... The main purpose of statutory reserve requirements set by the Central Bank is to protect the depositor but this pool of resources allows for financial, fiscal deficit has resulted in financial tax obligation on universal banks. It develops a situation that can create high inflation and continues hig ...

instruction to the survey

... contracts, share options, and interest rate swaps. With futures and options, the parties agree to buy or sell a particular underlying financial instrument or a real asset at a given time in the future at a given price. Swaps, on the other hand, mean that the parties exchange payment flows (for examp ...

... contracts, share options, and interest rate swaps. With futures and options, the parties agree to buy or sell a particular underlying financial instrument or a real asset at a given time in the future at a given price. Swaps, on the other hand, mean that the parties exchange payment flows (for examp ...

Access to Refinancing and Mortgage Interest Rates

... behavior of interest rates around the eligibility threshold in three distinct policy regimes: prior to HARP (Jan 2005-Feb 2009) when lender treatment was symmetric; under the initial formulation of the program, the so-called HARP 1.0 (Mar 2009-Dec 2011), when existing lenders enjoyed some advantage ...

... behavior of interest rates around the eligibility threshold in three distinct policy regimes: prior to HARP (Jan 2005-Feb 2009) when lender treatment was symmetric; under the initial formulation of the program, the so-called HARP 1.0 (Mar 2009-Dec 2011), when existing lenders enjoyed some advantage ...

Non-Owner-Occupancy Misrepresentation and Loan Default

... A. Verifying the Quality of the BlackBox-Equifax Merge As we mention in Section II of the published article, our primary data set consists of a merge between (i) loan-level mortgage data collected by BlackBox Logic and (ii) borrower-level credit report information collected by Equifax. The merge is ...

... A. Verifying the Quality of the BlackBox-Equifax Merge As we mention in Section II of the published article, our primary data set consists of a merge between (i) loan-level mortgage data collected by BlackBox Logic and (ii) borrower-level credit report information collected by Equifax. The merge is ...

Patrick Bayer, Duke University and NBER

... about house prices, housing characteristics, and neighborhood identifiers that allow us to create neighborhood sociodemographic characteristics based on Census data.11 We then provided this rich sample to one of the major credit rating agencies. The credit rating agency used the name and address to ...

... about house prices, housing characteristics, and neighborhood identifiers that allow us to create neighborhood sociodemographic characteristics based on Census data.11 We then provided this rich sample to one of the major credit rating agencies. The credit rating agency used the name and address to ...

The Democratization of Credit and the Rise in Consumer Bankruptcies

... Notable exceptions to this are Allard, Cresta, and Rochet (1997) and Newhouse (1996), who show that fixed costs can support pooling equilibria in insurance markets with a finite number of risk types. ...

... Notable exceptions to this are Allard, Cresta, and Rochet (1997) and Newhouse (1996), who show that fixed costs can support pooling equilibria in insurance markets with a finite number of risk types. ...

Recent episodes of credit card distress in Asia

... growth in credit card lending. First, as noted earlier, ample liquidity in the banking systems and lower interest rates put pressure on banks to focus more on consumer lending. In Korea, banks financed not only their own credit card operations, but also the dominant monoline credit card issuers thro ...

... growth in credit card lending. First, as noted earlier, ample liquidity in the banking systems and lower interest rates put pressure on banks to focus more on consumer lending. In Korea, banks financed not only their own credit card operations, but also the dominant monoline credit card issuers thro ...

lending in a low interest rate environment

... beginning of the financial crisis, cf. Chart 2 (left). The tightening was primarily implemented in the form of price increases and higher collateral requirements. Prices have also become more differentiated. Since early 2014, commercial banks, in particular, have gradually eased their credit standar ...

... beginning of the financial crisis, cf. Chart 2 (left). The tightening was primarily implemented in the form of price increases and higher collateral requirements. Prices have also become more differentiated. Since early 2014, commercial banks, in particular, have gradually eased their credit standar ...

Probability of Default for Microfinance Institutions

... missing typically indicate that the information is difficult to obtain. This information should therefore not be included in the final model » Factors must be intuitive. Experienced credit analysts should be familiar with the factor and its relationship with credit risk given the credit culture in w ...

... missing typically indicate that the information is difficult to obtain. This information should therefore not be included in the final model » Factors must be intuitive. Experienced credit analysts should be familiar with the factor and its relationship with credit risk given the credit culture in w ...

An Analysis of Interest Rate Spread in the Banking Sector in

... the interest rate bands for lending were removed for all sectors except agriculture, small industries, and exports while, for deposits, the ceilings were removed but the floors were retained. In this context, it is important to recognise that although deregulation of interest rates is often consider ...

... the interest rate bands for lending were removed for all sectors except agriculture, small industries, and exports while, for deposits, the ceilings were removed but the floors were retained. In this context, it is important to recognise that although deregulation of interest rates is often consider ...