Our responsible growth strategy is delivering strong, consistent, high

... peaked at 11.6 billion. We issued more than 7 billion common shares during the crisis. We funded acquisitions, strengthened our balance sheet to meet higher capital requirements, and repaid the government’s TARP investment within 13 months. We are working the share count down; at year end, we were a ...

... peaked at 11.6 billion. We issued more than 7 billion common shares during the crisis. We funded acquisitions, strengthened our balance sheet to meet higher capital requirements, and repaid the government’s TARP investment within 13 months. We are working the share count down; at year end, we were a ...

550.448 Financial Engineering and Structured Products

... Homeowner motivations beyond rational economic (interest-rate related) considerations, which play an important role in assessing prepayment risk. ...

... Homeowner motivations beyond rational economic (interest-rate related) considerations, which play an important role in assessing prepayment risk. ...

Financial Instability and Monetary Policy: The Swedish Evidence

... The financial system is strongly integrated, which means that stability problems arising in one part of the system rapidly spread to other parts. The increasing importance of security markets, for example, has put more emphasize on price bubbles.2 Thus, the term financial instability is sometimes use ...

... The financial system is strongly integrated, which means that stability problems arising in one part of the system rapidly spread to other parts. The increasing importance of security markets, for example, has put more emphasize on price bubbles.2 Thus, the term financial instability is sometimes use ...

Sl no - on CDR

... CDR Core Group at its meeting held on April 21, 2009, approved an updated Master Circular incorporating all revised RBI guidelines relating to restructuring under CDR Mechanism as also all policy decisions taken by CDR Core Group till March 31, 2009. A copy of updated Master Circular is enclosed for ...

... CDR Core Group at its meeting held on April 21, 2009, approved an updated Master Circular incorporating all revised RBI guidelines relating to restructuring under CDR Mechanism as also all policy decisions taken by CDR Core Group till March 31, 2009. A copy of updated Master Circular is enclosed for ...

BFC FINANCIAL CORP (Form: 10-K, Received: 04

... priority lien against the real property for the delinquent real estate taxes. Interest accrues at the rate established at the auction or by statute. The minimum repayment, in order to satisfy the lien, is the certificate amount plus the interest accrued through the redemption date and applicable pen ...

... priority lien against the real property for the delinquent real estate taxes. Interest accrues at the rate established at the auction or by statute. The minimum repayment, in order to satisfy the lien, is the certificate amount plus the interest accrued through the redemption date and applicable pen ...

Unlocking SME finance through market-based debt

... categories, the case for non-bank debt instruments is more limited in the SME space as briefly discussed in Section IX which covers small-/mid-cap bonds and private placements. It makes the case for mini-bonds as one of the most promising and well-suited types of SME bonds, and presents private plac ...

... categories, the case for non-bank debt instruments is more limited in the SME space as briefly discussed in Section IX which covers small-/mid-cap bonds and private placements. It makes the case for mini-bonds as one of the most promising and well-suited types of SME bonds, and presents private plac ...

Full Year Results 2015

... The transaction will occur through the sale of 80% of MLC Limited after the extraction of NAB’s superannuation and investments business and certain other restructuring steps. NAB will retain the MLC brand, although it will be licensed for use by the life insurance business for 10 years, and will con ...

... The transaction will occur through the sale of 80% of MLC Limited after the extraction of NAB’s superannuation and investments business and certain other restructuring steps. NAB will retain the MLC brand, although it will be licensed for use by the life insurance business for 10 years, and will con ...

Form 10-Q - Wells Fargo

... (1) Tangible common equity is a non-GAAP financial measure and represents total equity less preferred equity, noncontrolling interests, and goodwill and certain identifiable intangible assets (including goodwill and intangible assets associated with certain of our nonmarketable equity investments ...

... (1) Tangible common equity is a non-GAAP financial measure and represents total equity less preferred equity, noncontrolling interests, and goodwill and certain identifiable intangible assets (including goodwill and intangible assets associated with certain of our nonmarketable equity investments ...

PDF Basics of Fannie Mae Single

... such as mortgage bankers, commercial banks and credit unions — originates the loans backing Fannie Mae MBS. Lenders submit groups of similar mortgage loans to Fannie Mae for securitization. Fannie Mae ensures that the loans it acquires generally meet its credit quality guidelines 1 and then it secur ...

... such as mortgage bankers, commercial banks and credit unions — originates the loans backing Fannie Mae MBS. Lenders submit groups of similar mortgage loans to Fannie Mae for securitization. Fannie Mae ensures that the loans it acquires generally meet its credit quality guidelines 1 and then it secur ...

citigroup`s 2008 annual report on form 10-k

... Citigroup expenses increased $1.1 billion, or 9%, year-overyear to $12.9 billion. Excluding the impact of the UK bonus tax of approximately $400 million in the second quarter of 2010, expenses increased by nearly $1.5 billion, or 13%, yearover-year. Approximately one-third of this 13% increase resul ...

... Citigroup expenses increased $1.1 billion, or 9%, year-overyear to $12.9 billion. Excluding the impact of the UK bonus tax of approximately $400 million in the second quarter of 2010, expenses increased by nearly $1.5 billion, or 13%, yearover-year. Approximately one-third of this 13% increase resul ...

Default Option Exercise over the Financial Crisis and Beyond

... difference-in-difference analysis shows that the HAMP program caused elevated default option exercise. In that regard, those eligible for HAMP loan modification become significantly more sensitive to negative equity in the wake of program implementation, relative to the non-HAMP eligible control gro ...

... difference-in-difference analysis shows that the HAMP program caused elevated default option exercise. In that regard, those eligible for HAMP loan modification become significantly more sensitive to negative equity in the wake of program implementation, relative to the non-HAMP eligible control gro ...

WHEDA Advantage Policies and Procedures Manual

... Post-Purchase Requirements ...................................................................................................... 60 ...

... Post-Purchase Requirements ...................................................................................................... 60 ...

EFTA Surveillance Authority Decision

... only benefit those with poorer credit rating, these loans would likely carry higher interest rates as they would be subject to higher risk and the percentage of Housing Bonds in the overall funding of housing purchase would be higher. The universality is also necessary to enable lending on equal low ...

... only benefit those with poorer credit rating, these loans would likely carry higher interest rates as they would be subject to higher risk and the percentage of Housing Bonds in the overall funding of housing purchase would be higher. The universality is also necessary to enable lending on equal low ...

indictment_-_hallinanneff

... and other persons known and unknown to the Grand Jury, including Co-Conspirator No. 1, being persons employed by and associated with the Hallinan Payday Lending Organization, an enterprise, which engaged in, and the activities of which affected, interstate and foreign commerce, knowingly and intenti ...

... and other persons known and unknown to the Grand Jury, including Co-Conspirator No. 1, being persons employed by and associated with the Hallinan Payday Lending Organization, an enterprise, which engaged in, and the activities of which affected, interstate and foreign commerce, knowingly and intenti ...

Credit Where it Counts: The Community Reinvestment Act and its

... The Community Reinvestment Act (CRA) was enacted in 1977 to help overcome barriers to credit that these groups faced. Scholars have long leveled numerous critiques against CRA as unnecessary, ineffectual, costly, and lawless. Many have argued that CRA should be eliminated. By contrast, I contend tha ...

... The Community Reinvestment Act (CRA) was enacted in 1977 to help overcome barriers to credit that these groups faced. Scholars have long leveled numerous critiques against CRA as unnecessary, ineffectual, costly, and lawless. Many have argued that CRA should be eliminated. By contrast, I contend tha ...

Interbank intermediation

... sheets in Germany. Figure 1 shows the share of interbank borrowing to total assets for the euro area average, France, the United States, and Germany. Throughout the observation period, the size of the interbank market as measured by the share of interbank lending in total assets is significantly hig ...

... sheets in Germany. Figure 1 shows the share of interbank borrowing to total assets for the euro area average, France, the United States, and Germany. Throughout the observation period, the size of the interbank market as measured by the share of interbank lending in total assets is significantly hig ...

NELNET INC

... Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes [X] No [ ] Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes [ ] No [X] Indicate by check mark wh ...

... Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes [X] No [ ] Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes [ ] No [X] Indicate by check mark wh ...

Accounting Comparability and Loan Contracting - CEAR

... quality and the cost of capital. The extensive literature examining this relationship in the equity market has not been able to reach a consensus as to whether and how financial reporting quality and the cost of equity capital are associated (Botosan 1997; Francis et al. 2005; Ecker, Francis, Kim, O ...

... quality and the cost of capital. The extensive literature examining this relationship in the equity market has not been able to reach a consensus as to whether and how financial reporting quality and the cost of equity capital are associated (Botosan 1997; Francis et al. 2005; Ecker, Francis, Kim, O ...

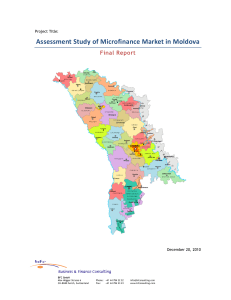

Assessment Study of Microfinance Market in Moldova

... Informal business: a business which is not registered and/or does not keep written accounting records. Microenterprise: an economic agent (formal or informal1) with an annual average of registered employees not more than 9, less than 3 million MDL annual sales, and less than 3 million MDL in assets. ...

... Informal business: a business which is not registered and/or does not keep written accounting records. Microenterprise: an economic agent (formal or informal1) with an annual average of registered employees not more than 9, less than 3 million MDL annual sales, and less than 3 million MDL in assets. ...

Is there any Dependence between Consumer Credit

... the line excessively, in the hope of reducing the impact of financial distress. Banks interpret such behavior as a signal of credit quality deterioration: this may lead to better risk management of the loan portfolio if corrective measures are taken early. To deal with the endogeneity problem of the ...

... the line excessively, in the hope of reducing the impact of financial distress. Banks interpret such behavior as a signal of credit quality deterioration: this may lead to better risk management of the loan portfolio if corrective measures are taken early. To deal with the endogeneity problem of the ...

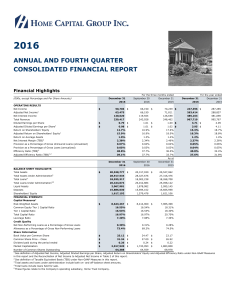

2016 Q4 Report - Home Capital Group

... of National Instrument 51-102. Please see the risk factors, which are set forth in detail in the Risk Management section of this report, as well as the Company’s other publicly filed information, which is available on the System for Electronic Document Analysis and Retrieval (SEDAR) at www.sedar.com ...

... of National Instrument 51-102. Please see the risk factors, which are set forth in detail in the Risk Management section of this report, as well as the Company’s other publicly filed information, which is available on the System for Electronic Document Analysis and Retrieval (SEDAR) at www.sedar.com ...

The Dark Side of Universal Banking: Financial Conglomerates and

... mortgages and credit card loans to nonprime borrowers. By 2006, LCFIs turned the U.S. housing market into a system of “Ponzi finance,” in which borrowers kept taking out new loans to pay off old ones. When home prices fell in 2007, and nonprime homeowners could no longer refinance, defaults skyrocke ...

... mortgages and credit card loans to nonprime borrowers. By 2006, LCFIs turned the U.S. housing market into a system of “Ponzi finance,” in which borrowers kept taking out new loans to pay off old ones. When home prices fell in 2007, and nonprime homeowners could no longer refinance, defaults skyrocke ...

Credit Risk Credit Risk Management System Management System

... Credit risk is the risk that a financial institution will incur losses because the financial position of a borrower has deteriorated to the point that the value of an asset (including off-balance-sheet assets) is reduced or extinguished. Among credit risks, the risk that the financial institution wi ...

... Credit risk is the risk that a financial institution will incur losses because the financial position of a borrower has deteriorated to the point that the value of an asset (including off-balance-sheet assets) is reduced or extinguished. Among credit risks, the risk that the financial institution wi ...

Estimating the Effects of Foreclosure Counseling for Troubled Borrowers Assistant Professor

... pay bills, as well as from the trigger event(s) that caused the disruption in payments (job loss, health emergency, etc.). Such a psychological state creates a tendency to focus on immediate issues and ignore other information. The literature suggests that anxiety leads people to process information ...

... pay bills, as well as from the trigger event(s) that caused the disruption in payments (job loss, health emergency, etc.). Such a psychological state creates a tendency to focus on immediate issues and ignore other information. The literature suggests that anxiety leads people to process information ...

Public-Sector Loans to Private-Sector Businesses

... economic development: the Community Development Block Grant (CDBG) Program; the Section 108 Program; and the Economic Development Initiative (EDI). The research describes the CDBG, Section 108, and EDI programs, how they work, and what types of economic development they fund; estimates the size and ...

... economic development: the Community Development Block Grant (CDBG) Program; the Section 108 Program; and the Economic Development Initiative (EDI). The research describes the CDBG, Section 108, and EDI programs, how they work, and what types of economic development they fund; estimates the size and ...