Structural Features of Australian Residential Mortgage

... RMBS notes (Graph 2).10 In this way, a senior note is protected from taking any losses until all of its junior notes are fully charged off; the junior note is said to provide ‘credit enhancement’ to the senior note through the junior note’s credit subordination. The size of the credit enhancement to ...

... RMBS notes (Graph 2).10 In this way, a senior note is protected from taking any losses until all of its junior notes are fully charged off; the junior note is said to provide ‘credit enhancement’ to the senior note through the junior note’s credit subordination. The size of the credit enhancement to ...

equinix, inc. - corporate

... In June 2016, FASB issued ASU 2016-13, Financial Instruments - Credit Losses (Topic 326): Measurement of Credit Losses on Financial Instruments. The ASU requires the measurement of all expected credit losses for financial assets held at the reporting date based on historical experience, current cond ...

... In June 2016, FASB issued ASU 2016-13, Financial Instruments - Credit Losses (Topic 326): Measurement of Credit Losses on Financial Instruments. The ASU requires the measurement of all expected credit losses for financial assets held at the reporting date based on historical experience, current cond ...

International Competitor Analysis and Benchmarking

... which has been expressed in some quarters, that annuities represent poor value for money for consumers. This is in the context of trends which have significantly increased the cost of annuities. Given growth in the number of defined contribution pension scheme members, this is an increasingly import ...

... which has been expressed in some quarters, that annuities represent poor value for money for consumers. This is in the context of trends which have significantly increased the cost of annuities. Given growth in the number of defined contribution pension scheme members, this is an increasingly import ...

The Kay Review of UK Equity Markets and Long–Term Decision

... In 2010, only 11.5 per cent of UK shares were owned directly by individuals. In the early 1960s this figure was as high as 54 per cent. The major investment decisions which affect British companies are now taken by asset fund managers around the world who work for firms which control billions, often ...

... In 2010, only 11.5 per cent of UK shares were owned directly by individuals. In the early 1960s this figure was as high as 54 per cent. The major investment decisions which affect British companies are now taken by asset fund managers around the world who work for firms which control billions, often ...

Proposed Rule: Money Market Fund Reform

... proposing two alternatives for amending rules that govern money market mutual funds (or “money market funds”) under the Investment Company Act of 1940. The two alternatives are designed to address money market funds’ susceptibility to heavy redemptions, improve their ability to manage and mitigate p ...

... proposing two alternatives for amending rules that govern money market mutual funds (or “money market funds”) under the Investment Company Act of 1940. The two alternatives are designed to address money market funds’ susceptibility to heavy redemptions, improve their ability to manage and mitigate p ...

Does the Dodd-Frank Act Reduce Conflicts of Interest Faced by

... agencies, to assess credit risks. Since 2007, credit rating agencies have been widely criticized because of their generous ratings on mortgage-backed securities and other structured-Önance bonds that later defaulted. Critics argue that the observed rating errors underscore features of the rating ind ...

... agencies, to assess credit risks. Since 2007, credit rating agencies have been widely criticized because of their generous ratings on mortgage-backed securities and other structured-Önance bonds that later defaulted. Critics argue that the observed rating errors underscore features of the rating ind ...

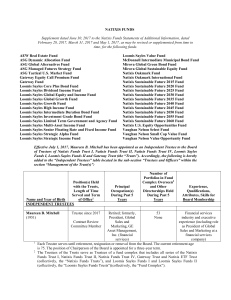

LOOMIS SAYLES VALUE FUND Supplement dated April 19, 2017 to

... the applicable rules of the SEC, the Board reserves the right to modify the exchange privilege at any time. Except as otherwise permitted by SEC rule, shareholders will receive at least 60 days’ advance notice of any material change to the exchange privilege. Effective July 1, 2017, the 5th sentence ...

... the applicable rules of the SEC, the Board reserves the right to modify the exchange privilege at any time. Except as otherwise permitted by SEC rule, shareholders will receive at least 60 days’ advance notice of any material change to the exchange privilege. Effective July 1, 2017, the 5th sentence ...

Equity Risk Premiums (ERP)

... should examine the factors that determine equity risk premiums. After all, equity risk premiums should reflect not only the risk that investors see in equity investments but also the price they put on that risk. Risk Aversion The first and most critical factor, obviously, is the risk aversion of inv ...

... should examine the factors that determine equity risk premiums. After all, equity risk premiums should reflect not only the risk that investors see in equity investments but also the price they put on that risk. Risk Aversion The first and most critical factor, obviously, is the risk aversion of inv ...

Scottish Widows Life Funds Investor`s Guide

... 1. SCOTTISH WIDOWS LIFE FUNDS, MANAGED BY ABERDEEN ASSET MANAGEMENT The Scottish Widows funds are all managed by a subsidiary of Aberdeen Asset Management plc (‘Aberdeen’). Aberdeen Asset Management is a global asset manager. Based in 25 countries, Aberdeen manages assets for both institutional and ...

... 1. SCOTTISH WIDOWS LIFE FUNDS, MANAGED BY ABERDEEN ASSET MANAGEMENT The Scottish Widows funds are all managed by a subsidiary of Aberdeen Asset Management plc (‘Aberdeen’). Aberdeen Asset Management is a global asset manager. Based in 25 countries, Aberdeen manages assets for both institutional and ...

Pillar 3 Report for 30 September 2016 (PDF 1MB)

... Management Strategy and the establishment of additional controls through supporting frameworks and policies. Overview of key risk types ...

... Management Strategy and the establishment of additional controls through supporting frameworks and policies. Overview of key risk types ...

BDC`s 2016 Annual Report

... Supporting businesses affected by lower oil prices As a development bank, when the going gets tough, our job is to step in and see how we can help. That’s why we launched a national oil and gas sector initiative to support businesses affected by lower oil prices. This initiative included a $500 mill ...

... Supporting businesses affected by lower oil prices As a development bank, when the going gets tough, our job is to step in and see how we can help. That’s why we launched a national oil and gas sector initiative to support businesses affected by lower oil prices. This initiative included a $500 mill ...

LLB Fund Overview - Quarterly Report 1 / 2017

... More transparency thanks to retrocession-free pricing model At the beginning of July 2014, the LLB introduced a pioneering pricing model that does without commission fees for own funds and third-party funds – both in asset management and investment advice. For selected strategy products and bond fu ...

... More transparency thanks to retrocession-free pricing model At the beginning of July 2014, the LLB introduced a pioneering pricing model that does without commission fees for own funds and third-party funds – both in asset management and investment advice. For selected strategy products and bond fu ...

Form ADV - Palisade Capital Management

... Clients may obtain a copy of the Guidelines by submitting a request to Palisade, as described above. Palisade’s Compliance Department is responsible for monitoring receipt of research and recommendations from the Proxy Agent, obtaining voting decisions from the appropriate Palisade investment profes ...

... Clients may obtain a copy of the Guidelines by submitting a request to Palisade, as described above. Palisade’s Compliance Department is responsible for monitoring receipt of research and recommendations from the Proxy Agent, obtaining voting decisions from the appropriate Palisade investment profes ...

2016 年 11 月 1 日~2017 年 4 月 30 日

... This interim report and unaudited financial statements (the “Report and Accounts”) may be translated into other languages. Any such translation shall only contain the same information and have the same meaning as the English language Report and Accounts. To the extent that there is any inconsistency ...

... This interim report and unaudited financial statements (the “Report and Accounts”) may be translated into other languages. Any such translation shall only contain the same information and have the same meaning as the English language Report and Accounts. To the extent that there is any inconsistency ...

Alterna Savings and Credit Union Limited

... by DICO as stabilization authority would, in this case, not be appropriate; (2) A credit union has failed to comply with an order of DICO made while the credit union was subject to Supervision; (3) DICO is of the opinion that the assets of a credit union are not sufficient to give adequate protectio ...

... by DICO as stabilization authority would, in this case, not be appropriate; (2) A credit union has failed to comply with an order of DICO made while the credit union was subject to Supervision; (3) DICO is of the opinion that the assets of a credit union are not sufficient to give adequate protectio ...

- Franklin Templeton Investments

... be illiquid securities and subject to the Fund’s restrictions on investments in illiquid securities. The Fund’s investment in CDOs will not receive the same investor protection as an investment in registered securities. ...

... be illiquid securities and subject to the Fund’s restrictions on investments in illiquid securities. The Fund’s investment in CDOs will not receive the same investor protection as an investment in registered securities. ...

Santander Consumer USA Holdings Inc. (Form: S-1

... determine what kind of collateral to provide in order to secure the desired loan amount, and helps minimize a lender’s loss exposure when accepting collateral that can fluctuate in value. Clean-Up Call The action of an issuer of a debt instrument (such as a bond) requiring early redemption of the in ...

... determine what kind of collateral to provide in order to secure the desired loan amount, and helps minimize a lender’s loss exposure when accepting collateral that can fluctuate in value. Clean-Up Call The action of an issuer of a debt instrument (such as a bond) requiring early redemption of the in ...

united states securities and exchange commission - corporate

... standards; if health or safety concerns arise with respect to a product, we may be forced to withdraw it from the market. The development and commercialization process, particularly with respect to specialty medicines as well as the complex generic medicines that we are increasingly focusing on, is ...

... standards; if health or safety concerns arise with respect to a product, we may be forced to withdraw it from the market. The development and commercialization process, particularly with respect to specialty medicines as well as the complex generic medicines that we are increasingly focusing on, is ...

Skybridge Multi-Adviser Hedge Fund Portfolios LLC

... investment company. The investment objective of the Company’s Multi-Strategy Series G (“Series G”) is to seek capital appreciation. The Company is a fund of hedge funds and seeks to implement its objectives principally through investing in investment funds managed by third-party investment managers ...

... investment company. The investment objective of the Company’s Multi-Strategy Series G (“Series G”) is to seek capital appreciation. The Company is a fund of hedge funds and seeks to implement its objectives principally through investing in investment funds managed by third-party investment managers ...

Franklin Flexible Alpha Bond Fund Prospectus

... Franklin Fund Allocator Series Franklin Conservative Allocation Fund Franklin Corefolio Allocation Fund Franklin Founding Funds Allocation Fund Franklin Growth Allocation Fund Franklin Moderate Allocation Fund Franklin LifeSmartTM 2015 Retirement Target Fund Franklin LifeSmartTM 2020 Retirement Targ ...

... Franklin Fund Allocator Series Franklin Conservative Allocation Fund Franklin Corefolio Allocation Fund Franklin Founding Funds Allocation Fund Franklin Growth Allocation Fund Franklin Moderate Allocation Fund Franklin LifeSmartTM 2015 Retirement Target Fund Franklin LifeSmartTM 2020 Retirement Targ ...

Canadian Repo Market Ecology

... Right of substitution: If the counterparties agree to this mechanic, the repo seller may substitute the collateral during the lifetime of the agreement with another security. The rate and haircut may change after certain substitutions. The right of substitution gives flexibility in financing to repo ...

... Right of substitution: If the counterparties agree to this mechanic, the repo seller may substitute the collateral during the lifetime of the agreement with another security. The rate and haircut may change after certain substitutions. The right of substitution gives flexibility in financing to repo ...

US$1500000000 Perpetual Fixed Rate Resettable

... Prospective investors acknowledge that they have not relied on the Managers or any person affiliated with the Managers in connection with their investigation of the accuracy of such information or their investment decision. In making an investment decision, prospective investors must rely on their o ...

... Prospective investors acknowledge that they have not relied on the Managers or any person affiliated with the Managers in connection with their investigation of the accuracy of such information or their investment decision. In making an investment decision, prospective investors must rely on their o ...

Chapter 14A

... (10) a “connected subsidiary” has the meaning in rule 14A.16; (11) a “connected transaction” has the meaning in rules 14A.23 to 14A.30; (12) a “continuing connected transaction” has the meaning in rule 14A.31; (13) a “controller” has the meaning in rule 14A.28(1); (14) a “deemed disposal” has the m ...

... (10) a “connected subsidiary” has the meaning in rule 14A.16; (11) a “connected transaction” has the meaning in rules 14A.23 to 14A.30; (12) a “continuing connected transaction” has the meaning in rule 14A.31; (13) a “controller” has the meaning in rule 14A.28(1); (14) a “deemed disposal” has the m ...