IMF Staff Comments on EU Commission Consultation on Short Selling

... response to unanticipated buyer demand, to facilitate arbitrage among cash, futures and options markets, or to hedge the risk of a long position in the same or a related security. It also generates additional income for long-term investors through securities lending. The Commission proposal notes th ...

... response to unanticipated buyer demand, to facilitate arbitrage among cash, futures and options markets, or to hedge the risk of a long position in the same or a related security. It also generates additional income for long-term investors through securities lending. The Commission proposal notes th ...

Douglass. Rob has focused on these narkets fron the point of

... fixed rates. It was only four or five years ago that $US floating rates were over 2O%, whereas today, they are below 7%. In the same time fixed rates have ranged betweet 8% and L6%. In considering whether to borrow on a fixed rate basis, a borrower ï¡il1 if possible take into account a number of fac ...

... fixed rates. It was only four or five years ago that $US floating rates were over 2O%, whereas today, they are below 7%. In the same time fixed rates have ranged betweet 8% and L6%. In considering whether to borrow on a fixed rate basis, a borrower ï¡il1 if possible take into account a number of fac ...

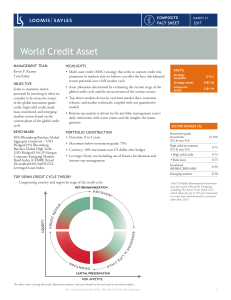

World Credit Asset

... the global credit cycle. Accessing a broad investment opportunity set allows the product team to seek to create a diversified portfolio with what the team believes are the most attractive issuers in the global investment grade credit, high yield credit, bank loan, securitized and emerging markets. I ...

... the global credit cycle. Accessing a broad investment opportunity set allows the product team to seek to create a diversified portfolio with what the team believes are the most attractive issuers in the global investment grade credit, high yield credit, bank loan, securitized and emerging markets. I ...

Document

... Investment options are offered through a group variable annuity contract (Forms 902-GAQC-09 or 902-GAQC-09(CT) or 902-GAQC09(OR)) underwritten by United of Omaha Life Insurance Company for contracts issued in all states except New York. United of Omaha Life Insurance Company, Omaha, NE 68175 is lice ...

... Investment options are offered through a group variable annuity contract (Forms 902-GAQC-09 or 902-GAQC-09(CT) or 902-GAQC09(OR)) underwritten by United of Omaha Life Insurance Company for contracts issued in all states except New York. United of Omaha Life Insurance Company, Omaha, NE 68175 is lice ...

Riding the Stagecoach to Hell: A Qualitative Analysis of

... such as 10 percent down and a 30-year amortization period. As in the private sector, the HOLC and the FHA discouraged lending to black borrowers and recommended the use of restrictive covenants. In addition, however, federal authorities developed a new discriminatory tool known as the “residential s ...

... such as 10 percent down and a 30-year amortization period. As in the private sector, the HOLC and the FHA discouraged lending to black borrowers and recommended the use of restrictive covenants. In addition, however, federal authorities developed a new discriminatory tool known as the “residential s ...

OFEMPLOYEESIMPROVE

... deal to deal with the impacts of the international financial crisis that struck in 2008 and those impacts are still being felt. Funding available for housing has not been immune to this. That said, that is not the only reason why SLP targets have not been met. In some cases (with hindsight) we can n ...

... deal to deal with the impacts of the international financial crisis that struck in 2008 and those impacts are still being felt. Funding available for housing has not been immune to this. That said, that is not the only reason why SLP targets have not been met. In some cases (with hindsight) we can n ...

Property Index Overview of European Residential Markets

... however, the risk of recession is complicating this process significantly and endangers the sustainability of the reforms. The fiscal situation is a potential factor increasing the risk of recession, as well as an area of economy that worsens dramatically due to recession. Nevertheless, it is clear ...

... however, the risk of recession is complicating this process significantly and endangers the sustainability of the reforms. The fiscal situation is a potential factor increasing the risk of recession, as well as an area of economy that worsens dramatically due to recession. Nevertheless, it is clear ...

Price Dispersion in OTC Markets: A New

... One important approach to measure liquidity is through the price impact of trading. A popular (and intuitive) measure was introduced by Amihud quantifying the effect of trading on price changes. ...

... One important approach to measure liquidity is through the price impact of trading. A popular (and intuitive) measure was introduced by Amihud quantifying the effect of trading on price changes. ...

Housing Activity during Business Cycles

... house commencements had largely been static. The beginning of the GFC downturn saw activity fall sharply but a strong recovery in detached house building was prompted by the government’s stimulus programme and record reductions in interest rates. However, the withdrawal of the stimulus and interest ...

... house commencements had largely been static. The beginning of the GFC downturn saw activity fall sharply but a strong recovery in detached house building was prompted by the government’s stimulus programme and record reductions in interest rates. However, the withdrawal of the stimulus and interest ...

Institute of Actuaries of India Subject ST5 – Finance and Investment A

... depart from the benchmark. These could be set either as a load difference (eg limiting corporate bonds to below 10% of the total portfolio) or a load ratio. ...

... depart from the benchmark. These could be set either as a load difference (eg limiting corporate bonds to below 10% of the total portfolio) or a load ratio. ...

and debt

... – “Has the expansion of household credit run its course? Will it reverse? We cannot know the answer to these questions with any certainty, but my guess is that the democratisation of finance which has underpinned this rise in household debt probably has not yet run its course...” – “Eventually, hous ...

... – “Has the expansion of household credit run its course? Will it reverse? We cannot know the answer to these questions with any certainty, but my guess is that the democratisation of finance which has underpinned this rise in household debt probably has not yet run its course...” – “Eventually, hous ...

United States housing bubble

The United States housing bubble was an economic bubble affecting many parts of the United States housing market in over half of American states. Housing prices peaked in early 2006, started to decline in 2006 and 2007, and reached new lows in 2012. On December 30, 2008, the Case-Shiller home price index reported its largest price drop in its history. The credit crisis resulting from the bursting of the housing bubble is—according to general consensus—the primary cause of the 2007–2009 recession in the United States.Increased foreclosure rates in 2006–2007 among U.S. homeowners led to a crisis in August 2008 for the subprime, Alt-A, collateralized debt obligation (CDO), mortgage, credit, hedge fund, and foreign bank markets. In October 2007, the U.S. Secretary of the Treasury called the bursting housing bubble ""the most significant risk to our economy.""Any collapse of the U.S. housing bubble has a direct impact not only on home valuations, but the nation's mortgage markets, home builders, real estate, home supply retail outlets, Wall Street hedge funds held by large institutional investors, and foreign banks, increasing the risk of a nationwide recession. Concerns about the impact of the collapsing housing and credit markets on the larger U.S. economy caused President George W. Bush and the Chairman of the Federal Reserve Ben Bernanke to announce a limited bailout of the U.S. housing market for homeowners who were unable to pay their mortgage debts.In 2008 alone, the United States government allocated over $900 billion to special loans and rescues related to the U.S. housing bubble, with over half going to Fannie Mae and Freddie Mac (both of which are government-sponsored enterprises) as well as the Federal Housing Administration. On December 24, 2009, the Treasury Department made an unprecedented announcement that it would be providing Fannie Mae and Freddie Mac unlimited financial support for the next three years despite acknowledging losses in excess of $400 billion so far. The Treasury has been criticized for encroaching on spending powers that are enumerated for Congress alone by the United States Constitution, and for violating limits imposed by the Housing and Economic Recovery Act of 2008.