Personal Financial Statement - Lamar Bank and Trust Company

... Defendant in any suits or Legal Action Have you been declared bankrupt in the last 14 years? If so when? ...

... Defendant in any suits or Legal Action Have you been declared bankrupt in the last 14 years? If so when? ...

CUTTING THROUGH THE JARGON: A Basic Primer on

... Cap Rates provide a tool for investors to use for roughly valuing a property based on its net operating income. For example, if a real estate investment provides $160,000 a year in Net Operating Income and similar properties have sold based on 8% cap rates, the subject property can be roughly valued ...

... Cap Rates provide a tool for investors to use for roughly valuing a property based on its net operating income. For example, if a real estate investment provides $160,000 a year in Net Operating Income and similar properties have sold based on 8% cap rates, the subject property can be roughly valued ...

MACROPRU. 5 principles for macroprudential policy

... My aim in doing so is twofold: first, to help to build a common understanding of what it is and how it works; and second, to engage the finest minds – you – in partnership to push the frontiers of knowledge in ways that can make it better. 1) “It’s the real economy, stupid” ...

... My aim in doing so is twofold: first, to help to build a common understanding of what it is and how it works; and second, to engage the finest minds – you – in partnership to push the frontiers of knowledge in ways that can make it better. 1) “It’s the real economy, stupid” ...

PDF(Business Economic Analysis of Two Industries)

... demand of mobile phones in the market. The increased demand calls for increased supply or it can be said that there will not be a situation of over production because when the cost is cut it will automatically be sold off whatever is produced by the manufacturers. This is supported by Say’s law of m ...

... demand of mobile phones in the market. The increased demand calls for increased supply or it can be said that there will not be a situation of over production because when the cost is cut it will automatically be sold off whatever is produced by the manufacturers. This is supported by Say’s law of m ...

Introduction C 1 H A P T E R

... 30,000 and many private rented sector tenants may have incorrectly ticked this category in the Census. See Cornerstone, October 2007, p 5. Source: Central Bank of Ireland, Quarterly Bulletin Q4, 2010, p 23. Household net worth in Ireland increased by 83% between Q1, 2002 and Q4, 2006 reaching a valu ...

... 30,000 and many private rented sector tenants may have incorrectly ticked this category in the Census. See Cornerstone, October 2007, p 5. Source: Central Bank of Ireland, Quarterly Bulletin Q4, 2010, p 23. Household net worth in Ireland increased by 83% between Q1, 2002 and Q4, 2006 reaching a valu ...

savings

... In general, the lower the probability of an “event”, the less you will pay in premiums. In general, the larger the number of people in the risk pool, the less you will pay in premiums. ...

... In general, the lower the probability of an “event”, the less you will pay in premiums. In general, the larger the number of people in the risk pool, the less you will pay in premiums. ...

CommonSenseEconomics

... held over lengthy time periods like 25 or 30 years. However, over short periods such as five or even ten years, the variability of stock holdings is relatively high. Thus, as retirement approaches and funds will be needed for spending, it is prudent to switch from stocks to bonds. Treasury Inflation ...

... held over lengthy time periods like 25 or 30 years. However, over short periods such as five or even ten years, the variability of stock holdings is relatively high. Thus, as retirement approaches and funds will be needed for spending, it is prudent to switch from stocks to bonds. Treasury Inflation ...

Main Presentation Title

... Episode Last? Special presentation for the IPAA Carl Calabro, Director, Market Analysis Markets Group Strategic Advisors in Global Energy ...

... Episode Last? Special presentation for the IPAA Carl Calabro, Director, Market Analysis Markets Group Strategic Advisors in Global Energy ...

NBER WORKING PAPERS SERIES ASSET BUBBLES AND GROWFH Noriyuki Yanagawa

... reflects parameters of tastes and technology. We find that bubbles, when they exist, retard reflects parameters of tastes and technology. We find that bubbles, when they exist, retard the growth of the economy, perhaps even in the long run, and reduce the welfare of all the growth of the economy, pe ...

... reflects parameters of tastes and technology. We find that bubbles, when they exist, retard reflects parameters of tastes and technology. We find that bubbles, when they exist, retard the growth of the economy, perhaps even in the long run, and reduce the welfare of all the growth of the economy, pe ...

Can Fin Homes Limited

... comfortably above the statutory norm of 12% stipulated by national housing bank (NHB) since FY07. The capital adequacy ratio (CAR) for FY14 stands at 13.8%, comfortable but lower than the high of 19% witnessed in FY11. The mild reduction in CAR is due to high business growth within the same period a ...

... comfortably above the statutory norm of 12% stipulated by national housing bank (NHB) since FY07. The capital adequacy ratio (CAR) for FY14 stands at 13.8%, comfortable but lower than the high of 19% witnessed in FY11. The mild reduction in CAR is due to high business growth within the same period a ...

Property Index Overview of European Residential Markets

... the European Union characterised by a recession that started at the end of 2011 and is linked to the financial crisis and unsustainable debt levels. Real GDP growth dropped to -0.3%. The unsustainable accumulation of debt in the private and public sector, combined with uncertainty over the macroecon ...

... the European Union characterised by a recession that started at the end of 2011 and is linked to the financial crisis and unsustainable debt levels. Real GDP growth dropped to -0.3%. The unsustainable accumulation of debt in the private and public sector, combined with uncertainty over the macroecon ...

The RBI holds and the US Fed raises

... Bonds and this has had a muted impact on markets. Post Trump winning the US elections FIIs have been large sellers in the Indian Bonds markets. Indian Markets post demonetization has been delinked from the global bond sell off. Indian Bonds have rallied by 50 basis points (bps) against the global yi ...

... Bonds and this has had a muted impact on markets. Post Trump winning the US elections FIIs have been large sellers in the Indian Bonds markets. Indian Markets post demonetization has been delinked from the global bond sell off. Indian Bonds have rallied by 50 basis points (bps) against the global yi ...

Irrational Exuberance

... and better information than retail investors of those public companies. Such information asymmetry is more serious than that in the US because the China’s financial market is less transparent than the US’s financial market and its regulations are less strict. Impact: retail investors over-valuate ...

... and better information than retail investors of those public companies. Such information asymmetry is more serious than that in the US because the China’s financial market is less transparent than the US’s financial market and its regulations are less strict. Impact: retail investors over-valuate ...

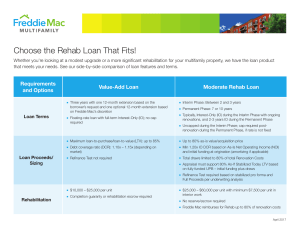

Mod Rehab vs Value-Add Chart

... Choose the Rehab Loan That Fits! Whether you’re looking at a modest upgrade or a more significant rehabilitation for your multifamily property, we have the loan product that meets your needs. See our side-by-side comparison of loan features and terms. ...

... Choose the Rehab Loan That Fits! Whether you’re looking at a modest upgrade or a more significant rehabilitation for your multifamily property, we have the loan product that meets your needs. See our side-by-side comparison of loan features and terms. ...

Agrarian and food crises in India

... falling productivity because of soil depletion inadequate public investment in agricultural research and extension impact of climate changes on harvests ...

... falling productivity because of soil depletion inadequate public investment in agricultural research and extension impact of climate changes on harvests ...

United States housing bubble

The United States housing bubble was an economic bubble affecting many parts of the United States housing market in over half of American states. Housing prices peaked in early 2006, started to decline in 2006 and 2007, and reached new lows in 2012. On December 30, 2008, the Case-Shiller home price index reported its largest price drop in its history. The credit crisis resulting from the bursting of the housing bubble is—according to general consensus—the primary cause of the 2007–2009 recession in the United States.Increased foreclosure rates in 2006–2007 among U.S. homeowners led to a crisis in August 2008 for the subprime, Alt-A, collateralized debt obligation (CDO), mortgage, credit, hedge fund, and foreign bank markets. In October 2007, the U.S. Secretary of the Treasury called the bursting housing bubble ""the most significant risk to our economy.""Any collapse of the U.S. housing bubble has a direct impact not only on home valuations, but the nation's mortgage markets, home builders, real estate, home supply retail outlets, Wall Street hedge funds held by large institutional investors, and foreign banks, increasing the risk of a nationwide recession. Concerns about the impact of the collapsing housing and credit markets on the larger U.S. economy caused President George W. Bush and the Chairman of the Federal Reserve Ben Bernanke to announce a limited bailout of the U.S. housing market for homeowners who were unable to pay their mortgage debts.In 2008 alone, the United States government allocated over $900 billion to special loans and rescues related to the U.S. housing bubble, with over half going to Fannie Mae and Freddie Mac (both of which are government-sponsored enterprises) as well as the Federal Housing Administration. On December 24, 2009, the Treasury Department made an unprecedented announcement that it would be providing Fannie Mae and Freddie Mac unlimited financial support for the next three years despite acknowledging losses in excess of $400 billion so far. The Treasury has been criticized for encroaching on spending powers that are enumerated for Congress alone by the United States Constitution, and for violating limits imposed by the Housing and Economic Recovery Act of 2008.