Low Incomes and High House Prices in Metro

... for the benefit of society at large. These investments allow the marketplace to function and create private sector (residential, industrial and commercial) real estate value. Would your home hold the same value to you or a potential buyer if it were not serviced by water, sewer, gas and electricity? ...

... for the benefit of society at large. These investments allow the marketplace to function and create private sector (residential, industrial and commercial) real estate value. Would your home hold the same value to you or a potential buyer if it were not serviced by water, sewer, gas and electricity? ...

Sample letter from CAI volunteers to Member of Congress

... Dear Ms. Majors and Claire, The Federal Housing Finance Agency (FHFA) has adopted a position that would have detrimental impacts on an estimated one million Missouri homeowners who reside in community associations – homeowner associations (HOAs) and condominiums. FHFA wants to nullify lien priority ...

... Dear Ms. Majors and Claire, The Federal Housing Finance Agency (FHFA) has adopted a position that would have detrimental impacts on an estimated one million Missouri homeowners who reside in community associations – homeowner associations (HOAs) and condominiums. FHFA wants to nullify lien priority ...

Investment and Financial Markets

... their home mortgages than their home was actually worth, this is commonly known as being “underwater.” Should we have tried to help them more? Atif Mian and Amir Sufi provided strong evidence that in the aftermath of the Great Recession, the speed of recovery depended critically on providing assista ...

... their home mortgages than their home was actually worth, this is commonly known as being “underwater.” Should we have tried to help them more? Atif Mian and Amir Sufi provided strong evidence that in the aftermath of the Great Recession, the speed of recovery depended critically on providing assista ...

Credit Supply and the Housing Boom

... U.S. mortgage borrowers. Following the Asian crisis in the late 1990s, a “glut” of global savings flowed towards U.S. safe assets, finding its way into the mortgage market through the purchase of MBS, as documented by Bernanke et al. (2011). In our model, we also capture this inflow of foreign funds ...

... U.S. mortgage borrowers. Following the Asian crisis in the late 1990s, a “glut” of global savings flowed towards U.S. safe assets, finding its way into the mortgage market through the purchase of MBS, as documented by Bernanke et al. (2011). In our model, we also capture this inflow of foreign funds ...

Why the “miracle of compound interest” leads to financial crises *

... In this paper I want to discuss the financial sector’s tendency to dominate, deflate and polarize economies, thwarting economic potential. Understanding these financial dynamics is essential to explain why all nations are not operating up to the technological potential toward which classical liberal ...

... In this paper I want to discuss the financial sector’s tendency to dominate, deflate and polarize economies, thwarting economic potential. Understanding these financial dynamics is essential to explain why all nations are not operating up to the technological potential toward which classical liberal ...

Answers to Chapter 24 Questions

... obtained in the course of intermediation. However, this is likely to be quite costly in terms of customer good will and loss of business. Securitization enables FIs to manage risk exposure by changing their portfolio mix without alienating customers. That is, customers are still serviced and the FI ...

... obtained in the course of intermediation. However, this is likely to be quite costly in terms of customer good will and loss of business. Securitization enables FIs to manage risk exposure by changing their portfolio mix without alienating customers. That is, customers are still serviced and the FI ...

Foreign Liquidity to Real Estate Market: Ripple Effect and Housing

... estate, and efficient portfolios with international real estate outperforming those without, hence indicating that international diversification appears to be important. With a new angle, this paper researches on international real estate acquisition from the recipient country’s perspective. It appe ...

... estate, and efficient portfolios with international real estate outperforming those without, hence indicating that international diversification appears to be important. With a new angle, this paper researches on international real estate acquisition from the recipient country’s perspective. It appe ...

Leverage, Default, and Forgiveness

... Promises’’ introducing collateral equilibrium. In that paper I showed the way supply and demand could determine leverage as well as interest rates, and I showed that assets like houses that were good collateral would be priced higher (and sometimes too high) because they provided an additional servi ...

... Promises’’ introducing collateral equilibrium. In that paper I showed the way supply and demand could determine leverage as well as interest rates, and I showed that assets like houses that were good collateral would be priced higher (and sometimes too high) because they provided an additional servi ...

Restructuring America`s Real Estate

... Georgia Tech is evaluating the potential impacts of a real estate restructuring program in 11 US cities including Atlanta, Cleveland, Detroit, Denver, Houston, Los Angeles, Miami, Philadelphia, and Phoenix. These impacts were developed in partnership with a university partner in each city, and with ...

... Georgia Tech is evaluating the potential impacts of a real estate restructuring program in 11 US cities including Atlanta, Cleveland, Detroit, Denver, Houston, Los Angeles, Miami, Philadelphia, and Phoenix. These impacts were developed in partnership with a university partner in each city, and with ...

CT Cengage PPT template

... M1 Currency in circulation, nonbank travelers’ checks, demand deposits in commercial banks, and other checkable deposits at commercial banks and thrift institutions including credit union share drafts accounts. M2 The total of M1 plus savings and small-denomination time deposits at all commercial ba ...

... M1 Currency in circulation, nonbank travelers’ checks, demand deposits in commercial banks, and other checkable deposits at commercial banks and thrift institutions including credit union share drafts accounts. M2 The total of M1 plus savings and small-denomination time deposits at all commercial ba ...

The Impact of Student Debt on the Ability to Buy A House

... Some can, if they qualify, enter programs like income-based repayment, which extend the length of repayment of a loan, but limit the monthly payment to a manageable 15 percent of adjusted gross income.30 Policymakers can help borrowers struggling with private lenders to find fair repayment terms tha ...

... Some can, if they qualify, enter programs like income-based repayment, which extend the length of repayment of a loan, but limit the monthly payment to a manageable 15 percent of adjusted gross income.30 Policymakers can help borrowers struggling with private lenders to find fair repayment terms tha ...

2.3 Measures to stabilize the financial system and revitalize the

... In an attempt to relieve the credit crunch caused by the US subprime mortgage crisis, a number of central banks cut policy rates to ease credit market strains. On 8 October 2008, the Fed and five leading central banks took a coordinated action to lower interest rates. In addition to conventional int ...

... In an attempt to relieve the credit crunch caused by the US subprime mortgage crisis, a number of central banks cut policy rates to ease credit market strains. On 8 October 2008, the Fed and five leading central banks took a coordinated action to lower interest rates. In addition to conventional int ...

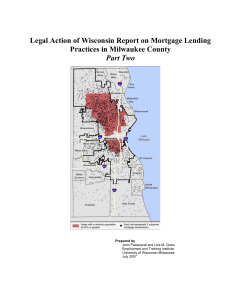

Legal Action of Wisconsin Report on Mortgage Lending

... or lengthen the time of their mortgages, or to move from an adjustable-rate mortgage to a fixed-rate loan. Refinancing activity increased in 1998 and again in 2003 and 2004 as interest rates dropped below the levels in place when many homeowners had previously purchased their homes. ...

... or lengthen the time of their mortgages, or to move from an adjustable-rate mortgage to a fixed-rate loan. Refinancing activity increased in 1998 and again in 2003 and 2004 as interest rates dropped below the levels in place when many homeowners had previously purchased their homes. ...

Investing in the Dutch housing market

... Performance of dutch residential property investments Residential property investment had an average total return of around 9% over the last few decades. Returns from rental incomes averaged 4% during the 2003 – 2012 period, and were highly stable. Capital growth returns averaged 5,5% and were more ...

... Performance of dutch residential property investments Residential property investment had an average total return of around 9% over the last few decades. Returns from rental incomes averaged 4% during the 2003 – 2012 period, and were highly stable. Capital growth returns averaged 5,5% and were more ...

United States housing bubble

The United States housing bubble was an economic bubble affecting many parts of the United States housing market in over half of American states. Housing prices peaked in early 2006, started to decline in 2006 and 2007, and reached new lows in 2012. On December 30, 2008, the Case-Shiller home price index reported its largest price drop in its history. The credit crisis resulting from the bursting of the housing bubble is—according to general consensus—the primary cause of the 2007–2009 recession in the United States.Increased foreclosure rates in 2006–2007 among U.S. homeowners led to a crisis in August 2008 for the subprime, Alt-A, collateralized debt obligation (CDO), mortgage, credit, hedge fund, and foreign bank markets. In October 2007, the U.S. Secretary of the Treasury called the bursting housing bubble ""the most significant risk to our economy.""Any collapse of the U.S. housing bubble has a direct impact not only on home valuations, but the nation's mortgage markets, home builders, real estate, home supply retail outlets, Wall Street hedge funds held by large institutional investors, and foreign banks, increasing the risk of a nationwide recession. Concerns about the impact of the collapsing housing and credit markets on the larger U.S. economy caused President George W. Bush and the Chairman of the Federal Reserve Ben Bernanke to announce a limited bailout of the U.S. housing market for homeowners who were unable to pay their mortgage debts.In 2008 alone, the United States government allocated over $900 billion to special loans and rescues related to the U.S. housing bubble, with over half going to Fannie Mae and Freddie Mac (both of which are government-sponsored enterprises) as well as the Federal Housing Administration. On December 24, 2009, the Treasury Department made an unprecedented announcement that it would be providing Fannie Mae and Freddie Mac unlimited financial support for the next three years despite acknowledging losses in excess of $400 billion so far. The Treasury has been criticized for encroaching on spending powers that are enumerated for Congress alone by the United States Constitution, and for violating limits imposed by the Housing and Economic Recovery Act of 2008.