Structural Features of Australian Residential Mortgage

... While historically Australian residential mortgages have experienced low default and loss rates (Debelle 2010), they nonetheless carry credit risk. Given the expected losses on a residential mortgage portfolio, securities backed by such a portfolio without some form of credit support to reduce the e ...

... While historically Australian residential mortgages have experienced low default and loss rates (Debelle 2010), they nonetheless carry credit risk. Given the expected losses on a residential mortgage portfolio, securities backed by such a portfolio without some form of credit support to reduce the e ...

Appendix III: Credit Growth OLS Regression, Summary Statistics

... In August 2014, increasing unsecured loan defaults by consumers led to the collapse of South Africa’s largest unsecured lender, African Bank Limited (ABL). These events have prompted many policy makers and researchers to review the dynamics of credit extension and the impact of the country’s consume ...

... In August 2014, increasing unsecured loan defaults by consumers led to the collapse of South Africa’s largest unsecured lender, African Bank Limited (ABL). These events have prompted many policy makers and researchers to review the dynamics of credit extension and the impact of the country’s consume ...

Form 10-K - Investor Relations Solutions

... (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No o Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Inte ...

... (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No o Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Inte ...

Assessment Study of Microfinance Market in Moldova

... Consulting (BFC) to conduct an assessment of the microfinance market in Moldova. The emphasis of the study was on microenterprises, Savings and Credit Associations (SCAs), and Microfinance Organizations (MFOs). The availability of services, products offered, and portfolios of institutions offering m ...

... Consulting (BFC) to conduct an assessment of the microfinance market in Moldova. The emphasis of the study was on microenterprises, Savings and Credit Associations (SCAs), and Microfinance Organizations (MFOs). The availability of services, products offered, and portfolios of institutions offering m ...

WHEDA Advantage Policies and Procedures Manual

... Desktop Originator/WHEDA Sponsorship Requirement (04/01/14).......................................... 33 ...

... Desktop Originator/WHEDA Sponsorship Requirement (04/01/14).......................................... 33 ...

FORM 20-F Annual Report 2016

... be adversely affected. In that event, the trading prices of our shares could decline, and you may lose all or part of your investment. In addition to the risks listed below, risks not currently known to us or that we now deem immaterial may also harm us and affect your investment. Our business may b ...

... be adversely affected. In that event, the trading prices of our shares could decline, and you may lose all or part of your investment. In addition to the risks listed below, risks not currently known to us or that we now deem immaterial may also harm us and affect your investment. Our business may b ...

Form 424B4 CITIZENS FINANCIAL GROUP INC/RI

... Interest on the notes will be payable semi-annually in arrears on February 1 and August 1 of each year, commencing on February 1, 2016. Prior to July 3, 2025, the notes may not be redeemed. At any time on or after July 3, 2025 (30 days prior to their maturity date), the notes may be redeemed, in who ...

... Interest on the notes will be payable semi-annually in arrears on February 1 and August 1 of each year, commencing on February 1, 2016. Prior to July 3, 2025, the notes may not be redeemed. At any time on or after July 3, 2025 (30 days prior to their maturity date), the notes may be redeemed, in who ...

Ellington Financial LLC (Form: 10-K, Received: 03/13

... Company Act"); and risks associated with investing in real estate assets, including changes in business conditions and the general economy. These and other risks, uncertainties and factors, including the risk factors described under Item 1A of this Annual Report on Form 10-K, could cause our actual ...

... Company Act"); and risks associated with investing in real estate assets, including changes in business conditions and the general economy. These and other risks, uncertainties and factors, including the risk factors described under Item 1A of this Annual Report on Form 10-K, could cause our actual ...

annual report 2015 - RHB Banking Group

... focus towards achieving its vision of being a leading multinational financial services group. The wire links further symbolise our commitment to fostering greater ties with our customers and key stakeholders by placing them at the centre of what we do, as described by our revitalised Brand Promise, ...

... focus towards achieving its vision of being a leading multinational financial services group. The wire links further symbolise our commitment to fostering greater ties with our customers and key stakeholders by placing them at the centre of what we do, as described by our revitalised Brand Promise, ...

6.5 Loan Portfolio

... and future strategies related to Banco do Brasil and its subsidiaries, associated companies and affiliates. Although these statements reflect management's current beliefs, they involve imprecisions and risks that are difficult to predict, and actual results and events may differ from those anticipat ...

... and future strategies related to Banco do Brasil and its subsidiaries, associated companies and affiliates. Although these statements reflect management's current beliefs, they involve imprecisions and risks that are difficult to predict, and actual results and events may differ from those anticipat ...

Banco do Brasil S.A. U.S.$1,000,000,000 Global Medium

... Prospective investors should have regard to the considerations described under “Risk Factors” included in Part B of this Program Circular. Application has been made to list the Notes under the Program on the Official List of the Luxembourg Stock Exchange and for such Notes to be admitted to trading ...

... Prospective investors should have regard to the considerations described under “Risk Factors” included in Part B of this Program Circular. Application has been made to list the Notes under the Program on the Official List of the Luxembourg Stock Exchange and for such Notes to be admitted to trading ...

News Release

... The estimated Solvency II ratio represents the shareholder view. This ratio excludes the contribution to Group Solvency Capital Requirement (‘SCR’) and Group Own Funds of fully ring-fenced with-profits funds (£2.7 billion) and staff pension schemes in surplus (£0.7 billion) – these exclusions have n ...

... The estimated Solvency II ratio represents the shareholder view. This ratio excludes the contribution to Group Solvency Capital Requirement (‘SCR’) and Group Own Funds of fully ring-fenced with-profits funds (£2.7 billion) and staff pension schemes in surplus (£0.7 billion) – these exclusions have n ...

On Credit Risk Modeling and Management

... unlikely to pay its credit obligations or the obligor is past due more than 90 days on any material credit obligation” This is clearly an unclear definition Furthermore, in retail banking especially, it is very usual that obligors repay their debt in full after the passage of these 90 days. Very oft ...

... unlikely to pay its credit obligations or the obligor is past due more than 90 days on any material credit obligation” This is clearly an unclear definition Furthermore, in retail banking especially, it is very usual that obligors repay their debt in full after the passage of these 90 days. Very oft ...

banco de crédito social cooperativo, sa, and its subsidiaries

... Profit or loss on derecognition in accounts of financial assets and liabilities not carried at fair value through profit or loss, net Profit or loss on financial assets and liabilities held for trading, net ...

... Profit or loss on derecognition in accounts of financial assets and liabilities not carried at fair value through profit or loss, net Profit or loss on financial assets and liabilities held for trading, net ...

PDF Download

... Using case studies, Erce (2013) finds indication that GDP dynamics are worse following post-default restructurings. Ongoing work by Trebesch and Zabel (2014) builds on these findings and conducts a more extensive empirical analysis on the output costs of different types of sovereign default. ...

... Using case studies, Erce (2013) finds indication that GDP dynamics are worse following post-default restructurings. Ongoing work by Trebesch and Zabel (2014) builds on these findings and conducts a more extensive empirical analysis on the output costs of different types of sovereign default. ...

public accounts and estimates committee

... volumes on: strategy and outlook; service delivery; capital investment; and the estimated financial statements. The set also includes the annual financial report, published after the end of the budget period. ...

... volumes on: strategy and outlook; service delivery; capital investment; and the estimated financial statements. The set also includes the annual financial report, published after the end of the budget period. ...

Sec 0 Cover - 2 Title TOC Tabs Etc.XLS

... Laws of the State of North Carolina, along with policies and procedures of the North Carolina Local Government Commission, require that all local governments in the State publish a complete set of financial statements annually. The financial statements must be presented in conformity with accounting ...

... Laws of the State of North Carolina, along with policies and procedures of the North Carolina Local Government Commission, require that all local governments in the State publish a complete set of financial statements annually. The financial statements must be presented in conformity with accounting ...

2015 annual report 99 going on 100: transforming to serve you first

... Net service fees and commissions increased by 25% to P3.6 billion, principally generated from underwriting and credit-related transactions. The improvements in core revenues compensated for the reduced trading gains that declined by 55% ending at P574 million due to challenging conditions in both th ...

... Net service fees and commissions increased by 25% to P3.6 billion, principally generated from underwriting and credit-related transactions. The improvements in core revenues compensated for the reduced trading gains that declined by 55% ending at P574 million due to challenging conditions in both th ...

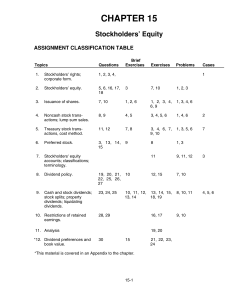

CHAPTER 15 Stockholders` Equity

... costs, and taxes, should be reported as a reduction of the amounts paid in. Issue costs are therefore debited to Additional Paid-in Capital because they are unrelated to corporate operations. ...

... costs, and taxes, should be reported as a reduction of the amounts paid in. Issue costs are therefore debited to Additional Paid-in Capital because they are unrelated to corporate operations. ...

AdamsSafe Harbors - Digital Access to Scholarship at Harvard

... payments on pretend loans.6 For instance, in an interest rate swap, the parties swap variable rate interest payments for fixed rate interest payments in the same currency on some made up amount of money they pretend to lend to each other.7 The buyer (often a nonfinancial business of some kind) wants ...

... payments on pretend loans.6 For instance, in an interest rate swap, the parties swap variable rate interest payments for fixed rate interest payments in the same currency on some made up amount of money they pretend to lend to each other.7 The buyer (often a nonfinancial business of some kind) wants ...

Guideline - OSFI-BSIF

... to more risks than those for which calculations are specified. Consequently, the minimum Total Ratio for life insurers is set at 120% rather than 100% to cover operational risks that are not explicitly measured, but which form part of the minimum requirement under MCCSR/TAAM. In addition, OSFI has e ...

... to more risks than those for which calculations are specified. Consequently, the minimum Total Ratio for life insurers is set at 120% rather than 100% to cover operational risks that are not explicitly measured, but which form part of the minimum requirement under MCCSR/TAAM. In addition, OSFI has e ...

ASTRAZENECA PLC (Form: F-3ASR, Received: 11/22/2016 11:52:39)

... be able to sell their debt securities. If a trading market were to develop, the debt securities could trade at prices that may be higher or lower than the initial offering price and this may result in a return that is greater or less than the interest rate on the debt security, depending on many fac ...

... be able to sell their debt securities. If a trading market were to develop, the debt securities could trade at prices that may be higher or lower than the initial offering price and this may result in a return that is greater or less than the interest rate on the debt security, depending on many fac ...

MultiFractality in Foreign Currency Markets

... The standard hypothesis concerning the behavior of asset returns states that they follow a random walk in discrete time or a Brownian motion in continuous time. The Brownian motion process is characterized by a quantity, called the Hurst exponent, which is related to some fractal aspects of the proc ...

... The standard hypothesis concerning the behavior of asset returns states that they follow a random walk in discrete time or a Brownian motion in continuous time. The Brownian motion process is characterized by a quantity, called the Hurst exponent, which is related to some fractal aspects of the proc ...

Payments on Long-Term Debt As Voidable Preferences

... an intent to limit the scope of the section, and that protection of payments on long-term debt is consistent with the policy of protecting "normal financial relations."' 14 Notwithstanding the commentary, in Aguillardv. Bank of Lafayette (In re Bourgeois),15 the first bankruptcy court to address thi ...

... an intent to limit the scope of the section, and that protection of payments on long-term debt is consistent with the policy of protecting "normal financial relations."' 14 Notwithstanding the commentary, in Aguillardv. Bank of Lafayette (In re Bourgeois),15 the first bankruptcy court to address thi ...

AVVISO n. 198

... • Untendered Debt means, with respect to data included herein through 2015, defaulted debt in respect of securities that were eligible for, but not tendered in, the 2005 Debt Exchange and the 2010 Debt Exchange. References to Untendered Debt in this prospectus do not constitute, and shall not be r ...

... • Untendered Debt means, with respect to data included herein through 2015, defaulted debt in respect of securities that were eligible for, but not tendered in, the 2005 Debt Exchange and the 2010 Debt Exchange. References to Untendered Debt in this prospectus do not constitute, and shall not be r ...

Federal takeover of Fannie Mae and Freddie Mac

The federal takeover of Fannie Mae and Freddie Mac refers to the placing into conservatorship of government-sponsored enterprises Fannie Mae and Freddie Mac by the U.S. Treasury in September 2008. It was one of the financial events among many in the ongoing subprime mortgage crisis.On September 6, 2008, the director of the Federal Housing Finance Agency (FHFA), James B. Lockhart III, announced his decision to place two Government-sponsored enterprises (GSEs), Fannie Mae (Federal National Mortgage Association) and Freddie Mac (Federal Home Loan Mortgage Corporation), into conservatorship run by the FHFA.At the same press conference, United States Treasury Secretary Henry Paulson, stated that placing the two GSEs into conservatorship was a decision he fully supported, and that he advised ""that conservatorship was the only form in which I would commit taxpayer money to the GSEs."" He further said that ""I attribute the need for today's action primarily to the inherent conflict and flawed business model embedded in the GSE structure, and to the ongoing housing correction.""The same day, the Federal Reserve Bank chairman Ben Bernanke stated in support: ""I strongly endorse both the decision by FHFA Director Lockhart to place Fannie Mae and Freddie Mac into conservatorship and the actions taken by Treasury Secretary Paulson to ensure the financial soundness of those two companies.""The following day, Herbert M. Allison was appointed chief executive of Fannie Mae. He came from TIAA-CREF.