Economics - Spring Branch ISD

... accounts that pay a higher rate of interest than do savings and checking accounts. 10. True or false; Funds placed in a CD, cannot be removed until the end of a certain time period, such as one or two years. 11. The first bankers in history were goldsmiths. ...

... accounts that pay a higher rate of interest than do savings and checking accounts. 10. True or false; Funds placed in a CD, cannot be removed until the end of a certain time period, such as one or two years. 11. The first bankers in history were goldsmiths. ...

Market Commentary - July 2016

... This document does not constitute advice or a personal recommendation or take into account the particular investment objectives, financial situations or needs of individuals. This research has been prepared with all reasonable care and is not knowingly misleading in whole or in part. The information ...

... This document does not constitute advice or a personal recommendation or take into account the particular investment objectives, financial situations or needs of individuals. This research has been prepared with all reasonable care and is not knowingly misleading in whole or in part. The information ...

The Non-Income Determinants of Consumption and Saving

... • Businesses only make investments when they expect them to be profitable. r = (Expected Revenue - cost of investment) / cost of investment. • Firms are risk takers, and returns are not guaranteed. ...

... • Businesses only make investments when they expect them to be profitable. r = (Expected Revenue - cost of investment) / cost of investment. • Firms are risk takers, and returns are not guaranteed. ...

Banking - mshsLyndaHampton

... With your authorization, or permission, your bank will withdraw the amount of your monthly payment or bill from your bank account. It is very important when using Automatic payments that you have enough money in your account for the payment. Arrange payments with when you receive your paycheck. Chec ...

... With your authorization, or permission, your bank will withdraw the amount of your monthly payment or bill from your bank account. It is very important when using Automatic payments that you have enough money in your account for the payment. Arrange payments with when you receive your paycheck. Chec ...

Math 1420 Homework 10

... Directions: Show all work for complete credit. The questions are also in your textbook. This test is work a total of 10 points towards your final grade. Section 4.1 1. Problem 54: Use the compound interest formulas: A = P (1 + 1r )nt and A = P ert to solve. Find the accumulated value of an investmen ...

... Directions: Show all work for complete credit. The questions are also in your textbook. This test is work a total of 10 points towards your final grade. Section 4.1 1. Problem 54: Use the compound interest formulas: A = P (1 + 1r )nt and A = P ert to solve. Find the accumulated value of an investmen ...

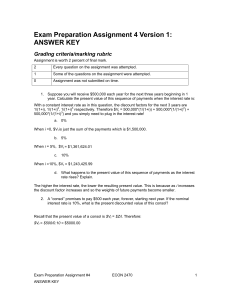

Exam Preparation Assignment 4 Version 1: ANSWER KEY

... The higher the interest rate, the lower the resulting present value. This is because as i increases the discount factor increases and so the weights of future payments become smaller. 2. A “consol” promises to pay $500 each year, forever, starting next year. If the nominal interest rate is 10%, what ...

... The higher the interest rate, the lower the resulting present value. This is because as i increases the discount factor increases and so the weights of future payments become smaller. 2. A “consol” promises to pay $500 each year, forever, starting next year. If the nominal interest rate is 10%, what ...

Word Wall Words

... creditor- The business or organization that extends the credit. finance charge- The total cost of using credit, including interest and any fees. credit score- A numerical rating, based on credit report information, that represents a person’s level of creditworthiness. cosigner- A person with a stron ...

... creditor- The business or organization that extends the credit. finance charge- The total cost of using credit, including interest and any fees. credit score- A numerical rating, based on credit report information, that represents a person’s level of creditworthiness. cosigner- A person with a stron ...

MODULE 5 – Lesson 3 CONTINUOUS COMPOUNDING 1. Mary is

... 7. Mark wants to invest $3,500 in an account that earns 6.2% compounded monthly. He would like to accumulate $5,000 in that account. a) How long will it take Mark to accomplish this? a) Would it make a big difference if the interest in his account is compounded continuously? 8. Becky is 48 years old ...

... 7. Mark wants to invest $3,500 in an account that earns 6.2% compounded monthly. He would like to accumulate $5,000 in that account. a) How long will it take Mark to accomplish this? a) Would it make a big difference if the interest in his account is compounded continuously? 8. Becky is 48 years old ...

Tom Traficanti`s Lending Presentation

... Supply of new homes constrained Builders still limit spec construction – credit for A&D loans limited Little inventory of available lots and new homes Cost of finished SFR lots exceed $80,000 - Majority of new homes exceed $300,000 ...

... Supply of new homes constrained Builders still limit spec construction – credit for A&D loans limited Little inventory of available lots and new homes Cost of finished SFR lots exceed $80,000 - Majority of new homes exceed $300,000 ...

– 20 No: 2013 Release Date: 16 May 2013

... rate has been kept at 0 percent while lending rate has been cut from 10 percent to 9.5 percent. Recent data suggest that domestic and external demand are evolving in line with expectations. Domestic demand follows a healthy recovery while exports slow down due to weak global economic activity. The c ...

... rate has been kept at 0 percent while lending rate has been cut from 10 percent to 9.5 percent. Recent data suggest that domestic and external demand are evolving in line with expectations. Domestic demand follows a healthy recovery while exports slow down due to weak global economic activity. The c ...

How does a monetary policy affect the economy

... can issue equity easily and buy extra assets and thus invest. However, when Ms is reduced, public spends less on stock-markets, thus equity prices and q falls and firms are reluctant to invest, they rather buy up existing firms. Keynesians also argue that interest rate rise makes bonds more attracti ...

... can issue equity easily and buy extra assets and thus invest. However, when Ms is reduced, public spends less on stock-markets, thus equity prices and q falls and firms are reluctant to invest, they rather buy up existing firms. Keynesians also argue that interest rate rise makes bonds more attracti ...

Transmission mechanism of monetary policy

... everything else being equal, higher interest rates make it less attractive to take out loans for financing consumption or investment. In addition, consumption and investment are also affected by movements in asset prices via wealth effects and effects on the value of collateral. For example, as equi ...

... everything else being equal, higher interest rates make it less attractive to take out loans for financing consumption or investment. In addition, consumption and investment are also affected by movements in asset prices via wealth effects and effects on the value of collateral. For example, as equi ...

View/Open - Pan Africa Christian University

... manager who has advised him to open a savings account with the bank and start depositing money every end of the month. The bank Manager has offered to pay martin a compound interest on deposits at a rate of 12% p.a. as long as Martin does not make any withdrawals in the intermediate period. Martin d ...

... manager who has advised him to open a savings account with the bank and start depositing money every end of the month. The bank Manager has offered to pay martin a compound interest on deposits at a rate of 12% p.a. as long as Martin does not make any withdrawals in the intermediate period. Martin d ...

Chapter 3: The IS

... • It is the situation in which the money demand is perfectly elastic. Usually, liquidity trap occurs at very low interest rate. • An increase in money supply cannot change the interest rate when there is a liquidity trap. • When there is a liquidity trap, the fiscal policy is more effective since th ...

... • It is the situation in which the money demand is perfectly elastic. Usually, liquidity trap occurs at very low interest rate. • An increase in money supply cannot change the interest rate when there is a liquidity trap. • When there is a liquidity trap, the fiscal policy is more effective since th ...

– 16 No: 2013 Release Date: 16 April 2013

... expectations. Domestic demand follows a healthy recovery while exports slow down due to weak global economic activity. The current account deficit has increased somewhat following the revival in domestic demand. However, the current policy framework and the decline in commodity prices are expected c ...

... expectations. Domestic demand follows a healthy recovery while exports slow down due to weak global economic activity. The current account deficit has increased somewhat following the revival in domestic demand. However, the current policy framework and the decline in commodity prices are expected c ...

GLOSSARY

... annual percentage rate (APR) the nominal rate on which interest is calculated per year (p. 92) annual percentage yield (APY) represents the effect of compounding (p. 92) asset anything of value (p. 19) asset-based lending banks analyze profit and loss (P&L) statements, tax returns, and business plan ...

... annual percentage rate (APR) the nominal rate on which interest is calculated per year (p. 92) annual percentage yield (APY) represents the effect of compounding (p. 92) asset anything of value (p. 19) asset-based lending banks analyze profit and loss (P&L) statements, tax returns, and business plan ...

Econ 306

... 3. (30 points)The following rates are given: Current spot exchange rate: $1.50/euro Current 1-year forward exchange rate : $1.60/euro Interest rate on 1-year dollar denominated bonds: 5% Interest rate on 1-year euro denominated bonds: 4% a. Is the dollar at a forward premium or discount? b. Should a ...

... 3. (30 points)The following rates are given: Current spot exchange rate: $1.50/euro Current 1-year forward exchange rate : $1.60/euro Interest rate on 1-year dollar denominated bonds: 5% Interest rate on 1-year euro denominated bonds: 4% a. Is the dollar at a forward premium or discount? b. Should a ...

In Class Worksheet 7

... 1. Suppose you want to setup a college fund for your 2 year old son. How much would you need to put into a bank account now so that your son will have $20,000 for college when he turns 18? Assume an interest rate of 4.89% compounded continuously. ...

... 1. Suppose you want to setup a college fund for your 2 year old son. How much would you need to put into a bank account now so that your son will have $20,000 for college when he turns 18? Assume an interest rate of 4.89% compounded continuously. ...

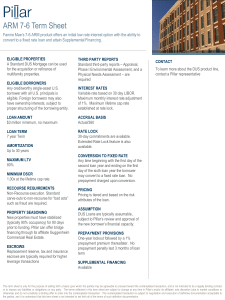

ARM 7-6 Term Sheet

... This term sheet is only for the purpose of setting forth a basis upon which the parties may be agreeable to proceed toward the contemplated transaction, and is not intended to be a legally binding contract or to impose any liabilities or obligations on any party. The terms reflected in this term she ...

... This term sheet is only for the purpose of setting forth a basis upon which the parties may be agreeable to proceed toward the contemplated transaction, and is not intended to be a legally binding contract or to impose any liabilities or obligations on any party. The terms reflected in this term she ...

PERSONAL FINANCE TEST B - Cardinal Spellman High School

... insured and thus virtually risk-free; they are "money in the bank" (CDs are insured by the FDIC for banks or by the NCUA for credit unions). They are different from savings accounts in that the CD has a specific, fixed term (often three months, six months, or one to five years), and, usually, a fixe ...

... insured and thus virtually risk-free; they are "money in the bank" (CDs are insured by the FDIC for banks or by the NCUA for credit unions). They are different from savings accounts in that the CD has a specific, fixed term (often three months, six months, or one to five years), and, usually, a fixe ...

NEW YORK – I wrote at the beginning of January that economic

... both Europe and the US in recent years. (In the US, it fell from 8.4% in 2000 to 6.8% in 2014; in the EU, it fell from 7.5% to 5.7% over the same period.) Other data provide a similar picture. Clearly, the idea that large corporations precisely calculate the interest rate at which they are willing t ...

... both Europe and the US in recent years. (In the US, it fell from 8.4% in 2000 to 6.8% in 2014; in the EU, it fell from 7.5% to 5.7% over the same period.) Other data provide a similar picture. Clearly, the idea that large corporations precisely calculate the interest rate at which they are willing t ...

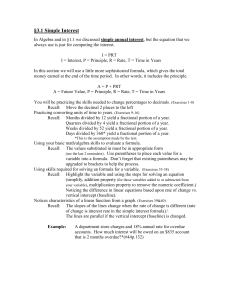

Chapter 3

... an investment problem with a commission rate involved. We must consider the amount originally invested as the cost of the investment plus a commission rate. The amount of the original investment plus the commission is the cost of the investment. Next, the amount of money earned when the investment i ...

... an investment problem with a commission rate involved. We must consider the amount originally invested as the cost of the investment plus a commission rate. The amount of the original investment plus the commission is the cost of the investment. Next, the amount of money earned when the investment i ...

1 - BrainMass

... b. Since all firms borrow from the same financial markets, all firms have the same required returns on debt c. For any given firm, the required return on debt is always greater than the required return on equity 13. which of the following items is not considered a receipt in a cash budget? a. b. c. ...

... b. Since all firms borrow from the same financial markets, all firms have the same required returns on debt c. For any given firm, the required return on debt is always greater than the required return on equity 13. which of the following items is not considered a receipt in a cash budget? a. b. c. ...