Chapter One

... Students can readily grasp that there is very little profit risk from an interest rate change on the $34 of NEA financed by equity. Likewise there is little profit risk from the $206 FRAs financed by FRLs because the cash inflows and outflows on these accounts do not change over the given maturity b ...

... Students can readily grasp that there is very little profit risk from an interest rate change on the $34 of NEA financed by equity. Likewise there is little profit risk from the $206 FRAs financed by FRLs because the cash inflows and outflows on these accounts do not change over the given maturity b ...

Links Between the Domestic and Eurobond

... it. With its own hand-picked executives in place, Sumitomo then financed the simultaneous development of three new models and the overhaul of TK's production system, extended credit to suppliers, and had the vast group of related Sumitomo companies buy Mazda vehicles. The new models were highly succ ...

... it. With its own hand-picked executives in place, Sumitomo then financed the simultaneous development of three new models and the overhaul of TK's production system, extended credit to suppliers, and had the vast group of related Sumitomo companies buy Mazda vehicles. The new models were highly succ ...

RTF 49.1 KB - Productivity Commission

... However, if a rising population cannot afford to rent then people still have to live somewhere. In this case they will either share housing or build squatter’s housing as happens in less developed economies. In these cases it can be seen that rising population alone will NOT lead to a rise in housin ...

... However, if a rising population cannot afford to rent then people still have to live somewhere. In this case they will either share housing or build squatter’s housing as happens in less developed economies. In these cases it can be seen that rising population alone will NOT lead to a rise in housin ...

Macro prudential measures and housing markets A note on

... increase unemployment. This mechanism can be expected to be strong precisely when households do not default on their loans. The recent US evidence suggests that it may be strong enough to warrant some careful consideration (see e.g. Mian and Sufi, ...

... increase unemployment. This mechanism can be expected to be strong precisely when households do not default on their loans. The recent US evidence suggests that it may be strong enough to warrant some careful consideration (see e.g. Mian and Sufi, ...

Introduction - World Bank Group

... occur through traditional or established bank wire systems that were created for, and cater to, large value commercial payments that originate through the Federal Reserve System’s Fedwire and are carried across the SWIFT messaging system. Because these systems are extremely flexible and ubiquitous ...

... occur through traditional or established bank wire systems that were created for, and cater to, large value commercial payments that originate through the Federal Reserve System’s Fedwire and are carried across the SWIFT messaging system. Because these systems are extremely flexible and ubiquitous ...

chapter_11

... – The purpose of company analysis to identify the best companies in a promising industry – This involves examining a firm’s past performance, but more important, its future prospects – It needs to compare the estimated intrinsic value to the prevailing market price of the firm’s stock and decide whe ...

... – The purpose of company analysis to identify the best companies in a promising industry – This involves examining a firm’s past performance, but more important, its future prospects – It needs to compare the estimated intrinsic value to the prevailing market price of the firm’s stock and decide whe ...

Advanced Derivatives: swaps beyond plain vanilla Structured notes

... S&P 500 total return x Notional Principal Payment details on next slide ...

... S&P 500 total return x Notional Principal Payment details on next slide ...

Czarski_Gabriel_Nothaft

... • H = the rental housing stock • Market vacancy Rate = ΣiMi / H • Incidence = ΣiVi / H • Average Duration = ΣiMi / ΣiVi • Vacancy rate = Incidence * Average Duration ...

... • H = the rental housing stock • Market vacancy Rate = ΣiMi / H • Incidence = ΣiVi / H • Average Duration = ΣiMi / ΣiVi • Vacancy rate = Incidence * Average Duration ...

Working Paper 0809

... made," (United Provinces (1931), pp. 297.) I did not see references to such loans in other parts of India at that time. In the modern period moneylenders commonly offer the "kist" form of credit, involving equal monthly or daily repayments, (DasGupta (1988), p. 603). Microlenders, however, overwhelm ...

... made," (United Provinces (1931), pp. 297.) I did not see references to such loans in other parts of India at that time. In the modern period moneylenders commonly offer the "kist" form of credit, involving equal monthly or daily repayments, (DasGupta (1988), p. 603). Microlenders, however, overwhelm ...

Money, Banking, and the Financial System

... that at some point the government will have to raise taxes to pay off the bonds issued to finance the deficit. To prepare for those future higher tax payments, households may begin to increase their saving. This increased saving will shift the demand curve for bonds to the right at the same time tha ...

... that at some point the government will have to raise taxes to pay off the bonds issued to finance the deficit. To prepare for those future higher tax payments, households may begin to increase their saving. This increased saving will shift the demand curve for bonds to the right at the same time tha ...

Characteristics of Different Types of Loans Commercial Loans

... Repos) Most transactions are overnight In most cases, the market value of the collateral is set above the loan amount when the contract is negotiated. ...

... Repos) Most transactions are overnight In most cases, the market value of the collateral is set above the loan amount when the contract is negotiated. ...

Financial Structure, Rural Credit and Supportive Institutional

... Myrdal (1965, p.128) pointed out that ‘studies in many countries have shown how the banking system, if not regulated to act differently, tends to become an instrument for siphoning off the savings from the poorer regions to the richer and more progressive ones where returns on capital are high and s ...

... Myrdal (1965, p.128) pointed out that ‘studies in many countries have shown how the banking system, if not regulated to act differently, tends to become an instrument for siphoning off the savings from the poorer regions to the richer and more progressive ones where returns on capital are high and s ...

Risk Free Discount Rates under AASB 1038 1

... Situations may arise where the present value of the planned margin of revenues over expenses for a group of related products will be adjusted as a result of changing underlying assumptions to the extent that the planned margin is eliminated and becomes a planned loss. That is, a review of expected f ...

... Situations may arise where the present value of the planned margin of revenues over expenses for a group of related products will be adjusted as a result of changing underlying assumptions to the extent that the planned margin is eliminated and becomes a planned loss. That is, a review of expected f ...

China`s Monetary Policy: 1998 - 2002

... 1999, the inter-bank borrowing rate, discount rates for commercial paper, and repos and spot trading rates in the inter-bank bond market were fully liberalized. Policy financial bonds and treasury bonds issuance were market-oriented with interest rates set by bid by purchasers. Discretionary bands a ...

... 1999, the inter-bank borrowing rate, discount rates for commercial paper, and repos and spot trading rates in the inter-bank bond market were fully liberalized. Policy financial bonds and treasury bonds issuance were market-oriented with interest rates set by bid by purchasers. Discretionary bands a ...

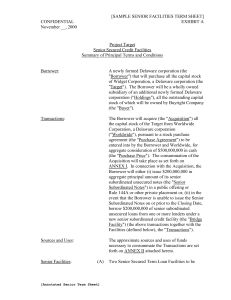

Senior Loan Term Sheet

... The above-described mandatory prepayments shall be allocated between the Term Loan Facilities pro rata, subject to the provisions set forth below under the caption "Special Application Provisions". Within each Term Loan Facility, mandatory prepayments shall be applied, first, to the next installment ...

... The above-described mandatory prepayments shall be allocated between the Term Loan Facilities pro rata, subject to the provisions set forth below under the caption "Special Application Provisions". Within each Term Loan Facility, mandatory prepayments shall be applied, first, to the next installment ...

Working Faper No. 792 Rudiger Dornbusch 1050

... slope of the saving schedule. If the saving schedule is negatively sloped, it will be steeper than the schedule depicting the value of consols. This is ensured by the fact that (l—q)(l--ç3) is at most a positive fraction. Therefore, next period's interest rate must fall and the present rate must ris ...

... slope of the saving schedule. If the saving schedule is negatively sloped, it will be steeper than the schedule depicting the value of consols. This is ensured by the fact that (l—q)(l--ç3) is at most a positive fraction. Therefore, next period's interest rate must fall and the present rate must ris ...

Monthly Economic and Financial Developments November 2004

... Future Release Dates: 2005: January 31st, February 28th, April 4th, May 2nd, May 30th, July 4th, August 2nd, August 29th, October 3rd, October 31st, November 28th ...

... Future Release Dates: 2005: January 31st, February 28th, April 4th, May 2nd, May 30th, July 4th, August 2nd, August 29th, October 3rd, October 31st, November 28th ...

docx - Minds on the Markets

... than the actual level of A portion of the inflation, the investor has expected return not been adequately (also known as compensated for the yield to maturity) decrease in the is a premium for purchasing power of the ...

... than the actual level of A portion of the inflation, the investor has expected return not been adequately (also known as compensated for the yield to maturity) decrease in the is a premium for purchasing power of the ...

collque coface 2004 partie I VA

... COUNTRIES’ ECAs ★ Risk diversification ★ Left with high risk – long maturity ★ Rules to be followed (WTO, OECD, EU Directives, Paris Club) ★ Break-even mission by own gvts ★ High pressure from own gvts for efficient utilization of limited public resources ★ Less flexible to adopt to changes (product ...

... COUNTRIES’ ECAs ★ Risk diversification ★ Left with high risk – long maturity ★ Rules to be followed (WTO, OECD, EU Directives, Paris Club) ★ Break-even mission by own gvts ★ High pressure from own gvts for efficient utilization of limited public resources ★ Less flexible to adopt to changes (product ...

MONETARY POLICY IN THE US BEFORE AND AFTER THE CRISIS

... 2. Not quickly made or easily reversed. Decisions on discount lending proposed by Federal Reserve banks, then approved by Board of Governors. In principle, each bank sets its own rate, in practice they rarely diverge for more than 1 or 2 days. 3. Creates moral hazard problem, as banks expect to be s ...

... 2. Not quickly made or easily reversed. Decisions on discount lending proposed by Federal Reserve banks, then approved by Board of Governors. In principle, each bank sets its own rate, in practice they rarely diverge for more than 1 or 2 days. 3. Creates moral hazard problem, as banks expect to be s ...

IV - LSE

... often been unable to obtain financing due to the prior caps on interest rates. Lenders who were willing to provide credit to lower quality borrowers were thus able to “price” their loans with higher interest rates to compensate them from the higher delinquency and loss levels that they expected from ...

... often been unable to obtain financing due to the prior caps on interest rates. Lenders who were willing to provide credit to lower quality borrowers were thus able to “price” their loans with higher interest rates to compensate them from the higher delinquency and loss levels that they expected from ...

Perspectives on the negative repo rate

... The National Institute of Economic Research’s Economic Sentiment Indicator is signalling on the whole that confidence has risen after the repo rate was cut below zero (see Figure 3:7). The expansionary monetary policy has contributed to high growth and rising inflation, but also entails risks ...

... The National Institute of Economic Research’s Economic Sentiment Indicator is signalling on the whole that confidence has risen after the repo rate was cut below zero (see Figure 3:7). The expansionary monetary policy has contributed to high growth and rising inflation, but also entails risks ...

Collateralized Debt Obligations – an overview

... the CDO. Investors can assess the various tranches of the CDO with full knowledge of what the collateral will be (or variation thereof). The primary risk they face is credit risk. On the other hand, with a managed CDO, a portfolio manager is appointed to “actively” manage the underlying collateral ...

... the CDO. Investors can assess the various tranches of the CDO with full knowledge of what the collateral will be (or variation thereof). The primary risk they face is credit risk. On the other hand, with a managed CDO, a portfolio manager is appointed to “actively” manage the underlying collateral ...

CGAP

... Simple Method: For a rough approximation of the “shadow” price of funds, multiply financial assets5 by the higher of (a) the effective rate which local banks charge medium-quality commercial borrowers, or (b) the inflation rate which is projected for the planning period by some credible (usually, th ...

... Simple Method: For a rough approximation of the “shadow” price of funds, multiply financial assets5 by the higher of (a) the effective rate which local banks charge medium-quality commercial borrowers, or (b) the inflation rate which is projected for the planning period by some credible (usually, th ...

Credit rationing

Credit rationing refers to the situation where lenders limit the supply of additional credit to borrowers who demand funds, even if the latter are willing to pay higher interest rates. It is an example of market imperfection, or market failure, as the price mechanism fails to bring about equilibrium in the market. It should not be confused with cases where credit is simply ""too expensive"" for some borrowers, that is, situations where the interest rate is deemed too high. On the contrary, the borrower would like to acquire the funds at the current rates, and the imperfection refers to the absence of equilibrium in spite of willing borrowers. In other words, at the prevailing market interest rate, demand exceeds supply, but lenders are not willing to either loan more funds, or raise the interest rate charged, as they are already maximising profits.