21_EFM06-HoChienwei-Determinants of Direct Stock Holding

... users are more likely to participate in stock markets. It is hypothesized that, compared to non-convenience credit card users, convenience credit card users are more likely to directly hold stocks. The same effect is expected for both types of households. Bertaut (1993) asserted that relatively smal ...

... users are more likely to participate in stock markets. It is hypothesized that, compared to non-convenience credit card users, convenience credit card users are more likely to directly hold stocks. The same effect is expected for both types of households. Bertaut (1993) asserted that relatively smal ...

Determinants of Microfinance Loan Performance and Fluctuation Over the Business Cycle

... greater when expressed in the domestic currency. Beck, Jakubik and Piloiu (2013) study the direct effect that foreign exchange rate changes can have on loan repayments in countries with a high level of foreign denominated debt. The authors proxy the degree of unhedged lending in foreign currencies u ...

... greater when expressed in the domestic currency. Beck, Jakubik and Piloiu (2013) study the direct effect that foreign exchange rate changes can have on loan repayments in countries with a high level of foreign denominated debt. The authors proxy the degree of unhedged lending in foreign currencies u ...

05. The Impact of Expense Shocks on the Financial Distress of

... consumption expenditure soars under this stressful environment. The household financial distress is also related to the structure and sophistication of financial markets. For example, in the housing mortgage market, the root of the recent US-led subprime crisis, lenders have developed products that ...

... consumption expenditure soars under this stressful environment. The household financial distress is also related to the structure and sophistication of financial markets. For example, in the housing mortgage market, the root of the recent US-led subprime crisis, lenders have developed products that ...

NBER WORKING PAPER SERIES OVERBORROWING, FINANCIAL CRISES AND 'MACRO-PRUDENTIAL' TAXES Javier Bianchi

... only mild crises as a result of the prudential decisions of the social planner during normal business cycles. These allocations can be implemented as a decentralized equilibrium with a tax on debt of about 1 percent on average, and this tax also reduces sharply the probability and severity of financ ...

... only mild crises as a result of the prudential decisions of the social planner during normal business cycles. These allocations can be implemented as a decentralized equilibrium with a tax on debt of about 1 percent on average, and this tax also reduces sharply the probability and severity of financ ...

Decision Avoidance and Deposit Interest Rate Setting

... anomalies (Frey and Eichenberger 1994) and that financial decisions are not always presented to investors in a manner which assists optimal decision making (Hirshleifer 2001). The importance of behavioural anomalies in this context is not really their presence or number, which is not addressed by th ...

... anomalies (Frey and Eichenberger 1994) and that financial decisions are not always presented to investors in a manner which assists optimal decision making (Hirshleifer 2001). The importance of behavioural anomalies in this context is not really their presence or number, which is not addressed by th ...

Liability

... that the jeep top (made of vinyl) did not hold during a major collision. The jeep manufacturer, Chrysler, also was named in the lawsuits. The damages claimed were quite large, about $100 million. Although the company had litigation insurance, there was some question whether the insurance company cou ...

... that the jeep top (made of vinyl) did not hold during a major collision. The jeep manufacturer, Chrysler, also was named in the lawsuits. The damages claimed were quite large, about $100 million. Although the company had litigation insurance, there was some question whether the insurance company cou ...

Expected Return

... large number of explanatory factors. If a theory of asset pricing is to have value, it must explain returns using a reasonably limited number of explanatory variables (i.e., systematic factors). 28. The APT factors must correlate with major sources of uncertainty, i.e., sources of uncertainty that a ...

... large number of explanatory factors. If a theory of asset pricing is to have value, it must explain returns using a reasonably limited number of explanatory variables (i.e., systematic factors). 28. The APT factors must correlate with major sources of uncertainty, i.e., sources of uncertainty that a ...

Commercial Mortgage-backed Securities: Prepayment and Default*

... focused on mortgage prepayment and default in residential mortgages while Ciochetti, Gau, and Yao [2000] focus on commercial mortgages. The Appendix presents a preliminary analysis of mortgage termination by examining the individual hazard rates of prepayment and default. Although the life-table met ...

... focused on mortgage prepayment and default in residential mortgages while Ciochetti, Gau, and Yao [2000] focus on commercial mortgages. The Appendix presents a preliminary analysis of mortgage termination by examining the individual hazard rates of prepayment and default. Although the life-table met ...

Deferred Fixed Annuities

... This hypothetical example is for illustrative purposes only. It is not intended to predict or project the direction of interest rates. Actual interest rates may be higher or lower than those shown here. Note: Both the short-term, non-fixed-interest-rate and fixed interest rates are assumed to be ann ...

... This hypothetical example is for illustrative purposes only. It is not intended to predict or project the direction of interest rates. Actual interest rates may be higher or lower than those shown here. Note: Both the short-term, non-fixed-interest-rate and fixed interest rates are assumed to be ann ...

A Causal Framework for Credit Default Theory

... default seems a little harsh at first sight. But many such loans have very low payment obligations so that delinquency rates and therefore default rates are substantially less than what one would expect. Indeed lenders of unsecured loans seek to obtain substantial gains from charging high interest r ...

... default seems a little harsh at first sight. But many such loans have very low payment obligations so that delinquency rates and therefore default rates are substantially less than what one would expect. Indeed lenders of unsecured loans seek to obtain substantial gains from charging high interest r ...

general bearing corporation

... those of historical fact, including, without limitation, ones identified by the use of the words: "anticipates," "estimates," "believes," "expects," "intends," "plans," "predicts," and similar expressions. In this Quarterly Report, such statements may relate, among other things, to the recoverabilit ...

... those of historical fact, including, without limitation, ones identified by the use of the words: "anticipates," "estimates," "believes," "expects," "intends," "plans," "predicts," and similar expressions. In this Quarterly Report, such statements may relate, among other things, to the recoverabilit ...

Estimating the Expected Marginal Rate of Substitution

... a vector of time-varying factors. Both assumptions are common in the literature; Campbell, Lo and MacKinlay (1997) and Cochrane (2001) provide excellent discussions. With these two assumptions, equation (10) becomes a panel estimating equation. Time-series variation is used to estimate the asset-spe ...

... a vector of time-varying factors. Both assumptions are common in the literature; Campbell, Lo and MacKinlay (1997) and Cochrane (2001) provide excellent discussions. With these two assumptions, equation (10) becomes a panel estimating equation. Time-series variation is used to estimate the asset-spe ...

Investment and saving Ch24 Economics Ch09 Macroeconomics

... The history of real interest rates over the years between 1973 and 2002 shows that the real interest rate A) can't be negative. B) fluctuated over a 10 percent range and can be negative. C) has stayed within a 5 percent range and can be negative. D) was negative for most of those years. 70) Starting ...

... The history of real interest rates over the years between 1973 and 2002 shows that the real interest rate A) can't be negative. B) fluctuated over a 10 percent range and can be negative. C) has stayed within a 5 percent range and can be negative. D) was negative for most of those years. 70) Starting ...

an econometric analysis of effect of changes in interest rates on

... purchase more goods and services than can be produced with current resources (labour, materials, etc.) causing upward pressures on prices. Over a short term, inflation can occur from various shocks in the economy. Food and energy price shocks are common examples of this type of inflation in Nigeria. ...

... purchase more goods and services than can be produced with current resources (labour, materials, etc.) causing upward pressures on prices. Over a short term, inflation can occur from various shocks in the economy. Food and energy price shocks are common examples of this type of inflation in Nigeria. ...

Uncertainty and the Disappearance of International Credit

... High-income countries must decide on how much new lending they are willing to provide emerging markets. Let B1* represent the aggregate amount of new short-term loans offered emerging markets in period one at a contractual interest rate of r. In period two, emerging markets must repay these loans pl ...

... High-income countries must decide on how much new lending they are willing to provide emerging markets. Let B1* represent the aggregate amount of new short-term loans offered emerging markets in period one at a contractual interest rate of r. In period two, emerging markets must repay these loans pl ...

NBER WORKING PAPER SERIES ON THE FUNDAMENTALS OF SELF-FULFILLING Craig Burnside Martin Eichenbaum

... liabilities. This transformation is the key mechanism by which government guar'The recent literature emphasizes the distinction between fundamental and multiple equilibrium explanations of twin crises.' For examples of papers that emphasize fundamentals see Corsetti, Pesenti and Roubini (1997), Bord ...

... liabilities. This transformation is the key mechanism by which government guar'The recent literature emphasizes the distinction between fundamental and multiple equilibrium explanations of twin crises.' For examples of papers that emphasize fundamentals see Corsetti, Pesenti and Roubini (1997), Bord ...

determining the risk free rate for regulated companies

... We now have the “standard” result, i.e., to value a cash flow due in two years when the CAPM horizon is one year, we employ both the one year spot rate and the two year spot rate. The one year spot rate is used to determine the market risk premium, because it accords with the perceived investor hori ...

... We now have the “standard” result, i.e., to value a cash flow due in two years when the CAPM horizon is one year, we employ both the one year spot rate and the two year spot rate. The one year spot rate is used to determine the market risk premium, because it accords with the perceived investor hori ...

PDF

... multiple equilibria). As more banks are in distress, the authorities first lower the interest rate and reduce the extent of downsizing requested from those banks that request assistance. They then completely bail out the banks through very low interest rates. Finally, as the crisis becomes very seve ...

... multiple equilibria). As more banks are in distress, the authorities first lower the interest rate and reduce the extent of downsizing requested from those banks that request assistance. They then completely bail out the banks through very low interest rates. Finally, as the crisis becomes very seve ...

A Causal Framework for Credit Default Theory

... default seems a little harsh at first sight. But many such loans have very low payment obligations so that delinquency rates and therefore default rates are substantially less than what one would expect. Indeed lenders of unsecured loans seek to obtain substantial gains from charging high interest r ...

... default seems a little harsh at first sight. But many such loans have very low payment obligations so that delinquency rates and therefore default rates are substantially less than what one would expect. Indeed lenders of unsecured loans seek to obtain substantial gains from charging high interest r ...

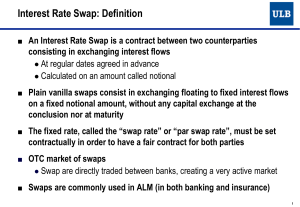

Interest Rate Swap

... ■ More complex contracts can be concluded in the OTC market, where e.g. ● The notional vary with time ● The contract is not spot but forward ● One or both legs are function of more than one reference rates (structured swaps) ...

... ■ More complex contracts can be concluded in the OTC market, where e.g. ● The notional vary with time ● The contract is not spot but forward ● One or both legs are function of more than one reference rates (structured swaps) ...

TITEL - VBA beleggingsprofessionals

... • Loss given default – The fraction of the outstanding loan that will not be recovered once default occurred. – Influenced by: • Collateral • Guarantees ...

... • Loss given default – The fraction of the outstanding loan that will not be recovered once default occurred. – Influenced by: • Collateral • Guarantees ...

Economic Activity and the Short-Term Credit Markets: An

... What most neoclassical models carry over directly from classicial models, however, is tte exclusive focus on money as the only financial quantityto merit attention. The nominalquantitythat varies, and that immediatelyimpliesa varyingreal quantitywhen prices are imperfectly flexible, is money. Some r ...

... What most neoclassical models carry over directly from classicial models, however, is tte exclusive focus on money as the only financial quantityto merit attention. The nominalquantitythat varies, and that immediatelyimpliesa varyingreal quantitywhen prices are imperfectly flexible, is money. Some r ...

Using Derivatives to Manage Interest Rate Risk Derivatives A

... The cash market risk exposure is that the bank will not have access to the funds for eight months. In March 2013, the market expected Eurodollar rates to increase sharply as evidenced by rising futures rates. But…. ...

... The cash market risk exposure is that the bank will not have access to the funds for eight months. In March 2013, the market expected Eurodollar rates to increase sharply as evidenced by rising futures rates. But…. ...

Using Derivatives to Manage Interest Rate Risk

... The cash market risk exposure is that the bank will not have access to the funds for eight months. In March 2013, the market expected Eurodollar rates to increase sharply as evidenced by rising futures rates. But…. ...

... The cash market risk exposure is that the bank will not have access to the funds for eight months. In March 2013, the market expected Eurodollar rates to increase sharply as evidenced by rising futures rates. But…. ...

May 2003 - Banco de España

... case of lending to corporations and in that of lending to households. However, given the strong growth of lending in recent years, the medium-term sustainability of such low doubtful assets ratios can be questioned. Credit to the private sector continues to grow at high rates, particularly mortgage ...

... case of lending to corporations and in that of lending to households. However, given the strong growth of lending in recent years, the medium-term sustainability of such low doubtful assets ratios can be questioned. Credit to the private sector continues to grow at high rates, particularly mortgage ...

Credit rationing

Credit rationing refers to the situation where lenders limit the supply of additional credit to borrowers who demand funds, even if the latter are willing to pay higher interest rates. It is an example of market imperfection, or market failure, as the price mechanism fails to bring about equilibrium in the market. It should not be confused with cases where credit is simply ""too expensive"" for some borrowers, that is, situations where the interest rate is deemed too high. On the contrary, the borrower would like to acquire the funds at the current rates, and the imperfection refers to the absence of equilibrium in spite of willing borrowers. In other words, at the prevailing market interest rate, demand exceeds supply, but lenders are not willing to either loan more funds, or raise the interest rate charged, as they are already maximising profits.