Copyright © 2001 by Harcourt, Inc. All rights reserved.

... Companies need money to operate, but this financing always comes at a cost For bonds (i.e., debt): Primary cost = stated interest rate Add’l cost = loss of flexibility • Must disgorge cash on a regular basis • Many inhibitive bond covenants regarding levels of various financial ratios that mus ...

... Companies need money to operate, but this financing always comes at a cost For bonds (i.e., debt): Primary cost = stated interest rate Add’l cost = loss of flexibility • Must disgorge cash on a regular basis • Many inhibitive bond covenants regarding levels of various financial ratios that mus ...

A case for high-yield bonds

... those of other major asset classes, including equities, and with significantly less downside.1 As the name indicates, high-yield bonds are indeed a higher-yielding asset class that may offer both higher income and higher total return than other bonds. Even so, the high-yield bond market is often vie ...

... those of other major asset classes, including equities, and with significantly less downside.1 As the name indicates, high-yield bonds are indeed a higher-yielding asset class that may offer both higher income and higher total return than other bonds. Even so, the high-yield bond market is often vie ...

A Causal Framework for Credit Default Theory

... corporate financial conditions, leading to possible credit defaults. Most existing theories1 of credit default do not meet this causal requirement. The purpose of this paper is to set down a framework from which causal credit default theories can be developed through a new structure for incorporatin ...

... corporate financial conditions, leading to possible credit defaults. Most existing theories1 of credit default do not meet this causal requirement. The purpose of this paper is to set down a framework from which causal credit default theories can be developed through a new structure for incorporatin ...

National Grid Company plc Annual Report and Accounts 2003/04

... The Transmission Owner (TO) owns and maintains the physical assets, develops the network to accommodate new connections/ disconnections, manages a programme of asset replacement and investment to ensure the longterm reliability of the systems. Revenue from charges for using the transmission network ...

... The Transmission Owner (TO) owns and maintains the physical assets, develops the network to accommodate new connections/ disconnections, manages a programme of asset replacement and investment to ensure the longterm reliability of the systems. Revenue from charges for using the transmission network ...

Managing Interest Rate Risk: Duration GAP and Economic

... par to yield 9.4 percent to maturity. Macaulay’s Duration for the option-free version of this bond is 5.36 semiannual periods, or 2.68 years. The Modified Duration of this bond is 5.12 semiannual periods or 2.56 years. ...

... par to yield 9.4 percent to maturity. Macaulay’s Duration for the option-free version of this bond is 5.36 semiannual periods, or 2.68 years. The Modified Duration of this bond is 5.12 semiannual periods or 2.56 years. ...

Chapter IV: How Securities are Traded? etImUlbRtRtUv

... Specialists. These members perform two roles. First, any order that the commission broker cannot execute immediately because the current market price is not at or better than the specified limit price will be left with the specialist for possible execution in the future, called broker’s broker. Seco ...

... Specialists. These members perform two roles. First, any order that the commission broker cannot execute immediately because the current market price is not at or better than the specified limit price will be left with the specialist for possible execution in the future, called broker’s broker. Seco ...

Entrepreneurship and Public Policy

... Corporate Income Tax II • Poterba (1989) models how corporate income tax affects venture capital – A reduction in the capital gains tax rate would in theory lower the required expected (pre-tax) rate of return on venture investments for taxable investors – However, since most VC investors after 198 ...

... Corporate Income Tax II • Poterba (1989) models how corporate income tax affects venture capital – A reduction in the capital gains tax rate would in theory lower the required expected (pre-tax) rate of return on venture investments for taxable investors – However, since most VC investors after 198 ...

DOC - Investor Overview

... accepted in the United States of America for interim financial information and with the instructions to Form 10-Q. They do not include all information and footnotes necessary for a fair presentation of financial position, and results of operations and cash flows in conformity with accounting princip ...

... accepted in the United States of America for interim financial information and with the instructions to Form 10-Q. They do not include all information and footnotes necessary for a fair presentation of financial position, and results of operations and cash flows in conformity with accounting princip ...

The Untangling of Client Assets at Lehman: A Year`s Progress

... that more customers have opted for segregated treatment for their assets even if it means more cost. “In the new structures being set up, hedge fund clients are increasingly demanding segregated accounts,” said Edmond Parker, who runs the derivatives practice at the law firm of Mayer Brown in London ...

... that more customers have opted for segregated treatment for their assets even if it means more cost. “In the new structures being set up, hedge fund clients are increasingly demanding segregated accounts,” said Edmond Parker, who runs the derivatives practice at the law firm of Mayer Brown in London ...

Rising Interest Rates: How Big a Threat?

... most affected; however, the level of disintermediation with these products could be significantly lower. Other product lines, such as immediate annuities, traditional life insurance, long-term care and disability income, will actually benefit from the rise in rates. Finally, some deferred annuity wr ...

... most affected; however, the level of disintermediation with these products could be significantly lower. Other product lines, such as immediate annuities, traditional life insurance, long-term care and disability income, will actually benefit from the rise in rates. Finally, some deferred annuity wr ...

The Reliance of Structured Finance Investors on Credit Rating

... Act highlights that credit ratings should be gradually removed from the criteria of financial regulations Reformers claim that the removal of rating-based regulations can eliminate the reliance of investors and of the entire financial system from the regulatory perspective. In the context, this pape ...

... Act highlights that credit ratings should be gradually removed from the criteria of financial regulations Reformers claim that the removal of rating-based regulations can eliminate the reliance of investors and of the entire financial system from the regulatory perspective. In the context, this pape ...

Presented

... Although all reasonable care has been taken to ensure the facts stated herein are accurate and that the opinions contained herein are fair and reasonable, this document is selective in nature and is intended to provide an introduction to, and overview of, the business of Converium. Where any informa ...

... Although all reasonable care has been taken to ensure the facts stated herein are accurate and that the opinions contained herein are fair and reasonable, this document is selective in nature and is intended to provide an introduction to, and overview of, the business of Converium. Where any informa ...

Credit Rating Agencies

... to be a poor fit for structured finance or assetbacked pools. Because rating agencies often lacked extensive historical loss experience for innovative structures or transactions based on untested assets (for example, subprime mortgages), they used different (and sometimes inappropriate) analytical t ...

... to be a poor fit for structured finance or assetbacked pools. Because rating agencies often lacked extensive historical loss experience for innovative structures or transactions based on untested assets (for example, subprime mortgages), they used different (and sometimes inappropriate) analytical t ...

open-end credit under -truth-in- lending

... ANY OPEN-END CREDIT PLAN. Further, as to any open-end consumer credit plan in existence on the effective date of the Act (July 1, 1969), the items specified herein, to the extent applicable, must be disclosed in a NOTICE mailed or delivered to the open-end consumer credit customer not later than Jul ...

... ANY OPEN-END CREDIT PLAN. Further, as to any open-end consumer credit plan in existence on the effective date of the Act (July 1, 1969), the items specified herein, to the extent applicable, must be disclosed in a NOTICE mailed or delivered to the open-end consumer credit customer not later than Jul ...

Manulife Financial Corporation announces Preferred Share issue

... “Securities Act”), or the securities laws of any state of the United States and may not be offered, sold or delivered, directly or indirectly in the United States or to, or for the account or benefit of, a “U.S. person” (as defined in Regulation S under the Securities Act) absent registration or an ...

... “Securities Act”), or the securities laws of any state of the United States and may not be offered, sold or delivered, directly or indirectly in the United States or to, or for the account or benefit of, a “U.S. person” (as defined in Regulation S under the Securities Act) absent registration or an ...

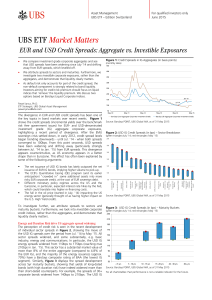

Market Matters EUR and USD Credit Spreads

... For marketing and information purposes by UBS. For qualified investors only. The information and opinions contained in this document have been compiled or arrived at based upon information obtained from sources believed to be reliable and in good faith, but is not guaranteed as being accurate, nor i ...

... For marketing and information purposes by UBS. For qualified investors only. The information and opinions contained in this document have been compiled or arrived at based upon information obtained from sources believed to be reliable and in good faith, but is not guaranteed as being accurate, nor i ...

The Bear Stearns Companies Inc.

... Financial instruments sold, but not yet purchased, at fair value Liabilities of variable interest entities and mortgage loan special purpose entities Accrued employee compensation and benefits Other liabilities and accrued expenses Long-term borrowings ...

... Financial instruments sold, but not yet purchased, at fair value Liabilities of variable interest entities and mortgage loan special purpose entities Accrued employee compensation and benefits Other liabilities and accrued expenses Long-term borrowings ...