PRIMARY MARKET`s PROCEDURE MANUAL BOLSA DE

... 5. Blocking of Securities: In order to trade, Primary Issues must be blocked at least one day before the beginning of trading. This prior deposit, whether of physical securities, global securities, macro-titles or dematerialized securities must be done at any Custody and Settlement Center, Transfer ...

... 5. Blocking of Securities: In order to trade, Primary Issues must be blocked at least one day before the beginning of trading. This prior deposit, whether of physical securities, global securities, macro-titles or dematerialized securities must be done at any Custody and Settlement Center, Transfer ...

A Project Report Presentation On *SBI Mutual Fund

... • Available for sale and repurchase at all times based on the net asset value (NAV) per unit. ...

... • Available for sale and repurchase at all times based on the net asset value (NAV) per unit. ...

Financial Statement Analysis of Depository

... Data for banks is available from the Uniform Bank Performance Report (UBPR). UBPR developed by the Fed, FDIC, and office of the comptroller of Currency so that there would be a standardized way to compare institutions. Also peer group and state reports for comparable banks. ...

... Data for banks is available from the Uniform Bank Performance Report (UBPR). UBPR developed by the Fed, FDIC, and office of the comptroller of Currency so that there would be a standardized way to compare institutions. Also peer group and state reports for comparable banks. ...

General Principals of Accounting

... • Cost of Capital is the price the investor must pay for the cash needed to make an investment • The Cash flow is the revenue an entity receives from its investments in buildings, equipment, or programs • Historical costs of Investment • Replacement cost of Investment • Current Market Value of Inves ...

... • Cost of Capital is the price the investor must pay for the cash needed to make an investment • The Cash flow is the revenue an entity receives from its investments in buildings, equipment, or programs • Historical costs of Investment • Replacement cost of Investment • Current Market Value of Inves ...

the exchange rate

... ● First, some of the results may be interpreted as lending support to concerns expressed by policymakers in EMEs. In particular, EMEs have been adversely affected by pro-cyclical effects of QE policies, inducing capital outflows from EMEs when capital is scarce and pushing capital into EMEs, driving ...

... ● First, some of the results may be interpreted as lending support to concerns expressed by policymakers in EMEs. In particular, EMEs have been adversely affected by pro-cyclical effects of QE policies, inducing capital outflows from EMEs when capital is scarce and pushing capital into EMEs, driving ...

Risk Free Discount Rates under AASB 1038 1

... Situations may arise where the present value of the planned margin of revenues over expenses for a group of related products will be adjusted as a result of changing underlying assumptions to the extent that the planned margin is eliminated and becomes a planned loss. That is, a review of expected f ...

... Situations may arise where the present value of the planned margin of revenues over expenses for a group of related products will be adjusted as a result of changing underlying assumptions to the extent that the planned margin is eliminated and becomes a planned loss. That is, a review of expected f ...

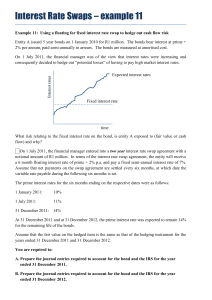

Interest Rate Swaps – example 11

... At 31 December 2011 and at 31 December 2012, the prime interest rate was expected to remain 14% for the remaining life of the bonds. Assume that the fair value on the hedged item is the same as that of the hedging instrument for the years ended 31 December 2011 and 31 December 2012. You are required ...

... At 31 December 2011 and at 31 December 2012, the prime interest rate was expected to remain 14% for the remaining life of the bonds. Assume that the fair value on the hedged item is the same as that of the hedging instrument for the years ended 31 December 2011 and 31 December 2012. You are required ...

Negotiable/Transferable Instruments Conventions

... addressed by one person to another, signed by the person giving it, requiring the person to whom it is addressed to pay on demand or at a fixed or determinable future time, a sum certain in money or to the order of a specific person, or to bearer. At a more practical level a bill of exchange is gene ...

... addressed by one person to another, signed by the person giving it, requiring the person to whom it is addressed to pay on demand or at a fixed or determinable future time, a sum certain in money or to the order of a specific person, or to bearer. At a more practical level a bill of exchange is gene ...

Commercial Real Estate Finance Leaders Expect Favorable Market

... Respondents believe commercial real estate markets are fundamentally sound. Construction activity is expected to be at or above the average historical rate of 1.9% of existing building stock. ...

... Respondents believe commercial real estate markets are fundamentally sound. Construction activity is expected to be at or above the average historical rate of 1.9% of existing building stock. ...

sample - Test Bank College

... secondary markets for many types of debt securities. Explain how such a lack of liquidity would affect the prices of the debt securities in the secondary markets. ANSWER: Investors were less willing to invest in many debt securities because they were concerned that these securities might default. As ...

... secondary markets for many types of debt securities. Explain how such a lack of liquidity would affect the prices of the debt securities in the secondary markets. ANSWER: Investors were less willing to invest in many debt securities because they were concerned that these securities might default. As ...

SPECIAL ASPECTS OF BANKS INVESTMENT ACTIVITY IN UKRAINE

... the purpose of obtaining income from transactions with securities from operations long-term funding for ...

... the purpose of obtaining income from transactions with securities from operations long-term funding for ...

The Year Ahead in Healthcare Convertible Bonds

... Investors – in Healthcare or otherwise – dislike uncertainty. The less certain the data is that investor projections are based on, the less of a valuation multiple the related assets will be able to attain. With the 2016 election cycle looming, this will become especially important in the Healthcare ...

... Investors – in Healthcare or otherwise – dislike uncertainty. The less certain the data is that investor projections are based on, the less of a valuation multiple the related assets will be able to attain. With the 2016 election cycle looming, this will become especially important in the Healthcare ...

Exploring the statistical potential of micro-databases

... taken into account and permits analysts to calculate marginal, rather than average effects. The micro-databases developed by Banco de Portugal contain detailed data on balance sheet positions of the MFI, OFI, NFC and households sectors, and allow to analyse leverage, liquidity, and market exposures ...

... taken into account and permits analysts to calculate marginal, rather than average effects. The micro-databases developed by Banco de Portugal contain detailed data on balance sheet positions of the MFI, OFI, NFC and households sectors, and allow to analyse leverage, liquidity, and market exposures ...

What if Interest Rates Rise? A Special Commentary Series

... We have thus far avoided discussion of the Federal Reserve’s (Fed) ability to cause interest rates to rise. This is not an oversight; rather it’s an acknowledgement that the Fed’s influence in the fixed income markets is both unprecedented and somewhat opaque. Starting in the latter days of the 2008 ...

... We have thus far avoided discussion of the Federal Reserve’s (Fed) ability to cause interest rates to rise. This is not an oversight; rather it’s an acknowledgement that the Fed’s influence in the fixed income markets is both unprecedented and somewhat opaque. Starting in the latter days of the 2008 ...

power consistency - Voya Investment Management

... Domestic Equity: Exposure to financial and market risks that accompany investments in equities. Markets are volatile and can decline significantly in response to adverse issuer, political, regulatory, market or economic developments. Small-cap stocks may be more volatile and less liquid than stocks ...

... Domestic Equity: Exposure to financial and market risks that accompany investments in equities. Markets are volatile and can decline significantly in response to adverse issuer, political, regulatory, market or economic developments. Small-cap stocks may be more volatile and less liquid than stocks ...

Portfolio Perspectives - Ryan Wealth Management

... profitability is more consistent than we might expect. Investors are always looking forward, so may not pay as much attention to what profitability is today as what they think it may be several years down the road. Additionally, many investors likely assume that current profitability may erode over ...

... profitability is more consistent than we might expect. Investors are always looking forward, so may not pay as much attention to what profitability is today as what they think it may be several years down the road. Additionally, many investors likely assume that current profitability may erode over ...