and Developed-Market Stocks

... traditional benchmark index, and we seek attractively valued stocks in just about any developing country where we see potential. The lines are not always so clear, depending on the metrics used in the classifications. For example, South Korea is currently classified by one index provider as emerging ...

... traditional benchmark index, and we seek attractively valued stocks in just about any developing country where we see potential. The lines are not always so clear, depending on the metrics used in the classifications. For example, South Korea is currently classified by one index provider as emerging ...

BOTSWANA SOCIETY PUBLIC FORUM SERIES Whither the

... crisis, has affected the country in many ways. Our diamond exports were badly affected, as were government revenues; we have large budget deficits and balance of payment deficits; foreign exchange reserves and government savings are falling, and for the first time we have been borrowing and building ...

... crisis, has affected the country in many ways. Our diamond exports were badly affected, as were government revenues; we have large budget deficits and balance of payment deficits; foreign exchange reserves and government savings are falling, and for the first time we have been borrowing and building ...

QIC Monthly Economic Brief - January 2014.docx

... the peso in January after the central bank was forced to scale back their exchange rate interventions due to a sharp drop in international reserves. Turkish assets, which have been under pressure since December due to increasing political risk following a deepening corruption probe, also performed p ...

... the peso in January after the central bank was forced to scale back their exchange rate interventions due to a sharp drop in international reserves. Turkish assets, which have been under pressure since December due to increasing political risk following a deepening corruption probe, also performed p ...

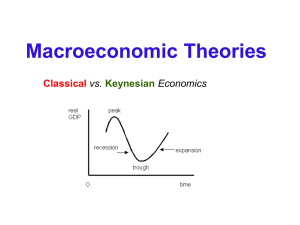

Economic Activity in a Changing World

... goods and services. The general drop in the total production of goods and services makes GDP decline. In a recession there are downturns in many industries. A downturn in one industry can affect others. For example, a recession in the auto-making industry can lead to a recession in businesses that m ...

... goods and services. The general drop in the total production of goods and services makes GDP decline. In a recession there are downturns in many industries. A downturn in one industry can affect others. For example, a recession in the auto-making industry can lead to a recession in businesses that m ...

chapter 6 -- a collaborative economy

... of their own self-interests. This is based on the premise from economic theory that a “Pareto optimal solution” for the distribution of wealth in society is, generally speaking, more likely to be obtained as a market system approximates the conditions of “pure competition.” In other words, the pure ...

... of their own self-interests. This is based on the premise from economic theory that a “Pareto optimal solution” for the distribution of wealth in society is, generally speaking, more likely to be obtained as a market system approximates the conditions of “pure competition.” In other words, the pure ...

a duration-dependent regime switching model for an open emerging

... manufacturing and the trade sales (trade), and the personal income less transfer payments (income). However, for our model, we prefer to use the net international reserves, domestic debt and consumer price index and industrial production. We select the net international reserves because the emerging ...

... manufacturing and the trade sales (trade), and the personal income less transfer payments (income). However, for our model, we prefer to use the net international reserves, domestic debt and consumer price index and industrial production. We select the net international reserves because the emerging ...

Why should the global reserve system be reformed?

... Any of these solutions would also solve the recurrent problem of making more resources available to the IMF during crises to increase its lending. The traditional way of doing so, which was approved by the G-20 in April 2009, has been to expand the IMF’s borrowing from member states. But this mechan ...

... Any of these solutions would also solve the recurrent problem of making more resources available to the IMF during crises to increase its lending. The traditional way of doing so, which was approved by the G-20 in April 2009, has been to expand the IMF’s borrowing from member states. But this mechan ...

Does creditor protection mitigate the likelihood of financial crises

... global considerations into account in formulating its economic policies. These foreign voices note the financial instability caused by wide fluctuations in the value of the dollar, such as its seesawing by 30-50 percent against the euro over the past decade. Periodic sizable declines in its exchange ...

... global considerations into account in formulating its economic policies. These foreign voices note the financial instability caused by wide fluctuations in the value of the dollar, such as its seesawing by 30-50 percent against the euro over the past decade. Periodic sizable declines in its exchange ...

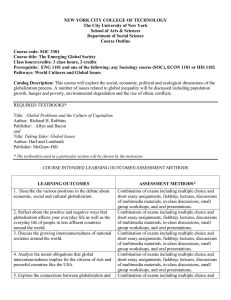

Course Outline Template Word Document

... * may vary slightly per instructor to suit their own needs Capstone Course Statement: This course fulfills the LAA/LAS Associate Capstone requirement, though it can also be taken for other requirements and electives. The City Tech LAA/LAS Associate Capstone is designed for students entering their se ...

... * may vary slightly per instructor to suit their own needs Capstone Course Statement: This course fulfills the LAA/LAS Associate Capstone requirement, though it can also be taken for other requirements and electives. The City Tech LAA/LAS Associate Capstone is designed for students entering their se ...

emerging markets outlook - RBC Global Asset Management

... have a substantial need for infrastructure improvement. Importantly, many emerging-market countries now have sufficient fiscal capacity and more reform-friendly governments, meaning that we are likely to see fiscal stimulus play an increasingly important role in emerging markets as well. The positiv ...

... have a substantial need for infrastructure improvement. Importantly, many emerging-market countries now have sufficient fiscal capacity and more reform-friendly governments, meaning that we are likely to see fiscal stimulus play an increasingly important role in emerging markets as well. The positiv ...

UK businesses investing for growth — will your investment strategy

... highlights, the relative costs of capital versus labour have changed in recent years as labour has become relatively more competitive. For some sectors, the NLW will reverse this trend and business investment may therefore become both more attractive and necessary to offset increased labour costs. B ...

... highlights, the relative costs of capital versus labour have changed in recent years as labour has become relatively more competitive. For some sectors, the NLW will reverse this trend and business investment may therefore become both more attractive and necessary to offset increased labour costs. B ...

Session 12: Managing an Open Economy

... the above shown; e.g., exchange rate changes may take time to affect actual imports and exports. Nontradables prices may rise quickly if there is excess demand, but the inflation may persist once it starts. When there is unemployment, unions strike may prevent prices from falling. The automatic tend ...

... the above shown; e.g., exchange rate changes may take time to affect actual imports and exports. Nontradables prices may rise quickly if there is excess demand, but the inflation may persist once it starts. When there is unemployment, unions strike may prevent prices from falling. The automatic tend ...

Globalization Chapter 01

... Many former Communist nations in Europe and Asia are now committed to democratic politics and free market economies and so, create new opportunities for international businesses China and Latin America are also moving toward greater free market reforms ...

... Many former Communist nations in Europe and Asia are now committed to democratic politics and free market economies and so, create new opportunities for international businesses China and Latin America are also moving toward greater free market reforms ...

Keynesian Theory

... curve shifts from SRAS1 to SRAS2. As the price level rises, the real balance, interest rate, and international trade effects decrease the quantity demanded of Real GDP. Ultimately, the economy moves into long-run equilibrium at point 2. ...

... curve shifts from SRAS1 to SRAS2. As the price level rises, the real balance, interest rate, and international trade effects decrease the quantity demanded of Real GDP. Ultimately, the economy moves into long-run equilibrium at point 2. ...

The Global City: Whose Social Construct is it Anyway?

... economic globalization and global city status are virtually identical to those identified by Sassen( 1991) and Friedmann (1986, 1995). Only the interrelationship of these attributes within an a positivistic causal framework is debated by White. These include five roughly "nested" economic attributes ...

... economic globalization and global city status are virtually identical to those identified by Sassen( 1991) and Friedmann (1986, 1995). Only the interrelationship of these attributes within an a positivistic causal framework is debated by White. These include five roughly "nested" economic attributes ...

Bill of Rights in Action 32:3 - Constitutional Rights Foundation

... John and Maria to get a certain kind of subprime mortcould do this because their house would be worth gage loan. Subprime loans were for people with low-tomuch more. House prices had only been going up. moderate incomes and who were often in debt. They also felt confident that they could sell their ...

... John and Maria to get a certain kind of subprime mortcould do this because their house would be worth gage loan. Subprime loans were for people with low-tomuch more. House prices had only been going up. moderate incomes and who were often in debt. They also felt confident that they could sell their ...

The Middle East and the New Global Economy: The Drive for

... sectors. Recently, the IMF [International Monetary Fund] published a note entitled “Resilient Lebanon Defies Odds In Face of Global Crisis” projecting that Lebanon could grow faster in 2009 than previously predicted. What is your current assessment of how Lebanon has fared in weathering the crisi ...

... sectors. Recently, the IMF [International Monetary Fund] published a note entitled “Resilient Lebanon Defies Odds In Face of Global Crisis” projecting that Lebanon could grow faster in 2009 than previously predicted. What is your current assessment of how Lebanon has fared in weathering the crisi ...

The Euro and the Financial Crisis

... The global financial crisis is the first major challenge for the euro as a multinational currency. Many wonder whether it will also be the last. Although early indications suggest that the eurozone countries are weathering the storm, this has not stopped prominent economists such as Martin Feldstein ...

... The global financial crisis is the first major challenge for the euro as a multinational currency. Many wonder whether it will also be the last. Although early indications suggest that the eurozone countries are weathering the storm, this has not stopped prominent economists such as Martin Feldstein ...

Chapter 2 : School of Thoughts

... – Monetary policy is more effective than fiscal policy. – No long-run trade-off between inflation and unemployment. – The market system was not perfect, the government would only make things worse. – Fiscal policy could only influence the distribution of income and the allocation of resources (crowd ...

... – Monetary policy is more effective than fiscal policy. – No long-run trade-off between inflation and unemployment. – The market system was not perfect, the government would only make things worse. – Fiscal policy could only influence the distribution of income and the allocation of resources (crowd ...

GLMF presentation Dec 12 UK

... Source: M&G, Bloomberg, Morningstar as at 2 November 2012. Sterling X Acc class shares, UK database, net income reinvested, price to price. European High Yield refers to the ML European High Yield Constrained Index, Emerging Market Local Currency Sovereign debt to the JPM EM-GBI Global Diversified I ...

... Source: M&G, Bloomberg, Morningstar as at 2 November 2012. Sterling X Acc class shares, UK database, net income reinvested, price to price. European High Yield refers to the ML European High Yield Constrained Index, Emerging Market Local Currency Sovereign debt to the JPM EM-GBI Global Diversified I ...

Cycles: economic, ideas (paradigms), policies

... (of base money), a large-scale drainage via sizeable bond sales that will take yields higher, would strain financial markets again, induce a new recession episode, heighten the debt-deflation threat, and trigger a string of bankruptcies. Banks will face major asset losses similar to those in central ...

... (of base money), a large-scale drainage via sizeable bond sales that will take yields higher, would strain financial markets again, induce a new recession episode, heighten the debt-deflation threat, and trigger a string of bankruptcies. Banks will face major asset losses similar to those in central ...

George A Provopoulos: The Greek economic crisis and the euro

... However, he never forgot his origins and, as exemplified by this foundation, passed on to future generations the ability to advance scientific and artistic knowledge. My presentation will deal with the origins of the present crisis in Europe and the lessons of the crisis for Europe’s single currency ...

... However, he never forgot his origins and, as exemplified by this foundation, passed on to future generations the ability to advance scientific and artistic knowledge. My presentation will deal with the origins of the present crisis in Europe and the lessons of the crisis for Europe’s single currency ...

Chapter 17 Disputes Over Macro Theory and Policy

... 2. Mainstream economists oppose requirements to balance the budget annually because it would require actions that would intensify the business cycle, such as raising taxes and cutting spending during recession and the opposite during booms. They support discretionary fiscal policy to combat recessio ...

... 2. Mainstream economists oppose requirements to balance the budget annually because it would require actions that would intensify the business cycle, such as raising taxes and cutting spending during recession and the opposite during booms. They support discretionary fiscal policy to combat recessio ...

DDD381-caratula copia - Pontificia Universidad Católica del Perú

... account surpluses —a phenomenon closely linked, we must insist, to financialization and global excess liquidity— is another matter of discussion. Perhaps the best known explanation is the one given by Ben Bernanke (2005 and 2007), that sees such phenomenon as the result of a “global savings glut” ca ...

... account surpluses —a phenomenon closely linked, we must insist, to financialization and global excess liquidity— is another matter of discussion. Perhaps the best known explanation is the one given by Ben Bernanke (2005 and 2007), that sees such phenomenon as the result of a “global savings glut” ca ...

Nouriel Roubini

Nouriel Roubini (born March 29, 1958) is an American economist. He teaches at New York University's Stern School of Business and is the chairman of Roubini Global Economics, an economic consultancy firm.The child of Iranian Jews, he was born in Turkey and grew up in Italy. After receiving a BA in political economics at Bocconi University, Milan and a doctorate in international economics at Harvard University, he became an academic at Yale and a practising economist at the International Monetary Fund (IMF), the Federal Reserve, World Bank, and Bank of Israel. Much of his early research focused on emerging markets. During the administration of President Bill Clinton, he was a senior economist for the Council of Economic Advisers, later moving to the United States Treasury Department as a senior adviser to Timothy Geithner, who in 2009 became Treasury Secretary.