Comments on First Midterm, Fall 20080

... Each country will have some comparative advantages. If each country concentrates it production in those goods in which it has a comparative advantage, and then trades, there will be more good in total. Since one would not trade unless it made them better each country will get some of the increased p ...

... Each country will have some comparative advantages. If each country concentrates it production in those goods in which it has a comparative advantage, and then trades, there will be more good in total. Since one would not trade unless it made them better each country will get some of the increased p ...

EASTERN MEDITERRANEAN UNIVERSITY

... 1. The elasticity of demand for labor will be higher the greater is the elasticity of substitution between labor and other inputs and the greater is the elasticity of demand for the products that use labor as a factor of production. 2. A monopsonist will hire more labor and pay a higher real wage ra ...

... 1. The elasticity of demand for labor will be higher the greater is the elasticity of substitution between labor and other inputs and the greater is the elasticity of demand for the products that use labor as a factor of production. 2. A monopsonist will hire more labor and pay a higher real wage ra ...

Fall 2012 - Montana State University

... “An economics reporter states that the European Union (EU) is increasing its productivity very rapidly in all industries. He claims that this productivity advance is so rapid that output from the EU in these industries will soon exceed that of the United States and, as a result, the United States wi ...

... “An economics reporter states that the European Union (EU) is increasing its productivity very rapidly in all industries. He claims that this productivity advance is so rapid that output from the EU in these industries will soon exceed that of the United States and, as a result, the United States wi ...

Syllabus - Hill College

... 57. Understand why a firm’s marginal revenue product curve is its labor demand curve. 58. Explain in what sense the demand for labor is a “derived” demand. 59. Identify the key factors influencing the elasticity of demand for inputs. 60. Describe how equilibrium wage rates are determined for perfect ...

... 57. Understand why a firm’s marginal revenue product curve is its labor demand curve. 58. Explain in what sense the demand for labor is a “derived” demand. 59. Identify the key factors influencing the elasticity of demand for inputs. 60. Describe how equilibrium wage rates are determined for perfect ...

Figure 3-1

... Factors of production cannot move instantaneously and costlessly from one industry to another. Changes in an economy’s output mix have differential effects on the demand for different factors of production. ...

... Factors of production cannot move instantaneously and costlessly from one industry to another. Changes in an economy’s output mix have differential effects on the demand for different factors of production. ...

18.2 the gains from trade

... When a country has a trade surplus, it lends to other countries or buys more foreign assets so that other countries can pay their trade deficits. ...

... When a country has a trade surplus, it lends to other countries or buys more foreign assets so that other countries can pay their trade deficits. ...

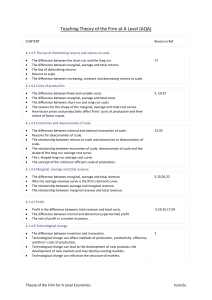

AQA Theory of the firm topic list

... Both the short-run and long-run benefits which are likely to result from competition. That firms do not just compete on the basis of price but that competition will, for example, also lead firms to strive to improve products, reduce costs, improve the quality of the service provided. The process of ...

... Both the short-run and long-run benefits which are likely to result from competition. That firms do not just compete on the basis of price but that competition will, for example, also lead firms to strive to improve products, reduce costs, improve the quality of the service provided. The process of ...

The Cobb-Douglas Production Function

... Because TFP is calculated assuming that the model holds, TFP is referred to as the “residual”…it reflects the model’s error when a country’s A is assumed equal to 1. A lower level of TFP implies that for any given level of capital per person, workers produce less output than a country with highe ...

... Because TFP is calculated assuming that the model holds, TFP is referred to as the “residual”…it reflects the model’s error when a country’s A is assumed equal to 1. A lower level of TFP implies that for any given level of capital per person, workers produce less output than a country with highe ...

ECON 2010-200 Principles of Microeconomics

... course explores how "the magic of the market" coordinates the decisions of individuals as to what goods to buy and as to how hard to work, and of firms as to what inputs to use to produce what goods. In addition, the course considers such questions as: Why is competition socially desirable? Is compe ...

... course explores how "the magic of the market" coordinates the decisions of individuals as to what goods to buy and as to how hard to work, and of firms as to what inputs to use to produce what goods. In addition, the course considers such questions as: Why is competition socially desirable? Is compe ...

Study Questions for Term Test 2

... Suppose the demand for bagels rises dramatically while the demand for breakfast cereal falls. Briefly explain how the competitive market economy will make the needed adjustments to re-establish an efficient allocation of society’s scarce resources. Use graphs. ...

... Suppose the demand for bagels rises dramatically while the demand for breakfast cereal falls. Briefly explain how the competitive market economy will make the needed adjustments to re-establish an efficient allocation of society’s scarce resources. Use graphs. ...

Econ 101 - Selin Sayek Böke`s web-page

... 5. Assume in the market defined in question 5 the free market equilibrium implies the price is TL 6 million and the equilibrium quantity is 25 units. There is a sudden increase in oil prices, which significantly increases the cost of production of this good. 1. Explain the short-un impact on this ma ...

... 5. Assume in the market defined in question 5 the free market equilibrium implies the price is TL 6 million and the equilibrium quantity is 25 units. There is a sudden increase in oil prices, which significantly increases the cost of production of this good. 1. Explain the short-un impact on this ma ...

PDF format

... Given the same unit cost data, a monopolistic producer will charge: a) a lower price and produce a larger output than a competitive firm. b) a lower price and produce a smaller output than a competitive firm. c) a higher price and produce a smaller output than a competitive firm. d) a higher price a ...

... Given the same unit cost data, a monopolistic producer will charge: a) a lower price and produce a larger output than a competitive firm. b) a lower price and produce a smaller output than a competitive firm. c) a higher price and produce a smaller output than a competitive firm. d) a higher price a ...

Final Exam I Intermediate Microeconomics Fall 2005 I. True

... 6. If a profit-maximizing competitive firm has constant returns to scale, then its long run profits must be zero. 7. In the Cournot model, each firm chooses its actions on the assumption that its rivals will react by changing their quantities in such a way as to maximize their own profits. 8. If all ...

... 6. If a profit-maximizing competitive firm has constant returns to scale, then its long run profits must be zero. 7. In the Cournot model, each firm chooses its actions on the assumption that its rivals will react by changing their quantities in such a way as to maximize their own profits. 8. If all ...

Econ 202 Exam 2 Practice Problems

... a. first year after it is imposed than in the fifth year after it is imposed because demand and supply will be more elastic in the first year than in the fifth year. b. first year after it is imposed than in the fifth year after it is imposed because demand and supply will be less elastic in the fir ...

... a. first year after it is imposed than in the fifth year after it is imposed because demand and supply will be more elastic in the first year than in the fifth year. b. first year after it is imposed than in the fifth year after it is imposed because demand and supply will be less elastic in the fir ...

Week of: February 21- Mar 1, 2013 Ms. Harriatte Date: NGSS

... Common Core Reading/Writing Standards ...

... Common Core Reading/Writing Standards ...

Microeconomic Topics for Senior Exercise General Topics Opportunity cost

... Total, average, marginal product curves Isoquants and isocosts; cost minimization Constant, increasing, and decreasing returns to scale Total, average, marginal cost curves LAC and optimal scale of production Relationship between long-run and short-run cost curves Competitive Markets Goal of profit ...

... Total, average, marginal product curves Isoquants and isocosts; cost minimization Constant, increasing, and decreasing returns to scale Total, average, marginal cost curves LAC and optimal scale of production Relationship between long-run and short-run cost curves Competitive Markets Goal of profit ...

Serie documentos de trabajo

... ft/ Note that although trade policy in Mexico was formally based on a combination of tariffs and import permits, the fact that the latter was heavily used made tariffs superfluous, as far as the protection effect is concerned. ...

... ft/ Note that although trade policy in Mexico was formally based on a combination of tariffs and import permits, the fact that the latter was heavily used made tariffs superfluous, as far as the protection effect is concerned. ...

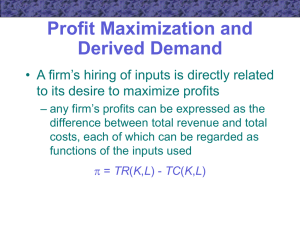

Lec08.pdf

... Production is a flow — quantity per period (month, year ...) Costs and profits should also be flows ($ per period) Some inputs are also flows — used up when used Raw materials, labor services Other inputs are stocks — machines, land ... Relevant input price is not their whole purchase cost but that of u ...

... Production is a flow — quantity per period (month, year ...) Costs and profits should also be flows ($ per period) Some inputs are also flows — used up when used Raw materials, labor services Other inputs are stocks — machines, land ... Relevant input price is not their whole purchase cost but that of u ...

Basic Economics Concepts Reading Guide – Chapters 1, 2, and 3

... 3. Use a production possibilities curve to demonstrate opportunity cost and growth. 4. Construct and interpret a simple circular flow model with households and business and resource and product market ...

... 3. Use a production possibilities curve to demonstrate opportunity cost and growth. 4. Construct and interpret a simple circular flow model with households and business and resource and product market ...

The Hicks-Marshall Rules of Derived Demand

... 2. "The demand for anything is likely to be less elastic, the less important is the part played by the cost of that thing in the total cost of some other thing , in the prod uction of w hich it is employ ed." 3. "The demand for anything is likely to be more elastic, the more elastic is the supply of ...

... 2. "The demand for anything is likely to be less elastic, the less important is the part played by the cost of that thing in the total cost of some other thing , in the prod uction of w hich it is employ ed." 3. "The demand for anything is likely to be more elastic, the more elastic is the supply of ...

Market for Inputs.SU4

... point at which the extra revenue yielded from one more unit is equal to the extra cost ...

... point at which the extra revenue yielded from one more unit is equal to the extra cost ...

Figure 3-1

... countries to have different relative supply curves, and thus cause international trade. In the specific factors model, factors specific to export sectors in each country gain from trade, while factors specific to import-competing sectors lose. Mobile factors that can work in either sector may ei ...

... countries to have different relative supply curves, and thus cause international trade. In the specific factors model, factors specific to export sectors in each country gain from trade, while factors specific to import-competing sectors lose. Mobile factors that can work in either sector may ei ...

ECMC02 – Week 10

... potential consumers. We are told that allocation K is Pareto-preferred to allocation J. We may therefore conclude that: A) every consumer must be better off with K than with J B) a majority of consumers are better off with K than J C) a move from K to J will make some consumers better off and none w ...

... potential consumers. We are told that allocation K is Pareto-preferred to allocation J. We may therefore conclude that: A) every consumer must be better off with K than with J B) a majority of consumers are better off with K than J C) a move from K to J will make some consumers better off and none w ...

Chapter 6 Inventory Controls

... production rate is 150 units per day. What is the most economic production size? How long does each production run last? How many production runs should have in one year? ...

... production rate is 150 units per day. What is the most economic production size? How long does each production run last? How many production runs should have in one year? ...

Comparative advantage

The theory of comparative advantage is an economic theory about the work gains from trade for individuals, firms, or nations that arise from differences in their factor endowments or technological progress. In an economic model, an agent has a comparative advantage over another in producing a particular good if he can produce that good at a lower relative opportunity cost or autarky price, i.e. at a lower relative marginal cost prior to trade. One does not compare the monetary costs of production or even the resource costs (labor needed per unit of output) of production. Instead, one must compare the opportunity costs of producing goods across countries. The closely related law or principle of comparative advantage holds that under free trade, an agent will produce more of and consume less of a good for which he has a comparative advantage.David Ricardo developed the classical theory of comparative advantage in 1817 to explain why countries engage in international trade even when one country's workers are more efficient at producing every single good than workers in other countries. He demonstrated that if two countries capable of producing two commodities engage in the free market, then each country will increase its overall consumption by exporting the good for which it has a comparative advantage while importing the other good, provided that there exist differences in labor productivity between both countries. Widely regarded as one of the most powerful yet counter-intuitive insights in economics, Ricardo's theory implies that comparative advantage rather than absolute advantage is responsible for much of international trade.