Homework 3

... (a) Consider period t = 2. Fix the first period type, θ. Assume in period 2 that the lowtype’s (IR) constraint binds, the high type’s (IC) constraint binds and we can ignore the other constraints. Characterize the second period rents obtained by the agents, UθL and UθH , as a function of {qLL , qLH ...

... (a) Consider period t = 2. Fix the first period type, θ. Assume in period 2 that the lowtype’s (IR) constraint binds, the high type’s (IC) constraint binds and we can ignore the other constraints. Characterize the second period rents obtained by the agents, UθL and UθH , as a function of {qLL , qLH ...

Professor Alistair McGuire s Response

... – R&D endogenous in this case – Firms can use to establish market power ...

... – R&D endogenous in this case – Firms can use to establish market power ...

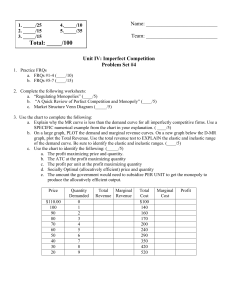

problem-set-7 - WordPress @ VIU Sites

... 2. Why may randomized pricing lead to higher average prices in a store?(3) 3. An auto dealer in Chicago recently told his mother that he makes no money on the sales of his cars but the markup on required accessories is 200 percent. Can this possibly be a profitmaximizing strategy? Explain. (4) 4. If ...

... 2. Why may randomized pricing lead to higher average prices in a store?(3) 3. An auto dealer in Chicago recently told his mother that he makes no money on the sales of his cars but the markup on required accessories is 200 percent. Can this possibly be a profitmaximizing strategy? Explain. (4) 4. If ...

Week 5: Competitive Forces on the Internet Part I

... E.g., if P = $10, original market share is s% then undercutting more profitable if 9.99 > 10s, i.e., 99.9% > s. Implication – only Nash eq. of Bertrand competition game is price at or near zero. (Exactly zero if price cuts can be arbitrarily small.) Note a very competitive market even if there are v ...

... E.g., if P = $10, original market share is s% then undercutting more profitable if 9.99 > 10s, i.e., 99.9% > s. Implication – only Nash eq. of Bertrand competition game is price at or near zero. (Exactly zero if price cuts can be arbitrarily small.) Note a very competitive market even if there are v ...

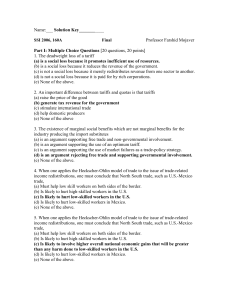

Document

... • Demand curve for the firm is the market demand curve • Firm produces a quantity (Q*) where marginal revenue (MR) is equal to marginal cost (MR) • Exception: Q* = 0 if average variable cost (AVC) is above the demand curve at all levels of output ...

... • Demand curve for the firm is the market demand curve • Firm produces a quantity (Q*) where marginal revenue (MR) is equal to marginal cost (MR) • Exception: Q* = 0 if average variable cost (AVC) is above the demand curve at all levels of output ...

Calculus Worked-Out Problem 14.2: The Problem Consider again

... the long-run market equilibrium price and quantity? How many firms are active, and how much does each produce? Now suppose that demand doubles to Qd =65,800 - 1,200P. If, in the short run, the number of firms is fixed (so that neither entry nor exit is possible) and fixed costs are sunk, what is the ...

... the long-run market equilibrium price and quantity? How many firms are active, and how much does each produce? Now suppose that demand doubles to Qd =65,800 - 1,200P. If, in the short run, the number of firms is fixed (so that neither entry nor exit is possible) and fixed costs are sunk, what is the ...

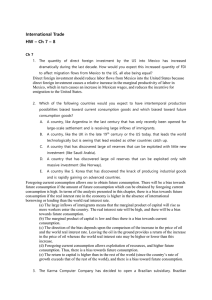

Brander–Spencer model

The Brander–Spencer model is an economic model in international trade originally developed by James Brander and Barbara Spencer in the early 1980s. The model illustrates a situation where, under certain assumptions, a government can subsidize domestic firms to help them in their competition against foreign producers and in doing so enhances national welfare. This conclusion stands in contrast to results from most international trade models, in which government non-interference is socially optimal.The basic model is a variation on the Stackelberg–Cournot ""leader and follower"" duopoly game. Alternatively, the model can be portrayed in game theoretic terms as initially a game with multiple Nash equilibria, with government having the capability of affecting the payoffs to switch to a game with just one equilibrium. Although it is possible for the national government to increase a country's welfare in the model through export subsidies, the policy is of beggar thy neighbor type. This also means that if all governments simultaneously attempt to follow the policy prescription of the model, all countries would wind up worse off.The model was part of the ""New Trade Theory"" that was developed in the late 1970s and early 1980s, which incorporated then recent developments from literature on industrial organization into theories of international trade. In particular, like in many other New Trade Theory models, economies of scale (in this case, in the form of fixed entry costs) play an important role in the Brander–Spencer model.