14ed Bonds

... declining call premium Yield to call: yearly rate of return earned on a bond until it’s called ...

... declining call premium Yield to call: yearly rate of return earned on a bond until it’s called ...

M03_MishkinEakins3427056_08_FMI_C03

... borrower must pay the lender for the use of the loan principal. • Simple Interest Rate: the interest payment divided by the loan principal; the percentage of principal that must be paid as interest to the lender. Convention is to express on an annual basis, irrespective of the loan term. Copyright © ...

... borrower must pay the lender for the use of the loan principal. • Simple Interest Rate: the interest payment divided by the loan principal; the percentage of principal that must be paid as interest to the lender. Convention is to express on an annual basis, irrespective of the loan term. Copyright © ...

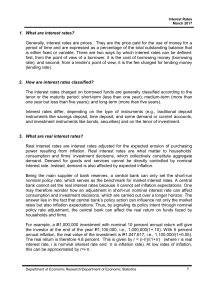

Interest Rates

... Interbank Call Loan Rate - the rate on loans among banks for periods not exceeding 24 hours primarily for the purpose of covering reserve deficiencies. Philippine Interbank Offered Rate (PHIBOR) - represents the simple average of the interest rate offers submitted by participating banks on a dai ...

... Interbank Call Loan Rate - the rate on loans among banks for periods not exceeding 24 hours primarily for the purpose of covering reserve deficiencies. Philippine Interbank Offered Rate (PHIBOR) - represents the simple average of the interest rate offers submitted by participating banks on a dai ...

Directors` Guide to Credit - Federal Reserve Bank of Atlanta

... Financial ratios vary by industry. The Risk Management Association (RMA) provides standard industry ratio benchmarks that can be used to compare the performance of a specific borrower to entities within the same industry. Leverage ratios These measure the percentage of funds that creditors have prov ...

... Financial ratios vary by industry. The Risk Management Association (RMA) provides standard industry ratio benchmarks that can be used to compare the performance of a specific borrower to entities within the same industry. Leverage ratios These measure the percentage of funds that creditors have prov ...

PDF (figures and comments)

... Reinvestment Strategy ▶ Move short-term interest rates first, because we have greater confidence in the likely effects of such a move on the economy ▶ Desirable to have the flexibility to respond if necessary to a large unexpected negative shock by reducing short-term rates ▶ Reducing the size of o ...

... Reinvestment Strategy ▶ Move short-term interest rates first, because we have greater confidence in the likely effects of such a move on the economy ▶ Desirable to have the flexibility to respond if necessary to a large unexpected negative shock by reducing short-term rates ▶ Reducing the size of o ...

Multiple Choice - Marriott School

... In either case, the demand for dollars is weaker, indicating a shift to the left of the demand curve, which lowers the dollar exchange rate. B) The dollar slid broadly amid reports suggesting that expectations for interest-rate increases by the Federal Reserve are overdone. (2 points) The news sugge ...

... In either case, the demand for dollars is weaker, indicating a shift to the left of the demand curve, which lowers the dollar exchange rate. B) The dollar slid broadly amid reports suggesting that expectations for interest-rate increases by the Federal Reserve are overdone. (2 points) The news sugge ...

Ch - Pearson Canada

... is called the future worth of P. The compensation for giving up the use of money. The ability to exchange one cash flow for another at zero cost. An equivalence of cash flows due to the mathematical relationship between time and money. The conventional method of stating the annual interest rate. It ...

... is called the future worth of P. The compensation for giving up the use of money. The ability to exchange one cash flow for another at zero cost. An equivalence of cash flows due to the mathematical relationship between time and money. The conventional method of stating the annual interest rate. It ...

AGEC $424$ EXAM 2 (125 points)

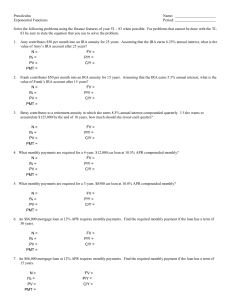

... 2. What are the monthly mortgage payments on a 30-year loan for $150,000 at 5% compounded monthly? a. (6 points) Show work and calculate the monthly payment (round to the penny) ...

... 2. What are the monthly mortgage payments on a 30-year loan for $150,000 at 5% compounded monthly? a. (6 points) Show work and calculate the monthly payment (round to the penny) ...

Coupon bonds - Mentor High

... • Usually have a face value of at least $1,000 – $5,000 is a common denomination ...

... • Usually have a face value of at least $1,000 – $5,000 is a common denomination ...

May 23, 2011

... housing credit, following a similar increase in February. The total amount of mortgages granted in the twelve months up to and including April was about NIS 50 billion, some 25 percent higher than the amount in the previous twelve months. About 47 percent of new mortgages in April were not indexed t ...

... housing credit, following a similar increase in February. The total amount of mortgages granted in the twelve months up to and including April was about NIS 50 billion, some 25 percent higher than the amount in the previous twelve months. About 47 percent of new mortgages in April were not indexed t ...

questions in real estate finance

... Allows the lender to adjust the contract interest rate periodically to reflect changes in market interest rates. This change in the rate is generally reflected by a change in the monthly payment Provisions to limit rate changes Initial rate is generally less than FRM rate ...

... Allows the lender to adjust the contract interest rate periodically to reflect changes in market interest rates. This change in the rate is generally reflected by a change in the monthly payment Provisions to limit rate changes Initial rate is generally less than FRM rate ...

FREE Sample Here - College Test bank

... 30. According to the liquidity premium theory of interest rates A) Long term spot rates are higher than the average of current and expected future short term rates. B) Investors prefer certain maturities and will not normally switch out of those maturities. C) Investors are indifferent between diffe ...

... 30. According to the liquidity premium theory of interest rates A) Long term spot rates are higher than the average of current and expected future short term rates. B) Investors prefer certain maturities and will not normally switch out of those maturities. C) Investors are indifferent between diffe ...

A Brief Guide to Financial Derivatives and Hedge Funds

... Initially, they were used to reduce exposure to changes in foreign exchange rates, interest rates, or stock indexes. For example, if an American company expects payment for a shipment of goods in British Pound Sterling, it may enter into a derivative contract with another party to reduce the risk ...

... Initially, they were used to reduce exposure to changes in foreign exchange rates, interest rates, or stock indexes. For example, if an American company expects payment for a shipment of goods in British Pound Sterling, it may enter into a derivative contract with another party to reduce the risk ...

When US rates rise

... 40 economies seeing rising leading indicators in the past 6 months. This strongly suggests that the pace of US monetary tightening will be more gradual than usually is the case. Indeed Federal Reserve Vice Chair Stanley Fischer recently opined that the pace of rate hikes will probably be more akin t ...

... 40 economies seeing rising leading indicators in the past 6 months. This strongly suggests that the pace of US monetary tightening will be more gradual than usually is the case. Indeed Federal Reserve Vice Chair Stanley Fischer recently opined that the pace of rate hikes will probably be more akin t ...

Loan Intrest

... • Sources of loans – Commercial banks, savings institutions, finance companies, credit unions, some automobile manufacturers, friends, or family members Copyright ©2004 Pearson Education, Inc. All rights reserved. ...

... • Sources of loans – Commercial banks, savings institutions, finance companies, credit unions, some automobile manufacturers, friends, or family members Copyright ©2004 Pearson Education, Inc. All rights reserved. ...

Commercial Mortgage Backed Securities (CMBS)

... • Conduits to sell pools of commercial mortgages – Subsidiaries of commercial banks – MGIC Investment Corp. – Residential Funding Corporation ...

... • Conduits to sell pools of commercial mortgages – Subsidiaries of commercial banks – MGIC Investment Corp. – Residential Funding Corporation ...

solutions to the November 2005 Course FM/2 Examination 1

... The certificates mature at the end of the term. The bank does NOT permit early withdrawals. During the next 6 years the bank will continue to offer certificates of deposit with the same terms and interest rates. An investor initially deposits 10,000 in the bank and withdraws both principal and inter ...

... The certificates mature at the end of the term. The bank does NOT permit early withdrawals. During the next 6 years the bank will continue to offer certificates of deposit with the same terms and interest rates. An investor initially deposits 10,000 in the bank and withdraws both principal and inter ...

Short Duration Income Fund Commentary

... compared with the previous two quarters. For the most part, investors continued to favor riskier assets. The Federal Open Market Committee (FOMC) raised rates 25 basis points at its June meeting, the third increase since December. However, expectations of increased economic stimulus in the United St ...

... compared with the previous two quarters. For the most part, investors continued to favor riskier assets. The Federal Open Market Committee (FOMC) raised rates 25 basis points at its June meeting, the third increase since December. However, expectations of increased economic stimulus in the United St ...

chapter06 - IIS-RU

... A bond having a claim on assets only after the senior debt has been paid off in the event of liquidation ...

... A bond having a claim on assets only after the senior debt has been paid off in the event of liquidation ...

Interest

Interest is money paid by a borrower to a lender for a credit or a similar liability. Important examples are bond yields, interest paid for bank loans, and returns on savings. Interest differs from profit in that it is paid to a lender, whereas profit is paid to an owner. In economics, the various forms of credit are also referred to as loanable funds.When money is borrowed, interest is typically calculated as a percentage of the principal, the amount owed to the lender. The percentage of the principal that is paid over a certain period of time (typically a year) is called the interest rate. Interest rates are market prices which are determined by supply and demand. They are generally positive because loanable funds are scarce.Interest is often compounded, which means that interest is earned on prior interest in addition to the principal. The total amount of debt grows exponentially, and its mathematical study led to the discovery of the number e. In practice, interest is most often calculated on a daily, monthly, or yearly basis, and its impact is influenced greatly by its compounding rate.