Savings and Investing

... © 2008. Oklahoma State Department of Education. All rights reserved. 30 ...

... © 2008. Oklahoma State Department of Education. All rights reserved. 30 ...

Asset Bubbles, Inflation, and Agricultural Land Values

... increased by 13.6 percent. However, note the average of 9.6 percent increase in values for three years in the sales data followed by a 13.1 percent increase in 2011. The sales data values are lower in 2007, but values in 2011 are over 14 percent higher. Shultz (2006) reports by comparing land values ...

... increased by 13.6 percent. However, note the average of 9.6 percent increase in values for three years in the sales data followed by a 13.1 percent increase in 2011. The sales data values are lower in 2007, but values in 2011 are over 14 percent higher. Shultz (2006) reports by comparing land values ...

Document

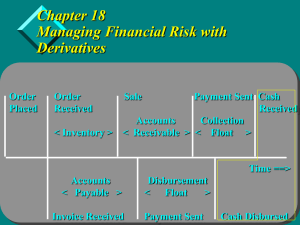

... react to change more rapidly than others, because credit perceptions differ from market to market, and because receptivity to specific debt structures differs from market to market. If, for instance, a corporation wants term floating-rate funds but finds that the market for its fixed-rate debt is co ...

... react to change more rapidly than others, because credit perceptions differ from market to market, and because receptivity to specific debt structures differs from market to market. If, for instance, a corporation wants term floating-rate funds but finds that the market for its fixed-rate debt is co ...

Carbaugh, International Economics 9e, Chapter 14

... Balance of payments surplus would expand money supply; deficit would shrink money supply By the classical quantity theory of money, increases in the money supply led directly to an increase in overall prices (and a shrinking money supply caused overall prices to fall) Carbaugh, Chap. 14 ...

... Balance of payments surplus would expand money supply; deficit would shrink money supply By the classical quantity theory of money, increases in the money supply led directly to an increase in overall prices (and a shrinking money supply caused overall prices to fall) Carbaugh, Chap. 14 ...

Residential mortgage lending for underserved communities: recent

... right-to-purchase feature of the properties in the pool. When a property is purchased, it is released from the security at a premium, which Moody’s noted as a “credit positive” in their ratings rationale.7 The secondary market for HPA’s properties may help the company expand their reach in existing ...

... right-to-purchase feature of the properties in the pool. When a property is purchased, it is released from the security at a premium, which Moody’s noted as a “credit positive” in their ratings rationale.7 The secondary market for HPA’s properties may help the company expand their reach in existing ...

The Role of Interest Rates in the Brazilian Business Cycles

... and zt is a random productivity shock which is assumed to follow a first-order Markov process. To capture the empirical evidence discussed in Section 2, I assume that firms face working capital constraints. In particular, I suppose that payments and receipts are not perfectly synchronized. In the begi ...

... and zt is a random productivity shock which is assumed to follow a first-order Markov process. To capture the empirical evidence discussed in Section 2, I assume that firms face working capital constraints. In particular, I suppose that payments and receipts are not perfectly synchronized. In the begi ...

Credit Unions and Caisses Populaires SECTOR OUTLOOK 3Q16

... provided below) are anticipated to restrain residential investment while lessening household burdens. Growth in exports in 2017 and 2018 are expected to be slower than previously forecast due to lower estimates of global demand, US growth that appears less favourable to Canadian exports, and ongoing ...

... provided below) are anticipated to restrain residential investment while lessening household burdens. Growth in exports in 2017 and 2018 are expected to be slower than previously forecast due to lower estimates of global demand, US growth that appears less favourable to Canadian exports, and ongoing ...

Aging and Deflation from a Fiscal Perspective

... (OECD) countries, implying that countries facing population aging were more likely to experience disinflation in the previous decade (see Shirakawa [2012]). In particular, as shown in Figure 2, Japan suffered from concurrent aging and deflation during the past two decades. While disinflation is presentl ...

... (OECD) countries, implying that countries facing population aging were more likely to experience disinflation in the previous decade (see Shirakawa [2012]). In particular, as shown in Figure 2, Japan suffered from concurrent aging and deflation during the past two decades. While disinflation is presentl ...

403(b) – Vendor Charge Comparison Annuities

... Fixed Annuities come in two basic types. The Standard Interest annuity is much like a traditional savings account or certificate of deposit. Interest is credited daily and interest rates are determined by the life insurance company on a periodic basis. There are also gurantees of principal and minim ...

... Fixed Annuities come in two basic types. The Standard Interest annuity is much like a traditional savings account or certificate of deposit. Interest is credited daily and interest rates are determined by the life insurance company on a periodic basis. There are also gurantees of principal and minim ...

The Puzzle of Persistently Negative Interest Rate

... in advanced economies—but real interest rates should unambiguously be no lower than in advanced economies. Growth theory provides good grounds to expect faster growth, but also higher real interest rates. For economies closed to financial flows, but with competitive domestic financial markets, the r ...

... in advanced economies—but real interest rates should unambiguously be no lower than in advanced economies. Growth theory provides good grounds to expect faster growth, but also higher real interest rates. For economies closed to financial flows, but with competitive domestic financial markets, the r ...

The Sinister Side of Cash

... Some might argue that scaling back U.S. dollars will work only if there is coordination among all the major economies, since American criminals and tax evaders will just turn to euros if they have to. This is very unlikely. Few U.S. retail outlets accept euros, banks already have to file reports on ...

... Some might argue that scaling back U.S. dollars will work only if there is coordination among all the major economies, since American criminals and tax evaders will just turn to euros if they have to. This is very unlikely. Few U.S. retail outlets accept euros, banks already have to file reports on ...

an econometric analysis of effect of changes in interest rates on

... people will build up an inflationary psychology, i.e. they expect more inflationary effect in future. Suppliers will expand their investment outlet to supply more and this expansionary investment demand will make price to rise more. Also financial institutions expect price to rise more and therefore ...

... people will build up an inflationary psychology, i.e. they expect more inflationary effect in future. Suppliers will expand their investment outlet to supply more and this expansionary investment demand will make price to rise more. Also financial institutions expect price to rise more and therefore ...

Chapter 21

... rate, reacts to the inflation rate, : r r where r autonomous component of r responsiveness of r to inflation ...

... rate, reacts to the inflation rate, : r r where r autonomous component of r responsiveness of r to inflation ...

BONDS

... • A d____ instrument issued by governments, corporations and other entities in order to finance projects or activities. A l____ that investors make to the bond’s i______. Term used for the price of a bond on primary market? • F____ value. What is the face value of a bond? • The amount l_____ to the ...

... • A d____ instrument issued by governments, corporations and other entities in order to finance projects or activities. A l____ that investors make to the bond’s i______. Term used for the price of a bond on primary market? • F____ value. What is the face value of a bond? • The amount l_____ to the ...

Chapter 10

... investment to do things like replace old factories and equipment, or to buy more and better capital goods. Plays a major role in our nation’s longterm economic growth and future living standards. Higher savings and investment contribute to increased productivity and stronger economic growth. ...

... investment to do things like replace old factories and equipment, or to buy more and better capital goods. Plays a major role in our nation’s longterm economic growth and future living standards. Higher savings and investment contribute to increased productivity and stronger economic growth. ...

Chapter 9

... Change in value of the long futures position = - $25 (110) (70) = - $192,500 The hedge was successful in the sense that the bank was protected against a decline in interest rates. In this case, rates increased such that the bank gained on the cash portfolio and lost on the futures position. There w ...

... Change in value of the long futures position = - $25 (110) (70) = - $192,500 The hedge was successful in the sense that the bank was protected against a decline in interest rates. In this case, rates increased such that the bank gained on the cash portfolio and lost on the futures position. There w ...

This PDF is a selection from a published volume from... National Bureau of Economic Research

... zero short-term interest rate often casts worries because zero rate is regarded as a natural lower boundary of a so called liquidity trap. It is commonly believed that the monetary policy without coordination with the expansionary fiscal policy would be ineffective in such a situation. However, the i ...

... zero short-term interest rate often casts worries because zero rate is regarded as a natural lower boundary of a so called liquidity trap. It is commonly believed that the monetary policy without coordination with the expansionary fiscal policy would be ineffective in such a situation. However, the i ...

Download pdf | 371 KB |

... uncertainty about what the right model of the economy is; the possibility that information might be misinterpreted; different views amongst policy makers within the central banks – are just that: real. The second simple point I want to make is that much of the most vocal recent criticism of guidance ...

... uncertainty about what the right model of the economy is; the possibility that information might be misinterpreted; different views amongst policy makers within the central banks – are just that: real. The second simple point I want to make is that much of the most vocal recent criticism of guidance ...

BM200-08 Cash Management 9May05

... • The APY is the yield or return number you should use when comparing different cash management alternatives • Financial institutions are required by law to state the APY which converts the different interest rates into similar compounding periods • 2. Consider safety • Some alternatives are explici ...

... • The APY is the yield or return number you should use when comparing different cash management alternatives • Financial institutions are required by law to state the APY which converts the different interest rates into similar compounding periods • 2. Consider safety • Some alternatives are explici ...

The Power of Forward Guidance Revisited

... the relative price of consumption between quarters 20 and 21 (since it is the real interest rate in quarter 20 that changes), but leaves the relative price of consumption for any two dates before quarter 20 and any two dates after quarter 20 unchanged. This implies that consumption growth can only d ...

... the relative price of consumption between quarters 20 and 21 (since it is the real interest rate in quarter 20 that changes), but leaves the relative price of consumption for any two dates before quarter 20 and any two dates after quarter 20 unchanged. This implies that consumption growth can only d ...

Chapter 7 - Irfan Lal

... using this technique is to adjust the federal funds rate the rate at which banks borrow reserves from each other. ...

... using this technique is to adjust the federal funds rate the rate at which banks borrow reserves from each other. ...

Interest

Interest is money paid by a borrower to a lender for a credit or a similar liability. Important examples are bond yields, interest paid for bank loans, and returns on savings. Interest differs from profit in that it is paid to a lender, whereas profit is paid to an owner. In economics, the various forms of credit are also referred to as loanable funds.When money is borrowed, interest is typically calculated as a percentage of the principal, the amount owed to the lender. The percentage of the principal that is paid over a certain period of time (typically a year) is called the interest rate. Interest rates are market prices which are determined by supply and demand. They are generally positive because loanable funds are scarce.Interest is often compounded, which means that interest is earned on prior interest in addition to the principal. The total amount of debt grows exponentially, and its mathematical study led to the discovery of the number e. In practice, interest is most often calculated on a daily, monthly, or yearly basis, and its impact is influenced greatly by its compounding rate.