Read now

... group of owners who invest for the long term. Timber ownership is dominated by financial institutions—Timber Investment Management Organizations (TIMOs) and Real Estate Investment Trusts (REITs)—concentrated in relatively few companies. Conversely, farm assets are owned primarily by individual farme ...

... group of owners who invest for the long term. Timber ownership is dominated by financial institutions—Timber Investment Management Organizations (TIMOs) and Real Estate Investment Trusts (REITs)—concentrated in relatively few companies. Conversely, farm assets are owned primarily by individual farme ...

ProposedRuleAttach2015-00056

... Any interested person may participate in the rule making through submission of written data, views and arguments to the Division of Real Estate. Persons are requested to submit data, views and arguments to the Division of Real Estate in writing no less than ten (10) days prior to the hearing date an ...

... Any interested person may participate in the rule making through submission of written data, views and arguments to the Division of Real Estate. Persons are requested to submit data, views and arguments to the Division of Real Estate in writing no less than ten (10) days prior to the hearing date an ...

Deficits and Inflation - Research Showcase @ CMU

... government spending. These efforts are an attempt to compute some measure of total government borrowing, based on the apparent belief that every dollar of government borrowing adds to the government "deficit." Others include government loan guarantees as a measure of the borrowing sponsored by gover ...

... government spending. These efforts are an attempt to compute some measure of total government borrowing, based on the apparent belief that every dollar of government borrowing adds to the government "deficit." Others include government loan guarantees as a measure of the borrowing sponsored by gover ...

The euro-dollar exchange rate IN-DEPTH

... the respective current account balance positions (CAP). The country with a weaker current account position tends to have a weaker currency (Edwards, 1989). The country with a current account deficit and with limited foreign currency reserves at its disposal may be forced by financial markets to depr ...

... the respective current account balance positions (CAP). The country with a weaker current account position tends to have a weaker currency (Edwards, 1989). The country with a current account deficit and with limited foreign currency reserves at its disposal may be forced by financial markets to depr ...

Pension Discount Rates: FASB ASC 715

... At the end of each fiscal year, plan sponsors must select a discount rate to use in valuing the liabilities of their pension plan for GAAP accounting purposes. As a result, the choice of discount rates will affect the balance sheet and credit rating. In addition, the disclosed discount rate will be ...

... At the end of each fiscal year, plan sponsors must select a discount rate to use in valuing the liabilities of their pension plan for GAAP accounting purposes. As a result, the choice of discount rates will affect the balance sheet and credit rating. In addition, the disclosed discount rate will be ...

slide 1 of 2

... ©2016 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or in part. ...

... ©2016 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or in part. ...

1 A $1000 bond has a coupon of 6% and matures after

... capital structure. Compare this balance sheet with the firm's current balance sheet. What course of action should the firm take? Assets =$100, Debt $?, Equity $? c) As a firm initially substitutes debt for equity financing, what happens to the cost of capital, and why? d) If a firm uses too much deb ...

... capital structure. Compare this balance sheet with the firm's current balance sheet. What course of action should the firm take? Assets =$100, Debt $?, Equity $? c) As a firm initially substitutes debt for equity financing, what happens to the cost of capital, and why? d) If a firm uses too much deb ...

Joshua A

... given. Within each period exchange occurs and allows the home consumers to trade the domestic product (x) with the foreign good (Y). The two goods are nonstorable, and the consumer can carry wealth from period 0 to 1 only by ...

... given. Within each period exchange occurs and allows the home consumers to trade the domestic product (x) with the foreign good (Y). The two goods are nonstorable, and the consumer can carry wealth from period 0 to 1 only by ...

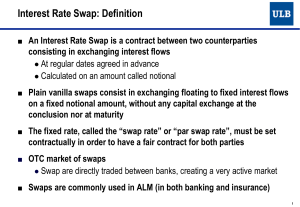

Interest Rate Swap

... ● In T1: Investment of nominal values of the expired bonds in new bonds with same maturity as the forward swap (if possible), and new coupon rate C1. ● From T1: The company receives a fixed coupon rate C1 and the fixed rate K1 of ...

... ● In T1: Investment of nominal values of the expired bonds in new bonds with same maturity as the forward swap (if possible), and new coupon rate C1. ● From T1: The company receives a fixed coupon rate C1 and the fixed rate K1 of ...

GMO: Six Impossible Things Before Breakfast

... One thing to note that truly is different this time is that past periods of financial repression have generally been achieved with high(ish) inflation. This is the first time we have seen low inflation and the use of negative nominal interest rates in the case of some central banks. As a quick asid ...

... One thing to note that truly is different this time is that past periods of financial repression have generally been achieved with high(ish) inflation. This is the first time we have seen low inflation and the use of negative nominal interest rates in the case of some central banks. As a quick asid ...

background on savings institutions

... Savings institutions are classified as either stock owned or mutual (owned by depositors). Although most SIs are mutual, many SIs have shifted their ownership structure from depositors to shareholders through what is known as a mutual-to-stock conversion. This conversion allows SIs to obtain additio ...

... Savings institutions are classified as either stock owned or mutual (owned by depositors). Although most SIs are mutual, many SIs have shifted their ownership structure from depositors to shareholders through what is known as a mutual-to-stock conversion. This conversion allows SIs to obtain additio ...

Summary of the EU`s new risk retention rules as they relate to

... illiquidity premium for non-compliant deals may reduce over time as more transactions – both compliant and non-compliant – are issued and the CLO investor base grows. Affected investors will also want to know whether CLO transactions launched prior to 1 January 2011 will become subject to the EU ri ...

... illiquidity premium for non-compliant deals may reduce over time as more transactions – both compliant and non-compliant – are issued and the CLO investor base grows. Affected investors will also want to know whether CLO transactions launched prior to 1 January 2011 will become subject to the EU ri ...

On the Predictive Power of Interest Rates and Internet Rate Spreads

... potential problem for the use of this variable in the new index of leading indicators proposed by Stock and Watson. Given the superiority of the commercial paperTreasury bill spread documented in Section I, in Section II the focus is narrowed to inquire why this particular spread has historically be ...

... potential problem for the use of this variable in the new index of leading indicators proposed by Stock and Watson. Given the superiority of the commercial paperTreasury bill spread documented in Section I, in Section II the focus is narrowed to inquire why this particular spread has historically be ...

The Role of Interest Rate Swaps in Corporate

... market are yet to be fully understood, financial economists have proposed a number of different hypotheses to explain how and why firms use interest rate swaps. The early explanation, popular among market participants, was that interest rate swaps lowered financing costs by making it possible for fi ...

... market are yet to be fully understood, financial economists have proposed a number of different hypotheses to explain how and why firms use interest rate swaps. The early explanation, popular among market participants, was that interest rate swaps lowered financing costs by making it possible for fi ...

Decision Avoidance and Deposit Interest Rate Setting

... The type of individual prone to such behavioural biases within financial markets has also been examined. Agnew (2006) reports more highly paid employees tend to make better financial decisions and in most cases women have better financial performance and men display more risky investment behaviours. ...

... The type of individual prone to such behavioural biases within financial markets has also been examined. Agnew (2006) reports more highly paid employees tend to make better financial decisions and in most cases women have better financial performance and men display more risky investment behaviours. ...

Measuring the Stance of Monetary Policy on and off the Zero Lower

... assumption is that investors engage in this activity on an ongoing basis so that there is no opportunity to profit from such trades for any sustainable period of time. However, imposing no-arbitrage restrictions on bond yields of different maturities might be restrictive, especially during the finan ...

... assumption is that investors engage in this activity on an ongoing basis so that there is no opportunity to profit from such trades for any sustainable period of time. However, imposing no-arbitrage restrictions on bond yields of different maturities might be restrictive, especially during the finan ...

Mensch tracht, und Gott lacht

... that the central bank will continue to do what it sees as most appropriate over time. In the absence of a more precise statement about what constitutes “appropriate” this is probably about as vague as one can imagine. At the other end of the spectrum is an explicit commitment that policy will be set ...

... that the central bank will continue to do what it sees as most appropriate over time. In the absence of a more precise statement about what constitutes “appropriate” this is probably about as vague as one can imagine. At the other end of the spectrum is an explicit commitment that policy will be set ...

Read Paper - Economics

... beneficial for the country with positive interest rates in financial autarky? The answer to this question may be yes and we show this formally in the model. Financial autarky raises welfare by maintaining full employment and higher consumption levels but may reduce welfare by impairing the ability o ...

... beneficial for the country with positive interest rates in financial autarky? The answer to this question may be yes and we show this formally in the model. Financial autarky raises welfare by maintaining full employment and higher consumption levels but may reduce welfare by impairing the ability o ...

Chapter 8 The Money Markets

... 13) A banker’s acceptance is an order to pay a specified amount of money to the bearer on a given date. Banker’s acceptances have been used since the twelfth century. Answer: TRUE 14) Interest rates on banker’s acceptances are low because the risk of default is very low. Answer: TRUE ...

... 13) A banker’s acceptance is an order to pay a specified amount of money to the bearer on a given date. Banker’s acceptances have been used since the twelfth century. Answer: TRUE 14) Interest rates on banker’s acceptances are low because the risk of default is very low. Answer: TRUE ...

Interest

Interest is money paid by a borrower to a lender for a credit or a similar liability. Important examples are bond yields, interest paid for bank loans, and returns on savings. Interest differs from profit in that it is paid to a lender, whereas profit is paid to an owner. In economics, the various forms of credit are also referred to as loanable funds.When money is borrowed, interest is typically calculated as a percentage of the principal, the amount owed to the lender. The percentage of the principal that is paid over a certain period of time (typically a year) is called the interest rate. Interest rates are market prices which are determined by supply and demand. They are generally positive because loanable funds are scarce.Interest is often compounded, which means that interest is earned on prior interest in addition to the principal. The total amount of debt grows exponentially, and its mathematical study led to the discovery of the number e. In practice, interest is most often calculated on a daily, monthly, or yearly basis, and its impact is influenced greatly by its compounding rate.