Abnormal Returns, Risk, and Options in Large Data Sets

... have periods of quiescence and turbulence. A popular model for this feature is the class of ARCH processes, see Engle (1982). The ARCH model relates current variance to the past squared realizations. Kearns and Pagan (1997) considered how this second moment dependence might in uence the properties o ...

... have periods of quiescence and turbulence. A popular model for this feature is the class of ARCH processes, see Engle (1982). The ARCH model relates current variance to the past squared realizations. Kearns and Pagan (1997) considered how this second moment dependence might in uence the properties o ...

Abstract Data Types

... O(1) Link new node to Head void list.AddBack(T value); O(1) Link new node to Tail T value = list.DeleteFront(); O(1) remove Head node T value = list.DeleteBack(); O(1) remove Tail node Iterator iter = list.Insert(T value); O(1) link new node after current node Iterator iter = list.Remove(); O(1) rem ...

... O(1) Link new node to Head void list.AddBack(T value); O(1) Link new node to Tail T value = list.DeleteFront(); O(1) remove Head node T value = list.DeleteBack(); O(1) remove Tail node Iterator iter = list.Insert(T value); O(1) link new node after current node Iterator iter = list.Remove(); O(1) rem ...

Scapegoat trees and splay trees

... First let’s consider the simple case where we start with a perfectly-balanced tree, and we only want to perform searches and deletions. To get good search and delete times, we will use a technique called global rebuilding. When we get a delete request, we locate and mark the node to be deleted, but ...

... First let’s consider the simple case where we start with a perfectly-balanced tree, and we only want to perform searches and deletions. To get good search and delete times, we will use a technique called global rebuilding. When we get a delete request, we locate and mark the node to be deleted, but ...

A-View-from-the-Desk

... ability to perform a specific function in both a falling and rising rate environment. As we mentioned, prices on 10-yr and 15-yr collateral are down almost 5 points over the past two months. Therefore, if rates fall these pools should have plenty of room for price appreciation, creating a nice total ...

... ability to perform a specific function in both a falling and rising rate environment. As we mentioned, prices on 10-yr and 15-yr collateral are down almost 5 points over the past two months. Therefore, if rates fall these pools should have plenty of room for price appreciation, creating a nice total ...

CPS 214: Networks and Distributed Systems Lecture 4

... N25 calls its successor N40 to return its predecessor Set its successor to N36 Notifies N36 it is predecessor ...

... N25 calls its successor N40 to return its predecessor Set its successor to N36 Notifies N36 it is predecessor ...

Linked list

... insertion of new element at one end and deletion of an element at the other end. The end at which the deletion of an element takes place is called as front. Which insertion of new element can take place is called as rear. Queue is also called as first-in-first-out (FIFO). ...

... insertion of new element at one end and deletion of an element at the other end. The end at which the deletion of an element takes place is called as front. Which insertion of new element can take place is called as rear. Queue is also called as first-in-first-out (FIFO). ...

Chapter 02 Asset Classes and Financial Instruments

... 52. June call and put options on King Books Inc are available with exercise prices of $30, $35 and $40. Among the different exercise prices, the call option with the _____ exercise price and the put option with the _____ exercise price will have the greatest value. A. $40; $30 B. $30; $40 C. $35; $3 ...

... 52. June call and put options on King Books Inc are available with exercise prices of $30, $35 and $40. Among the different exercise prices, the call option with the _____ exercise price and the put option with the _____ exercise price will have the greatest value. A. $40; $30 B. $30; $40 C. $35; $3 ...

Document

... markets, pushing the Dow Jones Industrial Average to its secondlargest point gain ever and putting the blue-chip index within shooting distance of a record just weeks after it was reeling.” December 1999.Good news on the economy, leading to a decrease in stock prices: “Good economic news was bad n ...

... markets, pushing the Dow Jones Industrial Average to its secondlargest point gain ever and putting the blue-chip index within shooting distance of a record just weeks after it was reeling.” December 1999.Good news on the economy, leading to a decrease in stock prices: “Good economic news was bad n ...

NBER WORKING PAPER SERIES FINANCIAL CRISES AND LIQUIDITY SHOCKS: A BANK-RUN PERSPECTIVE

... See Calvo (1979) for a more detailed analysis of monetary models with perfect foresight. Using similar techniques, one can show that the present model boils down to two differential equations (in m and p), with no initial conditions. The linear approximation at the steady state displays two positive ...

... See Calvo (1979) for a more detailed analysis of monetary models with perfect foresight. Using similar techniques, one can show that the present model boils down to two differential equations (in m and p), with no initial conditions. The linear approximation at the steady state displays two positive ...

FRBSF L CONOMIC

... Data and methodology Risk premiums cannot be directly observed and must be estimated. A financial asset’s risk premium consists of the price and the quantity of risk. A conventional measure for equities uses the one-year-ahead forward earnings yield, which is expected earnings over the next four qua ...

... Data and methodology Risk premiums cannot be directly observed and must be estimated. A financial asset’s risk premium consists of the price and the quantity of risk. A conventional measure for equities uses the one-year-ahead forward earnings yield, which is expected earnings over the next four qua ...

An Experienced View on Markets and Investing

... This model is now widely used both in academic research and by practitioners. Litterman: Do you view the value premium and the size premium as risk factors? Fama: I do. They are both associated with covariation in returns that can’t be diversified away. These sources of variance seem to have differen ...

... This model is now widely used both in academic research and by practitioners. Litterman: Do you view the value premium and the size premium as risk factors? Fama: I do. They are both associated with covariation in returns that can’t be diversified away. These sources of variance seem to have differen ...

Real Estate and Land Use

... • For firms, space is a factor of production. • For households space is a commodity • Supply of real estate comes from the construction sector and depends on the price of those assets relative to the cost of replacing or constructing ...

... • For firms, space is a factor of production. • For households space is a commodity • Supply of real estate comes from the construction sector and depends on the price of those assets relative to the cost of replacing or constructing ...

Relativistic Red-Black Trees - PDXScholar

... The tree is balanced by assigning a color to each node (red or black) and preserving the following properties: 1. Both children of a red node are black. 2. The black depth of every leaf is the same. The black depth is the number of black nodes encountered on the path from the root to the leaf. These ...

... The tree is balanced by assigning a color to each node (red or black) and preserving the following properties: 1. Both children of a red node are black. 2. The black depth of every leaf is the same. The black depth is the number of black nodes encountered on the path from the root to the leaf. These ...

Chap 4 problem solutions

... payments and ending value. Note that long-term debt securities also have some reinvestment rate risk because their interest payments have to be reinvested at prevailing rates. p. The term structure of interest rates is the relationship between yield to maturity and term to maturity for bonds of a si ...

... payments and ending value. Note that long-term debt securities also have some reinvestment rate risk because their interest payments have to be reinvested at prevailing rates. p. The term structure of interest rates is the relationship between yield to maturity and term to maturity for bonds of a si ...

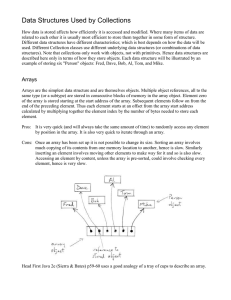

Data Structures

... Data Structures Used by Collections How data is stored affects how efficiently it is accessed and modified. Where many items of data are related to each other it is usually most efficient to store them together in some form of structure. Different data structures have different characteristics; whic ...

... Data Structures Used by Collections How data is stored affects how efficiently it is accessed and modified. Where many items of data are related to each other it is usually most efficient to store them together in some form of structure. Different data structures have different characteristics; whic ...

Path Queries on Compressed XML

... compression when it is not necessary. The idea of the algorithm(s) is to traverse the DAG of the input instance starting from the root, visiting each node v only once. We choose a new selection of v on the basis of the selection of its ancestors, and split v if different predecessors of v require di ...

... compression when it is not necessary. The idea of the algorithm(s) is to traverse the DAG of the input instance starting from the root, visiting each node v only once. We choose a new selection of v on the basis of the selection of its ancestors, and split v if different predecessors of v require di ...

Scribe Notes

... are given k sorted lists L1 , . . . , Lk each of length n, and you want to find the successor of x in each of them. One could trivially solve this problem with k separate binary searches, resulting in a runtime of O(k log n). Fractional cascading allows this problem to be solved in O(k + log n). To ...

... are given k sorted lists L1 , . . . , Lk each of length n, and you want to find the successor of x in each of them. One could trivially solve this problem with k separate binary searches, resulting in a runtime of O(k log n). Fractional cascading allows this problem to be solved in O(k + log n). To ...

Lattice model (finance)

For other meanings, see lattice model (disambiguation)In finance, a lattice model [1] is a technique applied to the valuation of derivatives, where, because of path dependence in the payoff, 1) a discretized model is required and 2) Monte Carlo methods fail to account for optimal decisions to terminate the derivative by early exercise. For equity options, a typical example would be pricing an American option, where a decision as to option exercise is required at ""all"" times (any time) before and including maturity. A continuous model, on the other hand, such as Black Scholes, would only allow for the valuation of European options, where exercise is on the option's maturity date. For interest rate derivatives lattices are additionally useful in that they address many of the issues encountered with continuous models, such as pull to par.