Option-Implied Volatility Measures and Stock

... relationship between stock returns and the corresponding option-implied volatility measure. However, portfolio level analysis might suffer from the aggregation effect due to omission of useful information in the cross-section because it does not control for the effects of other option-implied volat ...

... relationship between stock returns and the corresponding option-implied volatility measure. However, portfolio level analysis might suffer from the aggregation effect due to omission of useful information in the cross-section because it does not control for the effects of other option-implied volat ...

Chapter 6 Bonds, Bond Prices and the Determination of Interest Rates

... • You notice in the newspaper a company advertising that their bond mutual funds returned 13.5% last year. • You remember interest rates being fairly low and the paper backs that up. • How is the ad correct? • The ad is talking about last year’s returns, when interest rates were falling. • When an ...

... • You notice in the newspaper a company advertising that their bond mutual funds returned 13.5% last year. • You remember interest rates being fairly low and the paper backs that up. • How is the ad correct? • The ad is talking about last year’s returns, when interest rates were falling. • When an ...

Chapter 6 Bonds, Bond Prices and the Determination of Interest Rates

... • You notice in the newspaper a company advertising that their bond mutual funds returned 13.5% last year. • You remember interest rates being fairly low and the paper backs that up. • How is the ad correct? • The ad is talking about last year’s returns, when interest rates were falling. • When an ...

... • You notice in the newspaper a company advertising that their bond mutual funds returned 13.5% last year. • You remember interest rates being fairly low and the paper backs that up. • How is the ad correct? • The ad is talking about last year’s returns, when interest rates were falling. • When an ...

Retail Commercial Real Estate Market Richmond, Virginia

... Management Association), CPM (Certified Property Manager), NABE (National Association of Business Economists) and many more. In other words, the industry is very well trained. ...

... Management Association), CPM (Certified Property Manager), NABE (National Association of Business Economists) and many more. In other words, the industry is very well trained. ...

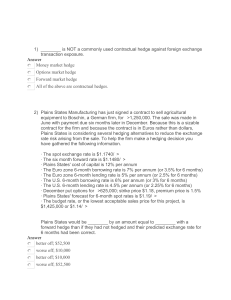

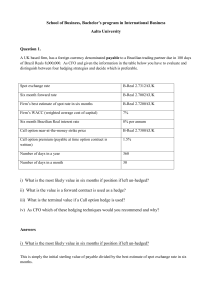

______ is NOT a commonly used contractual hedge against foreign

... premium) and leaves JPY50m portion of the exposure uncovered. At the time the option was purchased, the spot rate was JPY117. On February 1st, Futures contract price is USD0.8130 per 100 JPY and the JPY/USD spot price is 122. Calculate the effective amount of USD company will clear on February 1st. ...

... premium) and leaves JPY50m portion of the exposure uncovered. At the time the option was purchased, the spot rate was JPY117. On February 1st, Futures contract price is USD0.8130 per 100 JPY and the JPY/USD spot price is 122. Calculate the effective amount of USD company will clear on February 1st. ...

stack - CENG METU

... a root node and potentially many levels of additional nodes that form a hierarchy • Nodes that have no children are called leaf nodes ...

... a root node and potentially many levels of additional nodes that form a hierarchy • Nodes that have no children are called leaf nodes ...

ppt - Dave Reed

... a) if middle element is the item being searched for, then SUCCESS b) if middle element is > item being searched for, then binary search the left half c) if middle element is < item being searched for, then binary search the right half ...

... a) if middle element is the item being searched for, then SUCCESS b) if middle element is > item being searched for, then binary search the left half c) if middle element is < item being searched for, then binary search the right half ...

lecture 17

... • Claim: the maximum height of a tree when using height balancing is O(lg n). • Proof: By induction on the number of Union operations used to create the tree. When the tree height is h, the number of nodes is at least 2h. Basis: Clearly true for the first union operation, where h=1 and the resulting ...

... • Claim: the maximum height of a tree when using height balancing is O(lg n). • Proof: By induction on the number of Union operations used to create the tree. When the tree height is h, the number of nodes is at least 2h. Basis: Clearly true for the first union operation, where h=1 and the resulting ...

Seminar 3 - Wednesday 12-10-2016 with answers File

... Dubai frontiers, a small United Arab Emirates (UAE) based leisure company, has a foreign currency denominated payable to an Omani (Oman) trading partner. The payable is due in 90 days and its value is Omani Rials (OMR) 1,000,000. Given the information in the table below you must evaluate each of the ...

... Dubai frontiers, a small United Arab Emirates (UAE) based leisure company, has a foreign currency denominated payable to an Omani (Oman) trading partner. The payable is due in 90 days and its value is Omani Rials (OMR) 1,000,000. Given the information in the table below you must evaluate each of the ...

ppt

... toDo all edges in graph while (num selected < |V|-1 && toDo not empty) { c find and remove smallest edge from toDo if (selected plus c has no cycles) selected.insert(c) What data structures are needed? What is running time? ...

... toDo all edges in graph while (num selected < |V|-1 && toDo not empty) { c find and remove smallest edge from toDo if (selected plus c has no cycles) selected.insert(c) What data structures are needed? What is running time? ...

Tree-Structured Indexes

... Advantages for concurrency control. Fewer I/Os during build. Leaves will be stored sequentially (and linked, of course). Can control “fill factor” on pages. ...

... Advantages for concurrency control. Fewer I/Os during build. Leaves will be stored sequentially (and linked, of course). Can control “fill factor” on pages. ...

PreCalculus

... Ex: 15xy2 – 10 x3y + 25 xy3 = 5xy( 3y – 2x2 + 5y2) IF THERE ARE 2 TERMS: it could be….. Difference of perfect squares: Your answer is the product of two binomials. Take the square root of each term. One binomial is Plus and the other binomial is Subtract. Ex: 4x2 – 25y4 = (2x + 5y2)(2x – 5y2) Sum or ...

... Ex: 15xy2 – 10 x3y + 25 xy3 = 5xy( 3y – 2x2 + 5y2) IF THERE ARE 2 TERMS: it could be….. Difference of perfect squares: Your answer is the product of two binomials. Take the square root of each term. One binomial is Plus and the other binomial is Subtract. Ex: 4x2 – 25y4 = (2x + 5y2)(2x – 5y2) Sum or ...

Binary Heaps

... Properties of Binomial Queue • At most one binomial tree of any height • n nodes binary representation is of size ? deepest tree has height ? number of trees is ? Define: height(forest F) = maxtree T in F { height(T) } Binomial Q with n nodes has height Θ(log n) ...

... Properties of Binomial Queue • At most one binomial tree of any height • n nodes binary representation is of size ? deepest tree has height ? number of trees is ? Define: height(forest F) = maxtree T in F { height(T) } Binomial Q with n nodes has height Θ(log n) ...

Lattice model (finance)

For other meanings, see lattice model (disambiguation)In finance, a lattice model [1] is a technique applied to the valuation of derivatives, where, because of path dependence in the payoff, 1) a discretized model is required and 2) Monte Carlo methods fail to account for optimal decisions to terminate the derivative by early exercise. For equity options, a typical example would be pricing an American option, where a decision as to option exercise is required at ""all"" times (any time) before and including maturity. A continuous model, on the other hand, such as Black Scholes, would only allow for the valuation of European options, where exercise is on the option's maturity date. For interest rate derivatives lattices are additionally useful in that they address many of the issues encountered with continuous models, such as pull to par.