Using Derivatives to Manage Interest Rate Risk

... County Bank (as the buyer) with a six-month maturity based on a $1 million notional principal amount The floating rate is the 3-month LIBOR and the fixed (exercise) rate is 7% Metro Bank would refer to this as a “3 vs. 6” FRA at 7 percent on a $1 million notional amount from County Bank The phrase “ ...

... County Bank (as the buyer) with a six-month maturity based on a $1 million notional principal amount The floating rate is the 3-month LIBOR and the fixed (exercise) rate is 7% Metro Bank would refer to this as a “3 vs. 6” FRA at 7 percent on a $1 million notional amount from County Bank The phrase “ ...

File - Prof H.M.Patel

... This list keeps track of the free space available in the memory and a pointer to this list is stored in a pointer variable Avail (see Figure 5.4). Note that the end of free-storage list is also denoted by storing NULL in the last available block of memory. In this figure,Avail contains 22, hence, ...

... This list keeps track of the free space available in the memory and a pointer to this list is stored in a pointer variable Avail (see Figure 5.4). Note that the end of free-storage list is also denoted by storing NULL in the last available block of memory. In this figure,Avail contains 22, hence, ...

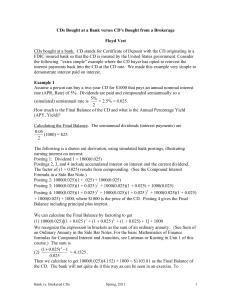

CDs Bought at a Bank verses CD`s Bought from a Brokerage Floyd

... summarize, the CD has earned interest of $103.81 and the principal was repaid. The interest on interest was $3.81. (See the exercises and Side Bar Notes for formulas.) You Try It #1 (a) Do a derivation similar to the above Example 1 for a semiannual two-year bank CD of $10,000 that pays an annual 2 ...

... summarize, the CD has earned interest of $103.81 and the principal was repaid. The interest on interest was $3.81. (See the exercises and Side Bar Notes for formulas.) You Try It #1 (a) Do a derivation similar to the above Example 1 for a semiannual two-year bank CD of $10,000 that pays an annual 2 ...

Download Dissertation

... and θ is the model parameter. Misspecification implies the nonexistence of a parameter θ such that f (X; θ) fits the true model for all X. However, misspecification does not rule out the existence of a parameter θ such that f (x; θ) fits the true model for one value X = x only. Since a parameter gen ...

... and θ is the model parameter. Misspecification implies the nonexistence of a parameter θ such that f (X; θ) fits the true model for all X. However, misspecification does not rule out the existence of a parameter θ such that f (x; θ) fits the true model for one value X = x only. Since a parameter gen ...

Money, Banking, and the Financial System

... •Recently, interest rates on U.S. Treasury notes and corporate bonds have been falling relative to their 30-year averages. •If interest rates on these securities rose back to their historical averages, holders of bonds would suffer losses. •Not surprisingly, many financial advisers have warned inves ...

... •Recently, interest rates on U.S. Treasury notes and corporate bonds have been falling relative to their 30-year averages. •If interest rates on these securities rose back to their historical averages, holders of bonds would suffer losses. •Not surprisingly, many financial advisers have warned inves ...

Solutions to Chapter 1

... The controller’s responsibilities include: supervises accounting, preparation of financial statements, and tax matters. The CFO of a large corporation supervises both the treasurer and the controller. The CFO is responsible for large-scale corporate planning and financial policy. 13. The stock price ...

... The controller’s responsibilities include: supervises accounting, preparation of financial statements, and tax matters. The CFO of a large corporation supervises both the treasurer and the controller. The CFO is responsible for large-scale corporate planning and financial policy. 13. The stock price ...

GEBA MAX - at www.GEBA.com.

... of premium payments, excluding subsequent premium less than 12 months old and adjusted for withdrawals). For owners aged 70-75 at issue, EarningsMax is calculated at 25% of contract earnings (earnings not to exceed a maximum of 100% of premium payments, excluding subsequent premium less than 12 mont ...

... of premium payments, excluding subsequent premium less than 12 months old and adjusted for withdrawals). For owners aged 70-75 at issue, EarningsMax is calculated at 25% of contract earnings (earnings not to exceed a maximum of 100% of premium payments, excluding subsequent premium less than 12 mont ...

Lecture - Binary Tree - Home

... 2. Each subtree is identified as being either left subtree or the right subtree of its parent 3. It may be empty Note: Property 1 says that each node can have maximum two children The order between the children of a node is specified by labeling its children as left child and right child ...

... 2. Each subtree is identified as being either left subtree or the right subtree of its parent 3. It may be empty Note: Property 1 says that each node can have maximum two children The order between the children of a node is specified by labeling its children as left child and right child ...

- PNC.com

... campaign rhetoric and posturing to detailed architecture, design, and policy implementation. Although it’s hard to be an outright contrarian in the current market, the future is far from certain. The sustainability of recent market moves depends on policy makers’ ability to deliver on their promises ...

... campaign rhetoric and posturing to detailed architecture, design, and policy implementation. Although it’s hard to be an outright contrarian in the current market, the future is far from certain. The sustainability of recent market moves depends on policy makers’ ability to deliver on their promises ...

Monetary Policy and Speculative Stock Markets

... the role of learning in an otherwise rational model. This enables to reproduce excess volatility of asset prices as well as a relatively high standard deviation of stock prices. As in my model, under rational expectations a monetary policy that targets asset prices induces a welfare-loss, while it i ...

... the role of learning in an otherwise rational model. This enables to reproduce excess volatility of asset prices as well as a relatively high standard deviation of stock prices. As in my model, under rational expectations a monetary policy that targets asset prices induces a welfare-loss, while it i ...

Lattice model (finance)

For other meanings, see lattice model (disambiguation)In finance, a lattice model [1] is a technique applied to the valuation of derivatives, where, because of path dependence in the payoff, 1) a discretized model is required and 2) Monte Carlo methods fail to account for optimal decisions to terminate the derivative by early exercise. For equity options, a typical example would be pricing an American option, where a decision as to option exercise is required at ""all"" times (any time) before and including maturity. A continuous model, on the other hand, such as Black Scholes, would only allow for the valuation of European options, where exercise is on the option's maturity date. For interest rate derivatives lattices are additionally useful in that they address many of the issues encountered with continuous models, such as pull to par.