Asia Investment Grade Bond Fund

... offered for sale in the United States of America, its territories or possessions and all areas subject to its jurisdiction, or to United States Persons. This document is not intended in any way to indicate or guarantee future investment results as the value of investments may go down as well as up. ...

... offered for sale in the United States of America, its territories or possessions and all areas subject to its jurisdiction, or to United States Persons. This document is not intended in any way to indicate or guarantee future investment results as the value of investments may go down as well as up. ...

submits the following comments in response to the KEMA Draft

... shapes, and sizes that are at least equal to or better than that of the diverse spectrum of incandescent bulbs (e.g., lighting to showcase artwork and home shelf displays, or lighting placed in a “powder room”). Unless markets are defined carefully and in a delimited way, it is difficult to determin ...

... shapes, and sizes that are at least equal to or better than that of the diverse spectrum of incandescent bulbs (e.g., lighting to showcase artwork and home shelf displays, or lighting placed in a “powder room”). Unless markets are defined carefully and in a delimited way, it is difficult to determin ...

Financial Market Structure and Economic Growth

... negatively because a purely monopolistic market tends to impose welfare losses compared with the benchmark of a competitive market. As Pagano (1993) shows market power allows banks to charge higher loan rates and offer savers lower deposit rates. An increased net interest rate margin reduces the equ ...

... negatively because a purely monopolistic market tends to impose welfare losses compared with the benchmark of a competitive market. As Pagano (1993) shows market power allows banks to charge higher loan rates and offer savers lower deposit rates. An increased net interest rate margin reduces the equ ...

Working Paper # 11 EVERYTHING IS NOT A BUBBLE When The

... However, the supply of Japanese bonds, real estate and stocks were restricted. Historically, financial institutions had bought government bonds by direct placement and held them to maturity (Shinkai, 1987) which was why trading activity was rather limited. Similarly, people and companies did not sel ...

... However, the supply of Japanese bonds, real estate and stocks were restricted. Historically, financial institutions had bought government bonds by direct placement and held them to maturity (Shinkai, 1987) which was why trading activity was rather limited. Similarly, people and companies did not sel ...

Influence of foreign bank presence on the level of crediting in Ukraine

... provision in the country they invest in when their parent country suffer economic crisis. Even worse situation occurs when foreign bank subsidiaries leave the host country altogether at the same time thus contributing to crunch of credit market. As for Ukrainian investigations on this issue it shoul ...

... provision in the country they invest in when their parent country suffer economic crisis. Even worse situation occurs when foreign bank subsidiaries leave the host country altogether at the same time thus contributing to crunch of credit market. As for Ukrainian investigations on this issue it shoul ...

Financial instruments

... • In principle, and with regard to most bonds, this type of investment does not offer any uncertainty (amount, date of interim income and capital repayment determined at the time of issue). • Bonds yield a higher return than short-term investments, with a lower risk than equity investments. Generall ...

... • In principle, and with regard to most bonds, this type of investment does not offer any uncertainty (amount, date of interim income and capital repayment determined at the time of issue). • Bonds yield a higher return than short-term investments, with a lower risk than equity investments. Generall ...

Community Development Investment Review: Conference

... nhancing the community development finance field’s access to the capital markets is an important topic and one that I care about quite a bit. Facilitating capital flows to address the economic needs of people in distressed areas is an element of overall economic growth, and so the Federal Reserve Sy ...

... nhancing the community development finance field’s access to the capital markets is an important topic and one that I care about quite a bit. Facilitating capital flows to address the economic needs of people in distressed areas is an element of overall economic growth, and so the Federal Reserve Sy ...

Passthrough Efficiency in the Fed`s New Monetary Policy Setting

... outflow scenario. The amount of HQLA required to meet LCR is higher for banks funded with non-operating wholesale deposits than for banks that are more heavily funded by operating deposits and retail deposits. (For example, J.P. Morgan should be advantaged here, relative to Morgan Stanley.) When mea ...

... outflow scenario. The amount of HQLA required to meet LCR is higher for banks funded with non-operating wholesale deposits than for banks that are more heavily funded by operating deposits and retail deposits. (For example, J.P. Morgan should be advantaged here, relative to Morgan Stanley.) When mea ...

Difference in strategic planning for domestic and international markets

... In addition to factors above, other theories may support the firm’s distinction of strategic planning in domestic and international market. For example, Dunning’s Eclectic paradigm (Dunning, 1988) explains the firms are vary in strategic planning in domestic and international market based on their O ...

... In addition to factors above, other theories may support the firm’s distinction of strategic planning in domestic and international market. For example, Dunning’s Eclectic paradigm (Dunning, 1988) explains the firms are vary in strategic planning in domestic and international market based on their O ...

The Growing Prominence of Non-Cash Collateral

... With regards to term financing, regulators have been pushing firms to extend their liabilities in an effort to reduce market strain related to possible future short-term liquidity pressure. That push has resulted in borrowers seeking more term trade opportunities, typically structured for at least a ...

... With regards to term financing, regulators have been pushing firms to extend their liabilities in an effort to reduce market strain related to possible future short-term liquidity pressure. That push has resulted in borrowers seeking more term trade opportunities, typically structured for at least a ...

Examination Paper, Solutions and Examiner`s Report Certificate in

... Hedging policy RRR does not have a formal hedging policy, although, in the past, occasional hedging deals have been entered into if it was considered that the spot rate was at a favourable level historically. RRR’s Board has delegated responsibility for hedging policy to its Risk Management Committe ...

... Hedging policy RRR does not have a formal hedging policy, although, in the past, occasional hedging deals have been entered into if it was considered that the spot rate was at a favourable level historically. RRR’s Board has delegated responsibility for hedging policy to its Risk Management Committe ...

Saving and Investing in the New Economy

... risk is any chance of loss. In the financial planning field, it is often understood as the quantifiable likelihood of a loss or less-than-expected returns. There are different kinds of risk. For example, a certificate of deposit (CD) requires that money stay deposited for a specific period of time. ...

... risk is any chance of loss. In the financial planning field, it is often understood as the quantifiable likelihood of a loss or less-than-expected returns. There are different kinds of risk. For example, a certificate of deposit (CD) requires that money stay deposited for a specific period of time. ...

Endogenous Liquidity Constraints, Financial Deepening and

... focuses on the households’ demand for credit, this article highlights the role of the supply of credit to households. The rest of the paper proceeds as follows. The structure of the economic system with endogenous liquidity constrained on consumption characterized by money and endogenous growth is o ...

... focuses on the households’ demand for credit, this article highlights the role of the supply of credit to households. The rest of the paper proceeds as follows. The structure of the economic system with endogenous liquidity constrained on consumption characterized by money and endogenous growth is o ...

BASEL I and BASEL II: HISTORY OF AN EVOLUTION

... – Wide swings in risk-based capital requirements – Some individual banks show unreasonably large declines in required capital • As a result, parts of the Basel II Accord have been revised ...

... – Wide swings in risk-based capital requirements – Some individual banks show unreasonably large declines in required capital • As a result, parts of the Basel II Accord have been revised ...

Solutions For Financial Professionals | Russell Investments

... Paul Eitelman in the United States sees a deteriorating outlook for corporate profits and a slightly weaker outlook for gross domestic product (GDP) growth this year. Even so, growth is likely to be robust enough to see the Fed tighten a couple of times this year. He reiterates an underweight prefer ...

... Paul Eitelman in the United States sees a deteriorating outlook for corporate profits and a slightly weaker outlook for gross domestic product (GDP) growth this year. Even so, growth is likely to be robust enough to see the Fed tighten a couple of times this year. He reiterates an underweight prefer ...

Intelligence in Securities Finance: Where Is It Going?

... The next step of market evolution is building up the business models, operations and technology that turn change from the enemy into an opportunity for growth. A common theme in this edition of Securities Finance Monitor is that the scope of change is broad, incisive, and seeping into almost every f ...

... The next step of market evolution is building up the business models, operations and technology that turn change from the enemy into an opportunity for growth. A common theme in this edition of Securities Finance Monitor is that the scope of change is broad, incisive, and seeping into almost every f ...

Can Low Interest Rates be Harmful: An Assessment of the Bank Risk

... regulation may not be effective if the extent of ex ante promises are hard to observe. They suggest raising real interest rates in normal times to prevent banks from making excessive liquidity promises. Cao and Illing (2012) model how financial intermediaries’ incentives for liquidity transformation ...

... regulation may not be effective if the extent of ex ante promises are hard to observe. They suggest raising real interest rates in normal times to prevent banks from making excessive liquidity promises. Cao and Illing (2012) model how financial intermediaries’ incentives for liquidity transformation ...

P a g e 1

... Investor Advisory Group and was the chair of the International Forum of Independent Audit Regulators' Investor and Other Stakeholders Working ...

... Investor Advisory Group and was the chair of the International Forum of Independent Audit Regulators' Investor and Other Stakeholders Working ...

Aucun titre de diapositive

... towards the advanced approach will not be able to compete against the 6 big banks. ...

... towards the advanced approach will not be able to compete against the 6 big banks. ...

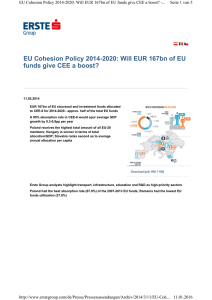

EU Cohesion Policy 2014-2020: Will EUR 167bn of EU funds give

... funds are likely to be redistributed in order to improve the rather weak absorption rate. Infrastructure will be the main priority for 2014- 2020, as the highway network is still far from complete. This is perceived as a major obstacle in attracting foreign investors to the eastern part of the count ...

... funds are likely to be redistributed in order to improve the rather weak absorption rate. Infrastructure will be the main priority for 2014- 2020, as the highway network is still far from complete. This is perceived as a major obstacle in attracting foreign investors to the eastern part of the count ...

An Empirical Analysis of the Determinants of Market Capitalization in

... a well developed stock market is crucial for the mobilization of financial resources for long term investment and thus constitutes one of the major pillars of economic growth . A precursor to this paradox and which has earlier been orchestrated by two opposing views of the Samuelson (1965)-led techn ...

... a well developed stock market is crucial for the mobilization of financial resources for long term investment and thus constitutes one of the major pillars of economic growth . A precursor to this paradox and which has earlier been orchestrated by two opposing views of the Samuelson (1965)-led techn ...

December 9, 2005 Dear Market Participant, Over the past few years

... interest in foreign exchange, has transformed the nature of the relationships among market participants. At the same time, credit and liquidity have become unbundled and repackaged for nontraditional or noninstitutional participants. As the foreign exchange industry continues to evolve rapidly, it i ...

... interest in foreign exchange, has transformed the nature of the relationships among market participants. At the same time, credit and liquidity have become unbundled and repackaged for nontraditional or noninstitutional participants. As the foreign exchange industry continues to evolve rapidly, it i ...

Evaluating Consumer Loans

... Any participation with a correspondent bank in a loan that the bank would not normally approve Loans to a poor credit risk based on the strength of the cosigner Single payment automobile or boat loans Loans secured by existing home furnishings Loans for skydiving equipment and hang gliders ...

... Any participation with a correspondent bank in a loan that the bank would not normally approve Loans to a poor credit risk based on the strength of the cosigner Single payment automobile or boat loans Loans secured by existing home furnishings Loans for skydiving equipment and hang gliders ...

Extra ?`s

... ____ The country of San Lorenzo is currently at its normal level of output (i.e. QAct = QNat). The San Lorenzen government normally collects $120 billion in taxes and spends $120 billion. However, the voters of San Lorenzo recently approved a referendum in which the government will spend $60 billion ...

... ____ The country of San Lorenzo is currently at its normal level of output (i.e. QAct = QNat). The San Lorenzen government normally collects $120 billion in taxes and spends $120 billion. However, the voters of San Lorenzo recently approved a referendum in which the government will spend $60 billion ...

Has Forward Guidance Been Effective?

... economic benefits of committing to accommodation with the potential risks associated with constraining future monetary policy. To allow the FOMC flexibility while still influencing expectations for the future path of interest rates, the Committee chose to issue “more-general rather than more-specifi ...

... economic benefits of committing to accommodation with the potential risks associated with constraining future monetary policy. To allow the FOMC flexibility while still influencing expectations for the future path of interest rates, the Committee chose to issue “more-general rather than more-specifi ...