The Case for lending to Professional Services Firms

... Before the financial crisis of 2007/2008, there was a one stop shop to borrow money. Your local high street bank would make money available to an enormous range of businesses at very attractive rates, and take practically anything as security. Banks lent freely and easily against payment due, stock ...

... Before the financial crisis of 2007/2008, there was a one stop shop to borrow money. Your local high street bank would make money available to an enormous range of businesses at very attractive rates, and take practically anything as security. Banks lent freely and easily against payment due, stock ...

quiz #3 version 2

... 16. Some argued that establishing the FDIC might encourage banks to make risky investments because… a. people were afraid to put their money back in the banks. b. if the government insured all deposits, the banks would not assume any of the risk. c. the FDIC prohibited most banks from making loans. ...

... 16. Some argued that establishing the FDIC might encourage banks to make risky investments because… a. people were afraid to put their money back in the banks. b. if the government insured all deposits, the banks would not assume any of the risk. c. the FDIC prohibited most banks from making loans. ...

Answers - UCSB Economics

... the rate of monetary expansion. The real revenue from seigniorage equals the money growth rate times the real balances held by the public. A greater monetary growth leads to a greater expected future inflation rate and then to a greater nominal interest rate. This reduces the real balances people ar ...

... the rate of monetary expansion. The real revenue from seigniorage equals the money growth rate times the real balances held by the public. A greater monetary growth leads to a greater expected future inflation rate and then to a greater nominal interest rate. This reduces the real balances people ar ...

chapter 18

... deliberately incur deficits when the economy is in recession, so as to stimulate demand incur surpluses when the economy is booming, so as to dampen demand ...

... deliberately incur deficits when the economy is in recession, so as to stimulate demand incur surpluses when the economy is booming, so as to dampen demand ...

Joao Carlos Ferraz (ES)

... The starting point: each country, a specific model for the financing of economic activities ...

... The starting point: each country, a specific model for the financing of economic activities ...

Development Banks

... The starting point: each country, a specific model for the financing of economic activities ...

... The starting point: each country, a specific model for the financing of economic activities ...

Chapter 18

... economic activity and inflation? The answer may change over time as a financial system evolves. The answer also may differ across economies because their mechanisms of finance vary. In the United States, securities markets are larger and more important than is the case in Europe or Japan, where bank ...

... economic activity and inflation? The answer may change over time as a financial system evolves. The answer also may differ across economies because their mechanisms of finance vary. In the United States, securities markets are larger and more important than is the case in Europe or Japan, where bank ...

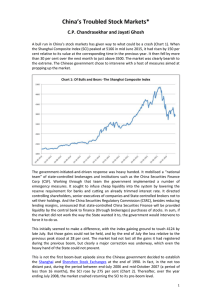

China’s Troubled Stock Markets* C.P. Chandrasekhar and Jayati Ghosh

... big banks were a roaring success, mobilizing more capital than expected and evincing huge investor interest. This pointed in two directions. Liquidity in the global economy was huge and China’s stocks were the season’s favourite. The government had a big hand in making those issues such a success. P ...

... big banks were a roaring success, mobilizing more capital than expected and evincing huge investor interest. This pointed in two directions. Liquidity in the global economy was huge and China’s stocks were the season’s favourite. The government had a big hand in making those issues such a success. P ...

October 2014 – Graduate School of Business

... South African Mortgage Market Overview • Sophisticated and mature. • Dominated by Big 4 Banks (5/Capitec?). ...

... South African Mortgage Market Overview • Sophisticated and mature. • Dominated by Big 4 Banks (5/Capitec?). ...

FINAL The Sword of Damocles FOR ADOBE

... The scale of the federal response has tempted some observers to forecast an immediate return to high inflation or a dollar crisis. We believe such forecasts are premature. For the moment it is sufficient to note that the risks of such developments have been elevated. It will likely take several year ...

... The scale of the federal response has tempted some observers to forecast an immediate return to high inflation or a dollar crisis. We believe such forecasts are premature. For the moment it is sufficient to note that the risks of such developments have been elevated. It will likely take several year ...

stock market crash of 1929

... Prices began to decline in September and early October, but speculation continued, fueled in many cases by individuals who had borrowed money to buy shares—a practice that could be sustained only as long as stock prices continued rising. On October 18 the market went into a free fall, and the wild r ...

... Prices began to decline in September and early October, but speculation continued, fueled in many cases by individuals who had borrowed money to buy shares—a practice that could be sustained only as long as stock prices continued rising. On October 18 the market went into a free fall, and the wild r ...

The Federal Reserve System (cont`d)

... lends money to only those people who are its members • Members are usually employees of a particular firm, people in a particular profession, or those who live in a community served by a a local credit union ...

... lends money to only those people who are its members • Members are usually employees of a particular firm, people in a particular profession, or those who live in a community served by a a local credit union ...

4th Homework - Samuel Moon Jung

... 9) The result of the too-big-to-fail policy is that ________ banks will take on ________ risks, making bank failures more likely. A) small; fewer B) small; greater C) big; fewer D) big; greater 10) The too-big-to-fail policy A) reduces moral hazard problems. B) puts large banks at a competitive disa ...

... 9) The result of the too-big-to-fail policy is that ________ banks will take on ________ risks, making bank failures more likely. A) small; fewer B) small; greater C) big; fewer D) big; greater 10) The too-big-to-fail policy A) reduces moral hazard problems. B) puts large banks at a competitive disa ...

How Higher Interest Rates Affect the Economy

... 8.30 in June 1999 to 8.88 in February 2000. Rates on new car loans from auto finance companies shot up even faster – from 6.56 to 7.34 during the same period. Since the average car loan clocks in around $20,000, this increase provides lenders an extra $106-$142 in interest payments during the first ...

... 8.30 in June 1999 to 8.88 in February 2000. Rates on new car loans from auto finance companies shot up even faster – from 6.56 to 7.34 during the same period. Since the average car loan clocks in around $20,000, this increase provides lenders an extra $106-$142 in interest payments during the first ...

Chapter 8

... Work through the sequence of changes in excess reserves, the interest rate, loan making, the money supply, total spending, and economic activity for an increase and a decrease in excess reserves. ...

... Work through the sequence of changes in excess reserves, the interest rate, loan making, the money supply, total spending, and economic activity for an increase and a decrease in excess reserves. ...

The primary objective of business financial

... The primary objective of business financial management is to a. maximize total corporate profit. b. maximize net income. c. minimize the chance of losses. d. maximize shareholder wealth (i.e. stock price). 2. Theoretically, stock price is not directly determined by a. the risk associated with expect ...

... The primary objective of business financial management is to a. maximize total corporate profit. b. maximize net income. c. minimize the chance of losses. d. maximize shareholder wealth (i.e. stock price). 2. Theoretically, stock price is not directly determined by a. the risk associated with expect ...

This PDF is a selection from a published volume from... Economic Research

... the riskier ABS tranches to help bridge the gap between the credit quality of the bonds that investors in the region would like to hold and the actual credit quality of potential corporate borrowers (see Gyntelberg and Remolona 2006) • In Australia, new specialist mortgage lenders, that relied solel ...

... the riskier ABS tranches to help bridge the gap between the credit quality of the bonds that investors in the region would like to hold and the actual credit quality of potential corporate borrowers (see Gyntelberg and Remolona 2006) • In Australia, new specialist mortgage lenders, that relied solel ...

Financing a Small Business 4.00 Explain the fundamentals of

... character of the entrepreneur and the people with whom he or she is associated, including the management team of the business. a. Responsibility by showing bills paid in the past b. Good credit rating c. Good reputation ...

... character of the entrepreneur and the people with whom he or she is associated, including the management team of the business. a. Responsibility by showing bills paid in the past b. Good credit rating c. Good reputation ...

The effect of rising interest rates on bonds, stocks and real

... When interest rates go up, bond prices typically go down. However, we believe the effects of rate increases will be less dramatic than in the past. The Fed has indicated rate hikes will be modest and will occur at a measured pace. However, the pace of rate increases is expected to accelerate in 2017 ...

... When interest rates go up, bond prices typically go down. However, we believe the effects of rate increases will be less dramatic than in the past. The Fed has indicated rate hikes will be modest and will occur at a measured pace. However, the pace of rate increases is expected to accelerate in 2017 ...

Why Equity Funds? - Federated Investors

... Mutual funds are subject to risks and fluctuate in value. International investing involves special risks including currency risk, increased volatility, political risks and differences in auditing and other financial standards. S&P 500 Index is an unmanaged capitalization-weighted index of 500 stocks ...

... Mutual funds are subject to risks and fluctuate in value. International investing involves special risks including currency risk, increased volatility, political risks and differences in auditing and other financial standards. S&P 500 Index is an unmanaged capitalization-weighted index of 500 stocks ...

Tom Traficanti`s Lending Presentation

... Local developers and local bankers struggle with new valuation model for northern Nevada Out of state Investors are changing their perception of Reno and face bleak investment alternatives, especially in major metro markets (bay area) RENO HAS HISTORICALLY FOLLOWED A “TERTIARY” MARKET CAP RATE ...

... Local developers and local bankers struggle with new valuation model for northern Nevada Out of state Investors are changing their perception of Reno and face bleak investment alternatives, especially in major metro markets (bay area) RENO HAS HISTORICALLY FOLLOWED A “TERTIARY” MARKET CAP RATE ...

Chapter 8 - FIU Faculty Websites

... Banks make money on the difference in the interest rate they pay on deposits and collect on ...

... Banks make money on the difference in the interest rate they pay on deposits and collect on ...

PowerPoint Presentation - T-Rex

... Goodrich & Young Investments LLP Personal Investment Managers ...

... Goodrich & Young Investments LLP Personal Investment Managers ...

Thursday, January 30, 2014 | Pappadeaux Seafood Kitchen

... Care Act ◦ 29% of respondents approved of Obamacare ◦ 22% of respondents approved of Affordable Care Act ...

... Care Act ◦ 29% of respondents approved of Obamacare ◦ 22% of respondents approved of Affordable Care Act ...

Are Banks Still Important for Financing Large Businesses?

... from bonds and commercial paper rose from about 45 percent in the mid-1970s to about 55 percent by the mid1990s.1 All types of debt instruments have also become more marketable. Corporate bonds issued in public markets have increased significantly as a portion of total corporate bonds, rising about ...

... from bonds and commercial paper rose from about 45 percent in the mid-1970s to about 55 percent by the mid1990s.1 All types of debt instruments have also become more marketable. Corporate bonds issued in public markets have increased significantly as a portion of total corporate bonds, rising about ...