U.S. Government and Federal Agency Securities

... operating Fannie Mae and Freddie Mac. The authority to do so was granted by Congress in July by the Housing and Economic Recovery Act of 2008. The decision was made because of concerns that increasing mortgage defaults had impaired the government sponsored enterprises’ (GSE) ability to both maintain ...

... operating Fannie Mae and Freddie Mac. The authority to do so was granted by Congress in July by the Housing and Economic Recovery Act of 2008. The decision was made because of concerns that increasing mortgage defaults had impaired the government sponsored enterprises’ (GSE) ability to both maintain ...

The Asian Banker

... ‘Dynamic Provisioning’ in form of counter cyclical buffers in. Formation of larger Asian supervisory colleges. Tightened regulations in the treatment of off-balance sheet items and fair value accounting practices. Reversion of mark-to-market accounting - Is MTM an improvement in the transpar ...

... ‘Dynamic Provisioning’ in form of counter cyclical buffers in. Formation of larger Asian supervisory colleges. Tightened regulations in the treatment of off-balance sheet items and fair value accounting practices. Reversion of mark-to-market accounting - Is MTM an improvement in the transpar ...

Green bonds - Squarespace

... In the United Kingdom, this presentation is being distributed only to, and is directed only at, persons who are eligible to be categorised as eligible counterparties (as defined in Article 24(2) of Directive 2004/39/EC on markets in financial instruments) (“Eligible Counterparties”). This presentati ...

... In the United Kingdom, this presentation is being distributed only to, and is directed only at, persons who are eligible to be categorised as eligible counterparties (as defined in Article 24(2) of Directive 2004/39/EC on markets in financial instruments) (“Eligible Counterparties”). This presentati ...

Fillable - Insurance Associates

... I/We hereby certify and declare that the above statement presents accurately my financial condition to the best of my knowledge and belief and I/We hereby authorize and request any person, firm or corporation to furnish any information requested by Meadowbrook Insurance Services concerning any trans ...

... I/We hereby certify and declare that the above statement presents accurately my financial condition to the best of my knowledge and belief and I/We hereby authorize and request any person, firm or corporation to furnish any information requested by Meadowbrook Insurance Services concerning any trans ...

Determinants of Commercial Banks` Lending

... funds for banks. If they are able to meet the cost element in fund and eke out some profits to meet corporate growth and shareholders’ expectation, they must really give adequate attention to the single most important source of their earningslending and credit administration. Emphasizing this assert ...

... funds for banks. If they are able to meet the cost element in fund and eke out some profits to meet corporate growth and shareholders’ expectation, they must really give adequate attention to the single most important source of their earningslending and credit administration. Emphasizing this assert ...

Jun 2010 - Maestro Investment Management

... Global equity markets have begun June on the back foot, having been plagued by the same factors that influenced them during May. The Table below provides a snapshot of selected markets, based on MSCI indices, as at 2 June. The MTD and YTD columns refer to month and year-to-date returns respectively ...

... Global equity markets have begun June on the back foot, having been plagued by the same factors that influenced them during May. The Table below provides a snapshot of selected markets, based on MSCI indices, as at 2 June. The MTD and YTD columns refer to month and year-to-date returns respectively ...

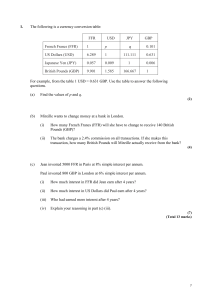

Financial Maths Questions File

... The table below shows the deposits, in Australian dollars (AUD), made by Vicki in an investment account on the first day of each month for the first four months in 1999. The interest rate is 0.75% per month compounded monthly. The interest is added to the account at the end of each month. ...

... The table below shows the deposits, in Australian dollars (AUD), made by Vicki in an investment account on the first day of each month for the first four months in 1999. The interest rate is 0.75% per month compounded monthly. The interest is added to the account at the end of each month. ...

2014 MID-YEAR INVESTMENT OuTlOOk

... Fed reduced its monthly bond buying. Why did the opposite happen? Markets have overemphasized the impact of QE— and underclubbed the importance of zero-interest-rate policy (ZIRP). QE-created liquidity leaked beyond U.S. borders. This is why the Fed’s signaling the end of bond buying was such a big ...

... Fed reduced its monthly bond buying. Why did the opposite happen? Markets have overemphasized the impact of QE— and underclubbed the importance of zero-interest-rate policy (ZIRP). QE-created liquidity leaked beyond U.S. borders. This is why the Fed’s signaling the end of bond buying was such a big ...

Justification for the decision on the buffer rate

... 3) effective European Systemic Risk Board's (ESRB) recommendations on the setting of the CCB rate. The calculation of the CCB guide shall be carried out taking into account the deviation of the credit (issued to the Latvian residents) to GDP ratio from its long-run trend (hereinafter, the credit-to- ...

... 3) effective European Systemic Risk Board's (ESRB) recommendations on the setting of the CCB rate. The calculation of the CCB guide shall be carried out taking into account the deviation of the credit (issued to the Latvian residents) to GDP ratio from its long-run trend (hereinafter, the credit-to- ...

IOSR Journal Of Humanities And Social Science (IOSR-JHSS)

... Sciences, University Mohammed V-Souissi, Rabat, Morocco ...

... Sciences, University Mohammed V-Souissi, Rabat, Morocco ...

The dollar: Separating perception from reality.

... The opinions referenced are those of Rick Golod and are subject to change at any time due to changes in market or economic conditions and may not necessarily come to pass. These comments are not necessarily representative of the opinions and views of other Behringer professionals, nor any of its aff ...

... The opinions referenced are those of Rick Golod and are subject to change at any time due to changes in market or economic conditions and may not necessarily come to pass. These comments are not necessarily representative of the opinions and views of other Behringer professionals, nor any of its aff ...

Callable Class, Series 2: Payout Scenarios #3

... “Nesbitt Burns” is a registered trademark of BMO Nesbitt Burns Corporation Limited used under license. ...

... “Nesbitt Burns” is a registered trademark of BMO Nesbitt Burns Corporation Limited used under license. ...

Governance, regulation and financial market

... boom in investment and consumption. It was intensified, but not caused, by the stock market crash in October. Between 1929 and 1933, money income fell 53%, real income fell 36% and unemployment rose to 25% of the workforce. Chaos in the banking sector culminated in a major banking crisis in 1933, ac ...

... boom in investment and consumption. It was intensified, but not caused, by the stock market crash in October. Between 1929 and 1933, money income fell 53%, real income fell 36% and unemployment rose to 25% of the workforce. Chaos in the banking sector culminated in a major banking crisis in 1933, ac ...

3 - Les Leba.

... prevail so that the greatest common good will be objective of the CBN. In this event, both the constitutional beneficiaries and all registered (not CBN designated) commercial banks will maintain domiciliary accounts with the CBN to facilitate the settlement and accounting for the Dollar revenue disb ...

... prevail so that the greatest common good will be objective of the CBN. In this event, both the constitutional beneficiaries and all registered (not CBN designated) commercial banks will maintain domiciliary accounts with the CBN to facilitate the settlement and accounting for the Dollar revenue disb ...

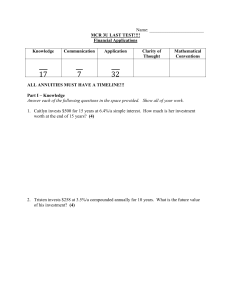

Test Chapter 8 Spring `14

... years, the interest rate changes to 9%/a compounded semi-annually. Calculate the value of the investment two years after this change. (7) ...

... years, the interest rate changes to 9%/a compounded semi-annually. Calculate the value of the investment two years after this change. (7) ...

Insurance Risk Management at Life Insurers: Dynamically Managing

... Historically, life insurance used a simple, protectionoriented business model. Liabilities were valued with traditional actuarial approaches and insurers generally allocated their assets conservatively in simple fixed income ...

... Historically, life insurance used a simple, protectionoriented business model. Liabilities were valued with traditional actuarial approaches and insurers generally allocated their assets conservatively in simple fixed income ...

Top 11 Reasons to Buy a Home Now

... choose the qualities you want to find just the home you want. It wasn’t so long ago that buyers were jumping on new listings as soon as they came onto the market, that is no longer a concern for buyers in this economy. ...

... choose the qualities you want to find just the home you want. It wasn’t so long ago that buyers were jumping on new listings as soon as they came onto the market, that is no longer a concern for buyers in this economy. ...

Chapter 5 Overheads

... You can purchase up to $5,000 worth of I Bonds annually (each calendar year). NOTE: You can purchase up to $5,000 in EE Bonds as well, totaling $10,000 max annually in paper bonds as of January 1, 2008. An individual may also purchase $5,000 in ELECTRONIC EE Bonds as well as an additional $5,000 in ...

... You can purchase up to $5,000 worth of I Bonds annually (each calendar year). NOTE: You can purchase up to $5,000 in EE Bonds as well, totaling $10,000 max annually in paper bonds as of January 1, 2008. An individual may also purchase $5,000 in ELECTRONIC EE Bonds as well as an additional $5,000 in ...

the money supply and the framework of monetary

... succession of interest rate cuts when it fears that future real GDP growth will be below trend. The Bank has an excellent record. It has met the Government’s inflation target in every month since independence, and inflation is now at its lowest and most stable level (below 2% on the CPI measure) for ...

... succession of interest rate cuts when it fears that future real GDP growth will be below trend. The Bank has an excellent record. It has met the Government’s inflation target in every month since independence, and inflation is now at its lowest and most stable level (below 2% on the CPI measure) for ...

M1 = currency + traveler`s checks + demand deposits + other

... You do need to memorize the items that make up M1, M2, and M3. The M probably refers to Monetary Aggregate. Don't worry about L. Full-bodied money has a value in another use equal to its value as money, e.g. if there was 1 cent worth of copper in a penny, it would be full-bodied money. Gresham's Law ...

... You do need to memorize the items that make up M1, M2, and M3. The M probably refers to Monetary Aggregate. Don't worry about L. Full-bodied money has a value in another use equal to its value as money, e.g. if there was 1 cent worth of copper in a penny, it would be full-bodied money. Gresham's Law ...

Interest Rates and Your Portfolio Liquidity and Your Portfolio

... the markets for risky bonds (e.g., corporate high yield bonds) means that investors should, over time, hold a smaller portion of these bonds in their portfolio. The simple reason is that, when market or economic times get tough, investors will find it harder to sell illiquid bonds, and their values ...

... the markets for risky bonds (e.g., corporate high yield bonds) means that investors should, over time, hold a smaller portion of these bonds in their portfolio. The simple reason is that, when market or economic times get tough, investors will find it harder to sell illiquid bonds, and their values ...

CH. 20 - Bakersfield College

... A situation in which credit has become so scarce that it is virtually unavailable, at any cost, to most potential borrowers Copyright © 2015 Pearson Education, Inc. ...

... A situation in which credit has become so scarce that it is virtually unavailable, at any cost, to most potential borrowers Copyright © 2015 Pearson Education, Inc. ...

The value of illiquidity

... obvious. An example is the widening bid/ask spread in the interbank credit market in 2007, which dried up almost entirely in 2008. This was mostly because lenders believed that other market participants had non-public information about the credit rating of the borrower, and questioned the credibilit ...

... obvious. An example is the widening bid/ask spread in the interbank credit market in 2007, which dried up almost entirely in 2008. This was mostly because lenders believed that other market participants had non-public information about the credit rating of the borrower, and questioned the credibilit ...