Debt Financing in a Challenging Regulatory and Market Environment

... and its operating partner. • 15 year Lease Term • NOI of $1.3MM • Relatively high $/SF for an MOB / Surgery Center of $590/SF value – related to the space usage. • Solution – CapitalOne was able to utilize its healthcare expertise and compare across the various components of the asset to illustrate ...

... and its operating partner. • 15 year Lease Term • NOI of $1.3MM • Relatively high $/SF for an MOB / Surgery Center of $590/SF value – related to the space usage. • Solution – CapitalOne was able to utilize its healthcare expertise and compare across the various components of the asset to illustrate ...

The Relationship between Bond Prices and Interest Rates

... face value of $5,000 to be received in 6 years, will result in a yield to maturity or return of 12% for the new investor over the remaining 6 years of the bond. The new investor will therefore buy the bond from the initial investor for $4,589 and receive a $500 coupon each year plus a principal repa ...

... face value of $5,000 to be received in 6 years, will result in a yield to maturity or return of 12% for the new investor over the remaining 6 years of the bond. The new investor will therefore buy the bond from the initial investor for $4,589 and receive a $500 coupon each year plus a principal repa ...

Opportunities for Corporate Finance in Latin American Capital Markets

... Latin American equity markets also absorbed new issues of common stock. The strong performance of these equity markets was due to the capital market reforms that five countries have put into effect. The commodities boom helped but was NOT the only reason for the rally. ...

... Latin American equity markets also absorbed new issues of common stock. The strong performance of these equity markets was due to the capital market reforms that five countries have put into effect. The commodities boom helped but was NOT the only reason for the rally. ...

Chapter 9

... Explain what is meant by the term or maturity structure of interest rates Identify and briefly describe the three theories used to explain the term structure of interest rates Identify broad historical price level changes in the U. S. and other economies and discuss their causes ...

... Explain what is meant by the term or maturity structure of interest rates Identify and briefly describe the three theories used to explain the term structure of interest rates Identify broad historical price level changes in the U. S. and other economies and discuss their causes ...

Munis and the Markets

... more sensitive and volatile than those with shorter durations; bond prices generally fall as interest rates rise, and the current low interest rate environment increases this risk. Current reductions in bond counterparty capacity may contribute to decreased market liquidity and increased price volat ...

... more sensitive and volatile than those with shorter durations; bond prices generally fall as interest rates rise, and the current low interest rate environment increases this risk. Current reductions in bond counterparty capacity may contribute to decreased market liquidity and increased price volat ...

Building Local Bond Markets

... based Global Custodian agency for making investment by American investors under section 17 of its SEC law. For Corporate Bonds Central Depository Company act as depository All Government/Corporate Bonds now exist in scripless form. SBP and SECP are now actively working to list Government Securities ...

... based Global Custodian agency for making investment by American investors under section 17 of its SEC law. For Corporate Bonds Central Depository Company act as depository All Government/Corporate Bonds now exist in scripless form. SBP and SECP are now actively working to list Government Securities ...

www.sbp.org.pk

... based Global Custodian agency for making investment by American investors under section 17 of its SEC law. For Corporate Bonds Central Depository Company act as depository All Government/Corporate Bonds now exist in scripless form. SBP and SECP are now actively working to list Government Securities ...

... based Global Custodian agency for making investment by American investors under section 17 of its SEC law. For Corporate Bonds Central Depository Company act as depository All Government/Corporate Bonds now exist in scripless form. SBP and SECP are now actively working to list Government Securities ...

It`s Different This Time

... First, governments around the world have responded to a low growth, low inflation environment with programs known as “Quantitative Easing” which entail the purchase by central banks of various types of bonds. The objective was to lower interest rates which was expected to stimulate economic growth b ...

... First, governments around the world have responded to a low growth, low inflation environment with programs known as “Quantitative Easing” which entail the purchase by central banks of various types of bonds. The objective was to lower interest rates which was expected to stimulate economic growth b ...

Bond Issues

... • Bonds may be issued between interest dates. • Interest, for the period between the issue date and the last interest date, is collected with the issue price of the bonds (accrued interest). • At the specified interest date, interest is paid for the entire interest period (semiannual or annual). • P ...

... • Bonds may be issued between interest dates. • Interest, for the period between the issue date and the last interest date, is collected with the issue price of the bonds (accrued interest). • At the specified interest date, interest is paid for the entire interest period (semiannual or annual). • P ...

Q3 - Trivant

... Over $600 billion in high grade bond offerings have been brought to the market year to date. This is significant considering the US stock market is barely over $10 trillion in market capitalization. Record amounts of bond offerings are headed to the market because interest rates are so low and the i ...

... Over $600 billion in high grade bond offerings have been brought to the market year to date. This is significant considering the US stock market is barely over $10 trillion in market capitalization. Record amounts of bond offerings are headed to the market because interest rates are so low and the i ...

callable bond

... Types of Corporate Bonds DEBENTURES - corporate bond not backed by collateral but only by the general credit standing of the corporations -- no pledge of any specific assets to assure repayment of the loan -- holder must rely on the full faith and credit of the issuer for repayment (reputation) ...

... Types of Corporate Bonds DEBENTURES - corporate bond not backed by collateral but only by the general credit standing of the corporations -- no pledge of any specific assets to assure repayment of the loan -- holder must rely on the full faith and credit of the issuer for repayment (reputation) ...

Bonds: Analysis and Strategy

... (2) Pure Yield Pickup – replace a lower yielding bond with a higher yielding one (3) Rate Anticipation – if expect rates to fall, swap into bonds with higher durations, etc. (4) Intermarket Spread (sector) – switches due to beliefs re. changes in yield spreads ...

... (2) Pure Yield Pickup – replace a lower yielding bond with a higher yielding one (3) Rate Anticipation – if expect rates to fall, swap into bonds with higher durations, etc. (4) Intermarket Spread (sector) – switches due to beliefs re. changes in yield spreads ...

Negotiable/Transferable Instruments Conventions

... addressed by one person to another, signed by the person giving it, requiring the person to whom it is addressed to pay on demand or at a fixed or determinable future time, a sum certain in money or to the order of a specific person, or to bearer. At a more practical level a bill of exchange is gene ...

... addressed by one person to another, signed by the person giving it, requiring the person to whom it is addressed to pay on demand or at a fixed or determinable future time, a sum certain in money or to the order of a specific person, or to bearer. At a more practical level a bill of exchange is gene ...

ECON366 - KONSTANTINOS KANELLOPOULOS

... conservative and the other aggressive. The conservative capital structure calls for a D/A ratio = 0.25, while the aggressive strategy call for D/A = 0.75. Once the firm selects its target capital structure it envisions two possible scenarios for its operations: Feast or Famine. The Feast scenario ha ...

... conservative and the other aggressive. The conservative capital structure calls for a D/A ratio = 0.25, while the aggressive strategy call for D/A = 0.75. Once the firm selects its target capital structure it envisions two possible scenarios for its operations: Feast or Famine. The Feast scenario ha ...

Introduction to Bonds and Notes (Yield

... • Bonds are debt obligations of the party that issues them .. they are a debt contract that promises to pay period interest payments over so many years then the full principal at the end. • Bonds are bought and sold on a huge secondary market. • Bonds are first issued by the agency that issues them ...

... • Bonds are debt obligations of the party that issues them .. they are a debt contract that promises to pay period interest payments over so many years then the full principal at the end. • Bonds are bought and sold on a huge secondary market. • Bonds are first issued by the agency that issues them ...

Chapter 10 PPP

... Rail and transportation bonds Financial issues Provide higher returns than government bonds due to ...

... Rail and transportation bonds Financial issues Provide higher returns than government bonds due to ...

Exchange-traded Treasury Bonds (TBs) - text version

... value is adjusted for movements in the Consumer Price Index (CPI). Coupons are paid quarterly rather than six monthly. This module focuses Treasury Bonds. ...

... value is adjusted for movements in the Consumer Price Index (CPI). Coupons are paid quarterly rather than six monthly. This module focuses Treasury Bonds. ...

Should We Worry about China Dumping US Treasuries?

... spots remain. Adoption of a so-called border-adjustment tax by the United States could be perceived as an across-the-board tarif f on Chinese goods, and could provoke some retaliatory response. To be sure, trade is not the only f lashpoint f or the U.S.-China relationship. Disagreements over deve ...

... spots remain. Adoption of a so-called border-adjustment tax by the United States could be perceived as an across-the-board tarif f on Chinese goods, and could provoke some retaliatory response. To be sure, trade is not the only f lashpoint f or the U.S.-China relationship. Disagreements over deve ...

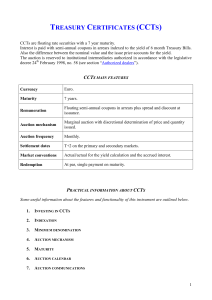

TREASURY CERTIFICATES (CCTS)

... Treasury Certificates are a kind of security very appreciated by families because of their feature to adjust coupons to market rates and therefore guarantee, in case of a negotiation before maturity, a capital amount very similar to that initially invested. CCTs have been issued, since March 1991, w ...

... Treasury Certificates are a kind of security very appreciated by families because of their feature to adjust coupons to market rates and therefore guarantee, in case of a negotiation before maturity, a capital amount very similar to that initially invested. CCTs have been issued, since March 1991, w ...

Capital Markets Update

... the anticipation of increased fiscal spending – Rates stabilized some in December, with the 10 year UST oscillating within a 25bps range and finishing the month unchanged at 2.45% – Long term rates have fallen marginally to start the year ...

... the anticipation of increased fiscal spending – Rates stabilized some in December, with the 10 year UST oscillating within a 25bps range and finishing the month unchanged at 2.45% – Long term rates have fallen marginally to start the year ...

z. téma 5 Mezinárodní trhy dluhových cenných papír

... with fixed coupons divide the stated coupon into parts defined by their payment schedule, for example, semi-annual pay. Bonds with floating rate coupons have set calculation schedules where the floating rate is calculated shortly before the next payment. Zero-coupon bonds do not pay interest. They a ...

... with fixed coupons divide the stated coupon into parts defined by their payment schedule, for example, semi-annual pay. Bonds with floating rate coupons have set calculation schedules where the floating rate is calculated shortly before the next payment. Zero-coupon bonds do not pay interest. They a ...

Session 33- Market Timing Indicators II

... This regression suggests two things. One is that the change in interest rates in this period is negatively correlated with the level of rates at the end of the prior year; if rates were high (low), they were more likely to decrease (increase). Second, for every 1% increase in the level of current ra ...

... This regression suggests two things. One is that the change in interest rates in this period is negatively correlated with the level of rates at the end of the prior year; if rates were high (low), they were more likely to decrease (increase). Second, for every 1% increase in the level of current ra ...

Multiple Choice

... The static spread is: the difference between the yield on a zero coupon bond and the yield on a coupon bond. the difference between a fixed-rate yield and a floating-rate yield. the difference between the yield on new Treasury bills versus new Treasury bonds. the difference between expected inflatio ...

... The static spread is: the difference between the yield on a zero coupon bond and the yield on a coupon bond. the difference between a fixed-rate yield and a floating-rate yield. the difference between the yield on new Treasury bills versus new Treasury bonds. the difference between expected inflatio ...