Start with government purchases of goods and services, and with

... money supply: the price level, the Federal Reserve policy, the currency-todeposits ratio, and the reserves-to-deposits ratio. Anything that increases the real money supply will lower the equilibrium interest rate for any level of national product. Anything that decreases the money supply will raise ...

... money supply: the price level, the Federal Reserve policy, the currency-todeposits ratio, and the reserves-to-deposits ratio. Anything that increases the real money supply will lower the equilibrium interest rate for any level of national product. Anything that decreases the money supply will raise ...

Real Business Cycle Theory

... This is the approach adopted by real business cycle (RBC) theory: to keep the fundamental assumption of a Walrasian model where households maximize utility, perfectly-competitive firms maximize profits, and all agents access to the same information.2 Traditional Keynesian models (such as the IS/MP ...

... This is the approach adopted by real business cycle (RBC) theory: to keep the fundamental assumption of a Walrasian model where households maximize utility, perfectly-competitive firms maximize profits, and all agents access to the same information.2 Traditional Keynesian models (such as the IS/MP ...

Chapter 15

... The price level is stuck at some level and is relatively unresponsive to changing economic conditions. “sticky prices” – The interest rate adjusts to balance the supply and demand for money. Keynes – The level of output responds to changes in the aggregate demand (AD) for goods and services. On SRAS ...

... The price level is stuck at some level and is relatively unresponsive to changing economic conditions. “sticky prices” – The interest rate adjusts to balance the supply and demand for money. Keynes – The level of output responds to changes in the aggregate demand (AD) for goods and services. On SRAS ...

The Austrian School

... understand properly the macrocosm of a developed economy” (Hennings, 1997, p.74). Ludwig von M ises (1953 [1912]), who is generally credited for using marginal utility analysis to account for the value of money, was also the first to recognize the significance of credit creation in the context of a ...

... understand properly the macrocosm of a developed economy” (Hennings, 1997, p.74). Ludwig von M ises (1953 [1912]), who is generally credited for using marginal utility analysis to account for the value of money, was also the first to recognize the significance of credit creation in the context of a ...

MARKETING

... supply. Trade unions on the labour market. 11. Theory of Capital, Interest and Profit. Capital, investment and interest rates. The demand for loan funds and their supply. Consumer decision-making. Investment decision-making. Real and nominal interest rate. 12. General Equilibrium. General equilibriu ...

... supply. Trade unions on the labour market. 11. Theory of Capital, Interest and Profit. Capital, investment and interest rates. The demand for loan funds and their supply. Consumer decision-making. Investment decision-making. Real and nominal interest rate. 12. General Equilibrium. General equilibriu ...

Econ 1202.2 Practice #7 MULTIPLE CHOICE. Choose the one

... 5) Assume there are just two assets, money and bonds. We can expect that an individual with a given level of wealth will A) hold less money when the current interest rate is very low. B) not hold money as long as bonds pay a positive rate of interest. C) hold lots of money even at very high interes ...

... 5) Assume there are just two assets, money and bonds. We can expect that an individual with a given level of wealth will A) hold less money when the current interest rate is very low. B) not hold money as long as bonds pay a positive rate of interest. C) hold lots of money even at very high interes ...

Money and Contracts

... In this section I document the relationship between the rate of interest on prime business loans and the rate of interest on treasury bills in the post-war United States. The evidence that I present is important to my theoretical arguments because I shall suggest that monetary policy operates by inc ...

... In this section I document the relationship between the rate of interest on prime business loans and the rate of interest on treasury bills in the post-war United States. The evidence that I present is important to my theoretical arguments because I shall suggest that monetary policy operates by inc ...

Monetary Policy - s3.amazonaws.com

... • How does monetary policy work? • What problems exist involving monetary policy timing and lags? • How can predictions about the length of a business cycle affect monetary policy? ...

... • How does monetary policy work? • What problems exist involving monetary policy timing and lags? • How can predictions about the length of a business cycle affect monetary policy? ...

Okruhy k závěrečným zkouškám

... supply. Trade unions on the labour market. 11. Theory of Capital, Interest and Profit. Capital, investment and interest rates. The demand for loan funds and their supply. Consumer decision-making. Investment decision-making. Real and nominal interest rate. 12. General Equilibrium. General equilibriu ...

... supply. Trade unions on the labour market. 11. Theory of Capital, Interest and Profit. Capital, investment and interest rates. The demand for loan funds and their supply. Consumer decision-making. Investment decision-making. Real and nominal interest rate. 12. General Equilibrium. General equilibriu ...

AP Macro Unit 4 Multiple Choice Questions

... 1. "The price for a ticket to the Super Bowl is $500." This statement best illustrates money used as a A. Liability B. Liquid asset C. Unit of account D. Medium of exchange E. Store of value 2. If you use money as a store of value, you would be A. Buying a new watch B. Searching the internet for a d ...

... 1. "The price for a ticket to the Super Bowl is $500." This statement best illustrates money used as a A. Liability B. Liquid asset C. Unit of account D. Medium of exchange E. Store of value 2. If you use money as a store of value, you would be A. Buying a new watch B. Searching the internet for a d ...

the rise and fall of technology and the business cycle

... says as compared to more well-known theories of business cycles, such as the Keynesian theory and the Monetarist theory. Then empirical evidence will be shown in an attempt to discover which theory fits the time series data the best. It is the hypothesis of this paper that Real Business Cycle theory ...

... says as compared to more well-known theories of business cycles, such as the Keynesian theory and the Monetarist theory. Then empirical evidence will be shown in an attempt to discover which theory fits the time series data the best. It is the hypothesis of this paper that Real Business Cycle theory ...

Liquidity Trap - Portland State University

... holding money becomes zero, and economic agents--banks, firms, or individuals--tend to hoard money even if they have more money than they need for transaction purposes. More importantly, traditional monetary policy becomes ineffective in stimulating the economy because the money creation process doe ...

... holding money becomes zero, and economic agents--banks, firms, or individuals--tend to hoard money even if they have more money than they need for transaction purposes. More importantly, traditional monetary policy becomes ineffective in stimulating the economy because the money creation process doe ...

Lecture 1 Introduction – Geography, Demography and Economics

... circumstanced like that of the Bank of England” "To limit the total amount of paper issued, and to resort for this purpose, whenever the temptation to borrow is strong, to some effectual principle of restriction; in no case, however, materially to diminish the sum in circulation, but to let it vibra ...

... circumstanced like that of the Bank of England” "To limit the total amount of paper issued, and to resort for this purpose, whenever the temptation to borrow is strong, to some effectual principle of restriction; in no case, however, materially to diminish the sum in circulation, but to let it vibra ...

Financial Markets - KsuWeb Home Page

... • Classical economists argue that business fluctuations are caused by a series of shocks to technology that alter the productivity of labor in a random way from one year to the next. • These shocks are transmitted to the capital market through changes in investment, causing saving, investment and th ...

... • Classical economists argue that business fluctuations are caused by a series of shocks to technology that alter the productivity of labor in a random way from one year to the next. • These shocks are transmitted to the capital market through changes in investment, causing saving, investment and th ...

What is Macroeconomics - Katsuhito Iwai`s Webpage.

... This will in turn discourage firms' demands for labor and enlarge the size of the already existing disequilibrium in the labor market. A second-round repercussion will thus be set off, and the so-called 'income multiplier process' will propagate itself throughout the entire economy.4 It must be emph ...

... This will in turn discourage firms' demands for labor and enlarge the size of the already existing disequilibrium in the labor market. A second-round repercussion will thus be set off, and the so-called 'income multiplier process' will propagate itself throughout the entire economy.4 It must be emph ...

Aggregate Demand II: Applying the IS-LM Model

... – “correction” after overbuilding in the 1920s – widespread bank failures in early 1930s made it harder to obtain financing for investment ...

... – “correction” after overbuilding in the 1920s – widespread bank failures in early 1930s made it harder to obtain financing for investment ...

Chpt. 12: “The Business Cycle and Unemployment”

... usually near the end of an expansion Depression = a very long and low recession ...

... usually near the end of an expansion Depression = a very long and low recession ...

Mankiw8e_Student_PPTs_Chapter 11 - E-SGH

... a significant recession. He proposed a package that would cost the government about $800 billion, or about 5% of annual GDP. The Package included some tax cuts and higher transfer payments, but much of it was made up of increases in government purchases of goods and ...

... a significant recession. He proposed a package that would cost the government about $800 billion, or about 5% of annual GDP. The Package included some tax cuts and higher transfer payments, but much of it was made up of increases in government purchases of goods and ...

Chapter 25 Monetary and fiscal policy in a closed economy

... goods. Firms have two choices: either to raise prices or to meet demand by raising supply Keynesian: in order to meet higher production, firms will increase their output capacity by investing in plant and investment ...

... goods. Firms have two choices: either to raise prices or to meet demand by raising supply Keynesian: in order to meet higher production, firms will increase their output capacity by investing in plant and investment ...

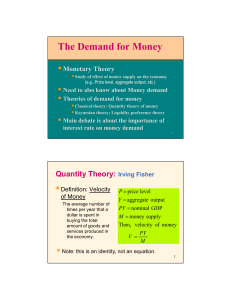

The Demand for Money - Spears School of Business

... ⇒ Neutrality of money (money cannot affect output) Interest rate has no role in money demand ...

... ⇒ Neutrality of money (money cannot affect output) Interest rate has no role in money demand ...

Aalborg Universitet Coping with Reality Madsen, Poul Thøis

... 9. In the following quotation he gives an overall view of his analysis of the general working of the actually existing economic system: “But the actual phenomena of the economic system are also coloured by certain special characteristics of the propensity to consume, the schedule of the marginal ef ...

... 9. In the following quotation he gives an overall view of his analysis of the general working of the actually existing economic system: “But the actual phenomena of the economic system are also coloured by certain special characteristics of the propensity to consume, the schedule of the marginal ef ...

NBER WORKING PAPER SERIES

... a full-fledged quantitative Keynesian toolkit. Much of the GT’s impact was based on method, perhaps as much from this quarter as from ideas, despite the fact that there is virtually nothing in the way of methodology in the book. Beginning in the early 1940s, the foundations for modern econometric an ...

... a full-fledged quantitative Keynesian toolkit. Much of the GT’s impact was based on method, perhaps as much from this quarter as from ideas, despite the fact that there is virtually nothing in the way of methodology in the book. Beginning in the early 1940s, the foundations for modern econometric an ...

selected topics 18/11/15 - FBE Moodle

... Qd is quantity demanded of the good and service, P is price of the good and service, I is consumer’s income per capita, PR is price of the related goods and services, T is taste patterns of consumers, PE is expected price of the good in some future period and N is number of consumers in the market. ...

... Qd is quantity demanded of the good and service, P is price of the good and service, I is consumer’s income per capita, PR is price of the related goods and services, T is taste patterns of consumers, PE is expected price of the good in some future period and N is number of consumers in the market. ...