The Adverse Effects of Government Spending in New Keynesian

... feature, price stickiness and the consequence of demand induced deviations of output from its natural level, is not sufficient to generate crowding in effects. Keynesian enhancements of the labour market structure, like real wage rigidity or involuntary unemployment due to labour market frictions, a ...

... feature, price stickiness and the consequence of demand induced deviations of output from its natural level, is not sufficient to generate crowding in effects. Keynesian enhancements of the labour market structure, like real wage rigidity or involuntary unemployment due to labour market frictions, a ...

Monetary Policy and the Behavior of Long

... presumably reflect the long-term real rate of interest (and, by comparison with equivalent long-term nominal bond yields, the long-term expectations for inflation). 3 This article will refer to "the transmission channel" of monetary policy. In fact, there are many transmission channels; monetary pol ...

... presumably reflect the long-term real rate of interest (and, by comparison with equivalent long-term nominal bond yields, the long-term expectations for inflation). 3 This article will refer to "the transmission channel" of monetary policy. In fact, there are many transmission channels; monetary pol ...

(Ir)relevance of the NRU for Policy Making

... variables and the observation that institutions do not vary much through time, also led researchers to adopt 5-year averages in their estimations (see, for example, Blanchard and Wolfers, 2000). However, we should note that cross-country regressions and 5-year data averages in panel estimation compl ...

... variables and the observation that institutions do not vary much through time, also led researchers to adopt 5-year averages in their estimations (see, for example, Blanchard and Wolfers, 2000). However, we should note that cross-country regressions and 5-year data averages in panel estimation compl ...

The Effects of Government Spending Shocks on Consumption under

... consumption is important for understanding the e¤ects of …scal policy on people’s welfare. Private consumption is the largest component of aggregate demand and is also assumed to be a principal determinant of agents’welfare. Economic theory has yet to come up with a general guidance regarding the dy ...

... consumption is important for understanding the e¤ects of …scal policy on people’s welfare. Private consumption is the largest component of aggregate demand and is also assumed to be a principal determinant of agents’welfare. Economic theory has yet to come up with a general guidance regarding the dy ...

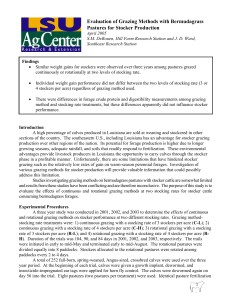

Fertilizer Sources on Bermudagrass Pastures for

... study. Fencing costs per stocker (not including labor) was $58 and $43 for R-L and R-H, respectively. Because the same fencing was needed for the pastures stocked at either 3 or 4 head per acre, fencing costs was lower on a per stocker basis for the R-H treatment. If these costs were prorated over t ...

... study. Fencing costs per stocker (not including labor) was $58 and $43 for R-L and R-H, respectively. Because the same fencing was needed for the pastures stocked at either 3 or 4 head per acre, fencing costs was lower on a per stocker basis for the R-H treatment. If these costs were prorated over t ...

Say`s Law - Wake Forest University

... he never sells, but with an intention to purchase some other commodity, which may be immediately useful to him, or which may contribute to future production. By producing, then, he necessarily becomes either the consumer of his own goods, or the purchaser and consumer of the goods of some other pers ...

... he never sells, but with an intention to purchase some other commodity, which may be immediately useful to him, or which may contribute to future production. By producing, then, he necessarily becomes either the consumer of his own goods, or the purchaser and consumer of the goods of some other pers ...

The Taylor Curve and the Unemployment-Inflation Tradeoff

... workers to enter into employment contracts in which they agree to supply as many hours of work as demanded by their employers (within reasonable limits) for an agreed-upon wage rate or salary. This contractually fixed wage rate or salary reflects, in part, what workers and employers expect the infla ...

... workers to enter into employment contracts in which they agree to supply as many hours of work as demanded by their employers (within reasonable limits) for an agreed-upon wage rate or salary. This contractually fixed wage rate or salary reflects, in part, what workers and employers expect the infla ...

Chapter 24 The Open Economy with Fixed Exchange Rates

... increased the scope for speculative attacks against ’soft’ Þxed exchange rate regimes. The weakness of a Þxed exchange rate regime where the exchange rate can be adjusted is that speculation is virtually risk-free: if an investor moves out of a currency which is expected to be devalued, he will obvi ...

... increased the scope for speculative attacks against ’soft’ Þxed exchange rate regimes. The weakness of a Þxed exchange rate regime where the exchange rate can be adjusted is that speculation is virtually risk-free: if an investor moves out of a currency which is expected to be devalued, he will obvi ...

Costly capital reallocation and the effects of government spending

... Their arguments are based on empirical evidence suggesting that increases in government spending are accompanied by increases in consumption, real wages, and productivity. They conclude that the neoclassical model is not consistent with the data. The two-sector neoclassical model can produce a much ...

... Their arguments are based on empirical evidence suggesting that increases in government spending are accompanied by increases in consumption, real wages, and productivity. They conclude that the neoclassical model is not consistent with the data. The two-sector neoclassical model can produce a much ...

A small model of the UK economy - Office for Budget Responsibility

... forward-looking follows from the price-setting behaviour of firms, which is assumed to follow Calvo (1983). The basic premise is that in each period a firm has a fixed probability that it will keep its price unchanged, so firms set prices now with a view to the future because they know that they may ...

... forward-looking follows from the price-setting behaviour of firms, which is assumed to follow Calvo (1983). The basic premise is that in each period a firm has a fixed probability that it will keep its price unchanged, so firms set prices now with a view to the future because they know that they may ...

Hyder, Zulfiqar and Adil Mahboob, 2006, “Equilibrium Real Effective

... (1994). The results of the study are also used for the forecasting of ERER and misalignment up to the year 2010. The results of the study reveal that ERER is determined by variables such as: a) terms of trade, b) trade openness, c) net capital inflows, d) relative productivity differential, e) gover ...

... (1994). The results of the study are also used for the forecasting of ERER and misalignment up to the year 2010. The results of the study reveal that ERER is determined by variables such as: a) terms of trade, b) trade openness, c) net capital inflows, d) relative productivity differential, e) gover ...

Real-time Taylor rules and the federal funds futures market

... Orphanidess analysis of the Taylor rule with real-time data uses only data through 1992. The fact that official Fed staff forecasts are only released with a five-year delay limits his data availability. In my analysis, I modify Taylors rule so that it can be analyzed through 1997 using data on the ...

... Orphanidess analysis of the Taylor rule with real-time data uses only data through 1992. The fact that official Fed staff forecasts are only released with a five-year delay limits his data availability. In my analysis, I modify Taylors rule so that it can be analyzed through 1997 using data on the ...

When is the Government Spending Multiplier Large? Northwestern University

... multiplier. Consistent with the theoretical analysis above, this result implies that for government spending to be a powerful weapon in combating output losses associated with the zero bound state, it is critical that the bulk of the spending come on line when the lower bound is actually binding. A ...

... multiplier. Consistent with the theoretical analysis above, this result implies that for government spending to be a powerful weapon in combating output losses associated with the zero bound state, it is critical that the bulk of the spending come on line when the lower bound is actually binding. A ...

Document

... Amount received each year = $100,000 Gain recognized each year = $40,000 Gross profit percentage x am’t received 40% x $100,000 Total gain recognized is $200,000 ...

... Amount received each year = $100,000 Gain recognized each year = $40,000 Gross profit percentage x am’t received 40% x $100,000 Total gain recognized is $200,000 ...

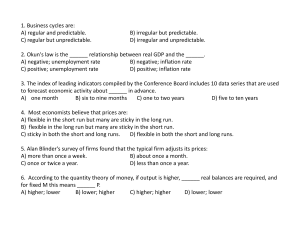

Answers to Key Questions

... most in the use of those resources which are particularly scarce in supply. Resources that are scarcest relative to the demand for them have the highest prices. As a result, producers use these resources as sparingly as is possible.” Evaluate this statement. Does your answer to part c, above, bear o ...

... most in the use of those resources which are particularly scarce in supply. Resources that are scarcest relative to the demand for them have the highest prices. As a result, producers use these resources as sparingly as is possible.” Evaluate this statement. Does your answer to part c, above, bear o ...

15.1 the consumer price index

... • The arrival of new goods puts an upward bias into the CPI and its measure of the inflation rate. Quality Change Bias • Better cars and televisions cost more than the versions they replace. • A price rise that is a payment for improved quality is not inflation but might get measured as inflation. ...

... • The arrival of new goods puts an upward bias into the CPI and its measure of the inflation rate. Quality Change Bias • Better cars and televisions cost more than the versions they replace. • A price rise that is a payment for improved quality is not inflation but might get measured as inflation. ...

Macroeconomics: A Growth Theory Approach

... and the stock of orange trees, while demand depends on price but does not depend much on the weather in Florida. If ...

... and the stock of orange trees, while demand depends on price but does not depend much on the weather in Florida. If ...

The Product Side: Some Theoretical Aspects

... situation and by produced goods in another must be included or excluded in both situations. If the comparison is made from the viewpoint of the group of individuals that obtains them only at a cost, these goods must be included in both situations with weights reflecting their importance to that grou ...

... situation and by produced goods in another must be included or excluded in both situations. If the comparison is made from the viewpoint of the group of individuals that obtains them only at a cost, these goods must be included in both situations with weights reflecting their importance to that grou ...

An Introduction to Basic Macroeconomic Markets

... business firms be affected? How will the actual rate of unemployment compare with the natural rate of unemployment? Will the current rate of output be sustainable in the future? 2. Why is an unanticipated increase in the price level likely to expand output in the short run, but not in the long run? ...

... business firms be affected? How will the actual rate of unemployment compare with the natural rate of unemployment? Will the current rate of output be sustainable in the future? 2. Why is an unanticipated increase in the price level likely to expand output in the short run, but not in the long run? ...

A.1. Reflecting on new developmentalism and classical

... active macroeconomic policy—particularly an exchange rate policy. And it is defined as republican in that it is strong enough to protect the public patrimony from the rent seeking of individuals and groups. Historically, as we will see, the first forms of developmental state are not social or progre ...

... active macroeconomic policy—particularly an exchange rate policy. And it is defined as republican in that it is strong enough to protect the public patrimony from the rent seeking of individuals and groups. Historically, as we will see, the first forms of developmental state are not social or progre ...

What Explains the Great Recession and the Slow Recovery?

... has been centered on frictions that affect mostly consumption. Compared to this line of work, in my model there are two shocks that can push the economy to the ZLB, one that affects households’ discount factors and works exactly in the same way as in related literature, and another that disturbs agg ...

... has been centered on frictions that affect mostly consumption. Compared to this line of work, in my model there are two shocks that can push the economy to the ZLB, one that affects households’ discount factors and works exactly in the same way as in related literature, and another that disturbs agg ...