Existe-t-il une relation entre l*information sectorielle et le tableau

... Model to measure investment properties. Whereas companies not primarily in the real estate business should adopt the cost model to measure their investment property in order to avoid the procyclical effect of fair value. Hypothesis 2: Fair Value may have a pro-cyclical effect, allowing better KPIs ...

... Model to measure investment properties. Whereas companies not primarily in the real estate business should adopt the cost model to measure their investment property in order to avoid the procyclical effect of fair value. Hypothesis 2: Fair Value may have a pro-cyclical effect, allowing better KPIs ...

Invesco Comstock Fund fact sheet: Inst`l ret shares

... Value Index is a trademark/service mark of the Frank Russell Co. Russell® is a trademark of the Frank Russell Co. An investment cannot be made directly in an index. 12-month forward and trailing P/E are calculated using weighted harmonic averaging, which helps avoid extreme results that may occur du ...

... Value Index is a trademark/service mark of the Frank Russell Co. Russell® is a trademark of the Frank Russell Co. An investment cannot be made directly in an index. 12-month forward and trailing P/E are calculated using weighted harmonic averaging, which helps avoid extreme results that may occur du ...

Practical Special Purpose Vehicles

... emerging markets investments and infrastructure projects, including in electric power, chemicals, and climate change across Asia. He is also on the adjunct faculty at CSUSM for business. He had started his practice in Wall Street with Seward & Kissel specializing in structured finance and asset-back ...

... emerging markets investments and infrastructure projects, including in electric power, chemicals, and climate change across Asia. He is also on the adjunct faculty at CSUSM for business. He had started his practice in Wall Street with Seward & Kissel specializing in structured finance and asset-back ...

FOR IMMEDIATE RELEASE What do stock markets tell us about

... International investors can make significant US Dollar returns from betting on movements on national stock markets. Recent research by academics at the Cass Business School, the Bank of England and City University Hong Kong uses data for more than 40 markets observed over 30 years to show that avera ...

... International investors can make significant US Dollar returns from betting on movements on national stock markets. Recent research by academics at the Cass Business School, the Bank of England and City University Hong Kong uses data for more than 40 markets observed over 30 years to show that avera ...

A Two-Period International Investment Model Setting Up the The

... • Differences in interest rates between countries are the result of (1) different indifference curves (consumer preferences) or (2) different ICPFs (different rates of return to investment). • Differences in intertemporal preferences reflect differences in people’s tastes, age, household responsibil ...

... • Differences in interest rates between countries are the result of (1) different indifference curves (consumer preferences) or (2) different ICPFs (different rates of return to investment). • Differences in intertemporal preferences reflect differences in people’s tastes, age, household responsibil ...

Communiqué de presse

... mezzanine debt, real estate and infrastructure. Each team will manage underlying sub-strategies based on its own individual philosophies and principles, with an investment committee comprised of both UBP and Partners Group investment professionals responsible for allocation decisions between the sub ...

... mezzanine debt, real estate and infrastructure. Each team will manage underlying sub-strategies based on its own individual philosophies and principles, with an investment committee comprised of both UBP and Partners Group investment professionals responsible for allocation decisions between the sub ...

Using Morningstar to Select Funds (TT07)

... Note: You can also choose between a Tax-free and Taxable money market account. I would check to see the yields when making this decision. Then you would click the button to view results and look at the individual reports. Determine which asset class is important for you and then review the funds to ...

... Note: You can also choose between a Tax-free and Taxable money market account. I would check to see the yields when making this decision. Then you would click the button to view results and look at the individual reports. Determine which asset class is important for you and then review the funds to ...

Which is NOT a basic function of money?

... Disadvantage- It’s risky to invest in only one company (putting all your eggs in one basket) If your stock does poorly, you can lose a lot of money. ...

... Disadvantage- It’s risky to invest in only one company (putting all your eggs in one basket) If your stock does poorly, you can lose a lot of money. ...

Code on Policy Quotations

... Section 8.2 covers situations where the product is priced for the full term, and premiums are not expected to increase unless there is a “significant” worsening in the assumptions underlying the pricing. This is in contrast to Section 8.1 which covers situations where the premiums are expected to in ...

... Section 8.2 covers situations where the product is priced for the full term, and premiums are not expected to increase unless there is a “significant” worsening in the assumptions underlying the pricing. This is in contrast to Section 8.1 which covers situations where the premiums are expected to in ...

Setting the Discount Rate for Valuing Pension Liabilities

... If the investment return assumption changed as much or as rapidly as the capital market assumptions, the calculated contribution rates for funds would change rapidly from year to year and this could inhibit the goal of providing intergenerational equity. On the other hand, if the median investment r ...

... If the investment return assumption changed as much or as rapidly as the capital market assumptions, the calculated contribution rates for funds would change rapidly from year to year and this could inhibit the goal of providing intergenerational equity. On the other hand, if the median investment r ...

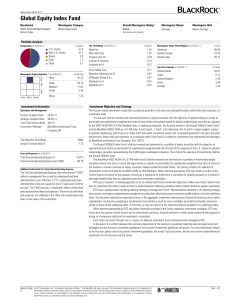

Global Equity Index Fund

... Fund in futures contracts for the purpose of acting as a substitute for investment in securities for liquidity purposes or in shares of exchange-traded funds that are registered open-end investment companies. BTC uses a "passive" or indexing approach to try to achieve each Fund's investment objectiv ...

... Fund in futures contracts for the purpose of acting as a substitute for investment in securities for liquidity purposes or in shares of exchange-traded funds that are registered open-end investment companies. BTC uses a "passive" or indexing approach to try to achieve each Fund's investment objectiv ...

Chapter 20, Section I

... Dividend per share (preferred) = Par value x Dividend rate Dividend per share (common) = ...

... Dividend per share (preferred) = Par value x Dividend rate Dividend per share (common) = ...

investors encourage the development of a uk municipal bond market

... therefore mitigate refinancing risk. flexibility in how to raise funds required including through private placements, direct access to public debt markets or through the use of an aggregator such as the UK ...

... therefore mitigate refinancing risk. flexibility in how to raise funds required including through private placements, direct access to public debt markets or through the use of an aggregator such as the UK ...

PowerShares Dynamic US Market UCITS ETF 31 May 2017

... There is no relationship between Licensor and PowerShares other than a license by Licensor to PowerShares of certain Quantitative Services Group Index Marks, trademarks and trade names, and the Index, for use by PowerShares. Such trademarks, trade names and Index have been created and developed by L ...

... There is no relationship between Licensor and PowerShares other than a license by Licensor to PowerShares of certain Quantitative Services Group Index Marks, trademarks and trade names, and the Index, for use by PowerShares. Such trademarks, trade names and Index have been created and developed by L ...

Quiz 3

... 3. When a firm issues preferred stock, it combines the disadvantages of equity finance with the disadvantages of debt finance. The disadvantage that preferred stock shares with equity (compared to debt finance) is: a. The dividends paid to preferred shareholders are paid out of the firm’s after-tax ...

... 3. When a firm issues preferred stock, it combines the disadvantages of equity finance with the disadvantages of debt finance. The disadvantage that preferred stock shares with equity (compared to debt finance) is: a. The dividends paid to preferred shareholders are paid out of the firm’s after-tax ...

fhipo makes available to its investors the report about the accrued

... mortgage portfolios in Mexico. Currently, it is the only investment vehicle that provides investors with exposure solely to the Mexican mortgage market and rewards them through a combination of dividend payments and capital gains. FHipo is managed by Concentradora Hipotecaria S.A.P.I. de C.V., which ...

... mortgage portfolios in Mexico. Currently, it is the only investment vehicle that provides investors with exposure solely to the Mexican mortgage market and rewards them through a combination of dividend payments and capital gains. FHipo is managed by Concentradora Hipotecaria S.A.P.I. de C.V., which ...

SEMINAR - Nanyang Business School

... institutions are a strong predictor of the subsequent leaders in economic development of their times. In essence, without the means for transforming technological innovation ideas into broad implementation in the economy, the growth benefits of technological progress will not be realized. For the pa ...

... institutions are a strong predictor of the subsequent leaders in economic development of their times. In essence, without the means for transforming technological innovation ideas into broad implementation in the economy, the growth benefits of technological progress will not be realized. For the pa ...

PowerPoint - Kuwait Financial Forum

... third-party integrators programmatic access (typically API-based) to their data. It’s entirely possible that the question of when to enter the mature API market may be taken out of players’ hands ...

... third-party integrators programmatic access (typically API-based) to their data. It’s entirely possible that the question of when to enter the mature API market may be taken out of players’ hands ...

184 kb PowerPoint presentation

... Risks in pension system: a. All models have risks, but nature and size varies from one model to another b. Some forms of financial risk are unique to defined contribution plans Individualization of pension provision: a. Increases financial risk (variation around the mean) b. Shifts more of demograph ...

... Risks in pension system: a. All models have risks, but nature and size varies from one model to another b. Some forms of financial risk are unique to defined contribution plans Individualization of pension provision: a. Increases financial risk (variation around the mean) b. Shifts more of demograph ...

PDF Download

... and agency problems, in the last few years this process was fundamentally flawed. First, massive undervaluation of fundamental risk and market liquidity risk caused both the origination of subprime mortgages, and the issuance of ABSs with AAA ratings derived from the underlying pool of mortgages to ...

... and agency problems, in the last few years this process was fundamentally flawed. First, massive undervaluation of fundamental risk and market liquidity risk caused both the origination of subprime mortgages, and the issuance of ABSs with AAA ratings derived from the underlying pool of mortgages to ...

Investor profile questionnaire - Sun Life of Canada

... the long term I have a better chance of higher returns. Nevertheless, I do worry when the stock market drops significantly. (10) I am very comfortable with volatility and seek more aggressive investments, knowing that in the short term this strategy may result in declines in value, but in the long t ...

... the long term I have a better chance of higher returns. Nevertheless, I do worry when the stock market drops significantly. (10) I am very comfortable with volatility and seek more aggressive investments, knowing that in the short term this strategy may result in declines in value, but in the long t ...

1 - JustAnswer

... b. Access to the capital markets c. Limited life d. Elimination of double taxation on corporate income e. All of the above 20. Which of the following should be considered when assessing the financial impact of business decisions? E a. The amount of projected earnings b. The risk-return tradeoff c. T ...

... b. Access to the capital markets c. Limited life d. Elimination of double taxation on corporate income e. All of the above 20. Which of the following should be considered when assessing the financial impact of business decisions? E a. The amount of projected earnings b. The risk-return tradeoff c. T ...

Outline of what exists

... Professor Atul Gawande, who has studied highly skilled decisionmaking under stress, points out: “Know-how and sophistication have increased remarkably across almost all our realms of endeavor, and as a result so has our struggle to deliver on them.” 2 Expert investment coach Lawrence Evans puts a fi ...

... Professor Atul Gawande, who has studied highly skilled decisionmaking under stress, points out: “Know-how and sophistication have increased remarkably across almost all our realms of endeavor, and as a result so has our struggle to deliver on them.” 2 Expert investment coach Lawrence Evans puts a fi ...

Production Incentive

... • Should prove that a contract / letter of intent is in place / has been awarded for the manufacture of components to supply into the light motor vehicle manufacture supply chain locally and/or internationally • Can prove that after the investment it will achieve at least 25% of total entity turnove ...

... • Should prove that a contract / letter of intent is in place / has been awarded for the manufacture of components to supply into the light motor vehicle manufacture supply chain locally and/or internationally • Can prove that after the investment it will achieve at least 25% of total entity turnove ...

CASE STUDY 4 USING A COMMSEC MARGIN LOAN TO

... Loan to invest in more securities, Lee has increased his exposure to price movements, dividends received, and franking credits delivering a profit 30% higher than the profit from Jenny’s ungeared investment – not including any potential received from the ...

... Loan to invest in more securities, Lee has increased his exposure to price movements, dividends received, and franking credits delivering a profit 30% higher than the profit from Jenny’s ungeared investment – not including any potential received from the ...