StatCentral.ie Statistic Information Page and Links International

... > Foreign assets - Direct investment abroad (Equity capital and reinvested earnings; Other capital); Equity (Monetary authority; General government; Monetary financial institutions; Other sectors); Bonds and notes (Monetary authority; General government; Monetary financial institutions; Other secto ...

... > Foreign assets - Direct investment abroad (Equity capital and reinvested earnings; Other capital); Equity (Monetary authority; General government; Monetary financial institutions; Other sectors); Bonds and notes (Monetary authority; General government; Monetary financial institutions; Other secto ...

Finance , Saving, And Investment,

... Loan: a sum of money or any valuable asset which an individual or group borrows from an individual or group, with the condition that it be returned or repaid at a later date. ...

... Loan: a sum of money or any valuable asset which an individual or group borrows from an individual or group, with the condition that it be returned or repaid at a later date. ...

Is China Changing?

... moderate. According to the National Bureau of Statistics (NBS), Chinese GDP growth, year-onyear, which had fallen from 8.1 per cent in the first quarter of 2012, to 7.6 per cent in the second and 7.4 per cent in the third quarter, had bounced back to 7.9 per cent in the last quarter of that year. Bu ...

... moderate. According to the National Bureau of Statistics (NBS), Chinese GDP growth, year-onyear, which had fallen from 8.1 per cent in the first quarter of 2012, to 7.6 per cent in the second and 7.4 per cent in the third quarter, had bounced back to 7.9 per cent in the last quarter of that year. Bu ...

new proxy advisory code seeks to resolve concerns from listed

... engagement between them and proxy advisory firms.” “This Code of Engagement is intended to be a voluntary framework. It outlines the way in which proxy firms should engage with listed companies, and it provides a mechanism for giving them feedback from listed companies. It should also help to identi ...

... engagement between them and proxy advisory firms.” “This Code of Engagement is intended to be a voluntary framework. It outlines the way in which proxy firms should engage with listed companies, and it provides a mechanism for giving them feedback from listed companies. It should also help to identi ...

How to foster investments in long-term assets such as

... participation of the private sector cannot be optimised through adequate regulation. Certain changes to current arrangements in relation to the involvement of the private sector may be considered so that there is a balance between them and the stability of the public programme. For example, in certa ...

... participation of the private sector cannot be optimised through adequate regulation. Certain changes to current arrangements in relation to the involvement of the private sector may be considered so that there is a balance between them and the stability of the public programme. For example, in certa ...

Monthly Percentage Returns: Pro

... The information in this document is not to be construed as an offer to buy or sell or a solicitation of an offer to buy or sell any financial instrument or to participate in any trading strategy in any jurisdiction in which such an offer or solicitation would violate applicable laws or regulations. ...

... The information in this document is not to be construed as an offer to buy or sell or a solicitation of an offer to buy or sell any financial instrument or to participate in any trading strategy in any jurisdiction in which such an offer or solicitation would violate applicable laws or regulations. ...

What Might Investors Expect from US High Yield?

... For instance, def ault risk recently was at below-average levels. J.P. Morgan cites the long-term def ault rate of the U.S. high-yield market as close to 3.8%, compared with a 2.8% f or the 12 months ended February 2017, and to J.P. Morgan’s projections of 2.5% f or 2017. Further, def aults (as of ...

... For instance, def ault risk recently was at below-average levels. J.P. Morgan cites the long-term def ault rate of the U.S. high-yield market as close to 3.8%, compared with a 2.8% f or the 12 months ended February 2017, and to J.P. Morgan’s projections of 2.5% f or 2017. Further, def aults (as of ...

World Economic Situation and Prospects 2004

... Global financial assets Global merchandise trade )Global financial assets as a percentage of GDP (right axis )Global merchandise trade as a percentage of GDP (right axis ...

... Global financial assets Global merchandise trade )Global financial assets as a percentage of GDP (right axis )Global merchandise trade as a percentage of GDP (right axis ...

Three Key Retirement Income Considerations Brian Flynn Financial

... health. Although you can't predict for certain how long you will live, you can make an estimate. However, it may not be wise to base your estimate on average life expectancy for your age and sex, particularly if you are healthy. The average life expectancy has risen steadily in the United States, re ...

... health. Although you can't predict for certain how long you will live, you can make an estimate. However, it may not be wise to base your estimate on average life expectancy for your age and sex, particularly if you are healthy. The average life expectancy has risen steadily in the United States, re ...

SPECIAL ASPECTS OF BANKS INVESTMENT ACTIVITY IN UKRAINE

... mortgage loans, etc. In stock investment tools include investing in securities, including bonds of internal state loan, municipal bonds, securities funds, companies on assets management (AMC), equities, corporate bonds, savings certificates, etc. It should be noted that such credit instrument for in ...

... mortgage loans, etc. In stock investment tools include investing in securities, including bonds of internal state loan, municipal bonds, securities funds, companies on assets management (AMC), equities, corporate bonds, savings certificates, etc. It should be noted that such credit instrument for in ...

Abnormal Investment, Overinvestment, and Stock Returns

... • Table 1: The country-by-country asset growth effects – Among developed countries, only 2 countries exhibit a reversed asset growth effect (Israel and New Zealand) and both are insignificant – 14 out of the 26 developed countries have a significant asset growth effect – The asset growth effect is v ...

... • Table 1: The country-by-country asset growth effects – Among developed countries, only 2 countries exhibit a reversed asset growth effect (Israel and New Zealand) and both are insignificant – 14 out of the 26 developed countries have a significant asset growth effect – The asset growth effect is v ...

Developing Community Wind in New Brunswick

... 1. No prior wind energy experience needed; 2. Investment may start as low as ...

... 1. No prior wind energy experience needed; 2. Investment may start as low as ...

DIFFUSION MODELLING

... aggregate demand in the economy. Thus a rise in investment demand will stimulates production of investment goods which in turn leads to high economic growth and development. Secondly, capital formation improves the productive capacity of the economy in a way that the economy is able to produce more ...

... aggregate demand in the economy. Thus a rise in investment demand will stimulates production of investment goods which in turn leads to high economic growth and development. Secondly, capital formation improves the productive capacity of the economy in a way that the economy is able to produce more ...

Greece Versus the Eurozone: Game of Chicken Enters Round

... If the investment is withdrawn in the early years, it may not return the full amount invested. This material represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events. In addition to the usual risks associated with investing, ...

... If the investment is withdrawn in the early years, it may not return the full amount invested. This material represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events. In addition to the usual risks associated with investing, ...

FINANCIAL MANAGEMENT

... The PSC Report 2002 which focused on the Management of Senior Manager’s Performance Agreements. The PSC report identified a definite need for an effective system to manage and monitor the performance of Senior Managers within the context of a public service in transformation. ...

... The PSC Report 2002 which focused on the Management of Senior Manager’s Performance Agreements. The PSC report identified a definite need for an effective system to manage and monitor the performance of Senior Managers within the context of a public service in transformation. ...

Data Mining, Arbitraged Away, or Here to Stay?

... people ask me about this strategy (also known as alternative beta, exotic beta, risk factor, style premia, risk premia investing) all the time. The number one question I receive is: what should an investor expect regarding returns generated from smart beta strategies (e.g. value, momentum, carry, lo ...

... people ask me about this strategy (also known as alternative beta, exotic beta, risk factor, style premia, risk premia investing) all the time. The number one question I receive is: what should an investor expect regarding returns generated from smart beta strategies (e.g. value, momentum, carry, lo ...

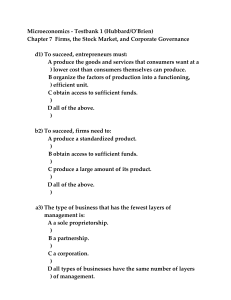

gitman_286618_IM_ch01

... allow borrowers who have difficulty making mortgage payments tap this built-up equity. Therefore, mortgage default rates are relatively low. 11. As home prices decline, the value of homes may be less than the amount owed to the bank. Hence, many borrowers will simply walk away from their homes and l ...

... allow borrowers who have difficulty making mortgage payments tap this built-up equity. Therefore, mortgage default rates are relatively low. 11. As home prices decline, the value of homes may be less than the amount owed to the bank. Hence, many borrowers will simply walk away from their homes and l ...

US Equities: Light at the End of the Tunnel

... The below-average real returns for equities during the past 12 years, in combination with the nearuninterrupted 30-year rally for bonds, has led to a recent shift in investor preferences. Since December 2007, investors have poured more than $1.1 trillion into bond mutual funds and exchange-traded fu ...

... The below-average real returns for equities during the past 12 years, in combination with the nearuninterrupted 30-year rally for bonds, has led to a recent shift in investor preferences. Since December 2007, investors have poured more than $1.1 trillion into bond mutual funds and exchange-traded fu ...

Das vollständige Interview im pdf

... “overheating risks”, there is nothing that hints at a strong inflation risk in the foreseeable future, as was the case in 2004. In fact the contrast could hardly be greater: softer commodity prices and more disciplined monetary policies across most of the world suggest greater pressures on prices. A ...

... “overheating risks”, there is nothing that hints at a strong inflation risk in the foreseeable future, as was the case in 2004. In fact the contrast could hardly be greater: softer commodity prices and more disciplined monetary policies across most of the world suggest greater pressures on prices. A ...

A Guide to Irish Regulated Real Estate Funds

... Whilst regulated investment limited partnerships are also available, to our knowledge none have been used / authorized for at least a decade and we have not accordingly considered them further given that the Financial Regulator would not be familiar with them in practice. The choice of legal structu ...

... Whilst regulated investment limited partnerships are also available, to our knowledge none have been used / authorized for at least a decade and we have not accordingly considered them further given that the Financial Regulator would not be familiar with them in practice. The choice of legal structu ...

Basics of Investment

... To invest is to allocate money (or sometimes another resource, such as time) in the expectation of some benefit in the future. Investing means putting your money to work for you in future. In finance, the expected future benefit from investment is a return. The return may consist of capital gai ...

... To invest is to allocate money (or sometimes another resource, such as time) in the expectation of some benefit in the future. Investing means putting your money to work for you in future. In finance, the expected future benefit from investment is a return. The return may consist of capital gai ...

TVM Capital

... – Pharma needs products from the biotech industry – Pipelines are increasingly externalized – The investor universe is changing: VC – Pharma partnerships, corporate VC, family offices looking for direct investments – IPOs: possible in the US, not (yet?) in Europe. ...

... – Pharma needs products from the biotech industry – Pipelines are increasingly externalized – The investor universe is changing: VC – Pharma partnerships, corporate VC, family offices looking for direct investments – IPOs: possible in the US, not (yet?) in Europe. ...

Corporate Finance

... This is a closed-book exam. The first part takes 20 minutes, while the second one lasts for two and a half hours. Each question in the first part gives one point. Good luck! Part 1 1. Compare the risk-neutral probability q of the upper stock price’s move in the binomial model with the actual one (p) ...

... This is a closed-book exam. The first part takes 20 minutes, while the second one lasts for two and a half hours. Each question in the first part gives one point. Good luck! Part 1 1. Compare the risk-neutral probability q of the upper stock price’s move in the binomial model with the actual one (p) ...