Peter Hoyt Named CEO - Path to Purchase Institute

... technology vendors. The company informs, connects and provides predictive analysis through custom and syndicated research, data, media and events. Learn more at www.stagnito-edgell.com. The Path to Purchase Institute is a global association serving the needs of retailers, brands and solution prov ...

... technology vendors. The company informs, connects and provides predictive analysis through custom and syndicated research, data, media and events. Learn more at www.stagnito-edgell.com. The Path to Purchase Institute is a global association serving the needs of retailers, brands and solution prov ...

Focal Area and Cross Cutting Strategies – Chemicals

... degradation (i.e. loss of ecosystem services): - land use change (loss of vegetative cover) - natural resources consumption (loss of biodiversity) - climate change (GHG emissions, vulnerability risks) ...

... degradation (i.e. loss of ecosystem services): - land use change (loss of vegetative cover) - natural resources consumption (loss of biodiversity) - climate change (GHG emissions, vulnerability risks) ...

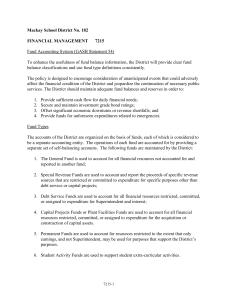

Fund Account System (GASB Statement 54) 7215

... to assign amounts to be used for specific purposes. Such assignments cannot exceed the available (spendable, unrestricted, uncommitted) fund balance in any particular fund. 5. Unassigned Fund Balance: Includes the residual classification for the District’s general fund and includes all spendable amo ...

... to assign amounts to be used for specific purposes. Such assignments cannot exceed the available (spendable, unrestricted, uncommitted) fund balance in any particular fund. 5. Unassigned Fund Balance: Includes the residual classification for the District’s general fund and includes all spendable amo ...

Developing an Investment Policy Statement Under ERISA

... sponsors who fail to take into account each year’s future cash outlays increase their chances of holding an investment portfolio which is either too risky or too conservative. The relationship between funding, assets, ...

... sponsors who fail to take into account each year’s future cash outlays increase their chances of holding an investment portfolio which is either too risky or too conservative. The relationship between funding, assets, ...

Upcoming changes to the BMO Money Market Funds

... As a result of these possible restrictions and the operational challenges created by them, many workplace-defined contribution plans are considering the removal of prime money market funds from the plan’s investment line-up in exchange for government money market funds or alternative stable value in ...

... As a result of these possible restrictions and the operational challenges created by them, many workplace-defined contribution plans are considering the removal of prime money market funds from the plan’s investment line-up in exchange for government money market funds or alternative stable value in ...

Chapter 14. Investment and asset prices

... • In the case where the firm issues new shares we simply subtract these costs from the value of shares held by existing shareholders • It is optimal for investors to let the firm expand the capital stock (invest) until the expected marginal gain on their shares is driven down to zero, that is qt – ( ...

... • In the case where the firm issues new shares we simply subtract these costs from the value of shares held by existing shareholders • It is optimal for investors to let the firm expand the capital stock (invest) until the expected marginal gain on their shares is driven down to zero, that is qt – ( ...

Fees Eat Diversification`s Lunch

... we have access to a biennial fee survey from a major institutional investment consulting firm with over $2 trillion in advised client assets. This data includes the average and distribution (i.e., several different percentiles) of both published and actual negotiated investment management fees for a ...

... we have access to a biennial fee survey from a major institutional investment consulting firm with over $2 trillion in advised client assets. This data includes the average and distribution (i.e., several different percentiles) of both published and actual negotiated investment management fees for a ...

Taiwan: diversifying into Southeast Asia

... That said, regional economic integration could allow foreign firms invested in ASEAN to tap a deeper and broader market. The ASEAN Economic Community has been established late last year. Aiming to transform the region into a single market, the AEC will promote free movement of goods, services, inves ...

... That said, regional economic integration could allow foreign firms invested in ASEAN to tap a deeper and broader market. The ASEAN Economic Community has been established late last year. Aiming to transform the region into a single market, the AEC will promote free movement of goods, services, inves ...

behavioral viewpoint - McGraw

... The quality-management viewpoint of the contemporary perspective includes quality control, quality assurance, and total quality management Quality is the total ability of a product or service to meet customer needs, and is one of the best ways to add value to a product and differentiate it from ot ...

... The quality-management viewpoint of the contemporary perspective includes quality control, quality assurance, and total quality management Quality is the total ability of a product or service to meet customer needs, and is one of the best ways to add value to a product and differentiate it from ot ...

Emerging Market Corporate Debt: An Attractive Investment Opportunity

... The EM Corporate Universe Is Well Diversified By Country And Sector Diversification is one of the benefits of investing in EM corporate bonds. The CEMBI broad index contains 1,195 issues from 549 issuers domiciled in 50 countries around the globe. This creates the potential for active managers to ob ...

... The EM Corporate Universe Is Well Diversified By Country And Sector Diversification is one of the benefits of investing in EM corporate bonds. The CEMBI broad index contains 1,195 issues from 549 issuers domiciled in 50 countries around the globe. This creates the potential for active managers to ob ...

Hedge Funds

... brokers. These are usually big international banks, and they typically hold funds’ money and act as custodians of their portfolios, transferring money or securities when funds’ trading demands it. (Again, all this is now automated, with funds’ computer systems directly linked to those of their prime ...

... brokers. These are usually big international banks, and they typically hold funds’ money and act as custodians of their portfolios, transferring money or securities when funds’ trading demands it. (Again, all this is now automated, with funds’ computer systems directly linked to those of their prime ...

Teacher Guidance on the Music Industry

... promote the product (records) & the performers; and bulk release the product to retail outlets or digital services. The business undertaken by record companies can be broadly split into three main areas: Administration, the Product and Promotion. The Administration part of the company, headed up by ...

... promote the product (records) & the performers; and bulk release the product to retail outlets or digital services. The business undertaken by record companies can be broadly split into three main areas: Administration, the Product and Promotion. The Administration part of the company, headed up by ...

Pathway to independence

... Consider these risks before investing: Allocation of assets among asset classes may hurt performance. Stock and bond prices may fall or fail to rise over time for several reasons, including general financial market conditions, factors related to a specific issuer or industry and, with respect to bo ...

... Consider these risks before investing: Allocation of assets among asset classes may hurt performance. Stock and bond prices may fall or fail to rise over time for several reasons, including general financial market conditions, factors related to a specific issuer or industry and, with respect to bo ...

SECURITIES AND EXCHANGE COMMISSION Washington, D.C.

... amendments to any of the foregoing as may be required to be filed with the Securities and Exchange Commission, and delivering, furnishing or filing any such documents with the appropriate governmental, regulatory authority or other person, and giving and granting to each such attorney-in-fact power ...

... amendments to any of the foregoing as may be required to be filed with the Securities and Exchange Commission, and delivering, furnishing or filing any such documents with the appropriate governmental, regulatory authority or other person, and giving and granting to each such attorney-in-fact power ...

Data Definitions

... The Alternative Minimum Tax (AMT) is an income tax imposed by the United States federal government on individuals, corporations, estates, and trusts. AMT is imposed at a nearly flat rate on an adjusted amount of taxable income above a certain threshold (also known as exemption). Bond Call Risk The p ...

... The Alternative Minimum Tax (AMT) is an income tax imposed by the United States federal government on individuals, corporations, estates, and trusts. AMT is imposed at a nearly flat rate on an adjusted amount of taxable income above a certain threshold (also known as exemption). Bond Call Risk The p ...

Asset Policy - Dove House School Academy

... Where there are directly attributable costs to bringing any fixed asset to the location and condition necessary for it to be capable of operating in the manner intended by management, these are included in the cost of the asset. Each category has its own Nominal Ledger code within the Balance Sheet ...

... Where there are directly attributable costs to bringing any fixed asset to the location and condition necessary for it to be capable of operating in the manner intended by management, these are included in the cost of the asset. Each category has its own Nominal Ledger code within the Balance Sheet ...

QSI Press Release Here

... chemical plants globally, representing billions of dollars in annual output. QSI common stock is quoted on the OTCQB under the ticker symbol QSIM. For more information, please visit www.qsinano.com. About National Investment Banking Association (NIBA) National Investment Banking Association (NIBA) i ...

... chemical plants globally, representing billions of dollars in annual output. QSI common stock is quoted on the OTCQB under the ticker symbol QSIM. For more information, please visit www.qsinano.com. About National Investment Banking Association (NIBA) National Investment Banking Association (NIBA) i ...

VALUE -OR iE NTED iN VESTMENTMANAGEMENT Fox Asset

... attempt to discern situations where intrinsic asset values are not widely recognized. Rigorous fundamental analysis, from both a quantitative and qualitative standpoint, is applied to all investment candidates. The firm employs a disciplined “bottom-up” approach to identify undervalued stocks. We se ...

... attempt to discern situations where intrinsic asset values are not widely recognized. Rigorous fundamental analysis, from both a quantitative and qualitative standpoint, is applied to all investment candidates. The firm employs a disciplined “bottom-up” approach to identify undervalued stocks. We se ...

Report Draft

... nowadays, but also individual investors who want to make the best of their assets. It is obviously known that for an individual or a corporation that invests money to make money, the success of the operation depends heavily on how well he/she knows the game. The problem is that some people investing ...

... nowadays, but also individual investors who want to make the best of their assets. It is obviously known that for an individual or a corporation that invests money to make money, the success of the operation depends heavily on how well he/she knows the game. The problem is that some people investing ...

Simplicity Is the Ultimate Sophistication

... Risk is measured by standard deviation. Standard deviation is a measure of how returns over time have varied from the mean; a lower number signifies lower volatility. Stocks are represented by the S&P 5009.0% Index which is a market capitalization-weighted price index composed of 500 widely held com ...

... Risk is measured by standard deviation. Standard deviation is a measure of how returns over time have varied from the mean; a lower number signifies lower volatility. Stocks are represented by the S&P 5009.0% Index which is a market capitalization-weighted price index composed of 500 widely held com ...

WORLD ENERGY

... Gas prices and capital costs of coal stations & renewables are key drivers of future investment in generation Wind power will be primary renewable source – calling for investment in voltage regulation & network reinforcement New capacity investment may be delayed as investors wait to see what ...

... Gas prices and capital costs of coal stations & renewables are key drivers of future investment in generation Wind power will be primary renewable source – calling for investment in voltage regulation & network reinforcement New capacity investment may be delayed as investors wait to see what ...

Netspar basic sheets

... Whenever guarantees (in annuities, but also in investment products) are provided it seems crucial to state them in real terms rather than nominal ones ...

... Whenever guarantees (in annuities, but also in investment products) are provided it seems crucial to state them in real terms rather than nominal ones ...

IDSC… Successful Model for an Egyptian Think Tank Presented by

... Networking either within the organization or with peer organizations maximizes the strength of capacity building initiatives. ...

... Networking either within the organization or with peer organizations maximizes the strength of capacity building initiatives. ...

anOnline Demo Sign Up for Streamline. Automate. Simplify.

... Whether you need to keep track of and easily communicate with employees; simplify and streamline the visitor process; automate and modernize your payroll system; or make sure your organization is completely prepared in case of an emergency, EIOBoard has got you covered. The software also integrates ...

... Whether you need to keep track of and easily communicate with employees; simplify and streamline the visitor process; automate and modernize your payroll system; or make sure your organization is completely prepared in case of an emergency, EIOBoard has got you covered. The software also integrates ...