March 2007 - NB must open doors

... This ominous-sounding term refers to the point in a company's early development when it has a product and an identified customer base but lacks the money it needs to market and produce its product in order to beat competitors and make its mark. ...

... This ominous-sounding term refers to the point in a company's early development when it has a product and an identified customer base but lacks the money it needs to market and produce its product in order to beat competitors and make its mark. ...

YOUR INVESTMENT WITH CORONATION

... While many investment companies are forced to take short-term action because they are under massive pressure to do well this month, this quarter, this year – we take the long-term view. We believe that being able to make decisions over the next five to ten years gives us a substantial advantage. We ...

... While many investment companies are forced to take short-term action because they are under massive pressure to do well this month, this quarter, this year – we take the long-term view. We believe that being able to make decisions over the next five to ten years gives us a substantial advantage. We ...

There is a famous pendulum in Portland, Oregon named Principia

... While the collapse in oil prices is bad for those in the oil business, it’s an economic benefit to the rest. Chief among the latter are China, India, and the Eurozone, all of which are large oil importers. Another example is Chile, who lost sizable export revenue as copper prices ...

... While the collapse in oil prices is bad for those in the oil business, it’s an economic benefit to the rest. Chief among the latter are China, India, and the Eurozone, all of which are large oil importers. Another example is Chile, who lost sizable export revenue as copper prices ...

Thought leadership | Financial Intelligence

... “Federated has been a leading provider of liquidity management services for four decades, and we will continue to offer products suitable for all of our clients,” said J. Christopher Donahue, president and chief executive officer. “Our clients have requested that we begin to share information on our ...

... “Federated has been a leading provider of liquidity management services for four decades, and we will continue to offer products suitable for all of our clients,” said J. Christopher Donahue, president and chief executive officer. “Our clients have requested that we begin to share information on our ...

EMH Lecture

... • Cheap (expensive) stocks tend to have surprisingly high (low) realized returns • Cheap (expensive) stocks tend to have low (high) volatility, because little (much) is expected of them • Investors may expect higher returns from expensive stocks but they may be repeatedly surprised by disappointing ...

... • Cheap (expensive) stocks tend to have surprisingly high (low) realized returns • Cheap (expensive) stocks tend to have low (high) volatility, because little (much) is expected of them • Investors may expect higher returns from expensive stocks but they may be repeatedly surprised by disappointing ...

IHS buys Toronto-based Dyadem International

... Proactive Investors is a publisher and is not registered with or authorised by the Financial Conduct Authority (FCA). You understand and agree that no content published constitutes a recommendation that any particular security, portfolio of securities, transaction, or investment strategy is suitable ...

... Proactive Investors is a publisher and is not registered with or authorised by the Financial Conduct Authority (FCA). You understand and agree that no content published constitutes a recommendation that any particular security, portfolio of securities, transaction, or investment strategy is suitable ...

English - Pictet Perspectives

... that some sort of middle path will be found. At least initially, a cut in personal taxes will likely have a bigger impact on smaller and medium-sized companies exclusively focused on the domestic market rather than S&P 500 ...

... that some sort of middle path will be found. At least initially, a cut in personal taxes will likely have a bigger impact on smaller and medium-sized companies exclusively focused on the domestic market rather than S&P 500 ...

October 31 , 2016 This is what late cycle looks like… Weakness

... On this front, the fact that China’s yield curve has moved to its flattest level in years – the gap between the 10-year yield of 2.60% and the two year note of 2.30% has collapsed to 30bps – stands in stark contrast to the buoyant GDP prints over the last several quarters. And now Beijing is taking ...

... On this front, the fact that China’s yield curve has moved to its flattest level in years – the gap between the 10-year yield of 2.60% and the two year note of 2.30% has collapsed to 30bps – stands in stark contrast to the buoyant GDP prints over the last several quarters. And now Beijing is taking ...

May in perspective – global markets May proved to be another

... for so many countries to have such low yields. None of us can know the full ramifications of this. In simple terms there are two ways to look at this. Either bonds are the short trade of the millennium (literally) at these levels or that something very unusual is going on globally and will continue ...

... for so many countries to have such low yields. None of us can know the full ramifications of this. In simple terms there are two ways to look at this. Either bonds are the short trade of the millennium (literally) at these levels or that something very unusual is going on globally and will continue ...

Has online travel management come of age?

... From the client’s perspective, the third online option may be seen as a best of both worlds solution, giving them access to sophisticated booking technology that they have not had to invest in themselves and with no additional cost to the business. In April 2015, the world’s leading online accommoda ...

... From the client’s perspective, the third online option may be seen as a best of both worlds solution, giving them access to sophisticated booking technology that they have not had to invest in themselves and with no additional cost to the business. In April 2015, the world’s leading online accommoda ...

Week Ahead: US Earnings and Abe Election Win Bolster Optimism

... continues to attract attention in the US because improvements in the US housing sector trickle down positively to other parts of the US economy, helping to increase overall employment and boost consumer confidence and spending. Europe – This week should give a good indication about any signs of a mo ...

... continues to attract attention in the US because improvements in the US housing sector trickle down positively to other parts of the US economy, helping to increase overall employment and boost consumer confidence and spending. Europe – This week should give a good indication about any signs of a mo ...

The Financial Reporting Practices of State

... Performance influences political promotions and demotions (Chen, Li and Zhou, 2005; Li and Zhou, 2005). ...

... Performance influences political promotions and demotions (Chen, Li and Zhou, 2005; Li and Zhou, 2005). ...

management of bleached and severely damaged coral reefs

... livelihoods of human populations dependent on reefs will depend on reef recovery. Countries of the Indian Ocean are now at serious risk of losing this valuable ecosystem. The economy of Maldives, for example, has traditionally been based on fisheries and tourism. Both of these activities can be link ...

... livelihoods of human populations dependent on reefs will depend on reef recovery. Countries of the Indian Ocean are now at serious risk of losing this valuable ecosystem. The economy of Maldives, for example, has traditionally been based on fisheries and tourism. Both of these activities can be link ...

Country Risk Updates – Q4 2015 Oct

... with expected returns, such as export payments and foreign debt and equity servicing. Low degree of uncertainty associated with expected returns. However, country-wide factors may result in higher volatility of returns at a future date. Enough uncertainty over expected returns to warrant close monit ...

... with expected returns, such as export payments and foreign debt and equity servicing. Low degree of uncertainty associated with expected returns. However, country-wide factors may result in higher volatility of returns at a future date. Enough uncertainty over expected returns to warrant close monit ...

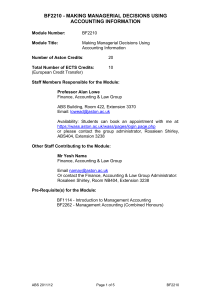

bf2210 - making managerial decisions using accounting information

... Managers use accounting to help them define the problems their organisations face, to make decisions concerning those problems and to communicate their decisions to others. Building on the first year introduction to management accounting (BF1114, or BF2262 for Combined Honours), this module explores ...

... Managers use accounting to help them define the problems their organisations face, to make decisions concerning those problems and to communicate their decisions to others. Building on the first year introduction to management accounting (BF1114, or BF2262 for Combined Honours), this module explores ...

Relative Velocity Statistics: Their Application in Portfolio Analysis

... was appraised, the general market expectation was for a further rise of 10%. With a velocity of 165, this would mean that the portfolio, which then amounted to $248,000, might be expected to advance not 10%, but 16.5%, to a value of $288,920. In effect, the portfolio under study might be expected to ...

... was appraised, the general market expectation was for a further rise of 10%. With a velocity of 165, this would mean that the portfolio, which then amounted to $248,000, might be expected to advance not 10%, but 16.5%, to a value of $288,920. In effect, the portfolio under study might be expected to ...

Taxation of Collective Investment Funds and

... fund has received approval from the IRC in this regard. ...

... fund has received approval from the IRC in this regard. ...

ING to sell 33 million shares in NN Group

... ordinary shares in NN Group. NN Group will not be issuing or selling shares as part of this transaction, and will not receive any proceeds from the offering. The transaction reduces ING Group’s stake in NN Group from 25.8% to 16.2% of outstanding shares (net of treasury shares). The shares will be o ...

... ordinary shares in NN Group. NN Group will not be issuing or selling shares as part of this transaction, and will not receive any proceeds from the offering. The transaction reduces ING Group’s stake in NN Group from 25.8% to 16.2% of outstanding shares (net of treasury shares). The shares will be o ...

FINDING THE VALUE OF BDCs - Valuation Research Corporation

... additional input to the board, investors, auditors and at times, the SEC, although certain BDCs do successfully perform their own valuations internally. BDCs are indeed skilled in capital allocation, however formal valuation skills designed to meet financial reporting challenges and third party revi ...

... additional input to the board, investors, auditors and at times, the SEC, although certain BDCs do successfully perform their own valuations internally. BDCs are indeed skilled in capital allocation, however formal valuation skills designed to meet financial reporting challenges and third party revi ...