Asset Acquisition for Constructed Assets

... SAP and other SAP products and services mentioned herein as well as their respective logos are trademarks or registered trademarks of SAP SE (or an SAP affiliate company) in Germany and other countries. Please see http://global12.sap.com/corporate-en/legal/copyright/index.epx for additional trademar ...

... SAP and other SAP products and services mentioned herein as well as their respective logos are trademarks or registered trademarks of SAP SE (or an SAP affiliate company) in Germany and other countries. Please see http://global12.sap.com/corporate-en/legal/copyright/index.epx for additional trademar ...

Link - Validus Risk Management

... are managed by private debt fund managers. Regulatory regimes such as the AIFMD in Europe and Dodd Frank in the United States are beginning to place specific obligations on fund managers, affecting how risks are identified, measured, managed and reported. For the institutional investor, therefore, t ...

... are managed by private debt fund managers. Regulatory regimes such as the AIFMD in Europe and Dodd Frank in the United States are beginning to place specific obligations on fund managers, affecting how risks are identified, measured, managed and reported. For the institutional investor, therefore, t ...

the role of pension funds in financing green growth

... stream - with green bonds consequently gaining interest as an asset class, particularly - though not only with the SRI universe of institutional investors. Yet, despite the interest in these instruments, pension funds‟ asset allocation to such green investments remains low. This is partly due to a l ...

... stream - with green bonds consequently gaining interest as an asset class, particularly - though not only with the SRI universe of institutional investors. Yet, despite the interest in these instruments, pension funds‟ asset allocation to such green investments remains low. This is partly due to a l ...

Sticker to Prospectus The Prospectus for ICON ECI Fund Fifteen

... financing middle- to large-ticket, business-essential equipment and other capital assets, we will typically underwrite and structure such financing in a manner similar to providers of senior indebtedness (i.e., our underwriting includes both creditworthiness and asset due diligence and consideration ...

... financing middle- to large-ticket, business-essential equipment and other capital assets, we will typically underwrite and structure such financing in a manner similar to providers of senior indebtedness (i.e., our underwriting includes both creditworthiness and asset due diligence and consideration ...

This PDF is a selection from an out-of-print volume from... of Economic Research Volume Title: Foreign Direct Investment

... also host (recipient) nations to 57 percent of these flows, and developed market nations in total were host to 8 1 percent. The share of FDI flows going to developing nations thus was only about 19 percent, a low share by the standards of earlier decades. Of this share, an overwhelming majority went ...

... also host (recipient) nations to 57 percent of these flows, and developed market nations in total were host to 8 1 percent. The share of FDI flows going to developing nations thus was only about 19 percent, a low share by the standards of earlier decades. Of this share, an overwhelming majority went ...

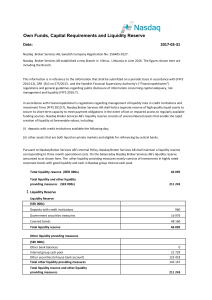

Own Funds, Capital Requirements and Liquidity Reserve

... funding sources. Nasdaq Broker Services AB’s liquidity reserve consists of unencumbered assets that enable the rapid creation of liquidity at foreseeable values, including: (i) deposits with credit institutions available the following day; (ii) other assets that are both liquid on private markets an ...

... funding sources. Nasdaq Broker Services AB’s liquidity reserve consists of unencumbered assets that enable the rapid creation of liquidity at foreseeable values, including: (i) deposits with credit institutions available the following day; (ii) other assets that are both liquid on private markets an ...

= Best Long-Term Shareholder Value

... Company raised gross proceeds of €215 million through the issuance of 215 million ordinary shares (the “Capital Raise”), which, together with the €200 million raised in the initial offering in April 2014, brings the total gross proceeds raised to €415 million. During the year ended 31 December 2015, ...

... Company raised gross proceeds of €215 million through the issuance of 215 million ordinary shares (the “Capital Raise”), which, together with the €200 million raised in the initial offering in April 2014, brings the total gross proceeds raised to €415 million. During the year ended 31 December 2015, ...

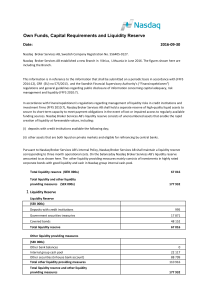

Own Funds, Capital Requirements and Liquidity Reserve

... funding sources. Nasdaq Broker Services AB’s liquidity reserve consists of unencumbered assets that enable the rapid creation of liquidity at foreseeable values, including: (i) deposits with credit institutions available the following day; (ii) other assets that are both liquid on private markets an ...

... funding sources. Nasdaq Broker Services AB’s liquidity reserve consists of unencumbered assets that enable the rapid creation of liquidity at foreseeable values, including: (i) deposits with credit institutions available the following day; (ii) other assets that are both liquid on private markets an ...

Pre-project SQA components Project Life Cycle SQA components

... Formal design reviews: to formally get professional doc. Approval Peer reviews: peer review of short doc., chapter, or reports. 2. Expert opinions Expert opinions support quality assessment efforts by introducing additional external capabilities into the organization’s in-house development process. ...

... Formal design reviews: to formally get professional doc. Approval Peer reviews: peer review of short doc., chapter, or reports. 2. Expert opinions Expert opinions support quality assessment efforts by introducing additional external capabilities into the organization’s in-house development process. ...

Does Fund Size Erode Performance? Organizational Diseconomies

... performance because of fund incentives to lock in assets under management after a long string of good past performances.4 When a fund is small and has little reputation, the manager goes about the business of stock picking. But as the fund gets large because of good past performance, the manager may ...

... performance because of fund incentives to lock in assets under management after a long string of good past performances.4 When a fund is small and has little reputation, the manager goes about the business of stock picking. But as the fund gets large because of good past performance, the manager may ...

Housing and Portfolio Choice: A Life Cycle Simulation Model

... as a primary residence and not as an investment in a real estate fund – can play a central role in determining optimal asset demand. First, housing is a prominent asset in most households’ portfolios and responsible for a significant part of the households’ expenses. Yao and Zhang (2005) report from ...

... as a primary residence and not as an investment in a real estate fund – can play a central role in determining optimal asset demand. First, housing is a prominent asset in most households’ portfolios and responsible for a significant part of the households’ expenses. Yao and Zhang (2005) report from ...

An Economic Perspective on Dividends

... of future results. Dividend yield is one component of performance and should not be unmanaged and unavailable for direct investment. Index returns do not reflect investment the only consideration for investment. Dividends are not guaranteed and will fluctuate. advisory and other fees or expenses tha ...

... of future results. Dividend yield is one component of performance and should not be unmanaged and unavailable for direct investment. Index returns do not reflect investment the only consideration for investment. Dividends are not guaranteed and will fluctuate. advisory and other fees or expenses tha ...

IOSR Journal of Business and Management (IOSR-JBM) ISSN: 2278-487X.

... social capital, psychological capital may provide leverage, return on investment, and competitive advantage through improved employee performance. Specifically, psychological capital is defined as a core psychological factor of positivity in general, and POB criteria meeting states in particular, th ...

... social capital, psychological capital may provide leverage, return on investment, and competitive advantage through improved employee performance. Specifically, psychological capital is defined as a core psychological factor of positivity in general, and POB criteria meeting states in particular, th ...

MACD BASED DOLLAR COST AVERAGING STRATEGY

... help the SET to enjoy greater stability. Hence, LTF investors who are ordinary persons will be entitled to tax benefits as investment motivators under the terms that they are required to hold the investment units for no less than five calendar years with no requirement for a full five accounting yea ...

... help the SET to enjoy greater stability. Hence, LTF investors who are ordinary persons will be entitled to tax benefits as investment motivators under the terms that they are required to hold the investment units for no less than five calendar years with no requirement for a full five accounting yea ...

OIE Annual Report - Think Asia, Invest Thailand

... The Office of Industrial Economics, which is under the Ministry of Industry, has compiled its annual report on the Thai economy, offering a good summary of sector by sector economic growth in 2014, and identifying trends for 2015. Additionally, the data presented includes industrial surveys by the B ...

... The Office of Industrial Economics, which is under the Ministry of Industry, has compiled its annual report on the Thai economy, offering a good summary of sector by sector economic growth in 2014, and identifying trends for 2015. Additionally, the data presented includes industrial surveys by the B ...

How Do Private Equity Investments Perform Compared to Public

... on companies: limited partner stakes in a private equity fund or ownership of publicly traded stocks.1 Despite the real differences between the two forms of ownership (including liquidity and control over cash flow timing), portfolio managers increasingly see them as alternative routes to equity exp ...

... on companies: limited partner stakes in a private equity fund or ownership of publicly traded stocks.1 Despite the real differences between the two forms of ownership (including liquidity and control over cash flow timing), portfolio managers increasingly see them as alternative routes to equity exp ...

Outlook 2016

... the year. This further reinforced our view that investing in the region requires seeking out quality companies that provide consistent shareholders returns and which trade at reasonable valuations. Asia continues to offer significant structural advantages in terms of growth potential over the longer ...

... the year. This further reinforced our view that investing in the region requires seeking out quality companies that provide consistent shareholders returns and which trade at reasonable valuations. Asia continues to offer significant structural advantages in terms of growth potential over the longer ...

Project and Investment Appraisal for Sustainable Value

... rather than the same amount in the future, i.e., one dollar (or other currency) today is worth more than one dollar tomorrow. An investor demands a rate of return even for a riskless investment, as a reward for delayed repayment. The “risk-free” rate of return is normally positive because people att ...

... rather than the same amount in the future, i.e., one dollar (or other currency) today is worth more than one dollar tomorrow. An investor demands a rate of return even for a riskless investment, as a reward for delayed repayment. The “risk-free” rate of return is normally positive because people att ...

Foreign Investment Laws and National Security

... security, while other agencies are oriented to promoting an open trade and investment policy. This tension among the member agencies is designed to elicit thoughtful judgments that take into account diverse economic and security considerations through a consensus-building deliberative process. In pr ...

... security, while other agencies are oriented to promoting an open trade and investment policy. This tension among the member agencies is designed to elicit thoughtful judgments that take into account diverse economic and security considerations through a consensus-building deliberative process. In pr ...

Icelandic foreign direct investment

... these properties may be estimated at several billion kr., of which real estate owned by the Icelandic state would amount to 1-1.5 billion kr. The Icelandic state owns holdings in foreign enterprises and agencies which were valued at 2.6 billion kr. in the treasury accounts for 1998. Other foreign as ...

... these properties may be estimated at several billion kr., of which real estate owned by the Icelandic state would amount to 1-1.5 billion kr. The Icelandic state owns holdings in foreign enterprises and agencies which were valued at 2.6 billion kr. in the treasury accounts for 1998. Other foreign as ...

An Overview of Fee Structures in Real Estate Funds and Their

... The base fees and costs generally relate to the three stages of a fund’s life cycle: inception, operations and dissolution. Clearly, there may be some overlap and/or ambiguity with regard In a competitive marketplace, differentials of a few basis points often matter in terms of investment manager se ...

... The base fees and costs generally relate to the three stages of a fund’s life cycle: inception, operations and dissolution. Clearly, there may be some overlap and/or ambiguity with regard In a competitive marketplace, differentials of a few basis points often matter in terms of investment manager se ...